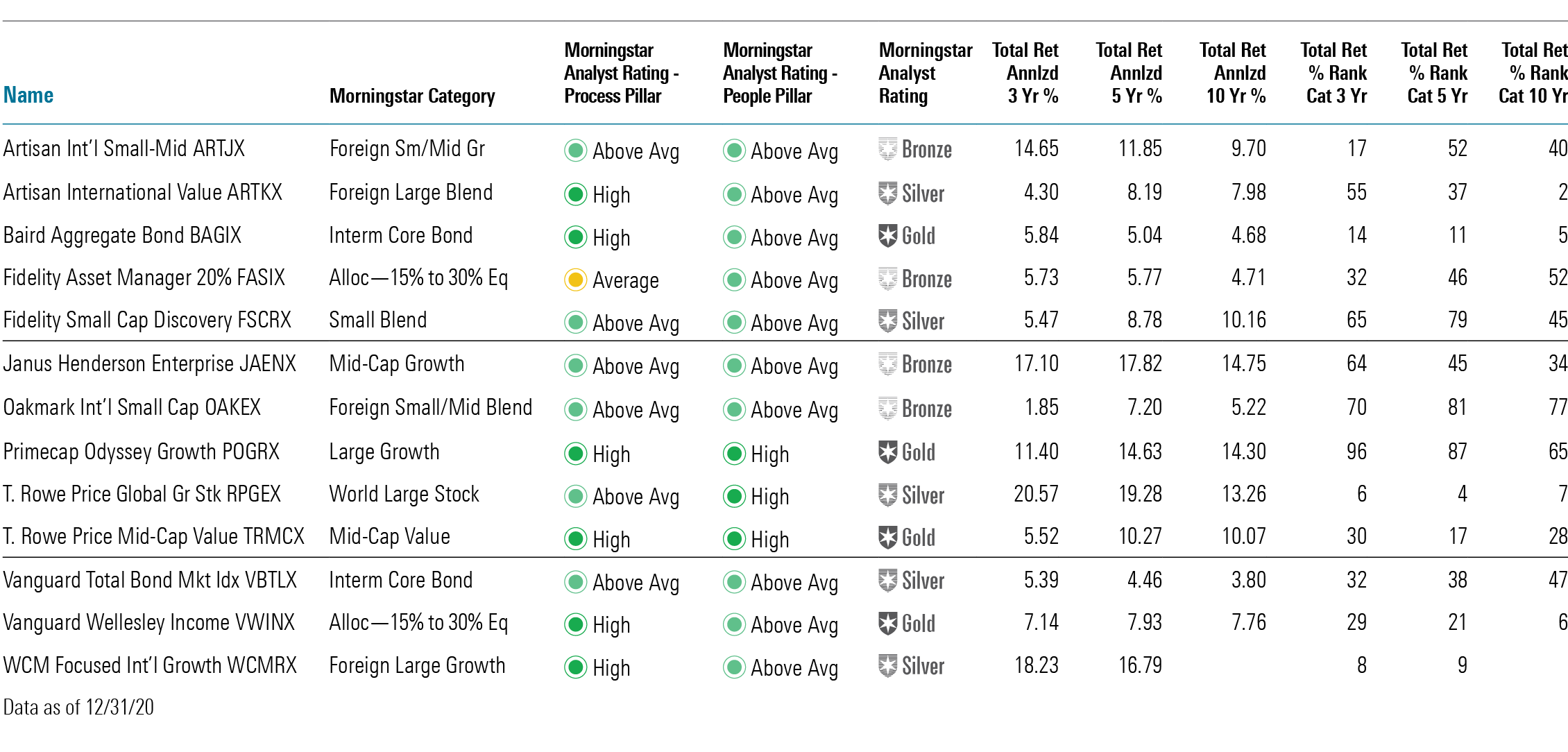

Funds for 2021 and Beyond

These funds look attractive to us today.

