Money Flowed to the Cheapest Funds in the Third Quarter

This month, Morningstar introduced a quarterly look at flows by fund cost.

Note: This is an excerpt from the Morningstar Direct U.S. Asset Flows Commentary for September 2019. Download the full report.

Our estimated U.S. mutual fund and exchange-traded fund flows for September 2019 show that, overall, passive U.S. equity funds saw $22.9 billion in inflows while active U.S. equity funds had $19.1 billion in outflows.

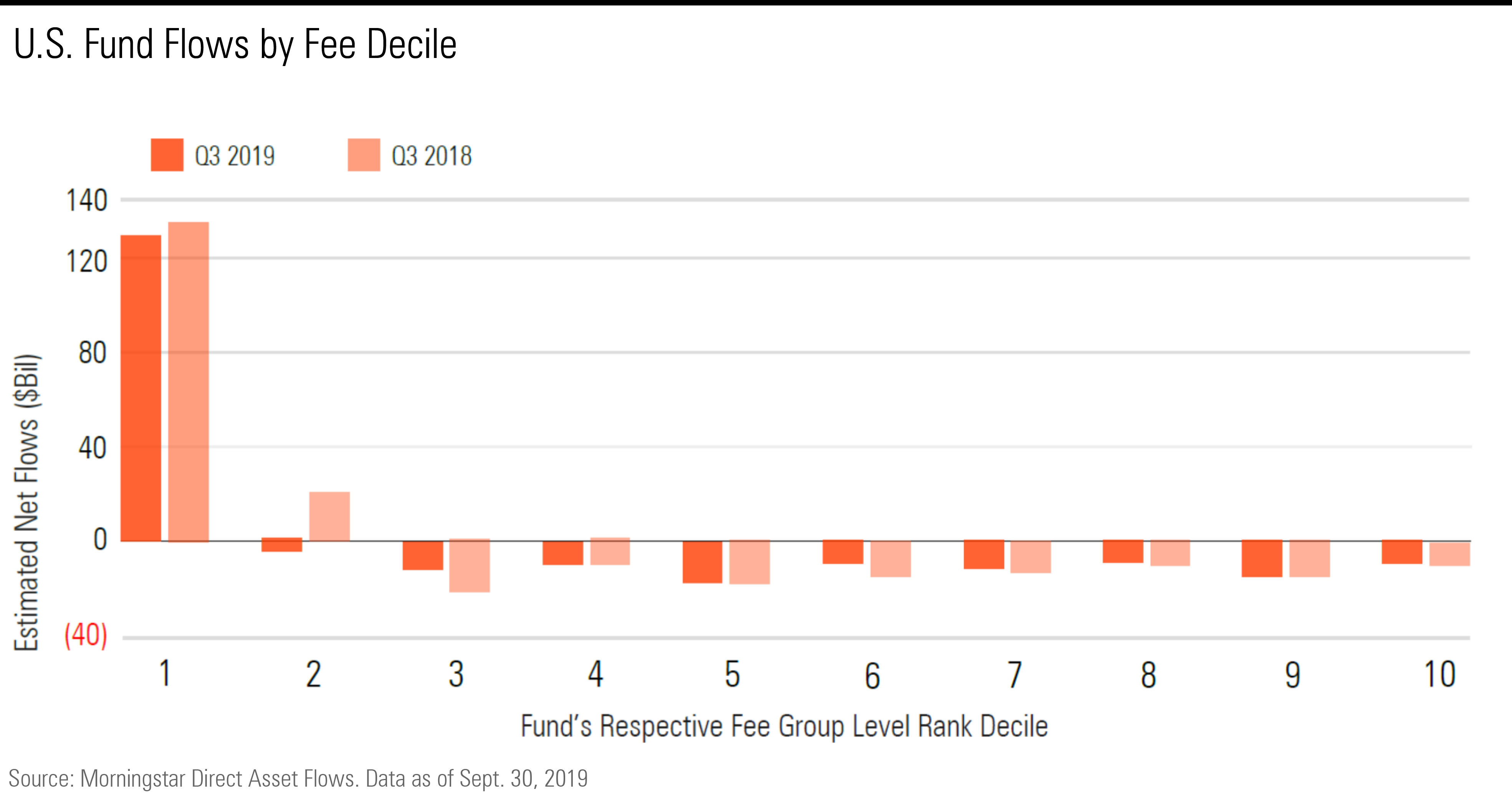

This month, Morningstar introduced a quarterly look at flows by fund cost. During the third quarter, the entirety of net flows to U.S. mutual funds went to the cheapest decile of funds. We estimate net flow for mutual funds by computing the change in assets not explained by the performance of the fund, and net flow for U.S. ETF shares outstanding and reported net assets.

