Why the Outlook for Wide-Moat Stocks Remains Bright

With valuations coming down, wide-moat stocks may be in a better position for a period of rising rates and inflation.

Stocks of companies with the greatest competitive advantages and strong fundamentals may be down in 2022, but investors shouldn’t count them out.

Companies that we peg as having Morningstar Economic Moat Ratings of wide--those with the greatest competitive advantages--generally outperform when inflation and interest rates are rising thanks to their greater ability to pass on price increases to customers and finance growth in their businesses without heavy borrowing.

Over longer periods of time, wide-moat stocks have tended to be the best performers in the market. That includes periods such as today, when interest rates are rising against a background of higher inflation.

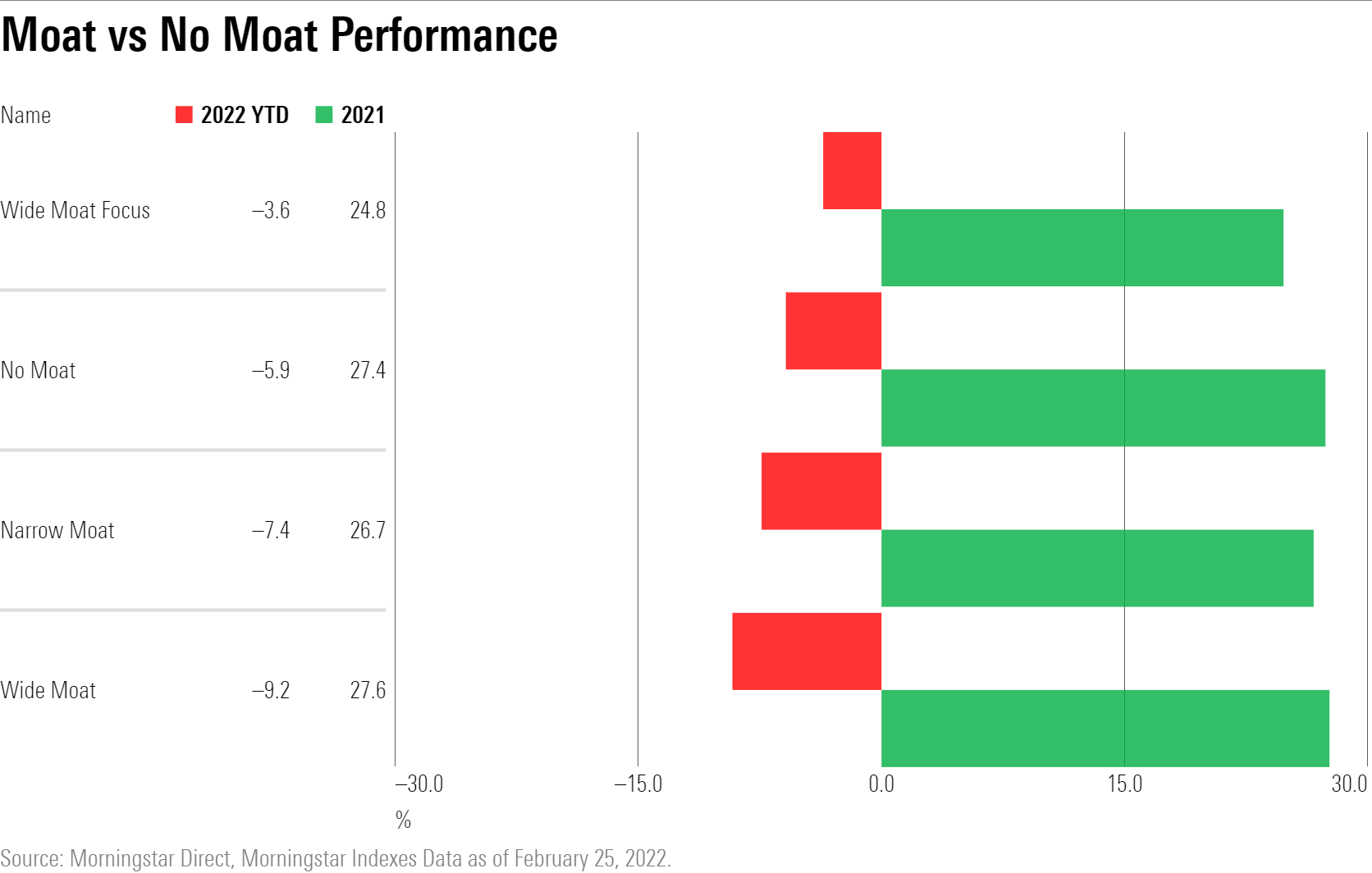

For seven of the past 10 calendar years, the Morningstar Wide Moat Index and the Morningstar Narrow Moat Index both outperformed the companies without economic moats of any kind and the U.S. market overall.

