15 Energy Stocks You Should Avoid

Thanks to a big rally, long-underperforming energy stocks are now starting to look expensive.

For years, energy stocks were money losers. Now a growing number are heading into overpriced territory.

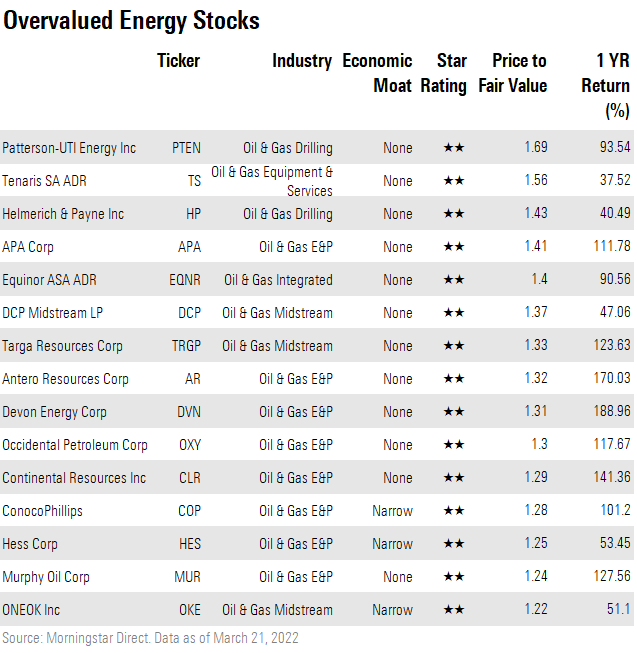

That includes some of the industry’s biggest names. ConocoPhillips COP, EOG Resources EOG, and Devon Energy DVN are now overvalued, according to Morningstar analysts.

As a group, energy stocks are "rich or fairly valued for the most part, with a few isolated opportunities,'' says David Meats, Morningstar’s equity research director for energy and utilities.

