U.S. Sustainable Funds Continued to Break Records in 2020

More funds, more flows, and impressive returns define the U.S. sustainable landscape.

Editor's note: This is adapted from the 2020 Sustainable Funds U.S. Landscape Report. Download the full report.

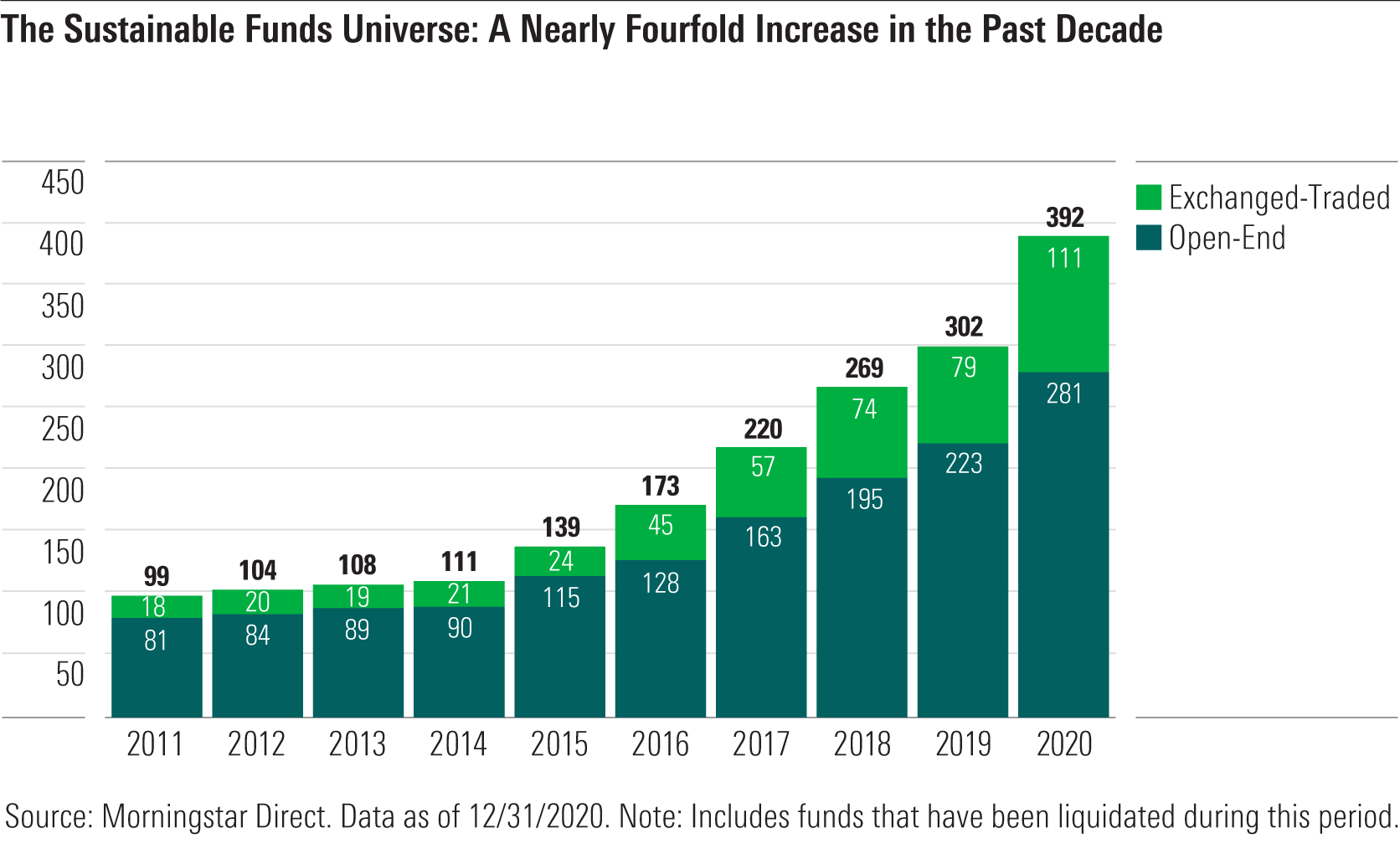

At the end of 2020, the group of sustainable open-end funds and exchange-traded funds available to U.S. investors numbered 392, up 30% from 2019. The group has experienced a nearly fourfold increase over the past 10 years, with significant growth beginning in 2015.