But that’s not the case this year. The Wide Moat Index is down 9% for the year to date as of Feb. 25, while narrow-moat companies are down just over 7% and no-moat stocks have lost 6%.

Many of the market’s biggest names, such as Microsoft MSFT and Amazon.com AMZN, fall into the wide-moat category, and these also happened to be some of the market's most highly valued stocks. With interest rates rising, the fast-growing names have taken a hit, leading to the wide-moat group’s underperformance.

The valuation-based impact can be seen by breaking out performance of undervalued wide-moat stocks. That group, as measured by the Morningstar Wide Moat Focus Index, is down less than 4% compared with an 8% drop for the overall market.

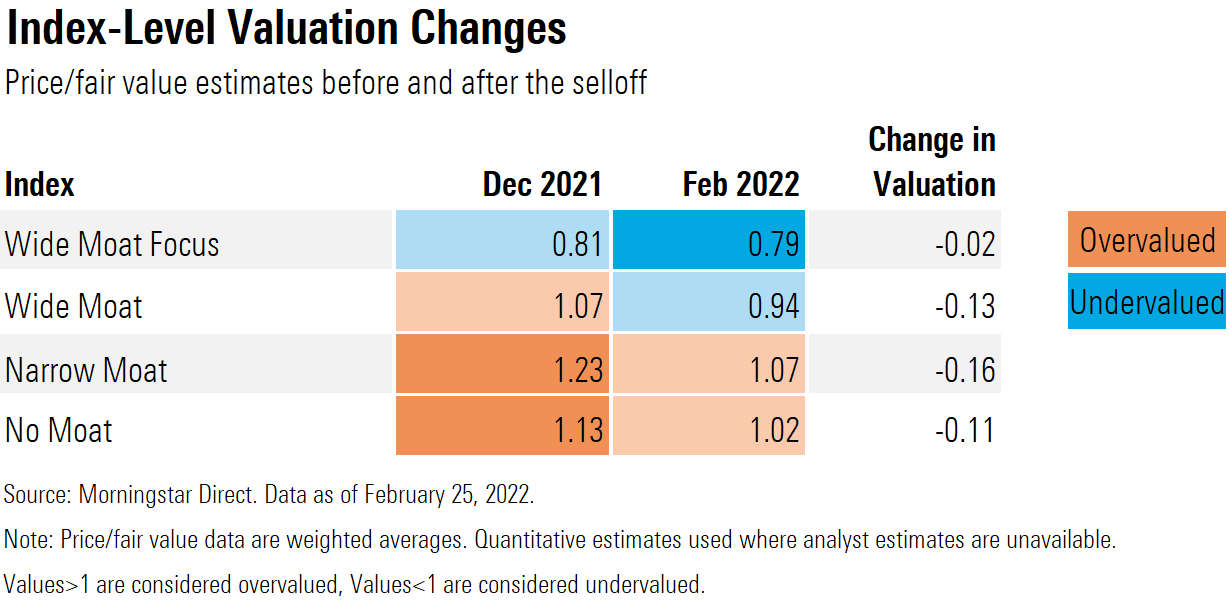

Now, valuations on wide-moat stocks in general have come down, and that could present an opportunity for the group to return to form.

