Second-Quarter Market Insights in 8 Charts

Our market commentary covers economic expectations after the pandemic, the global spread of inflation pressure, and more.

U.S. equities continued their march higher in the second quarter of 2021, pulling up many previously undervalued stocks as pandemic restrictions continued to fade and more people returned to work. Monumental stimulus has provided a tailwind for markets since the spring of 2020, and in June the Federal Reserve restated its commitment to stimulus efforts despite hawkish undertones.

The meeting also meaningfully impacted fixed-income markets: The yield curve flattened because of the 10-year U.S. Treasury note, a bellwether sign, ending the quarter lower than it started.

Every quarter, Morningstar's quantitative research team reviews the most recent U.S. market trends and evaluates the performance of individual asset classes. We then share our findings in the Morningstar Markets Observer, a publication that draws on careful research and market insights. (Morningstar Direct and Office clients can download the report here.)

Here are some of the market insights from our latest quarterly review.

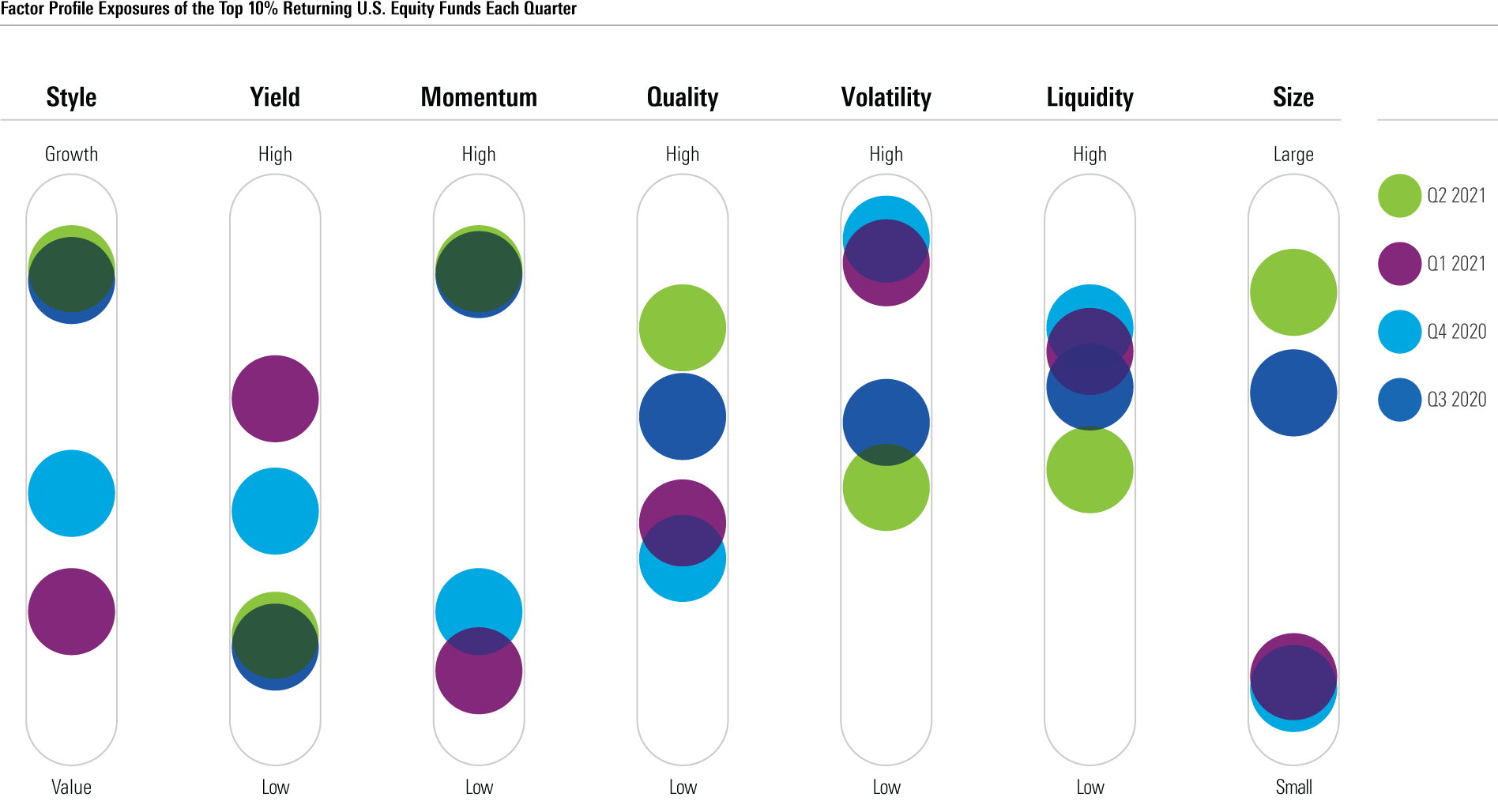

Right Back Where We Started: Growth, Momentum, Size Lead

As equity markets continued to rally after a challenging 2020, factor performance returned to a new normal. Momentum, growth, and large-cap-oriented funds raced to the front of the pack, leaving dividend plays behind.

Source: Morningstar. Data as of June 30, 2021.