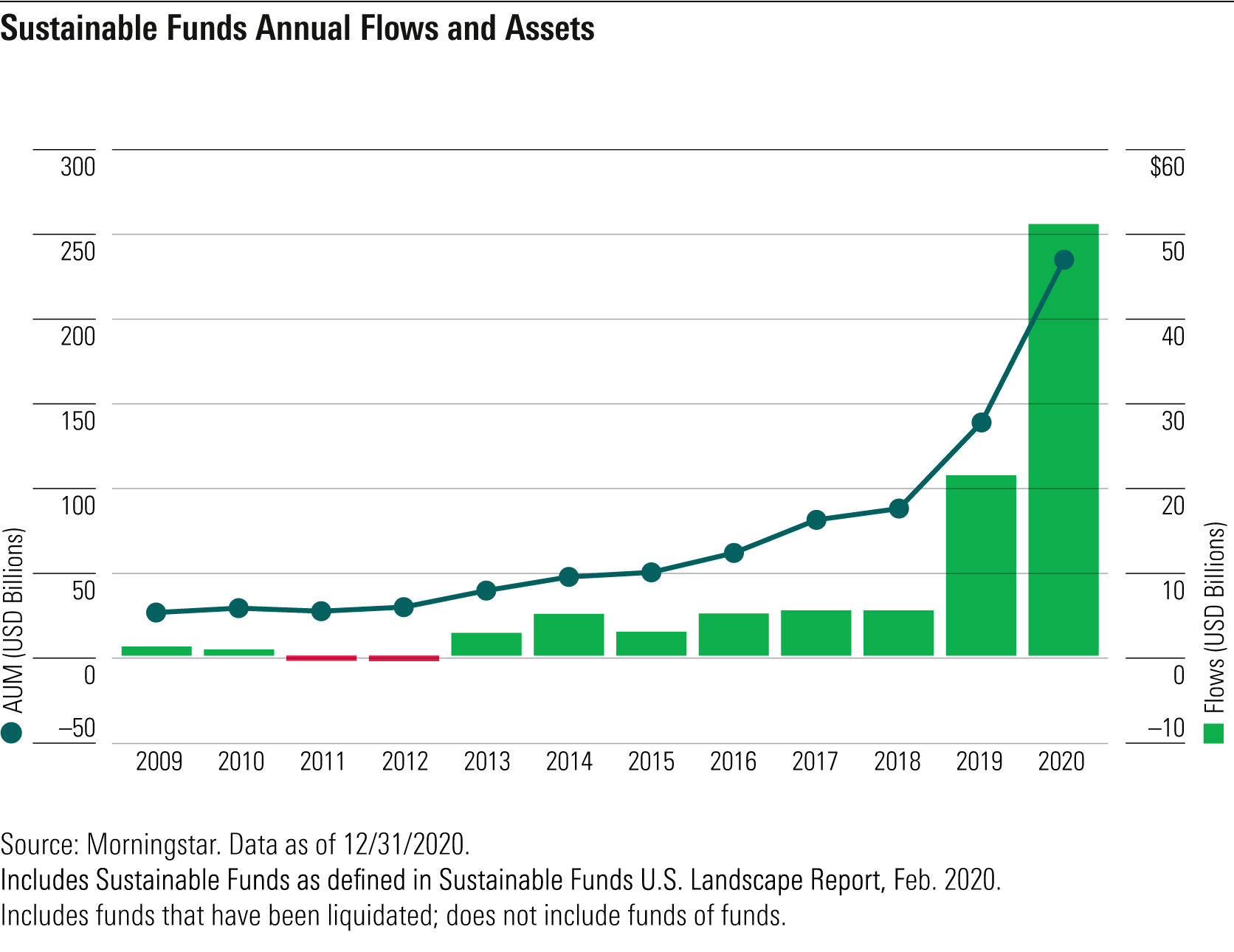

In 2020, sustainable funds were more attractive than ever for U.S. fund investors. For the fifth calendar year in a row, sustainable funds set an annual record for net flows: Flows reached $51.1 billion, with $20.5 billion of that coming in the fourth quarter.

