Which Funds Have the Biggest Russian Stock Holdings?

Investors in these funds had the most exposure to Russia heading into the war.

As the war in Ukraine continues investors are trying to understand their exposure to Russian investments, to either assess the risks they face or to question whether they want their money flowing into the country.

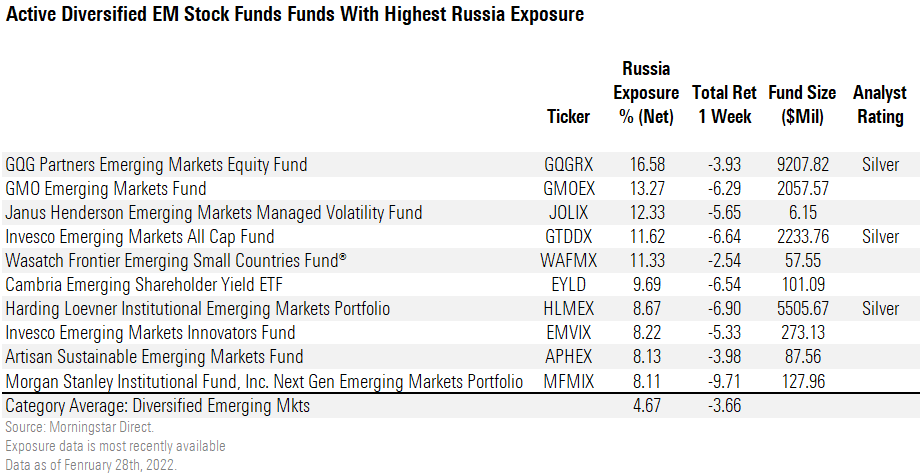

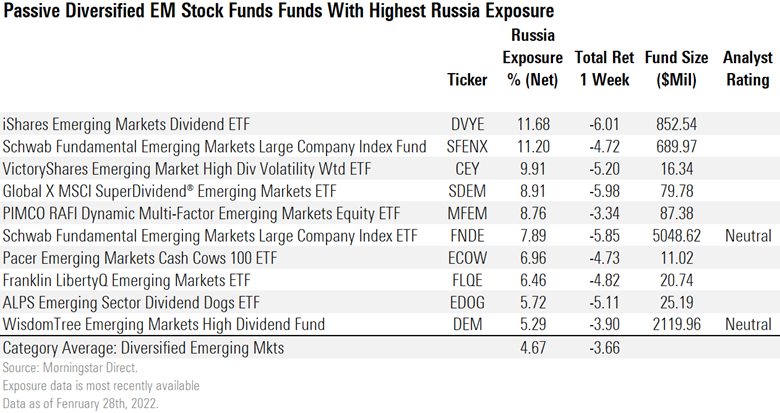

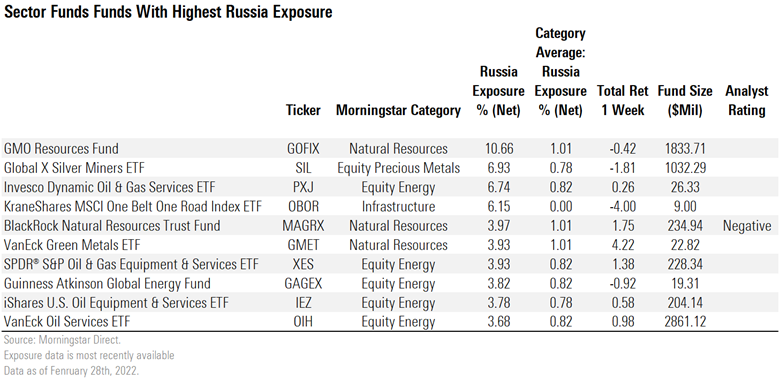

For the most part, funds with heavy exposure to Russian stocks have been confined to the emerging-markets, natural resources, and energy categories. The average exposure in these funds was relatively low before Russia invaded. Less than 5% for emerging markets funds and around 1% for the sector funds. But some funds in these spaces took on more exposure than their counterparts.

Managers funds with hefty Russia exposure are facing difficult choices. The Russian economy is being hammered with sanctions, the ruble has plunged nearly 30% against the dollar, and the MOEX Russia Index, which tracks the 50 largest and most liquid Russian companies from the main economic sectors, has fallen 32.3% in the last week.