Dave Sekera, Morningstar's chief U.S. market strategist, expects stocks to remain volatile while the Russian war on Ukraine persists. But allowing for short-term volatility, "for long-term investors, now appears to be an opportune time to trade up in quality to wide-moat-rated companies that are also trading at a significant discount to their fair value."

Wide-moat stocks "typically provide downside protection, but that hasn't been the case this year," says Andrew Lane, Morningstar's director of equity research for index strategies.

Quality’s Long-Term Outperformance

Another way to think about Morningstar’s moat ratings is that wide-moat stocks are “quality” stocks. Morningstar equity analysts make use of the moat rating to highlight companies with durable competitive advantages: things like brand loyalty, the network effect, cost advantages, and economies of scale. Our analysts believe that a company with a wide economic moat is positioned to fend off competitors for more than 20 years, while a company with a narrow moat rating holds advantages expected to support the company’s strong fundamentals over the next 10-20 years.

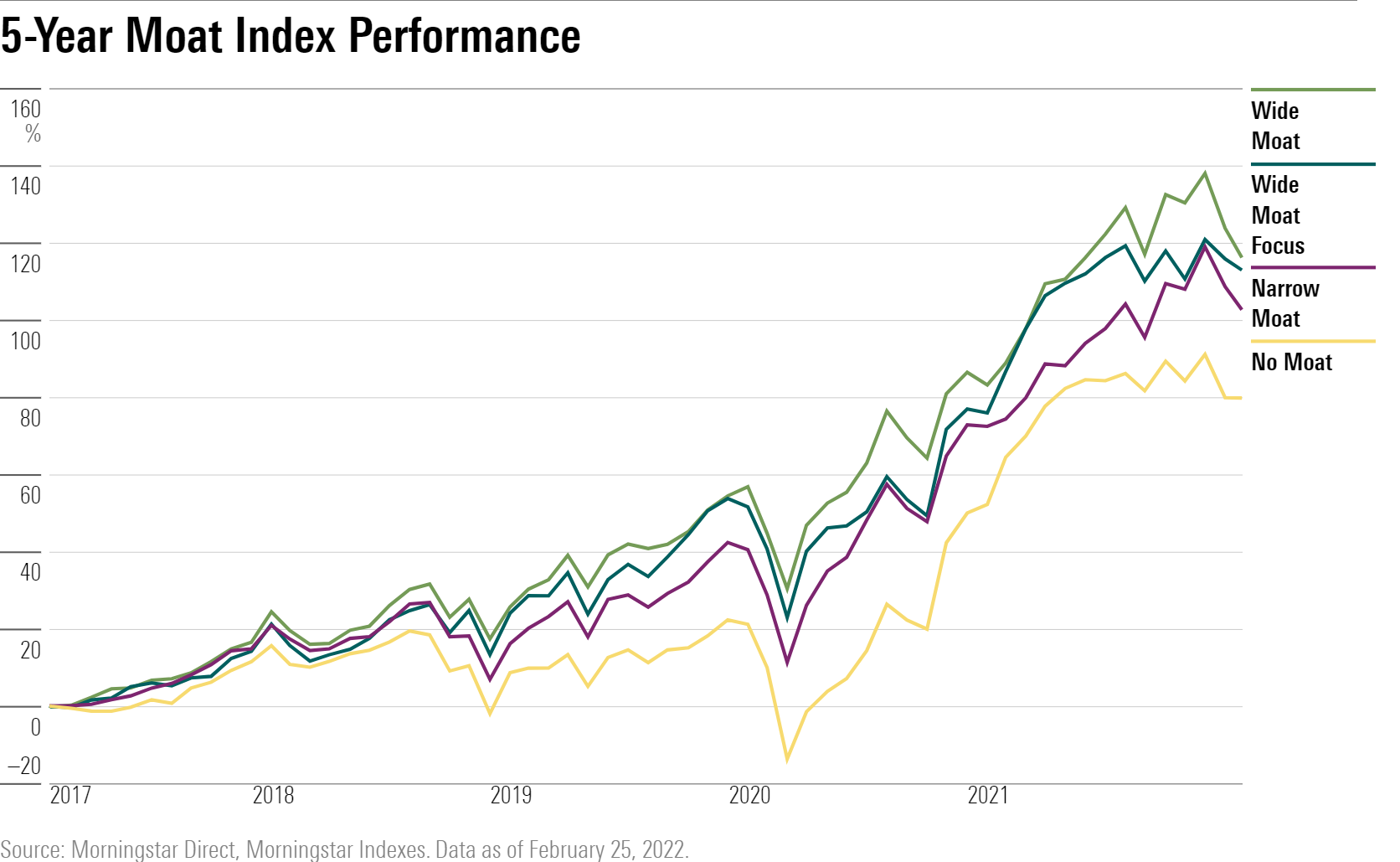

Over longer time periods, those quality names have shone.

The Morningstar Wide Moat Index has risen 17% over the past five years, beating the Morningstar U.S. Market Index’s return of 15%. The Morningstar No Moat Index, meanwhile, returns 12% for the same period.

Over the past 10 years, the Morningstar Wide Moat Focus Index has gained 338%, while the U.S. Market Index gained just over 280%. During the same time frame, the standard Wide Moat Index gained 318%, the Narrow Moat Index gained 292%, and the No Moat Index grew by 224%.

