You Can Do Better Than the Russell 2000

Other U.S. small-cap indexes are worth considering.

U.S. small-cap stocks went on a tear in November 2020 in the wake of the U.S. presidential election and favorable coronavirus vaccine news.

Investors betting on small-cap stocks' continued outperformance may consider investing in open-end funds and exchange-traded funds that follow U.S. small-cap indexes. One of these is the Russell 2000 Index, which iShares Russell 2000 ETF IWM replicates. It's the second-largest U.S. small-cap fund with over $51 billion in net assets as of Nov. 30.

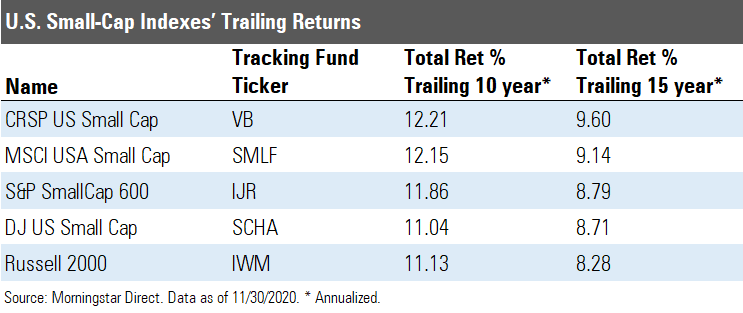

The Russell 2000's recent performance is competitive with other U.S. small-cap indexes like the CRSP U.S. Small Cap and the S&P SmallCap 600. In November, the Russell 2000 returned 18.43%, while the other indexes returned 16.01% and 18.17%, respectively. The Russell 2000 has also outperformed over the past three months, six months, and one year. However, the long-term returns aren't as favorable for the Russell 2000.

In the trailing 10 years annualized as of Nov. 30, the CRSP U.S. Small Cap Index had a 12.21% return and the S&P SmallCap 600 Index had an 11.86% return. Meanwhile, the Russell 2000 achieved just 11.13%. The trend remained when increasing the period to 15 years as of Nov. 30.

Here are three reasons why the Russell 2000 Index underperforms its competitors.

1) It holds thinly traded stocks. The Russell 2000 holds the 1,001st to 3,000th largest U.S. stocks and weights them by market cap. The lower bound of this range is lower than other small-cap indexes. Its competitors tend to hold slightly larger-cap names.

Smaller-cap companies tend to be less profitable and have weaker competitive advantages than larger-cap companies. This hurts the Russell 2000's performance as competitor indexes hold relatively larger names. These smaller stocks are also less liquid, which can increase trading costs and thus hurt performance.

2) It has no turnover buffers. Another issue is the index's reconstitution. If the 1,001st largest U.S. stock's price appreciates, it graduates from the index and is removed, as is the 3,000th stock if its price depreciates. The index makes these changes on a single day--rather than spreading changes over multiple days--and thus incurs unnecessary costs.

This issue is most costly for the Russell 2000's lower bound. Since transaction costs are higher for the smaller, less liquid stocks, reconstituting the smallest members with no buffering hurts performance.

3) It has significant price pressure. The Russell 2000 is the most widely used U.S. small-cap benchmark. As a result, reconstitution on a single day puts a large amount of money in motion, which can push prices of stocks that are added or removed in directions that aren't favorable to those who track it.

Other Index-Tracking Funds to Consider Vanguard Small-Cap ETF VB and Schwab U.S. Small-Cap ETF SCHA are more effective at getting U.S. small-cap exposure. Both funds track slightly larger stocks than the Russell 2000 does and have more generous buffering rules. They receive Morningstar Analyst Ratings of Silver.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)