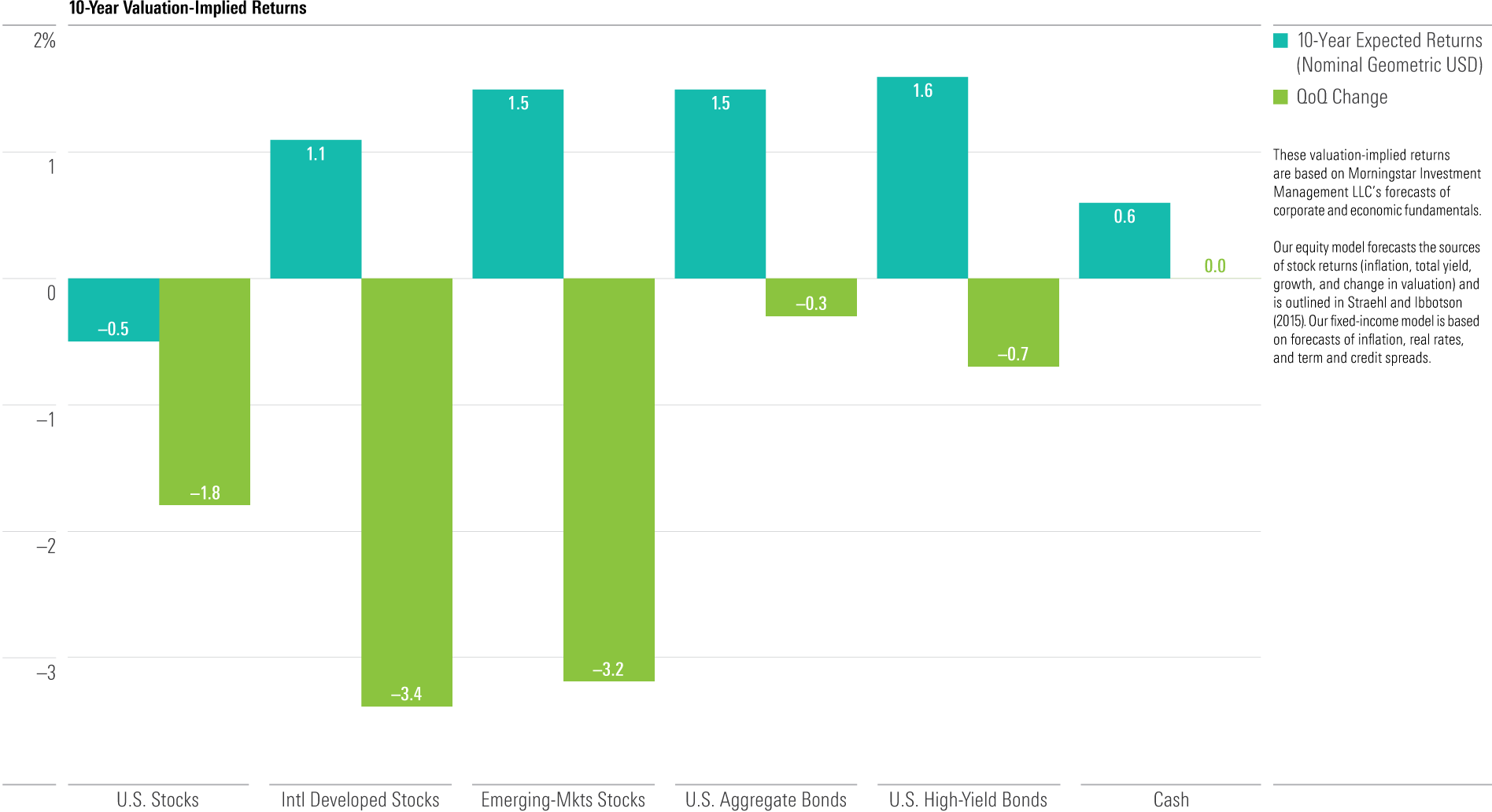

Return Expectations Slide

Morningstar Investment Management's return forecasts decreased for all major asset classes, though equities did so to a more dramatic extent than fixed income. However, models still indicate that international stocks will be more attractive than U.S. stocks over the next 10 years and investment-grade bonds offer a small return advantage over U.S. cash.

Source: Morningstar. Data as of June 30, 2021.