A version of this article first appeared in the January 2021 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Good riddance 2020! I'm still trying to make sense of that awful year, but let's pause to sum up the markets and the economy at this point.

As I write this, unemployment is still worse than it ever got in the 2008–09 recession. And with hospital capacity strained in many areas, it's quite likely that the jobs picture is going to get worse this winter before it gets better.

But vaccines are coming, and that means the economy should recover as the nation's health recovers. Exactly how fast America will get vaccinated and how long it will take to stop the spread of the coronavirus is unclear, even if the trend is positive.

After a decade of growth stocks beating value, we got treated in 2020 to growth stocks absolutely crushing value to a degree not seen since 1999. The typical mid-cap growth fund gained 39%, while the typical mid-cap value fund was up a mere 1%. The story was similar for large caps and small caps, though not quite as extreme.

With a severe recession that came out of the blue, it's quite logical that value stocks would be hurting, as they are more economically sensitive than growth. And it also is logical that growth companies that help us in this new reality would surge. Zoom ZM helps people work from home, Amazon.com AMZN helps people shop from home, and so on. But many other growth stocks came along for the ride in the rally, and we're left with a massive divide between growth and value. The Federal Reserve's extreme accommodation in the face of the recession naturally underpinned stocks across the board.

Meanwhile, bonds actually behaved logically. High quality rallied in the face of a shrinking economy while high yield (low quality) sold off sharply and then rebounded. The upshot, though, is fairly low yields and therefore low return prospects.

With that background, I think caution is in order, but it makes sense to stay on your plan and pick your spots for adding equity funds. Here are some funds that seem attractive to me today, but remember these are long-term picks. I don't know what the markets or these funds will do in 2021.

Source: Morningstar.

Reopened Morningstar Medalists Let's start with one of my favorite hunting grounds: reopened funds.

Closed funds typically reopen because outflows have brought asset levels down to where management thinks it can reopen and even grow without impeding performance. Secondarily, they sometimes reopen in hopes of stemming the tide of outflows, because outflows can be detrimental to performance.

Either way, when Morningstar Medalist funds reopen, it is an appealing contrary indicator. It tells me that the fund's strategy is out of favor, but the medalist rating tells me that the fundamentals remain strong. As it happens, four medalists reopened in 2020. Let's review, starting with the highest-rated and moving down from there.

T. Rowe Price Mid-Cap Value TRMCX manager David Wallack seeks stocks trading on cheap multiples but insists on healthy balance sheets and good management. Over time, that's worked well, but there's not a lot of interest in the meager returns generated in mid-value these days, even at funds with Morningstar Analyst Ratings of Gold, like this one. The fund hasn't had a year of net inflows since 2010, partly because value was out of favor and partly because the fund was closed for most of that time. But that's music to my ears. An excellent fund with a seasoned manager whose style is unloved? Yes, please.

There are some similarities with Artisan International Value ARTKX, which reopened in March 2020. David Samra is also a skilled, seasoned manager with a great track record. The fund did have net inflows as recently as 2017, however, and Samra runs a more focused portfolio.

Fidelity Small Cap Discovery FSCRX is a value-leaning small-cap blend fund, so it's no surprise why it's getting the cold shoulder from investors. Derek Janssen emphasizes durable business models with predictable earnings. Turnover of 34% is consistent with that emphasis on long-term stability. The fund reopened after assets dipped under $2 billion from a peak of $7 billion in 2013.

Janus Henderson Enterprise JAENX is still a big fund, but it reopened on Dec. 21, 2020, three years after it closed. I assume that this was a case of wanting to stem outflows rather than actually wanting more assets to manage. The fund had $3.3 billion in net outflows in 2020. Its total returns in 2020 were much better than the above fund, but its relative performance was much worse. This mid-growth fund's 19.2% gain in 2020 was only half that of peers and benchmark. Brian Demain and Cody Wheaton were more interested in insurance companies than red-hot names like Tesla TSLA and Zoom. Needless to say, that was the wrong call--for 2020 at least. They did hold technology and healthcare weightings as large as their typical peer's, but it was those super-fast growers that powered returns in 2020. The next few years may suit this strategy better.