A Diverse Menu of Sustainable Funds

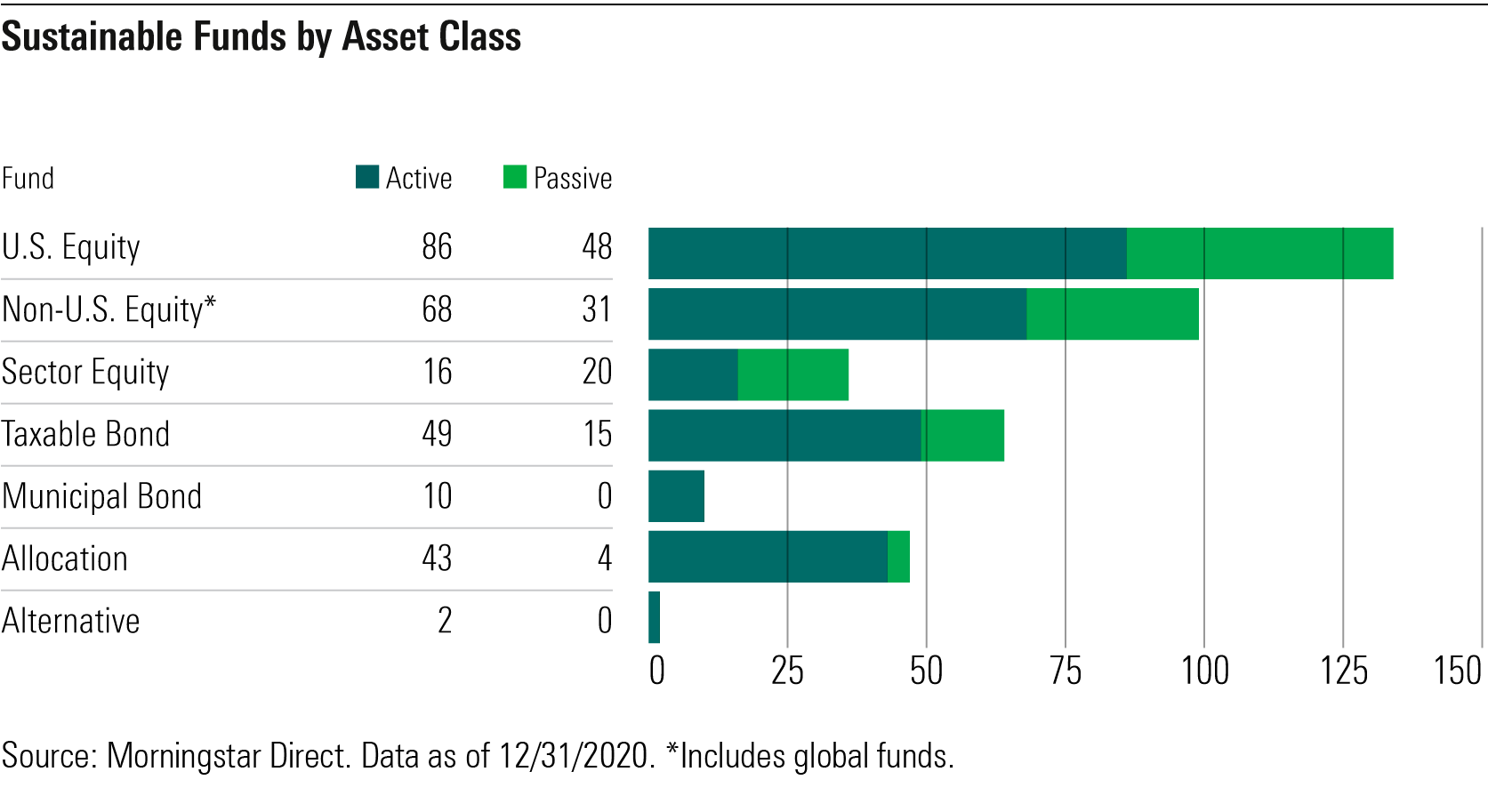

Of the 392 sustainable funds, 269 are equity funds, 74 are fixed-income funds, and 47 are allocation funds. Investors have the most choices in U.S. equity, with 134 funds. Another 99 funds are either world-stock or international-equity funds. Among fixed-income funds, 26 are intermediate-term funds. Overall, investors can find sustainable funds in 65 Morningstar Categories.