Key takeaways:

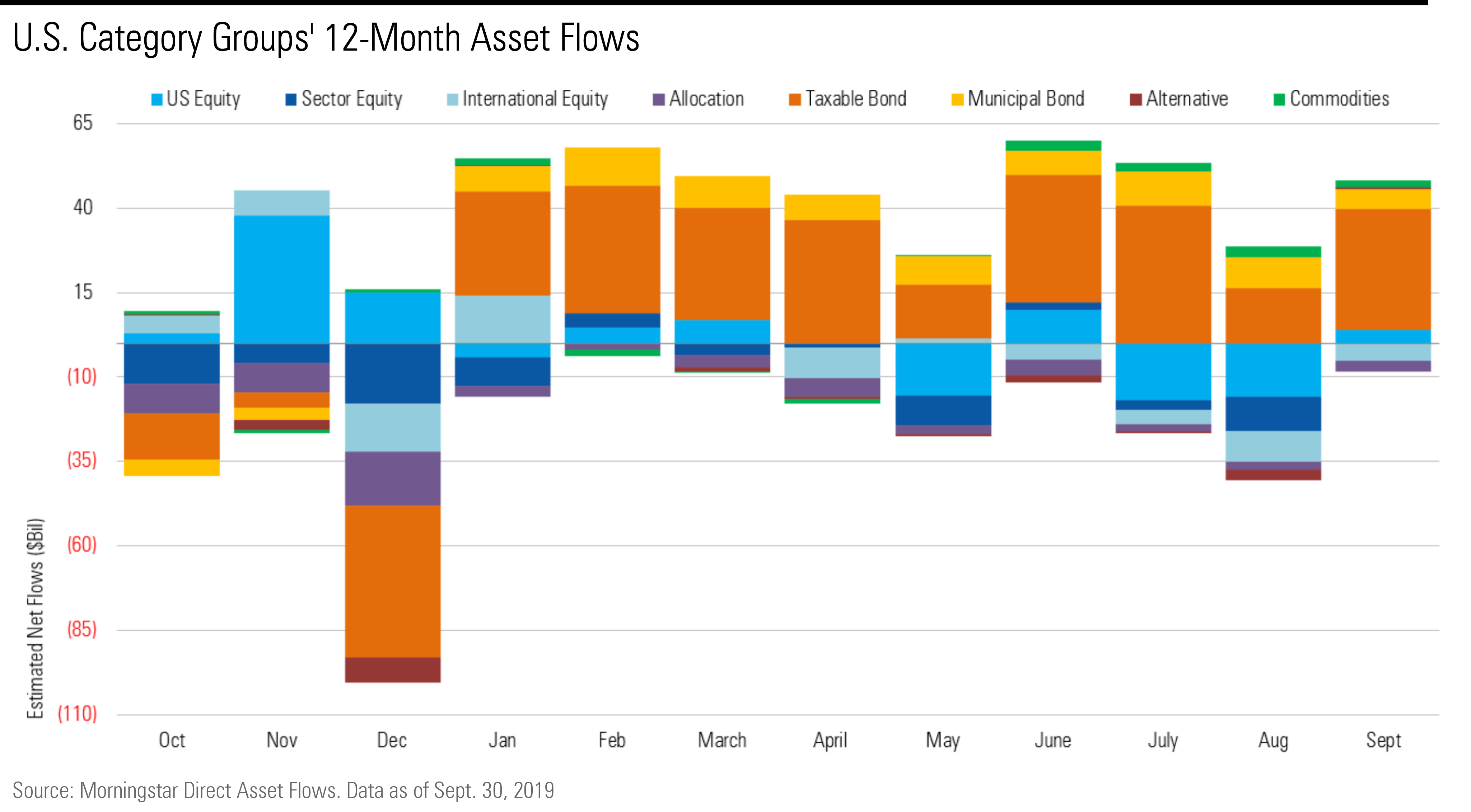

- In September, long-term funds collected nearly $39.9 billion after open-end funds and ETFs saw combined outflows in August of nearly $16.0 billion. September saw a pause in market volatility after August's sharp declines in equity markets sparked by growing evidence of a global economic slowdown and the ongoing U.S.-China trade dispute.

- When flows are measured by fee levels, the entirety of third-quarter long-term fund flows went to the cheapest decile of funds.