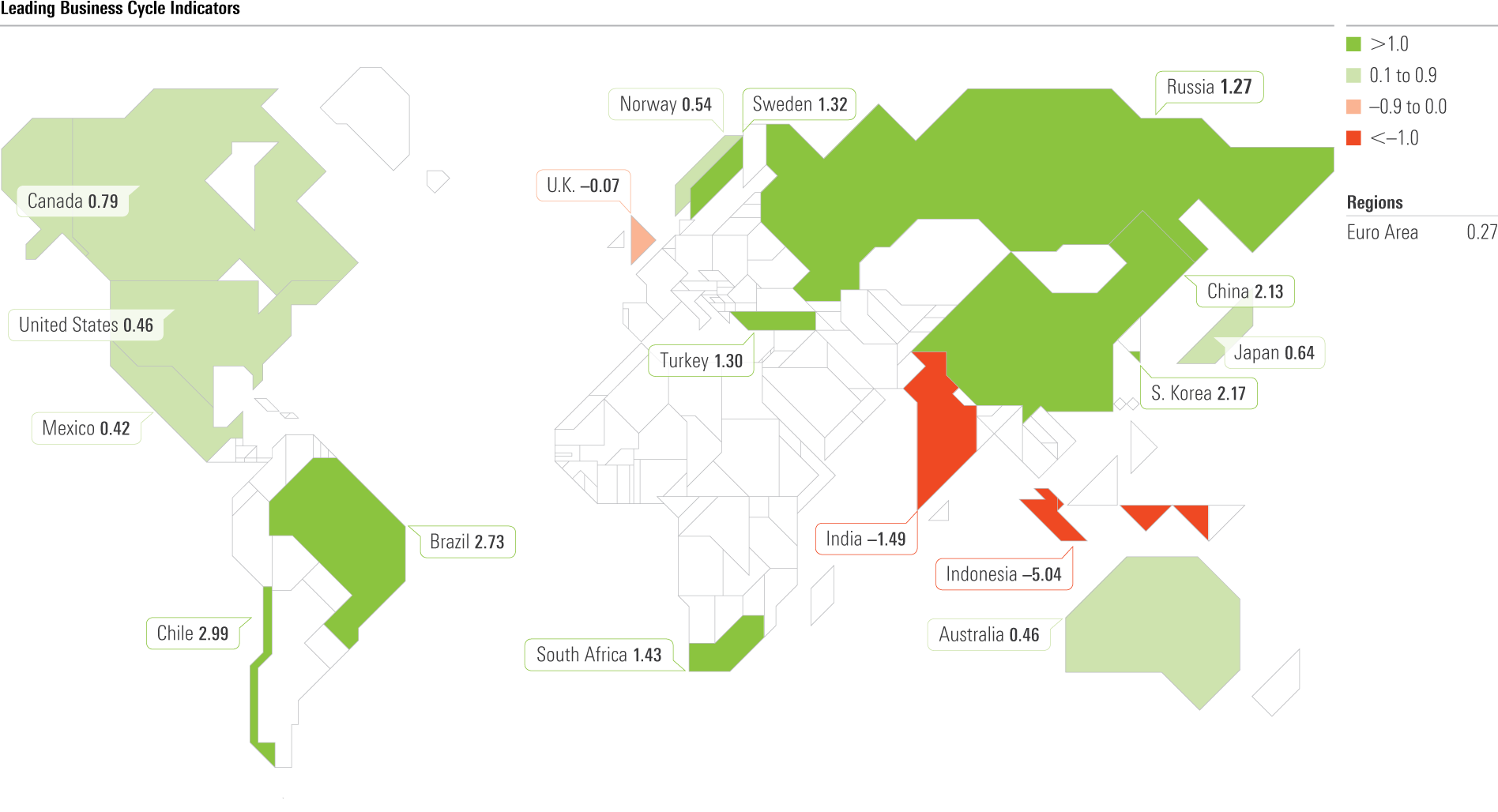

Leading Business Cycle Indicators Suggest Above-Trend Growth

The OECD's composite leading indicators utilize forward-looking data to determine whether an economy is expected to grow above (positive values) or below (negative) its long-term trend in the coming six to nine months. Emerging markets, including China and Brazil, are highly leveraged to the global economic cycle and look poised to see significant above-trend growth in the second half of 2021 as pandemic-related restrictions ease more broadly.

Source: Organization for Economic Co-operation and Development. Data as of June 30, 2021.