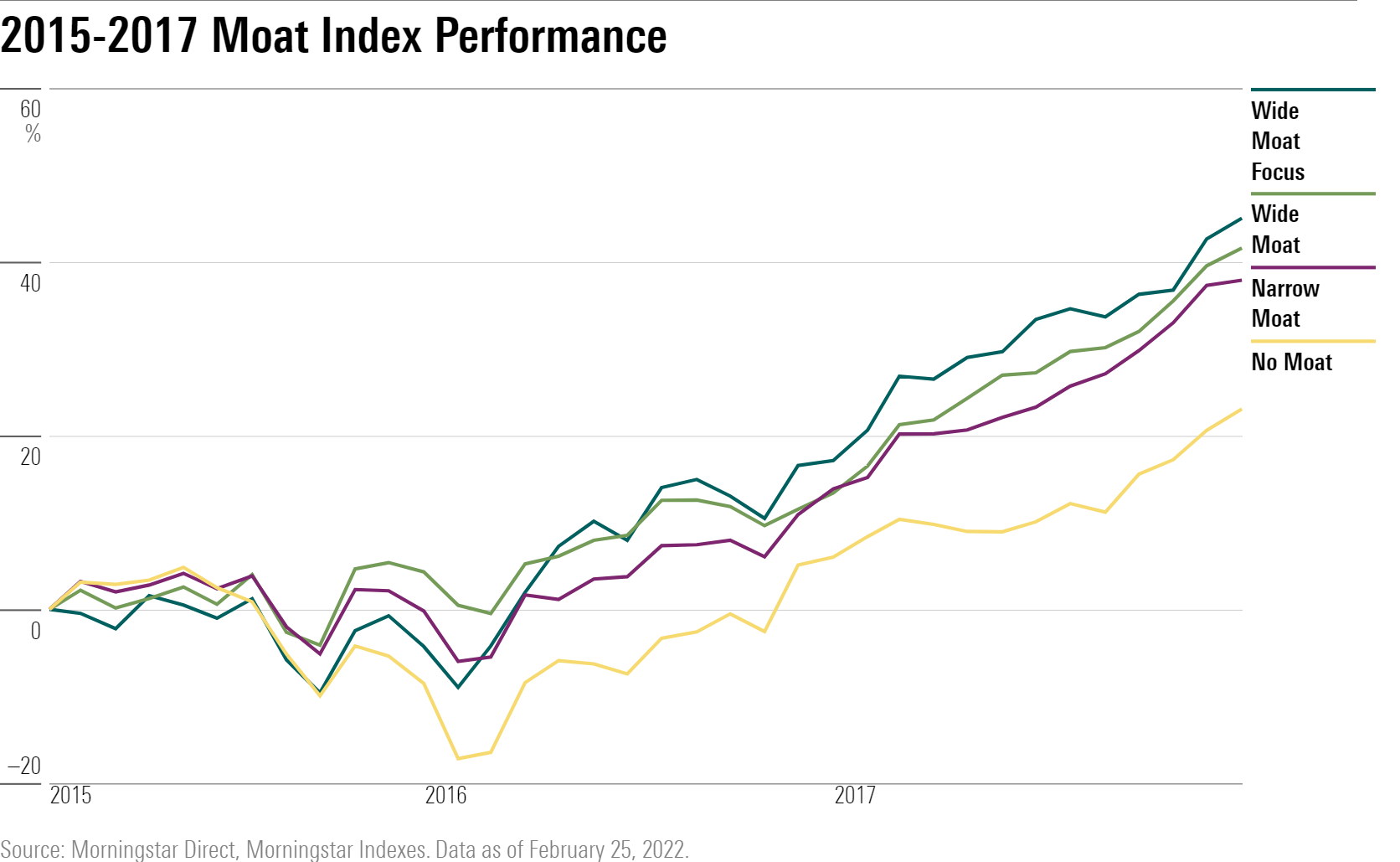

Wide Moat’s Rate-Hike Performance

The catalyst for the recent sell-off in the market’s more expensive stocks has been the rise in bond yields as investors anticipated a more aggressive move by the Federal Reserve to raise interest rates. Between 2015 and 2017, the Fed raised the federal-funds rate target from essentially zero--where it had stood since the financial crisis--to 1.5%. As interest rates rose, companies with economic moats outperformed their no-moat cousins by nearly 20 percentage points. Wide-moat companies, as a group, edged out narrow-moat stocks by 3% during this period. And wide-moat companies trading at or below fair value beat the broader Wide Moat Index by an extra 4%.

“Companies with wide economic moats tend to hold up better than other companies during market downturns because the durable competitive advantages they enjoy typically provide steady pricing power,” Lane says.

Wide-Moat Troubles

For now, the picture has been very different. Heading into 2022, wide-moat companies were overvalued as a group: The Morningstar Wide Moat Index was trading at 7% above its analyst-assessed fair value as of Dec. 31, 2021. That’s just slightly less lofty than the overall market, which was 13% above its calculated fair value at the year’s end.