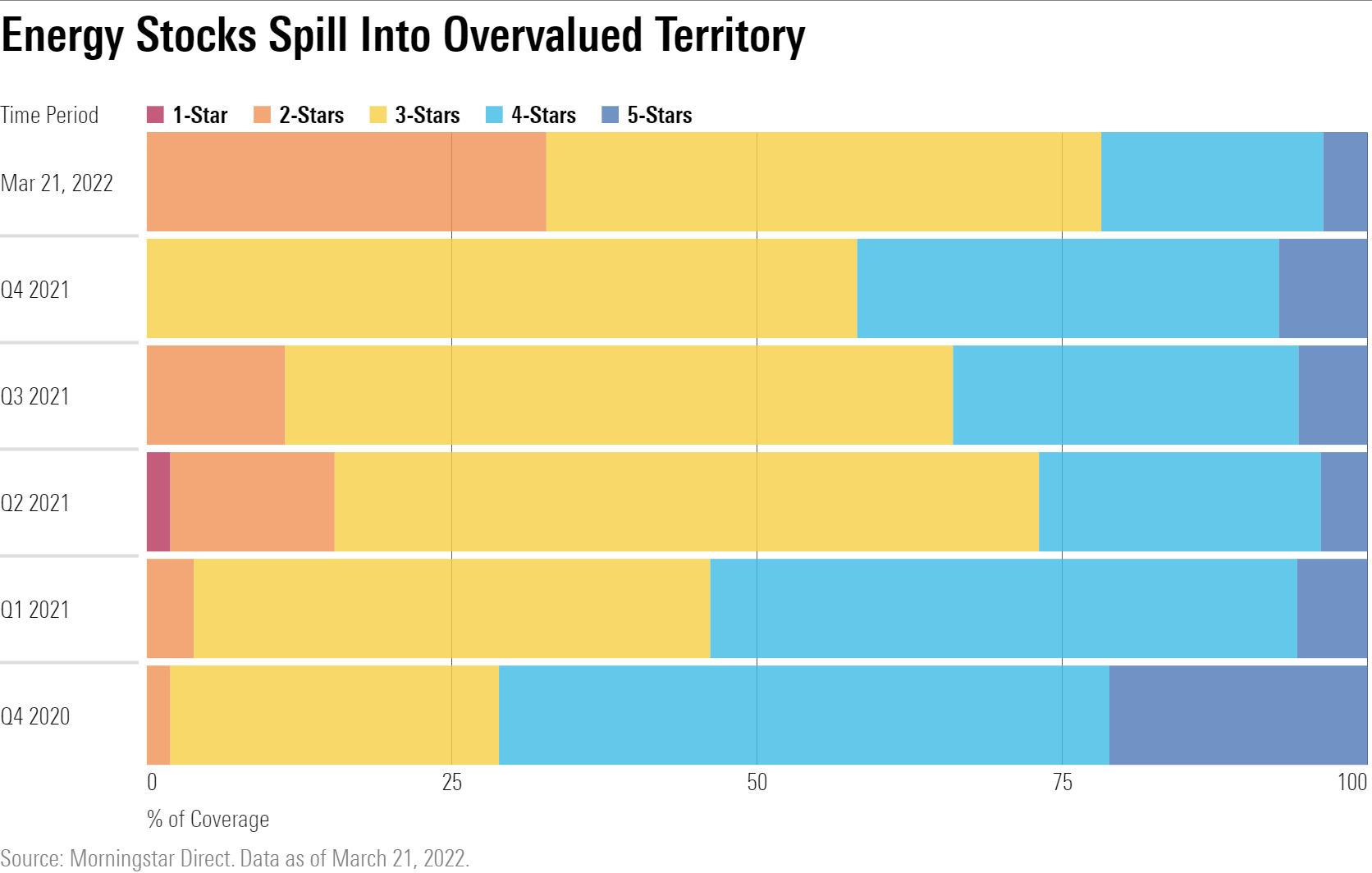

This marks a significant change in fortune for a group of stocks that just a year ago had looked cheap but only seemed to get cheaper. Starting in 2015, falling oil prices and growing environmental concerns had meant returns on oil and gas company shares lagged well behind the rest of the market. At the end of 2021’s first quarter, more than half the 55 energy stocks covered by Morningstar analysts were deemed undervalued and just two as expensive.