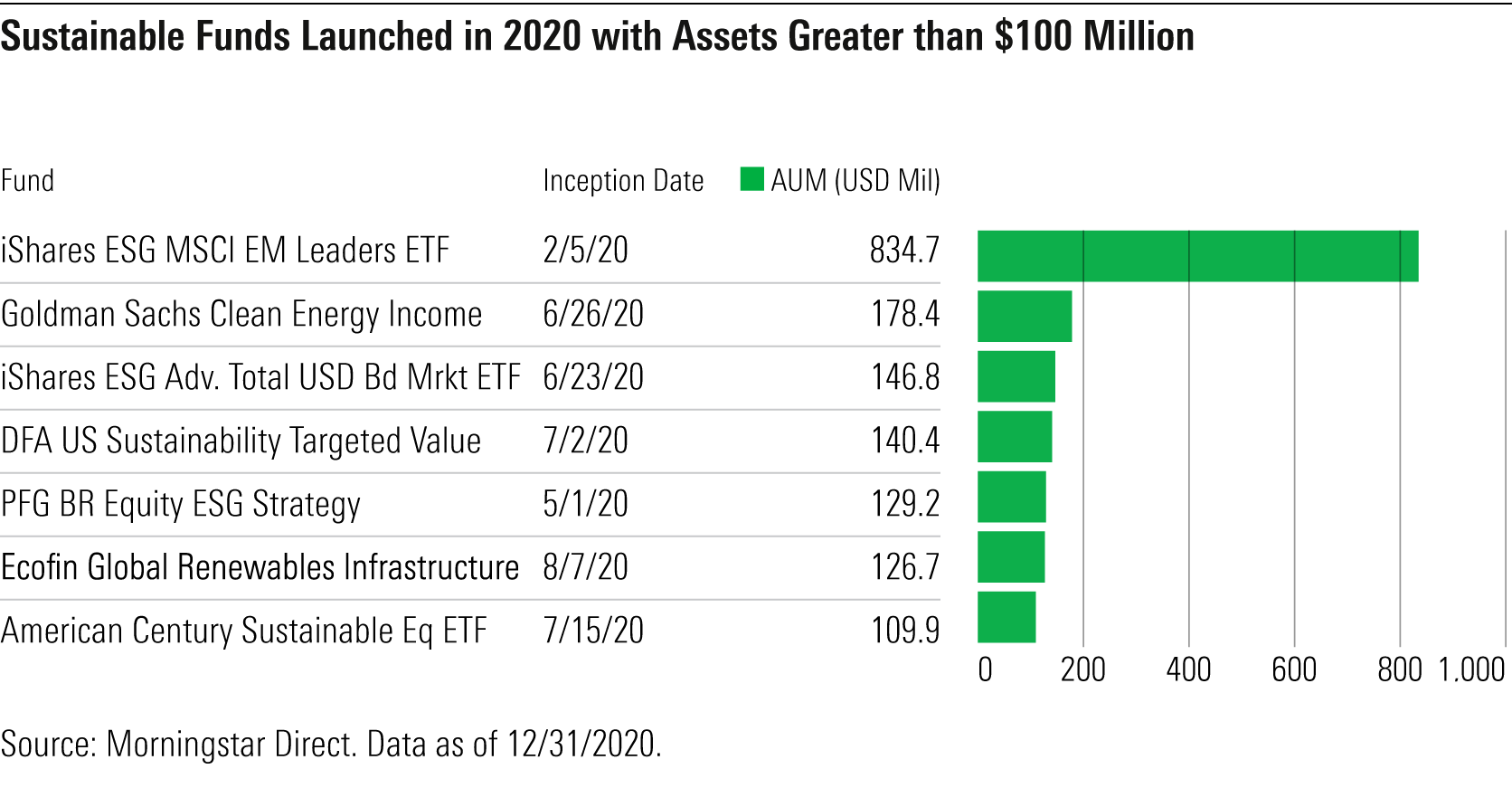

New Sustainable Funds in 2020

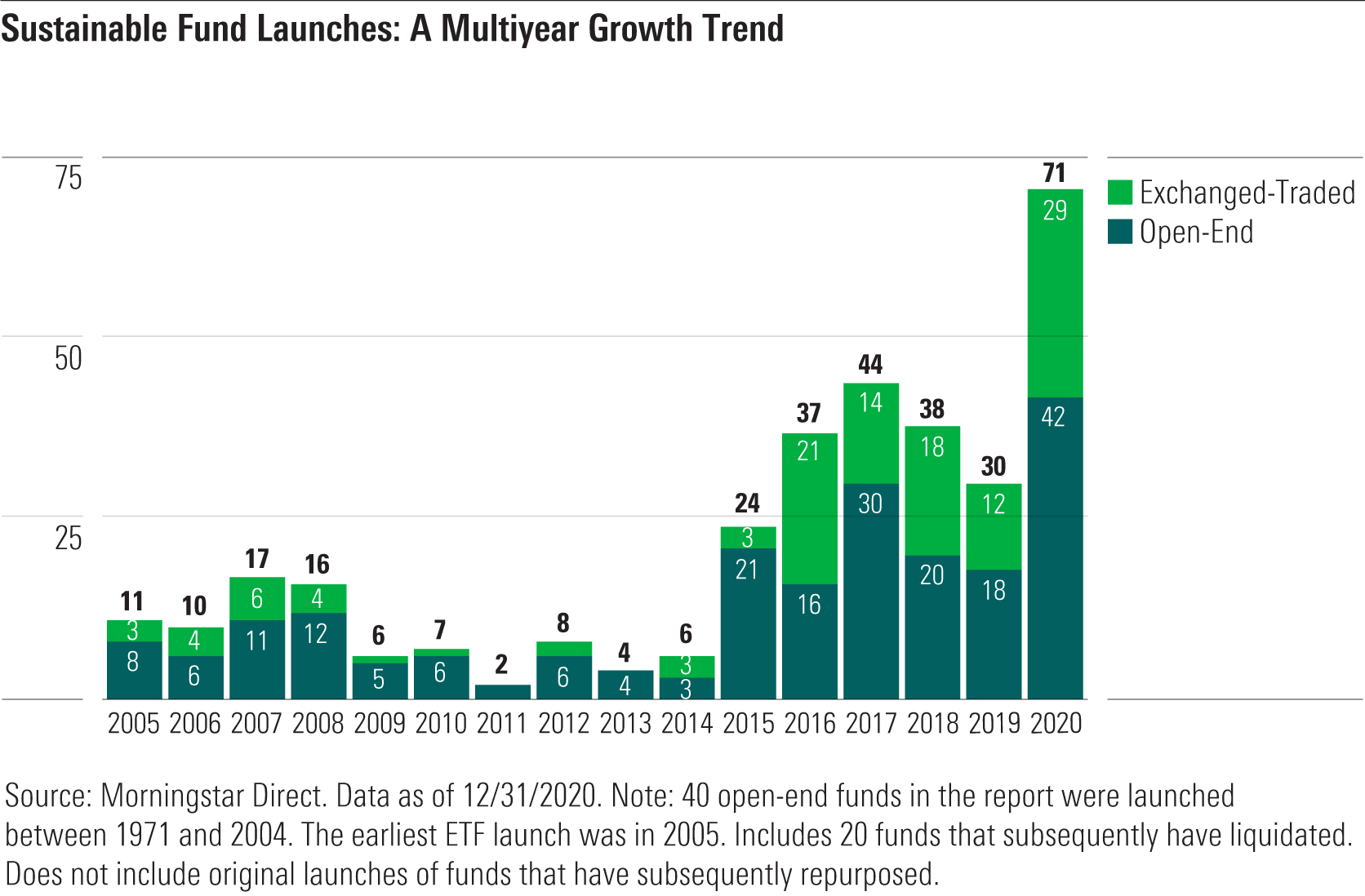

Sustainable fund launches continued a multiyear growth trend that began in 2015 when 24 new funds were launched, a record at the time. At least 30 funds have been launched each year since. In 2020, the 71 new funds that were launched easily topped the previous high-water mark of 44 set in 2017.

Seven of 2020's new sustainable funds already had assets of more than $100 million at year-end. Leading the way was iShares ESG MSCI Emerging Markets Leaders ETF LDEM. Launched in February, the fund had $835 million in assets at year-end, far more than any other fund in the class of 2020. Two sustainable sector funds made the list, Goldman Sachs Clean Energy Income GCEDX and Ecofin Global Renewables Infrastructure ECOIX, helped by the strong performance of renewable energy stocks during the year.

