A Sneak Peek at Vanguard’s High-Conviction Active Equity Funds for Advisory Clients

These strategies’ potential shouldn’t cloud their risks or lessons from Vanguard’s own history.

Vanguard’s expected launch later this year of three new high-conviction active equity funds for its Personal Advisor Services clients will be the indexing giant’s largest simultaneous debut of traditional stock-picking strategies since the 1990s. Vanguard also plans to combine these three new funds with two existing ones to create a curated five-fund active equity lineup for those clients.

The new funds are not live yet, but similar if not identical strategies offer previews of each as well as the five-fund portfolio. The results, albeit short and hypothetical, are impressive, and there are reasons for optimism for the long term. Yet their risks and Vanguard’s history with aggressive active launches argue for some caution.

A Vanguard Advice Select Strategies Preview

Vanguard turned to proven managers from two of its most trusted subadvisors for the new strategies.

Vanguard Advice Select Dividend Growth

The experienced and skilled Donald Kilbride of Wellington Management will run Vanguard Advice Select Dividend Growth. The former Boston Company research director and Greenberg-Summit Partners energy and materials analyst joined Wellington in 2002 as the sole generalist analyst for Edward Bousa, then Vanguard Wellington’s VWELX new stock manager. The balanced fund finished in the top quartile of its allocation--50% to 70% equity Morningstar Category in four of Kilbride’s first five calendar years on that job; in February 2006, Vanguard tapped him to lead Vanguard Dividend Growth VDIGX, which now has a Morningstar Analyst Rating of Gold.

Kilbride focuses on dividend growth as the best sign of a company’s ability to create lasting value and its willingness to share it. He looks for firms growing their dividends 3 percentage points per year faster than inflation, but he often finds large-cap stocks with embedded competitive advantages and five-year dividend-growth rates of at least 10%. As investors appreciate such companies during market panics, Kilbride’s portfolios tend to hold up better than the S&P 500, despite their concentration.

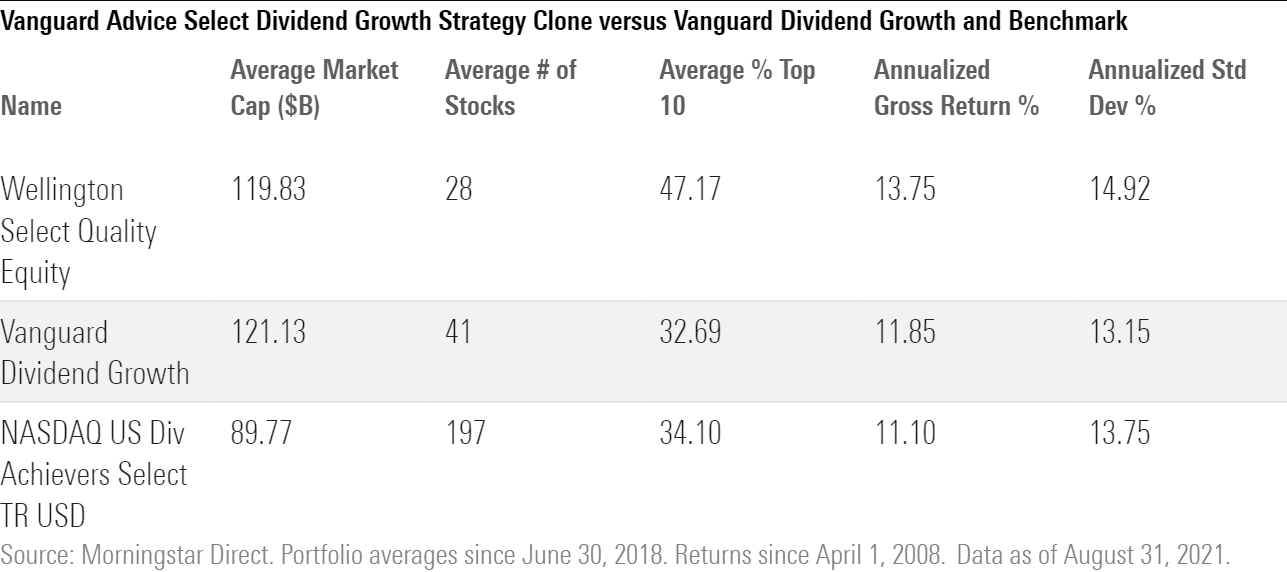

The new Vanguard Advice Select Dividend Growth will be more concentrated than Vanguard Dividend Growth, which has held 40-45 stocks in recent years. It’s likely to resemble the 25- to 30-stock portfolio of Wellington Select Quality Equity, a separate account Kilbride has managed since 2008.