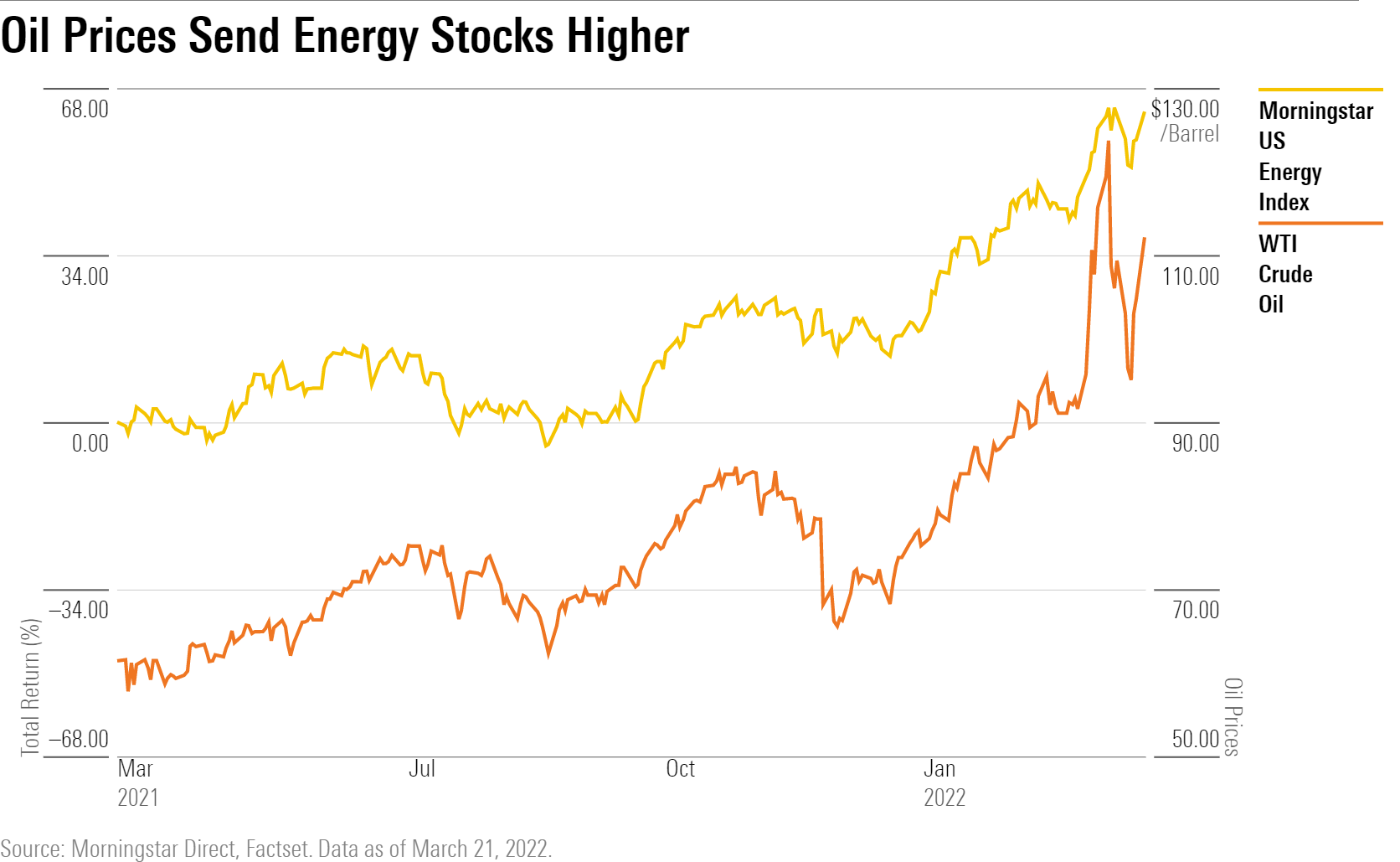

Then came the sharp reversal in oil prices last year as demand from economies reopening amid the pandemic overwhelmed the supply of energy. Then came the massive spike in oil prices of recent weeks caused by Russia’s attack on Ukraine. Earlier this month, oil prices briefly topped $135 per barrel for the first time since 2008, having stood at $62 one year ago.

The rise in oil prices has sparked a rally in energy stocks. The Morningstar US Energy Index is up 63% over the past year, with help from a 101% rally in ConocoPhillips, an 87% return on EOG Resources, and a 67% increase for Chevron CVX. Today, the number of undervalued energy stocks has fallen to 12, with 18 now in overvalued territory.