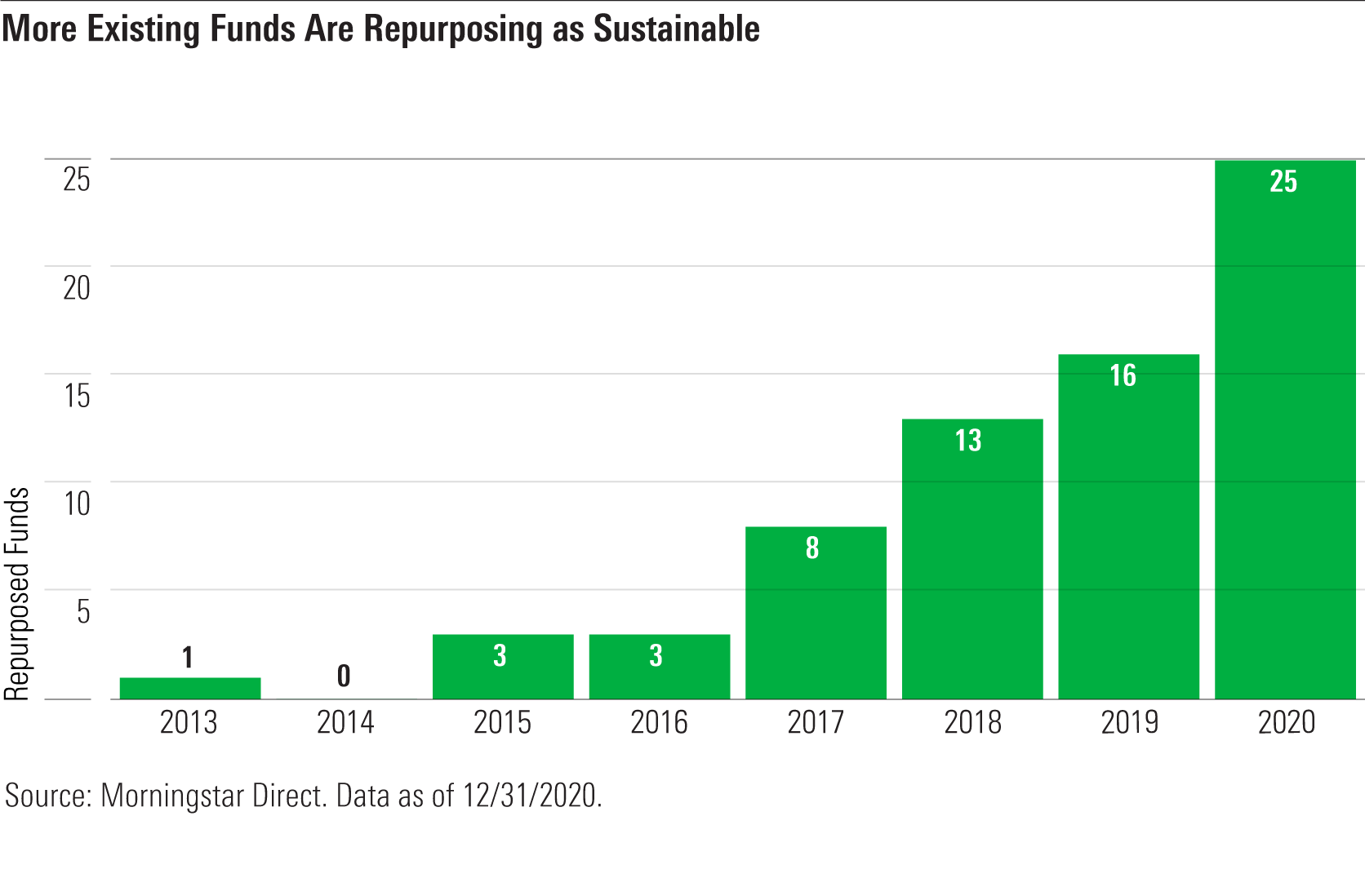

Repurposed funds continued to add to the growth of the sustainable funds universe. Last year, 25 existing funds changed their investment strategies to become sustainable funds. Repurposing funds is a way for asset managers to build their sustainable assets under management without having to start new funds from scratch and wait for them to reach scale.

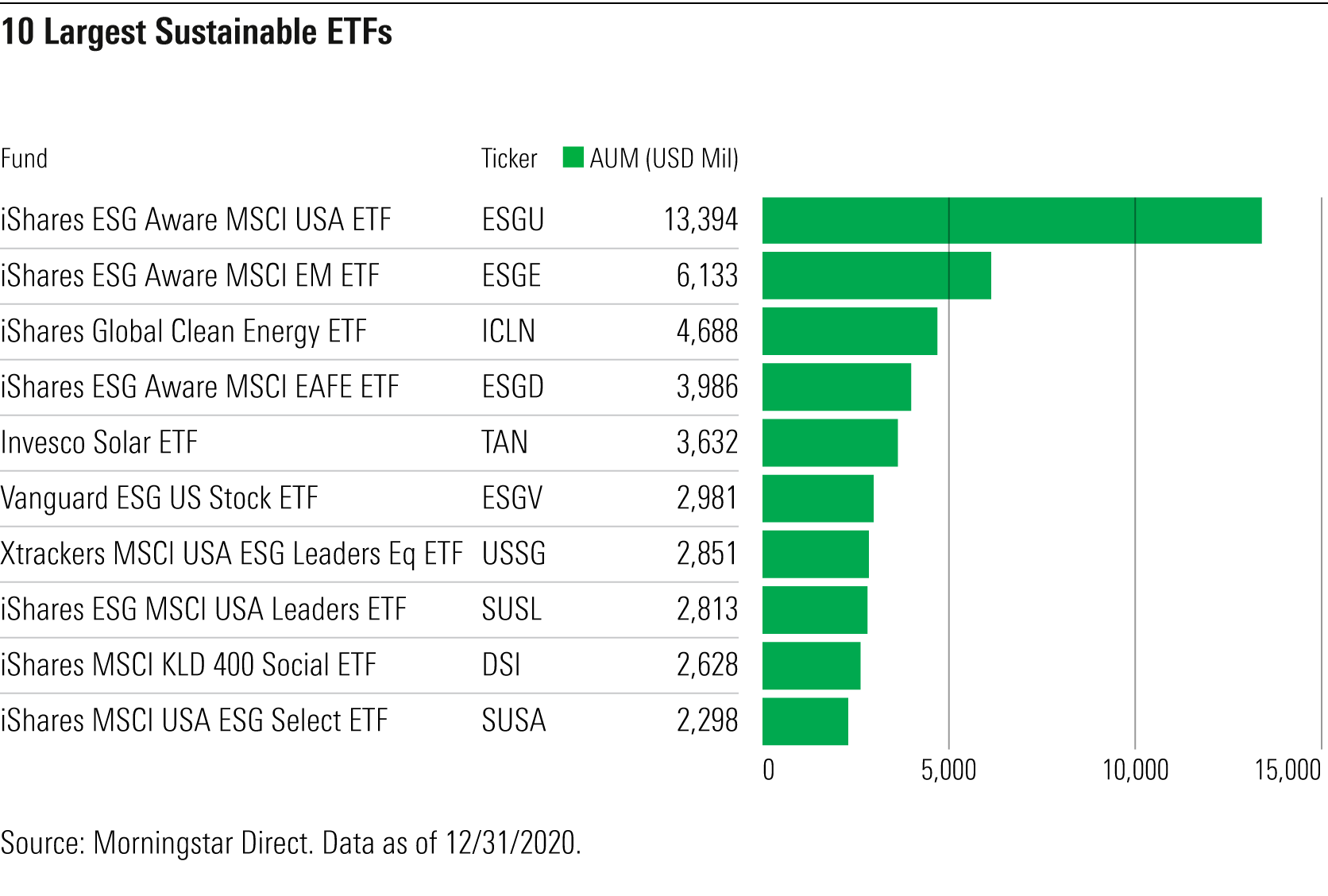

The number of sustainable ETFs has grown considerably over the past five years and now stands at 111. At the end of 2015, only 24 sustainable ETFs existed and 17 of them were sustainable-sector funds. The subsequent growth in the number of ETFs has been dominated by diversified funds. At the end of 2020, 88 sustainable ETFs were diversified funds and 23 were sector funds.