My Favorites Do a Pratfall As longtime readers know, Primecap funds are among the ones I recommend most frequently. And they had a dismal 2020 owing to limited exposure to FAANG stocks (Facebook FB, Amazon, Apple AAPL, Netflix NFLX, and Google GOOG [aka Alphabet]) and owning some travel stocks that got absolutely hammered. But I'm still a believer, even as I'm cautious about growth. Primecap Odyssey Growth POGRX is open and appealing.

An Ounce of Prevention After a crazy year like 2020, it's a good idea to make sure your defensive side holds up. One option that still has upside is an allocation fund that is mostly bonds.

Fidelity Asset Manager 20% FASIX is, as the name suggests, 20% equities, with the rest run by Fidelity's taxable-bond side. Fidelity's fixed-income team is topnotch. It is strong pretty much across the board. The modest equity kicker gives it a bit of increased return potential without too much additional risk.

Vanguard Wellesley Income VWINX is an allocation stalwart. Its value leanings make it feel a bit contrarian, too, at this point. Some have drawn parallels with 1999, but I don't buy that too much. But I would point out that value was cheap then because growth stocks took all the oxygen in the room, and as a result, value held up beautifully in the ensuing bear market. I'm sure we won't have an exact repeat, but value does seem pretty cheap.

High-quality bonds are another defensive staple. Long Treasuries were the champs of the COVID-19 bear market, but even moving beyond them into high-quality mortgages and corporate bonds can provide some defense.

Baird Aggregate Bond BAGIX, led by Mary Ellen Stanek, takes a disciplined approach that you can depend on. The fund sticks mainly to high-quality corporates and securitized debt. It avoids big bets on single issuers and most forms of big risk-taking, yet it consistently beats its peers.

Vanguard Total Bond Market Index VBTLX gives you super-cheap exposure to mainly government bonds. It is boring but effective. When the economy falters, interest rates fall, and government bonds--especially those with longer maturities--rally just at the time your stocks are losing money. One could pick a fund like this and then add more risk around it with things like high-yield and foreign bonds. That way, you have a low-cost, dependable core.

Foreign Is Cheap For a while now, I've been thinking that foreign equity is cheap and due for a good run. Eventually, I'll be right.

Silver-rated T. Rowe Price Global Growth Stock RPGEX is one of my favorite world-stock funds. Scott Berg takes a moderate growth approach in search of bargains around the globe. T. Rowe Price's crack analyst staff is able to deliver plenty of good ideas, and that shows in performance. The fund is about half U.S., half foreign--and Berg has had success on both fronts.

Oakmark International Small Cap OAKEX was pummeled in the bear market because of its high levels of exposure to cyclical names. Part of the appeal, though, is that very exposure to other economies and the lower correlation with the United States. David Herro and team have proved to be good stock-pickers, even if recent performance suggests otherwise.

Artisan International Small-Mid ARTJX probably wouldn't have anything to do with Oakmark's names. This fund lands well to the right in the Morningstar Style Box, as Rezo Kanovich seeks disruptive growth names in fields like cloud computing and artificial intelligence. Prepare for a volatile investment, as this is as bold as they come.

WCM Focused International Growth WCMRX is all about moats and competitive advantages. Thus, it lands in the large-growth corner of the style box. The team seeks strong but adaptable corporate cultures that can change with the times. Managers Mike Trigg and Pete Hunkel like fast-growers and steady dependable names. The Silver-rated fund has really clicked under their management.

Conclusion Opportunities are still out there for people open to them. Keep moving ahead even through the uncertainty.

Correction The January 2021 issue of FundInvestor incorrectly stated that Artisan International Value ARTKX gained just 1% in 2020. The correct figure was 8.5%, which was just slightly below the return of category peers and benchmark. The text in this article has been changed to remove the incorrect reference to Artisan's returns in 2020.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)