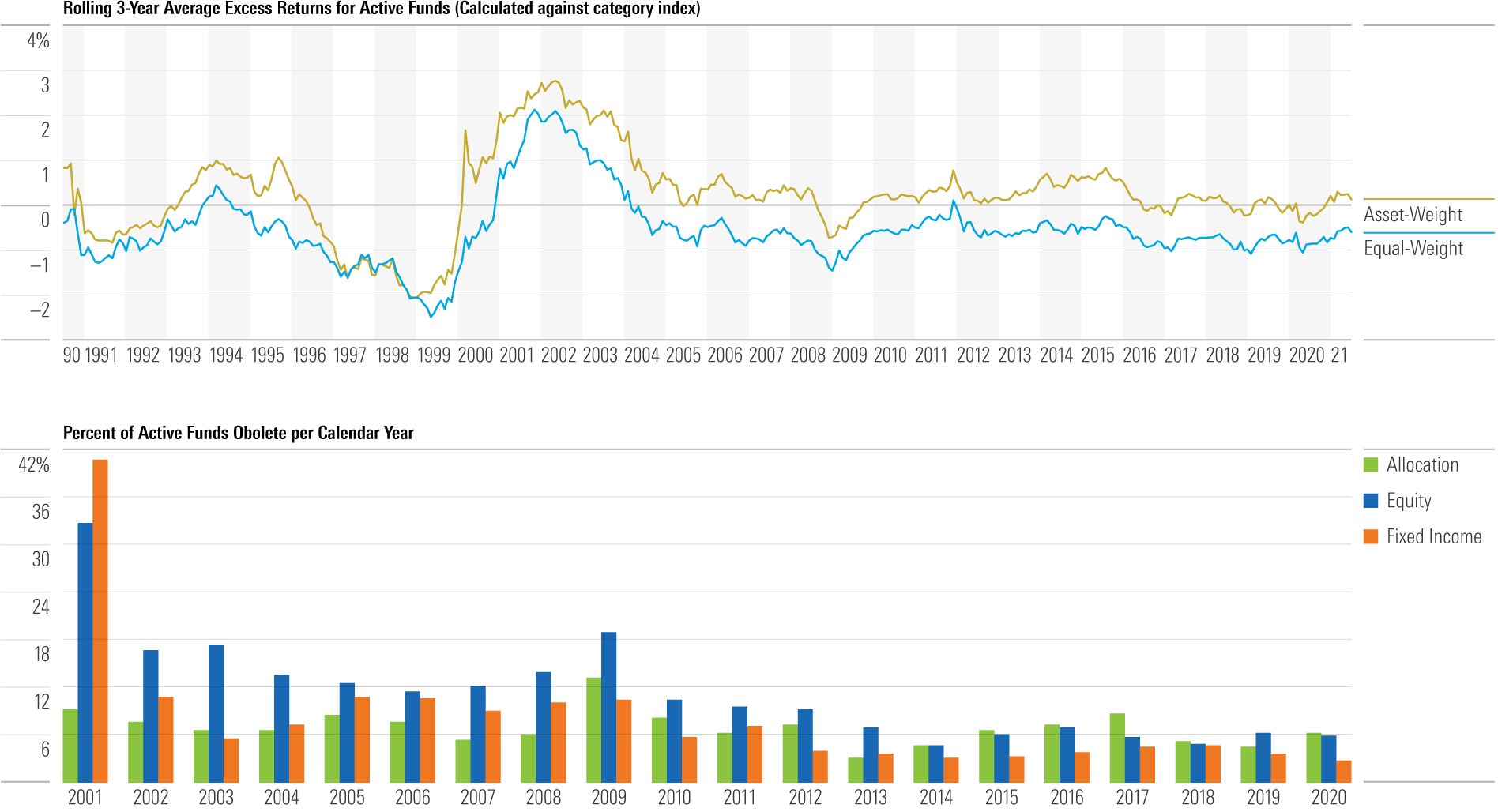

Is Active Back? Don't Get Your Hopes Up

Despite the long-spoken hope that traditional, active managers would prove their worth during the next market downturn, it failed to materialize. On average, active funds failed to produce excess returns (denoted by equal-weight) on a rolling three-year basis since 2012. When taking into account where investors' assets lie, active funds produced only a mere 0.2% three-year average excess return as of June 30. But even with challenged performance, the closure of active funds has slowed in the past decade.

Source: Morningstar Direct. Data as of June 30, 2021.