Vanguard Advice Select Dividend Growth’s fees will be 19 basis points higher than its more-diversified sibling, but its clone Wellington Select Quality Equity’s 13.7% annualized gross return has beaten Vanguard Dividend Growth and the Nasdaq U.S. Dividend Achievers Select Index by 1.9 and 2.6 percentage points, respectively, over Kilbride’s shared tenure.

Vanguard Advice Select Global Value

David Palmer, also of Wellington Management, will oversee the multi-cap Vanguard Advice Select Global Value with a contrarian style he has refined over more than a decade. Palmer began covering energy stocks for now Silver-rated Vanguard Windsor VWNEX in 1998 and ran a portion of the multi-cap U.S.-focused Vanguard Capital Value from late 2009 to mid-2016, when he took over the whole and built a strong, if volatile, record until its July 2020 merger with Windsor. Palmer had been a Windsor comanager since 2018 but took over Wellington’s 70% slice in 2019.

Palmer focuses on stocks in out-of-favor industries that look cheap relative to their normalized earnings. When they start to gain favor, he trims or sells them and buys in other out-of-favor areas. He will, however, hold on to businesses whose prospects keep improving as long as their valuations don’t get stretched. He also likes to vary investments’ time horizons, holding some stocks that take three or more years to pay off and others he expects to harvest in six months or less.

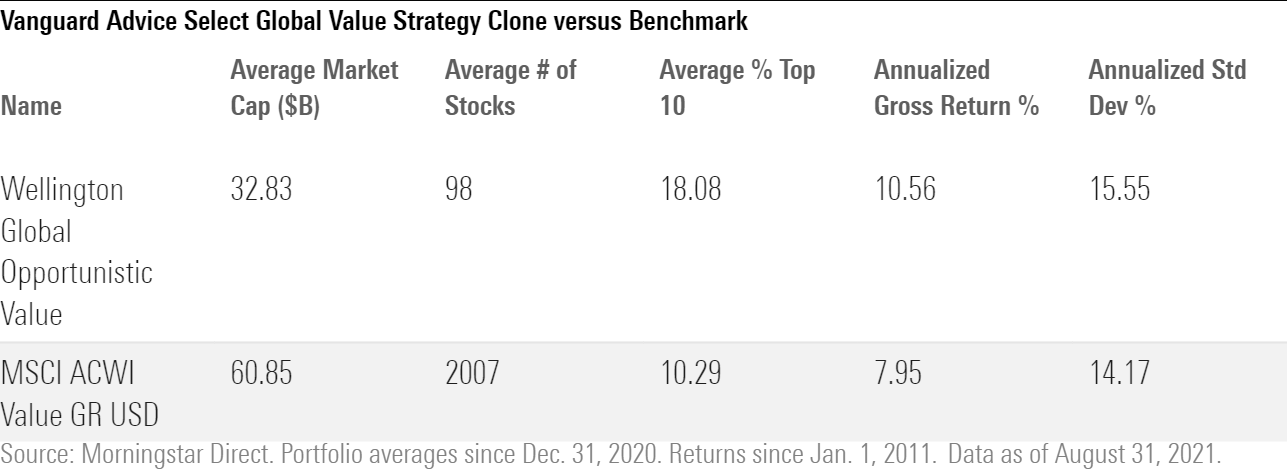

Palmer’s picks can be aggressive. The separate account Wellington Global Opportunistic Value, whose 100-stock portfolio is a clone of his new Vanguard fund, owns more mid-caps than the MSCI All-Country World Value Index and struggled in 2011 and 2018, both down years.

Palmer’s approach has paid off, though. In his 10-plus years at the helm, Wellington Global Opportunistic Value’s 10.6% annualized gross return through August beat the index by 2.6 percentage points, which would have cleared Vanguard Advice Select Global Value’s proposed 0.40% levy.

Vanguard Advice Select International Growth

James Anderson and Lawrence Burns of Baillie Gifford will comanage Vanguard Advice Select International Growth, but only for a little while. Anderson, who has excelled managing Baillie Gifford’s now 70% portion of Silver-rated Vanguard International Growth VWILX since 2003, will retire on April 30, 2022. While Burns lacks Anderson’s 40 years of industry experience, he is established. With Baillie Gifford since 2009, he joined its portfolio construction group of managers in 2012 and took over as deputy chair in 2019.

