Quotas for Women Aren't Enough to Protect Against Human Capital Risks

Upward mobility is as important as board quotas and a diverse employee base.

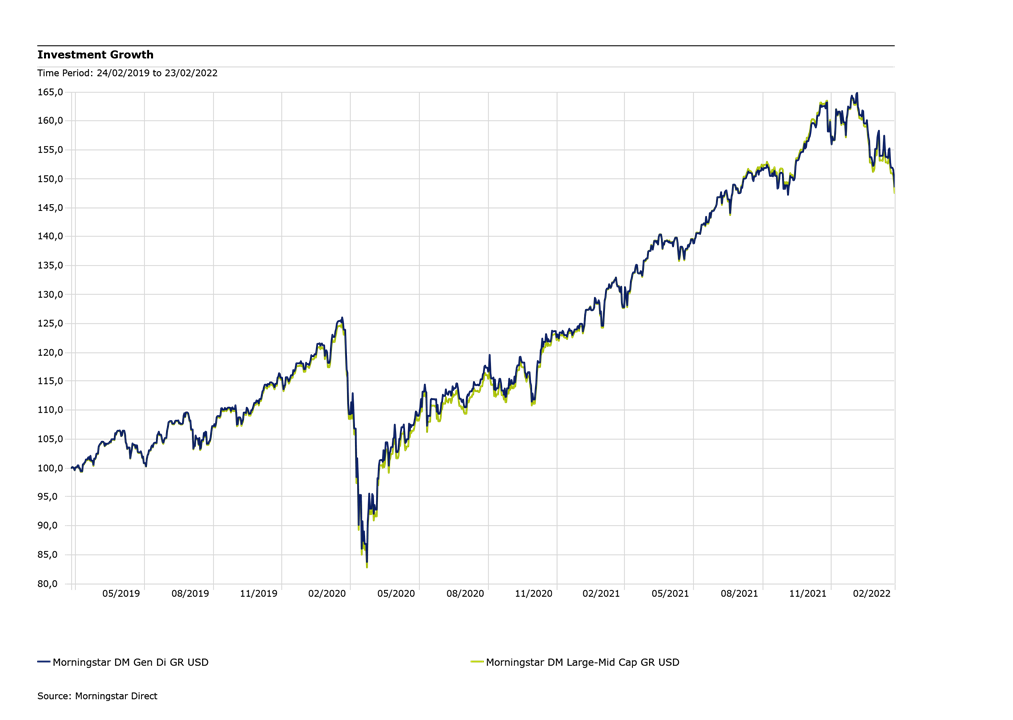

Gender diversity can mean many good things for investors. Returns from the Morningstar Developed Markets Gender Diversity Index are encouraging. Over the three years ended Feb. 23, 2022, the index returned 14.04% annually, versus 13.76% for the Morningstar Large-Mid Cap Index.

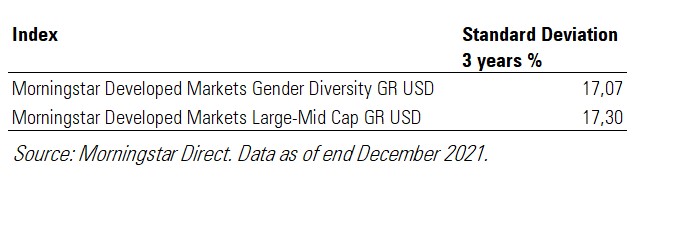

Investing in gender diversity was also less volatile, with a lower standard deviation than the market in the same period.

Exhibit 1: The Gender Diversity Index Has Slightly Outperformed the Broad Market in the Past Three Years (base=100 USD)

"The similarity of returns is by design. The Morningstar gender diversity index holds most of the constituents of its parent; it weights its constituents partly by market capitalization, just like its parent; and it keeps its regional weights in line with the broad market," says Dan Lefkovitz, a strategist for Morningstar Indexes.

"From a risk perspective, the gender diversity index has provided a smoother ride than its broad market equivalent," Lefkovitz continues. "This is consistent with Morningstar findings across other indexes and funds screened on environmental, social, and governance criteria. ESG factors represent real risks that affect financial performance."

Exhibit 2: The Gender Diversity Index Has Been Less Volatile Than the Market

Do Board Quotas Matter?

The conversation about diversity in the workplace continues to gain momentum, and studies are being conducted to understand the true impact of diversity on a firm. While more data and analysis are needed to prove the impact on a company's performance, there is evidence to show that lack of gender diversity is a human capital risk that is a material ESG issue for companies and their investors.

Board quotas aren't a guarantee that gender policies will lead to an improvement in gender diversity and equality. "As boards are a step removed from the day-to-day activities and do not have contact with the workforce directly, board diversity may not be a signal or drive the aspiration for employees to progress within the company," says Adam Fleck, director of ESG equity research at Morningstar.