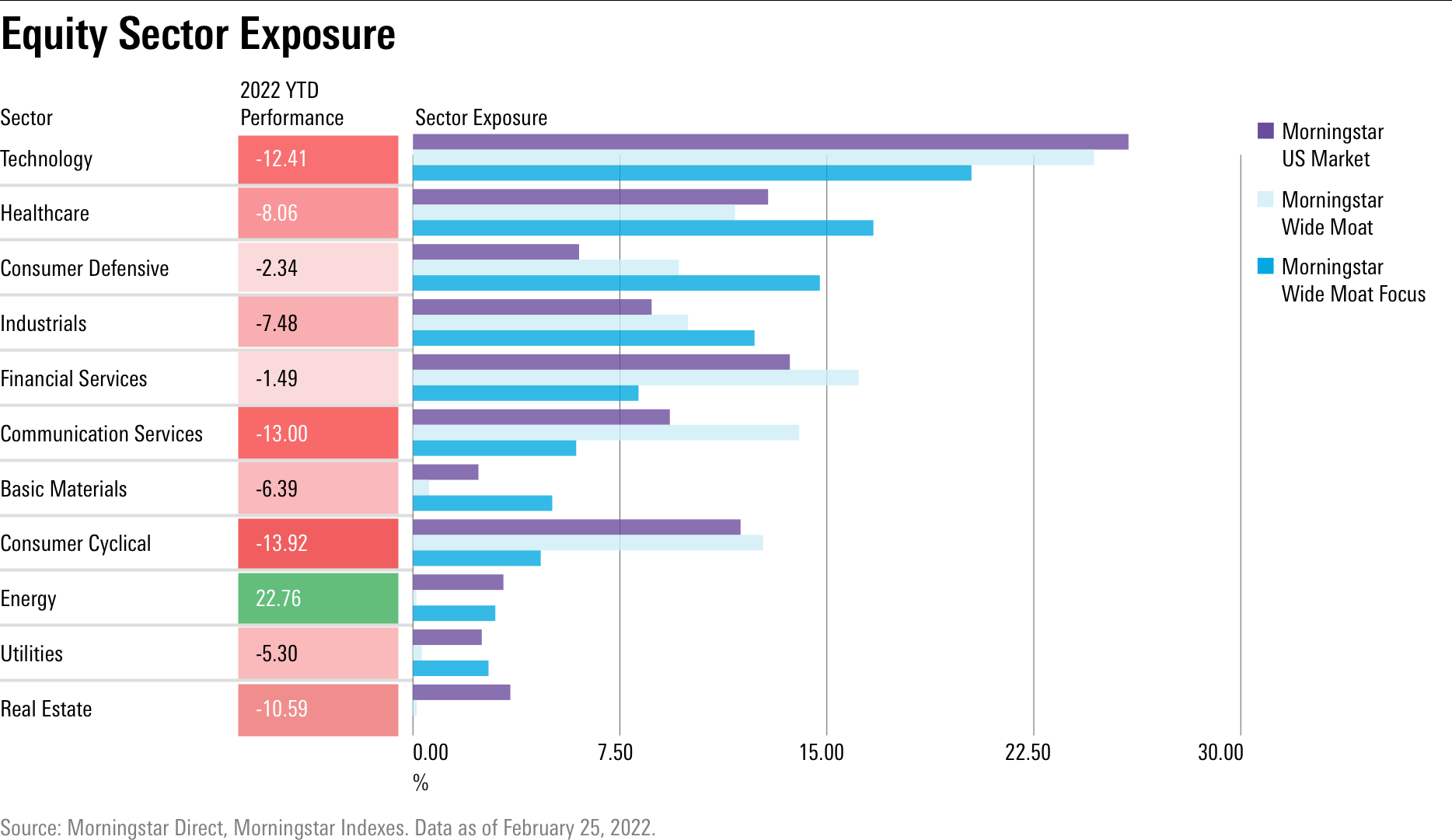

Sector tilts are underlying the outperformance for the Wide Moat Focus Index: It is underweighted in both technology and communication services, the areas of the market that have dropped the furthest this year.

“When we take a high-level look at the companies our analysts designate undervalued with durable competitive advantage, we see a bias toward value sectors,” Lane says. Just 20% of all wide-moat companies are classified as value. When the list is limited to just undervalued names, the concentration of value companies jumps to 44%.

The stocks providing some buoyancy to the Morningstar Wide Moat Focus Index’s performance include basic-materials company Compass Minerals International CMP--up 10.6% for the year as of Feb. 25--and financial-services firm Wells Fargo WFC, up 10.4%.

Cheniere Energy CQP is also a leading contributor of the group, up nearly 27% as of Feb 25. As oil prices surpass $100 per barrel on news of the Russia-Ukraine crisis, Cheniere has moved into overvalued territory. However, it remains in the Wide Moat Focus Index until reconstruction in March 2022.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)