The largest sustainable ETFs tend to be younger and all are passively managed. The list also reflects iShares' recent dominance of sustainable ETF flows. Seven of the 10 largest ETFs are iShares funds.

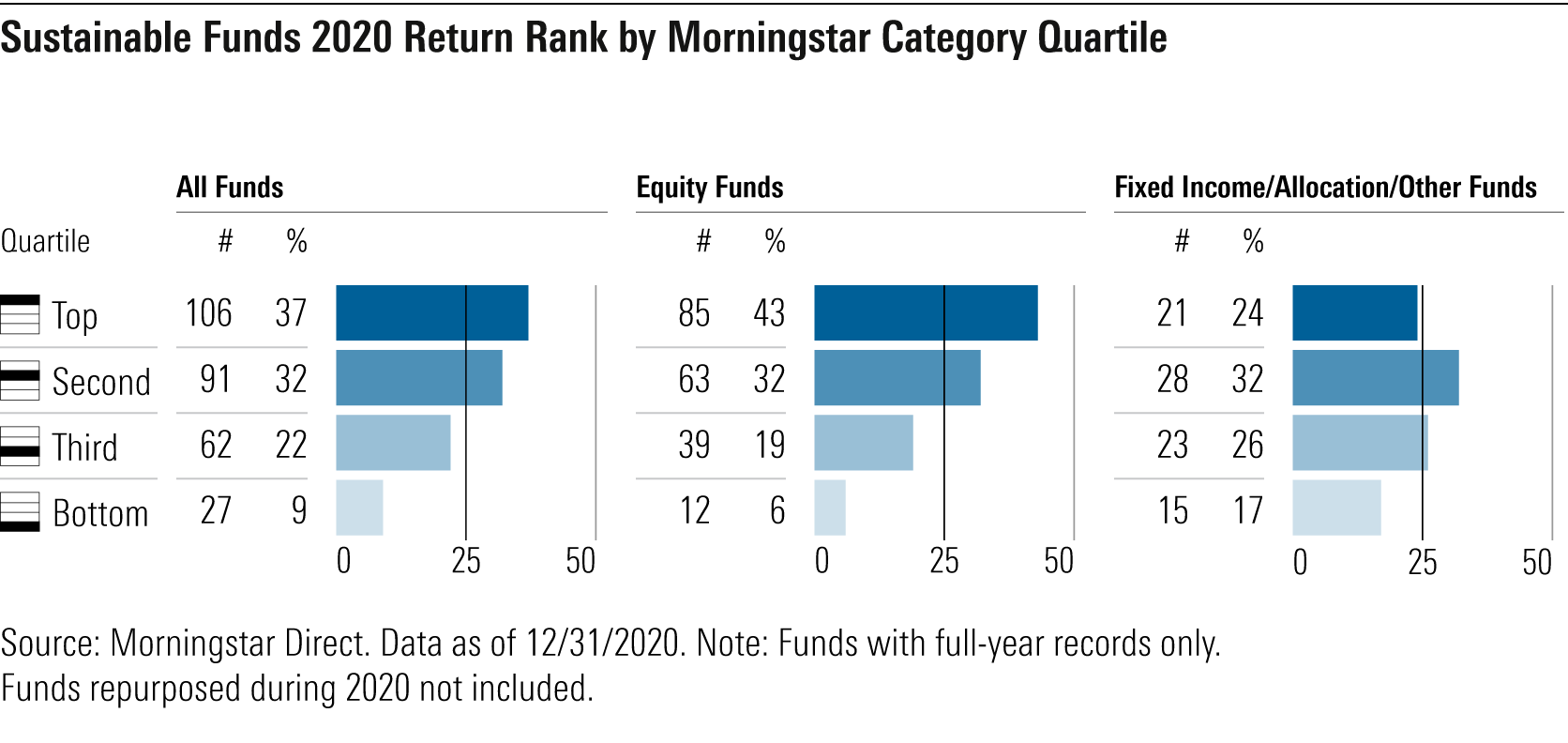

Sustainable Funds Post Strong Returns in 2020

Sustainable funds comfortably outperformed their conventional fund peers in 2020, especially equity funds. Three of every four sustainable equity funds finished in the top half of their category, and 43% posted top-quartile returns. By contrast, the returns of only 6% landed in their category's bottom quartile. Results for other funds were distributed more evenly across quartiles.