Baillie Gifford looks out up to 10 years and tries to identify emerging secular trends, such as the growth of Chinese consumerism, and then seeks the companies best positioned to capitalize on them. The team will hold on to these high-potential stocks even when they struggle, accepting failures with successes because in the long run the exponential compounding of spectacular winners should far exceed losers’ setbacks.

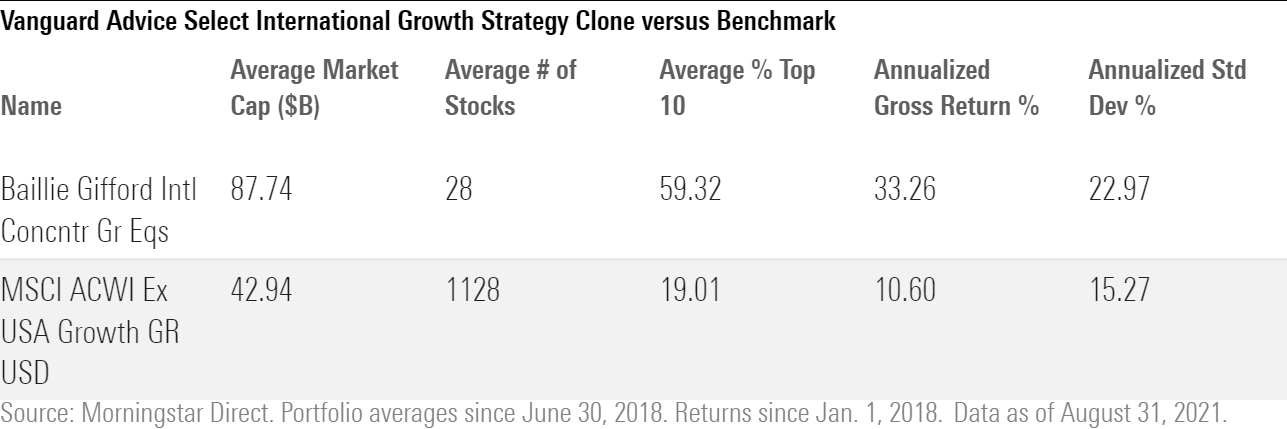

Stock-specific risk is high in Baillie Gifford’s typical 40- to 60-stock portfolios, but Vanguard Advice Select International Growth will be even more focused. Baillie Gifford International Concentrated Growth Equities BTLKX, a clone of the new strategy, owns 25-30 stocks and often stashes more than 60% of assets in its top 10 holdings.

That can magnify risks, but also rewards. From January 2018 through August 2021, Baillie Gifford International Concentrated Growth Equities’ 33.3% annualized gross return would have beaten the MSCI All-Country World ex USA Index by 22 percentage points even after deducting Vanguard's 0.42% annual fee for the new fund.

Complementary Incumbents

Vanguard will combine its three new Advice Select strategies with Gold-rated Vanguard Capital Opportunity VHCAX, subadvised by Primecap Management, and unrated Vanguard International Core Stock VZICX, run by Kenneth Abrams and F. Halsey Morris of Wellington.

Vanguard Capital Opportunity

Vanguard Capital Opportunity is the more aggressive and proven of the two. It has flourished under Primecap, its subadvisor since 1998, using a benchmark-agnostic, growth-oriented approach that can be contrarian. Its 150- to 180-stock portfolio is a blend of its five managers' and analyst team’s separate sleeves. Although the combination adds some diversification, company-level bets tend to cluster in healthcare and tech. The fund’s combined exposure to these two sectors has been above 50% of assets since mid-2003.

Vanguard International Core

Vanguard International Core Stock’s 80- to 100-stock portfolio has fewer holdings, but its sector over- and underweightings versus the MSCI All-Country World ex USA Index have been within about 3 percentage points since the fund’s October 2019 inception. The strategy trailed the gross return of its benchmark through August 2021. Abrams, a veteran manager, capably anchored Wellington’s portion of the small-growth strategy Vanguard Explorer VEXPX from 1994 to 2019, but it remains to be seen whether he can repeat that success with non-U.S. large caps. Morris, a longtime analyst, has no prior management experience.

