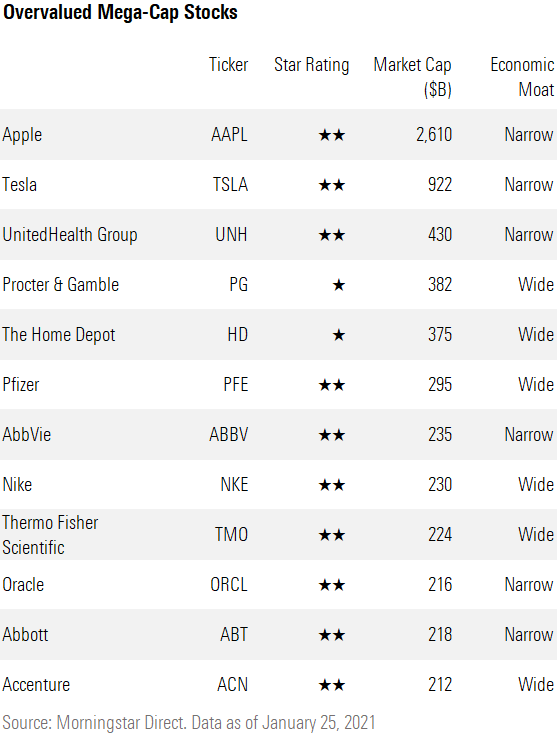

12 Overvalued Mega-Cap Stocks to Avoid

After a decade of outperformance, these mega-cap stocks are significantly overvalued today.

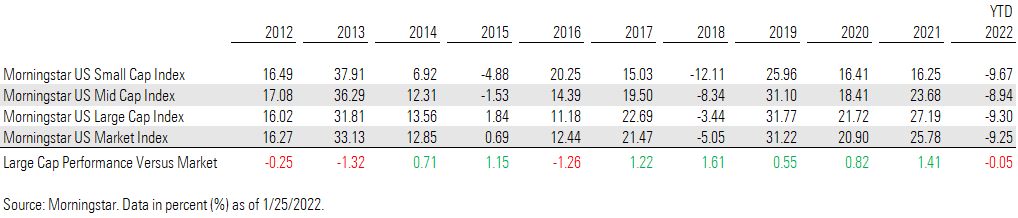

The market's biggest companies have only gotten bigger. Since the beginning of the pandemic, large-cap stocks have significantly outperformed small-cap and mid-cap stocks, only increasing what has been a decade-long dominance. Indeed, the Morningstar US Large Cap Index has outperformed the broader Morningstar US Market Index in seven out of 10 years.

In our prior article, we highlighted the growth in both number and dollar value of the largest of the large-cap stocks, or mega-cap stocks, which we define as stocks with market capitalizations in excess of $200 billion. It should come as no surprise to investors that after such a long run of outperformance, many mega-cap stocks have run up to levels that we do not think are supported by the companies' long-term underlying fundamentals.

Here are 12 overvalued mega-cap stocks that we think investors should avoid:

Here's an in-depth look at our valuation analysis for three of the names from the list. Premium Members can research the ratings and valuations for the remaining companies on each stock's individual analyst report.

Pfizer PFE

"After a deep dive on several of Pfizer's pipeline drugs combined with continued strong data for COVID-19 treatment Paxlovid, we have increased our projections for several key drugs, leading to a fair value estimate increase to $48 from $45.50. We expect Paxlovid sales to peak in the near term at close to $20 billion in annual sales for 2022 followed by a steady decline--but still an annual tail of close to $2 billion.

"For the core business of Pfizer, we expect close to 6% annual sales growth between 2020 and 2025 as new drugs offset generic competition. We expect Pfizer's COVID-19 vaccine sales will create very strong growth in 2021 and 2022 but likely weigh on growth by 2023 as competitive vaccines erode pricing and demand for Pfizer's vaccine slows as the pandemic fades. On the bottom line, we project a slightly healthier annual growth rate during the next five years as cost-cutting plans and share buybacks take shape. We don't model unannounced acquisitions, but acquisitions hold the potential to accelerate the company's growth rate. Over the long term, we believe the more diversified lineup of drugs should reduce the volatility of earnings. We anticipate restructuring efforts will help alleviate some margin pressure, as some high-margin products lose exclusivity. We estimate Pfizer's cost of equity at 7.5% and weighted average cost of capital at 7.0%, in line with the peer group."

--Damien Conover, sector strategist

UnitedHealth Group UNH

"Under one roof, UnitedHealth combines a top-tier health insurer (UnitedHealthcare), pharmacy benefit manager (OptumRx), provider (OptumHealth), and health analytics franchise (OptumInsight). The company's integrated strategy has resulted in some of the best returns in the industry in recent years and has been copied at least in part by the late-2018 mergers at CVS Health (added Aetna's insurance assets to its existing retail stores and market-leading PBM) and Cigna (added Express Scripts' PBM assets to its existing insurance operations). Outside of substantial regulator-led reforms, we think these vertically integrated organizations could help bend the healthcare cost curve in the United States, and UnitedHealth should be one of the key leaders of that charge going forward.

"UnitedHealth has demonstrated an uncanny ability to remain at the leading edge of changes affecting the industry. For example, its 2015 acquisition of Catamaran greatly increased its PBM scale and helped create a more holistic view of a patient's care. That combination of services has created attractive synergies for clients, such as employers or government programs, that are seeking to lower overall healthcare costs rather than just pharmacy or medical benefits. Adding service providers to the mix aligns incentives even further, especially since the firm's outpatient care assets offer significantly lower costs than hospital-based services. The firm's analytical tools help organizations pull various healthcare information related to its other operations together to provide an even fuller picture of a patient's health and care options.

"By providing those diverse yet connected services, UnitedHealth aims to grow in nearly any regulatory environment. Specifically, it is shooting for 13% to 16% earnings growth in the long run including strong operational growth and capital allocation activities, such as acquisitions and repurchases. While some regulatory scenarios could eventually cut into that mission, we suspect the value that UnitedHealth provides to the U.S. healthcare system will help it remain relevant in the long run."

--Julie Utterback, senior equity analyst

The Home Depot HD

"Given the maturity of the domestic home improvement industry, we expect demand to largely depend on changes in the real estate market, driven by prices, interest rates, turnover, and lending standards once COVID-19 subsides. We project 6% average sales growth over the next five years, supported by 5% average same-store sales increases and helped by offerings like buy online/pickup in store and better merchandising, which drives market share gains. Longer term, we forecast gross margins to expand modestly over the next decade (by 30 basis points from 2020 levels, to 34.3%) while the selling, general, and administrative expense ratio leverages by 140 basis points (to 17.1%) and the firm continues to capitalize on its scale and supply chain improvement initiatives. This leads to a terminal operating margin of 15.7%, higher than the 14.6% peak achieved in 2018.

"Home Depot's operating margins and returns on invested capital could improve as the firm focuses on the efficiency of the supply chain and the opportunity to better penetrate the pro business with market delivery centers that leverage its delivery capabilities. Additionally, we think Home Depot still has other opportunities to expand the business. It can capitalize on product lines with weak market share leaders, as it has previously done, for example, in appliances (as Sears faltered). Also, having deeper product lines to cross-sell (with brands like Company Store offering exposure to textiles and HD Supply reaching the maintenance, repair, and operations consumer) could add incremental revenue potential. The service business backed by a major national brand, as well as the commercial business coming from Interline and HD Supply, could build brand loyalty and keep consumers returning to a trusted source, something that could be hard to duplicate for a new entrant."

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)