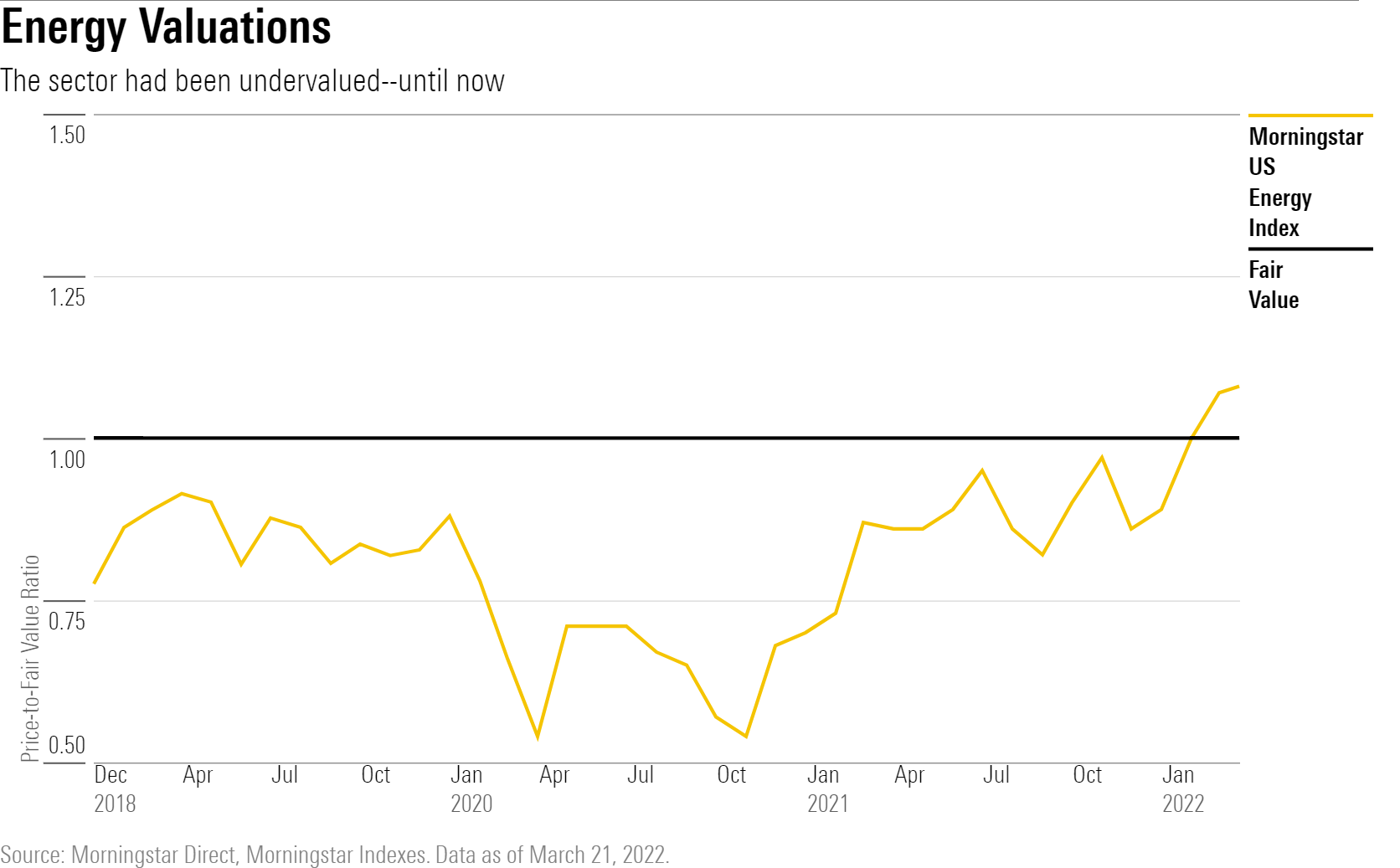

Energy stocks moved into overvalued territory at the end of February. At recent prices, Morningstar views the sector as 8% overvalued.

Even before the pandemic the energy sector had been undervalued, typically by 10% to 20%.

“The market is a bit myopic with oil prices; when prices are up it tends to assume they’ll stay up, when prices are down, it does the same,” Meats says. While he expresses skepticism that there are strong enough catalysts to pull oil prices down to an equilibrium level of $50 to $60 per barrel soon, he anticipates changes that will help alleviate tight supply.

Iran and Venezuela are in negotiations with the U.S. to loosen sanctions that would allow them to start exporting oil. “If the U.S. can come to terms with either one of those countries, then the supply picture changes as you get a big chunk of supply coming almost immediately,” Meats says. Additionally, the United Arab Emirates, a member of OPEC, has recently advocated for ramping up production.

Dominating the list of overvalued energy stocks are exploration and production companies, along with firms that provide drilling equipment.

Exploration and production companies, or E&P, are especially sensitive to oil prices, leaving many of them currently trading at lofty prices, according to Meats.

“As prices go up, their [E&P firms] revenue increases really quickly,’’ he says. “Costs will inflate over time if the environment remains the same, but not nearly as quickly.’’

Meats and his team forecasts the marginal cost of production--the minimum price for oil that E&P firms need to turn a profit--to be $55 for WTI crude and $60 per barrel for Brent crude, well below current levels. Nonetheless, Meats still points to the industry as one of the most overvalued in the sector at current share prices.

That includes Devon, which has soared 189%, Antero Resources AR up 170%, and APA APA, which gained 112%, all in the past year.

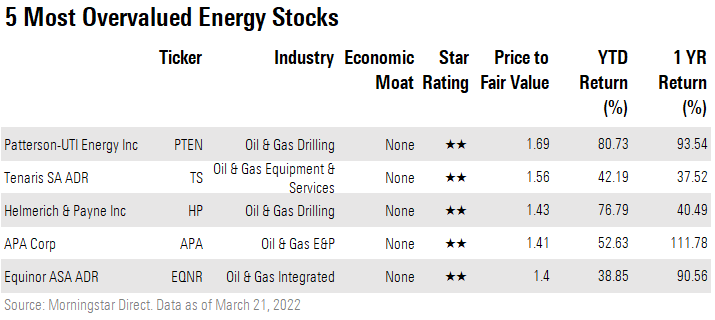

Among the companies that provide drilling equipment, the list of overvalued names includes Patterson-UTI Energy PTEN, Tenaris TS, and Helmerich & Payne HP.

Drilling equipment providers Helmerich & Payne and Patterson-UTI Energy rely heavily on oil rig demand. In 2014 there were roughly 2,000 rigs in use in North America. By early 2021 low oil prices and the pandemic helped push that number to just 360, according to Baker Hughes. Along with the rebound in oil prices, the number of rigs has bounced back to 663 as of March 18.

That jump in rig use helped Helmerich & Payne stock rally 41% in the past year and Patterson-UTI Energy shares gain 94%.

But Morningstar analyst Katherine Olexa sees downside risk to both. “It’s likely that the market is incorporating this high near-term demand, while we’re adopting a longer-term view,” she says. They expect the number of active rigs to drop to about 500 starting in 2025.

“There’s a number of reasons for this but a key one is that advancements in rig technology have reduced the number of rigs required to maintain production levels. This will likely continue since it’s a competitive market and rig providers--like HP and PTEN--constantly seek to attract customers by offering the latest and greatest tech possible,” she says.

For Tenaris--up roughly 38% over the past 12 months--Olexa sees the market overestimating the benefit from near-term demand for the company’s products, mainly pipes used for drilling and oil transportation. “The street appears to incorporate continued margin improvements, while we expect they’ll stabilize moving forward,” she says. Inflation is expected to hit Tenaris hard, pressuring margins, according to Olexa.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-03-2024/t_8ba91080cb4d43acae9d9119875abede_name_file_960x540_1600_v4_.jpg)