Meanwhile, sanctions have frozen trading in Russian stocks. The Russian stock market did not open Monday, and in the U.S. the NYSE and Nasdaq halted trading in Russia-based companies. In addition, in an important development for fund managers, MSCI-- which provides the index benchmarks followed by many emerging markets managers--is reportedly considering dropping Russia from its indexes.

Below is a list of funds showing hefty stakes in Russian stocks in Morningstar Direct. As Morningstar analysts note here, some of these funds may have reduced their holdings from the levels they publicly reported prior to the Russian invasion.

Among active diversified emerging market funds with heavy Russian equity exposure, three are covered by Morningstar analysts. Silver-rated GQG Partners Emerging Markets Equity GQGRX had the highest reported exposure at over 16%. As reported here, this position was trimmed extensively by before Friday.

Invesco Emerging Markets All Cap GTDDX, which also holds a Silver rating, has held an outsized position in Russia for the past year. This fund has a history of of taking outsized positions, senior analyst Gregg Wolper notes in a report.

“Differing from the pack doesn't always work out...when Brazil and Turkey ran into serious political and economic woes in the first half of 2018, this fund's overweightings in both countries backfired,'' Wolper wrote. ``But the managers consistently stick with their thoughtful and tested approach, and the fund's impressive long-term record shows it usually pays off over time.”

Silver-rated Harding Loevner Institutional Emerging Markets Fund HLMEX can also be significantly overweight countries and sectors, which comes with risks and rewards, analyst William Samuel Rocco writes.

In a Feb. 1 report, he noted that “three Russian stocks--Sberbank, the oil giant Lukoil, and the energy exploration and production company NOVATEK--were top-10 holdings as of Dec. 31, and the strategy also owned the internet company Yandex. Overall, the portfolio had 8.7% of its assets in Russian stocks firms, in fact, versus 5.2% for the typical diversified emerging-markets Morningstar Category peer and 3.5% for the MSCI Emerging Market Index (the category benchmark) at that time.”

For passively managed stock funds with heavy Russian equity exposure, two are on Morningstar's analyst coverage list. Schwab Fundamental Emerging Markets Large Company Index ETF FNDE earns a Neutral rating and tracks the Russell RAFI Emerging Markets Large Company Index, focusing on large cap stocks from emerging markets. "It's a value strategy which overweights a lot of cyclical companies trading at low price multiples," says senior analyst Daniel Sotiroff. "Most stocks in the Russian market are these types of companies--energy, materials, financials, etc. So FNDE has a higher weight in the Russian market than other EM strategies or the MSCI EM Index."

State-owned enterprises, those that are partially owned by their respective governments, comprise roughly 30% of the portfolio, which adds a layer of political risk. One of those companies in their portfolio is Gazprom, which fells 34% last week.

Neutral-rated WisdomTree Emerging Markets High Dividend Fund DEM tracks the WisdomTree Emerging Markets High Dividend Index, which targets the highest-yielding 30% of stocks listed in emerging markets, subject to some quality and momentum screens. Like the Schwab fund, it is exposed to political risk due to investments in state-owned enterprises.

Sotiroff writes: “Firms from the materials and energy sectors, along with other financial institutions in emerging markets, are partially owned by their respective governments. So, the fund has an additional layer of political risk because these state-owned firms may not always prioritize shareholder interests. As an example, a 2012 mandate from the Russian Federation required its state-owned enterprises pay out 25% of their income in the form of dividends. This caused the fund's weight in Russian firms to spike from less than 3% in early 2012 to roughly 20% by mid-2013. The portfolio's allocation to Russian stocks was about 15% higher than that of the MSCI Emerging Markets Index in October 2021.”

Shifting to sector funds, eight out of 10 with the highest exposure to Russian stocks were in the natural resources or energy categories. Precious metals and infrastructure had one fund make the list.

The only Morningstar covered fund to make the list was the BlackRock Natural Resources Trust MAGRX, which has a negative rating. Analyst Robert Starkey cites high demand for managers time as one of the reasons for the poor rating. The "team implements the same process framework we like on other BlackRock strategies, but we question the ease of execution and note the limited experience and resource in nutrition."

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)