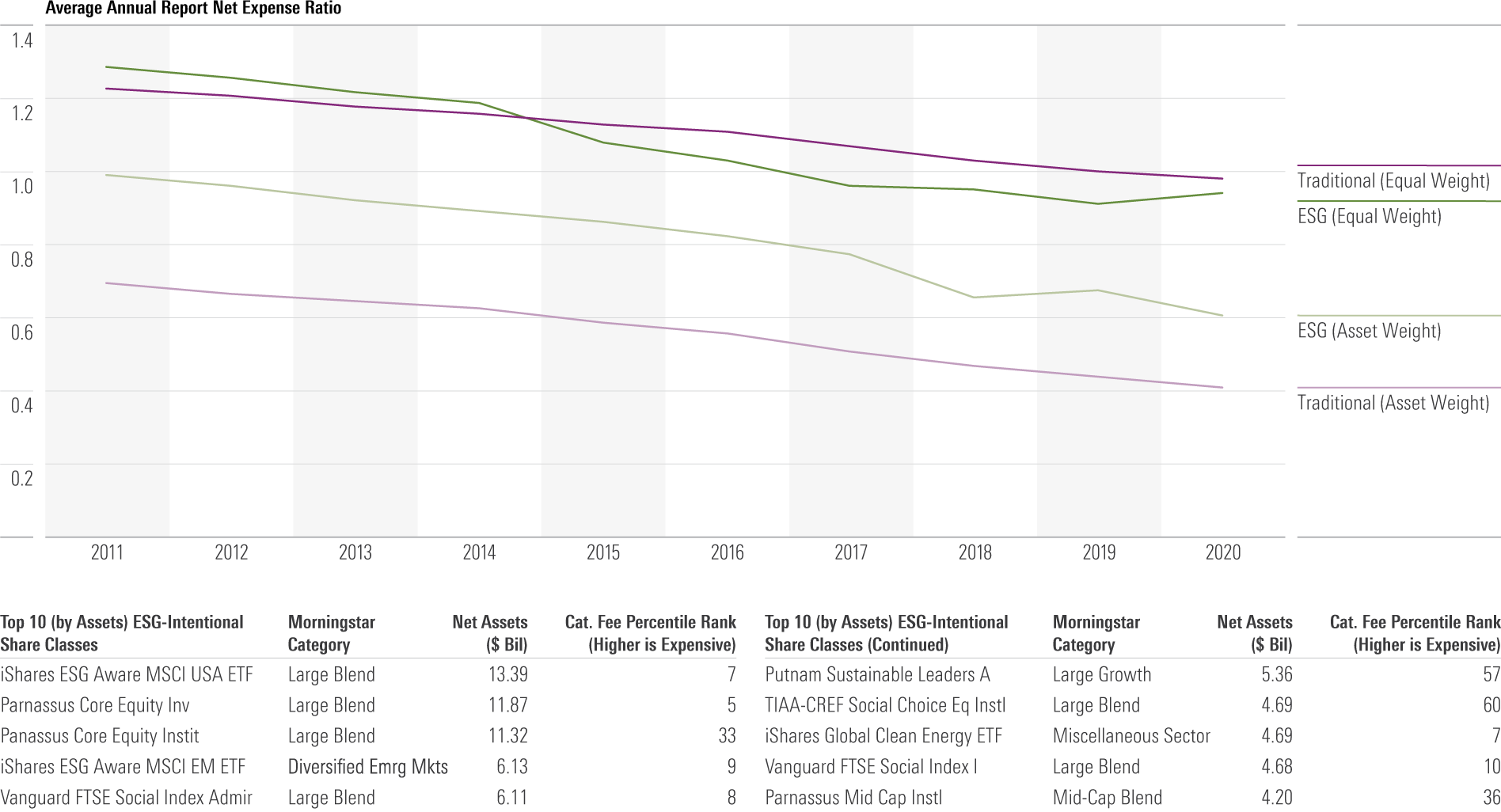

Despite Similar Price Tag, Investors Are Paying More for ESG

Morningstar's forthcoming U.S. Fund Fee Study includes the comparison between the fees of intentional environmental, social, and governance strategies and those of traditional strategies. Although asset managers are pricing the two groups similarly (denoted by equal weight), investors are pouring assets into pricier intentional ESG funds (denoted by asset weight). The chart below shows that of the largest ESG funds, most have below-average fees. However, when looking at the largest traditional funds, all have rock-bottom fees, within the bottom 10% of peers.

Source: Morningstar Direct. Data as of June 30, 2021.

Green Bonds Took on More Weight During Market Downturn

Green bonds are debt issued by either governments or corporations to finance environmental and climate-related projects. Interest has blossomed in recent years, especially in European markets, as investors look further for impactful investments. In the two-year period ended in June, the green bond ETF lagged its aggregate counterpart 2.9% to 3.3.%, as the fund experienced a steeper drawdown in March 2020 owing to its much higher exposure to corporates.

Source: Morningstar Direct. Data as of June 30, 2021.