How the Five Funds Have Fared Together

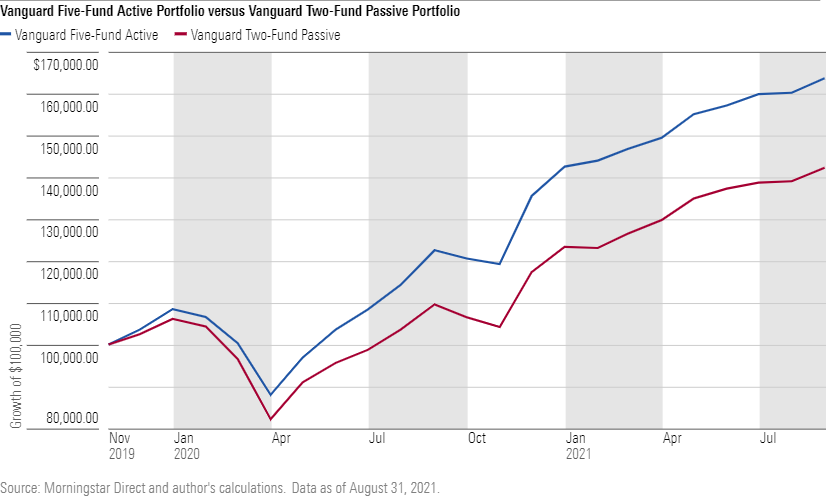

There are lots of ways to integrate Vanguard’s new Advice Select strategies with older funds, including passive ones. Equally weighting the five active offerings, however, shows they can make a potent portfolio. From the strategies’ earliest common November 2019 start through August 2021, $100,000 divided equally between them or their clones and rebalanced annually would have grown after management and advisory fees to $163,579, versus $142,205 after management fees but not advisory fees had that sum been likewise split between Vanguard Total Stock Market ETF VTI and Vanguard Total International Stock ETF VXUS.[1] Growth and U.S. leanings helped the five-fund portfolio in that period; two equal weighted index funds are not the market, but it would have been possible for an advisory client to do better than do-it-yourself index investors even after deducting PAS’ 0.30% annual charge.

Active Risks

That’s a short period to judge this active portfolio’s success, though, and these funds, individually or together, court many risks.

They’re concentrated, which cuts both ways. A few good picks can really help, but a few bad ones can really hurt. The five strategies’ picks also sometimes overlap. In June 2021, four of them held Alibaba BABA and two held ASML Holding ASML, which accounted for 1.85% and 2.72%, respectively, of the hypothetical portfolio’s assets.

Capacity is limited. Vanguard has often curbed new investors’ access to Vanguard Capital Opportunity because of its penchant for small- and mid-cap stocks. And with $22 billion in assets now, an asset surge could make it inaccessible again. Similarly, Vanguard Advice Select Dividend Growth’s $54 billion sibling Vanguard Dividend Growth was closed to new investors from mid-2016 to mid-2019.

Succession bears monitoring. Not only is Baillie Gifford’s Anderson about to hand the baton to Burns, but Wellington’s Abrams also is nearing retirement age and could leave Morris, who lacks a record of his own, in charge.

Persistence could be a problem. Even iconic managers stumble. Vanguard Windsor, for example, underperformed the S&P 500 and Russell 1000 Value Index by 1.41 and 1.03 annualized percentage points, respectively, in John Neff’s final decade.

Horizon Funds’ Lesson

Mixed results wouldn’t be unusual. That’s what happened with Vanguard’s last aggressive active launch on Aug. 14, 1995, when it debuted four Horizon Funds. That banner no longer exists, though, and neither does one of the funds. The firm liquidated Vanguard Global Asset Allocation just shy of its sixth anniversary.

Another, Vanguard Strategic Equity VSEQX, which uses computers to pick small- and mid-cap stocks, has produced better results than most mid-blend category peers, but through August its 11.2% annualized gain trailed its benchmark by 32 basis points, which over 25-plus years translates into a $12,506 shortfall based on the growth of an initial $10,000 investment in the fund versus the index.

The two other strategies, Vanguard Global Equity VHGEX and Vanguard Capital Opportunity, have trounced their respective benchmarks. Vanguard Capital Opportunity wasn’t a success initially, though. Its original subadvisor, Husic Capital Management, invested in as few as 23 stocks and had the ability to short up to 15% of its assets. The fund trailed the Russell Midcap Growth Index by 16.9 annualized percentage points until Primecap took it over in 1998.

With the Horizon Funds’ experience in mind, investors who find Vanguard’s new strategies enticing should also ask PAS advisors about their risks.

[1] One twelfth of each Vanguard Advice Select fund’s proposed annual fee has been deducted from the monthly gross result of its clone. One fourth of the 0.30% annual advisory fee was subtracted from all five funds every three months, beginning in January 2020.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)