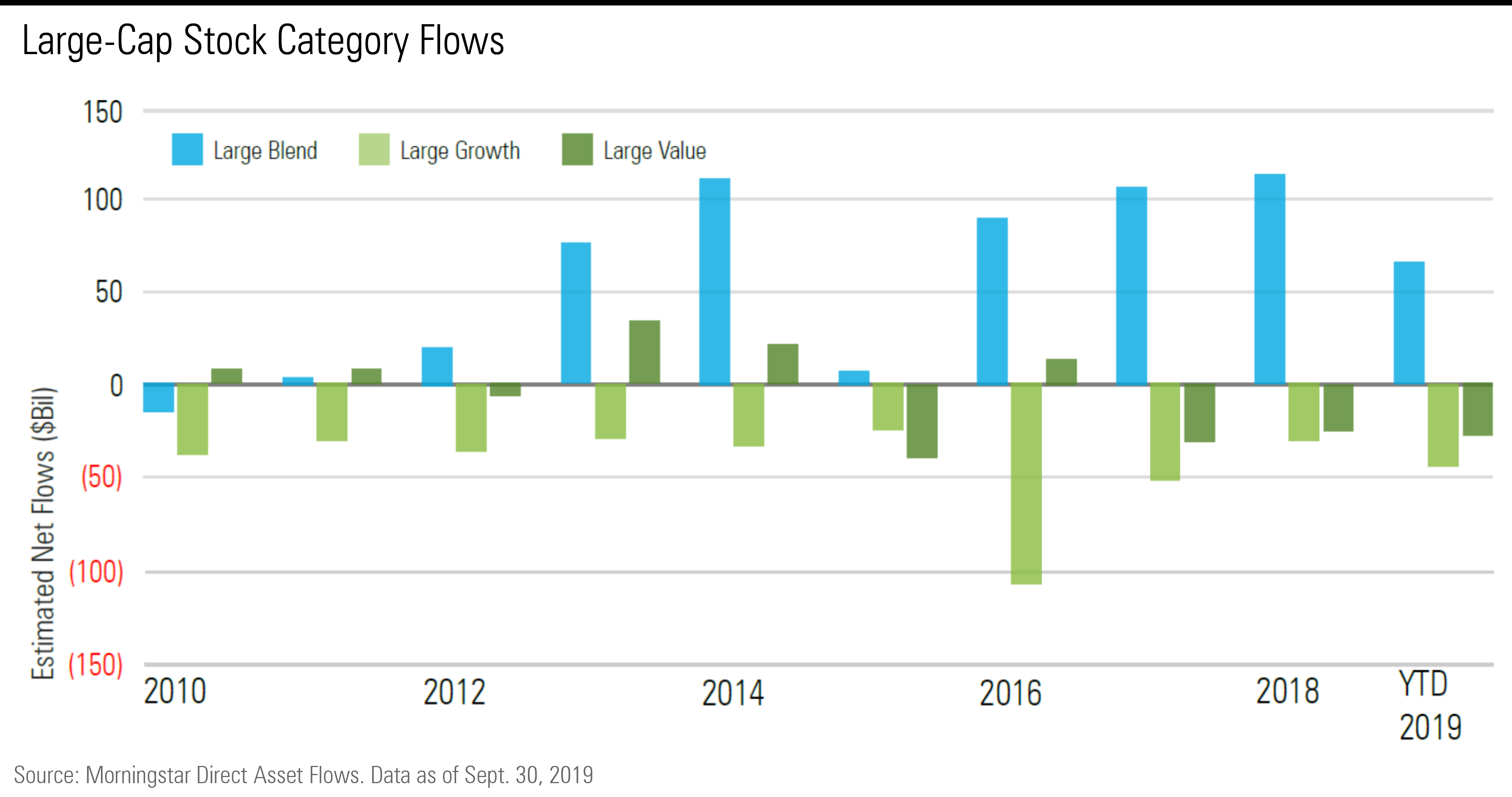

- U.S. stock funds experienced modest overall inflows of $3.8 billion in September, nowhere near the level needed to offset outflows seen in August of $15.8 billion and in July of $16.9 billion. In fact, U.S. stock fund flows finished September solidly negative for the year to date.

- Among category groups, taxable-bond funds attracted $36.0 billion of inflows in September, bouncing from a below-trend $16.3 billion worth of inflows seen in August. Municipal-bond funds took in $5.8 billion in September and are on track for a record year of inflows.

- Within U.S. stock funds, the bulk of the inflows went to passive large-blend funds, as investors continue to migrate to broad-based, U.S. market-tracking index funds. Large-growth and large-value funds both saw outflows.

- International-stock funds had a fourth consecutive month of outflows, bringing year-to-date outflows to $16.6 billion. The third quarter marked the biggest outflows for these funds as a percentage of total assets since the fourth quarter of 2011, when the European sovereign debt crisis peaked and the U.S.' credit rating was downgraded.

- Among all U.S. fund families, BlackRock/iShares led in September with $17.8 billion in long-term inflows, followed by Vanguard, which slipped out of the top spot with approximately $14.4 billion in inflows.

- State Street's flows in September were dominated by money heading into and out of SPDR S&P 500 ETF SPY, which holds a Morningstar Analyst Rating of Gold. The fund's $8.6 billion in inflows contributed the lion's share of the firm's overall inflows.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)