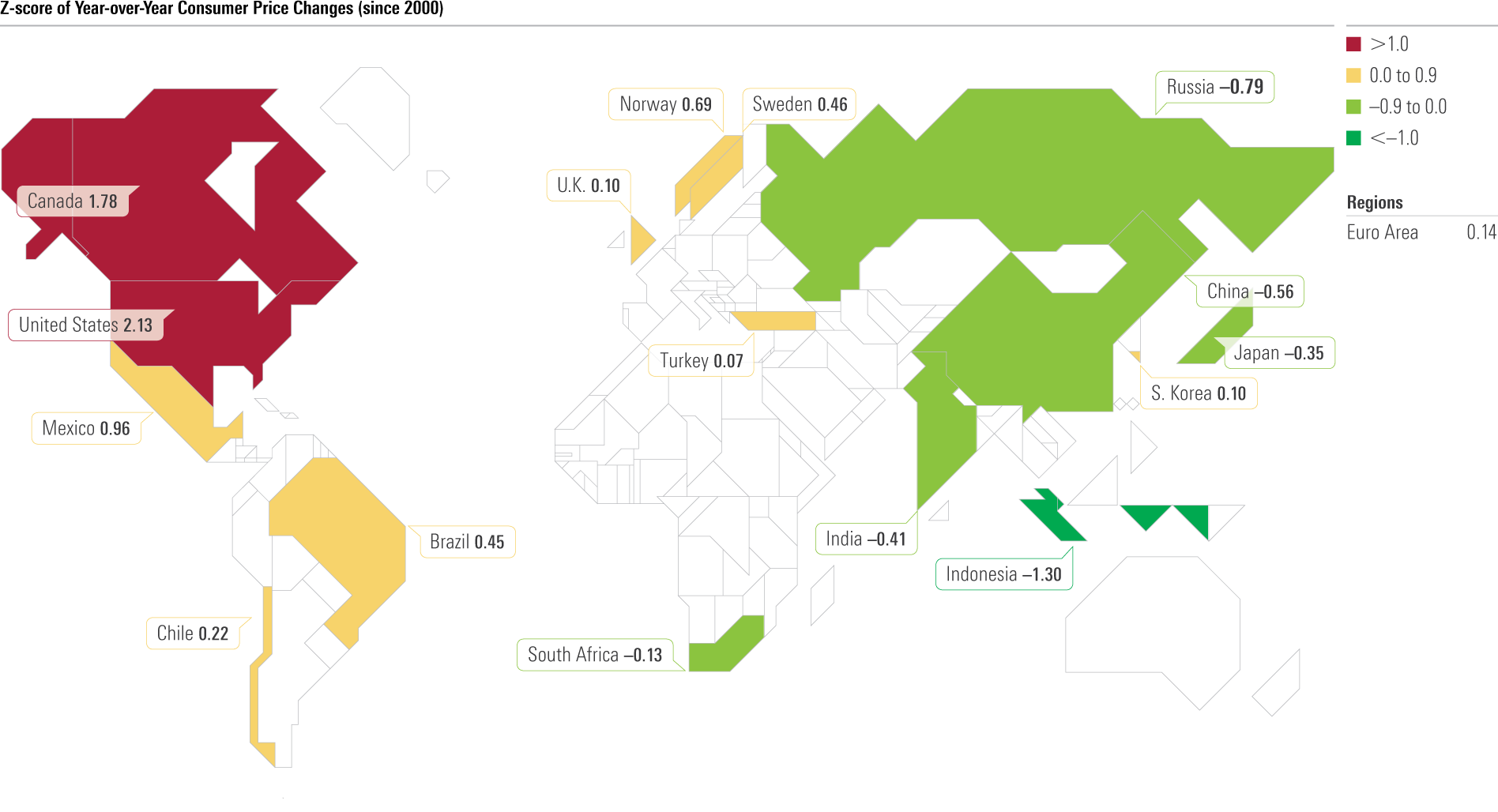

Inflation Pressure Building Across the Globe

The United States and Canada are experiencing the strongest inflation pressure among major economies, as measured by the z-score of year-over-year consumer price changes. Parts of Europe and Latin America, like Norway and Mexico, are also seeing above-average levels of inflation. However, the pace of price increases in Asia are generally below averages dating back to 2000.

Source: Organization for Economic Co-operation and Development. Data as of June 30, 2021.

Employment Gathers Momentum but Still Has a Ways to Go

Employment growth in sectors that were hardest hit by the pandemic gathered momentum, most notably leisure and hospitality, and education and health services. That said, employment in these sectors remains significantly stunted compared with pre-pandemic levels. Only transportation and warehousing has effectively closed the gap.

Source: Bureau of Labor Statistics. Data as of June 30, 2021.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)