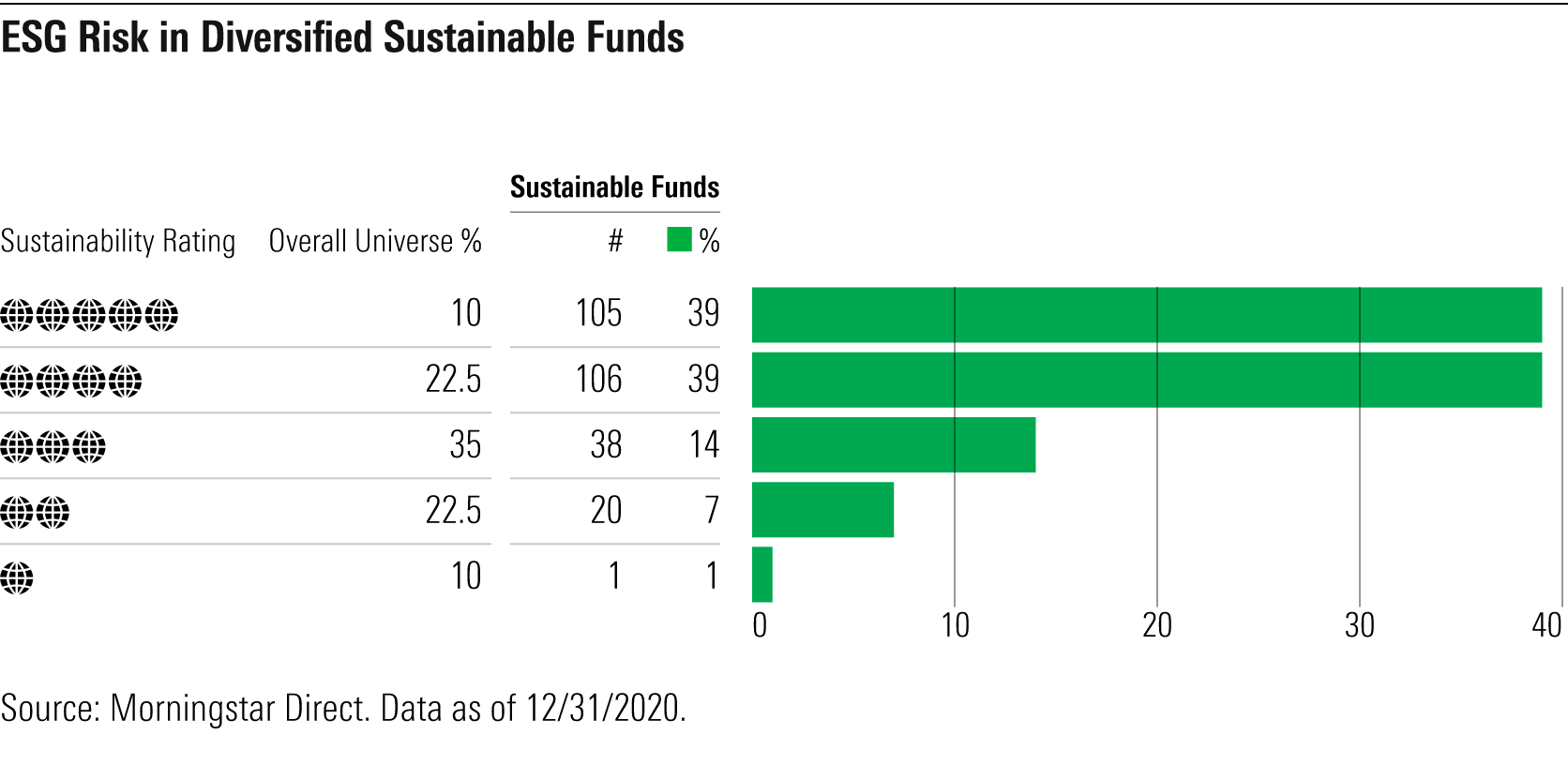

Sustainable Funds Limit ESG Risk Exposure

Sustainable funds have significantly lower levels of ESG risk embedded in their portfolios. About four in five (78%) of sustainable funds receive the highest ratings, 4 or 5 globes, compared with only one third of funds overall. At the other end of the scale, only 8% of sustainable funds receive the lowest rating, 1 or 2 globes, compared with one third of funds overall.

For a fund to be included in the sustainable funds universe, it must hold itself out to be a sustainable investment. In other words, ESG concerns must be central to its investment process, and the fund's intent should be apparent from a simple reading of its prospectus.

The turbulent events of 2020--the global coronavirus pandemic, continued weather extremes, the movement for racial justice in the United States, and the U.S. presidential election--underscored the salience of sustainability concerns to investment managers and strengthened the rationale for end investors to invest in a sustainable way. This climate has fueled the continued growth of the U.S. sustainable fund universe, both in terms of the total number of funds and flows.

For more insights on the evolution of the U.S. sustainable funds landscape and regulation of these products, sign up for our webinar.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)