Instead, what makes a difference is making sure the same opportunities for growth exist for all employees. What also matters is the degree of representation of diverse groups at multiple levels within an organization that may contribute to lower employee turnover rates comparatively.

If companies provide employees with a pathway for advance in their career, regardless of their background; and the employees see more equal representation in leadership roles, they may be more likely to stay with a company longer, the Morningstar-Sustainalytics report said. They may also be more engaged in what they do and motivated in their daily work.

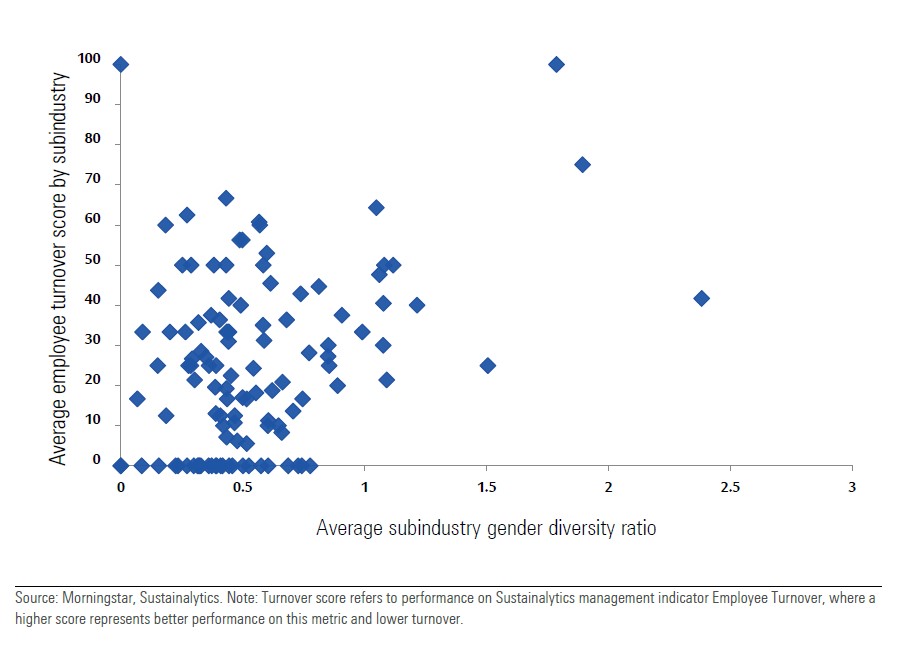

According to the report, there is also a moderately positive correlation between industry sectors in which there was greater parity between the percentage of women in senior management and the percentage of women in the workforce, and better employee turnover outcomes. The directionality shows a positive relationship between the degree of diversity within the workforce and up through senior management with lower levels of turnover.

Exhibit 3: Greater Gender Diversity Ratio Correlates With Lower Employee Turnover (Higher Turnover Score= Better)

Fewer Controversies

The Morningstar-Sustainalytics analysis of controversies data also suggests that the greater the gender diversity ratio, the fewer diversity-related incidents occur. The controversies list included all incidents related to employees' claims of discrimination including gender, discrimination related to race, religion, disability, and so on.

“We noted a negative correlation between subindustries with higher gender diversity ratios and the number of average diversity-related incidents,” says Fleck. “Our analysis suggests that those subindustries with higher levels of management that are more representative of the workforce are less likely to have incidents related to other forms of discrimination.”

Finally, companies that emphasize diversity and greater representation may find a greater talent pool to choose from, a more productive workforce, and a workforce where they can grow knowledge and skill sets internally, potentially resulting in companies better able to reach their strategic targets.

Finance, Apparel, and Marketing Are More Exposed to Gender Diversity Risks

The analysis of the industries with lowest gender diversity ratio reveals several surprises.

While it is not surprising that the financial industry, particularly investment banking and brokerage, but also management companies, banks, and insurance companies are on the list, it’s worth noting that luxury and retail apparel, and online and direct marketing are on the list. The latter sectors generally have a larger representation of women in the workforce; however, their average gender diversity ratio is 0.09, suggesting that less than 10% of their female workforce is represented in leadership roles.

The industries with the highest gender diversity ratios include rail transport, steel, automobiles, and gas utilities. They have a lower percentage of women in the workforce, but a higher percentage in senior management positions. The result is a lower turnover compared with industries with the lowest gender diversity ratio.

Current diversity data is limited, the report notes, and a more comprehensive data set is required to understand the impact of diversity on companies' performance. As that information becomes more comprehensive, it can reveal the degree of inclusivity and representation in a company's work force. But a key takeaway from this report is that it’s not enough to hire a diverse employee base or to have board quotas, it's also necessary for companies to ensure that employees have upward mobility.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)