How to Unearth Undervalued Stocks With This New Tool for ESG Investors

What you need to know about Morningstar Sustainalytics’ Low Carbon Transition Rating.

No one has a perfectly clear crystal ball. Investing involves assumptions, projections, and risks. Putting money to work in the market is essentially trying to predict the future, and investors need to be prepared if things don’t go as planned.

In that way, I think all investors need to consider how climate change will affect their portfolios, regardless of personal preferences or expectations. If the world continues to reduce its carbon emission output through greater promotion of electrification and expanded renewable energy, while consumers also shift their behavior accordingly, companies will have to reduce their own use and production of carbon-intensive energy sources and outputs.

One new tool in an investor’s arsenal is the Morningstar Sustainalytics Low Carbon Transition Rating, or LCTR. Launched in April 2023, this metric provides investors with a forward-looking and science-based assessment of a company’s current alignment to a net-zero pathway that limits global warming to 1.5 degrees Celsius.

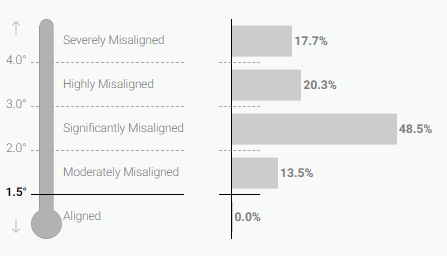

Specifically, the LCTR assigns companies one of five ratings. Those with an implied temperature rise, or ITR, of 1.5 degrees or less—in line with an eventual net-zero world—are marked as “Aligned.” Any with an ITR above 1.5 degrees are marked with varying levels of misalignment: Moderate through Severe.

Sustainalytics Low Carbon Transition Rating Universe Distribution

The initial findings are not favorable. Of the more than 5,800 public companies assigned an LCTR, only one—healthcare firm Novartis NVS—is estimated to have policies aligned to a 1.5-degree future. The vast majority—some 87%—are at least Significantly Misaligned.

Does this rating suggest that the planet is doomed? Not necessarily. I view this rating instead as a call to action. While it’s forward-looking, the rating is based on companies’ actions rather than just stated commitments. It measures whether management is actually setting up systems and goals to improve their operations to limit warming rather than just paying lip service. As such, I would expect the ratings will improve over time as companies intensify their carbon reduction efforts and disclose more information to the market.

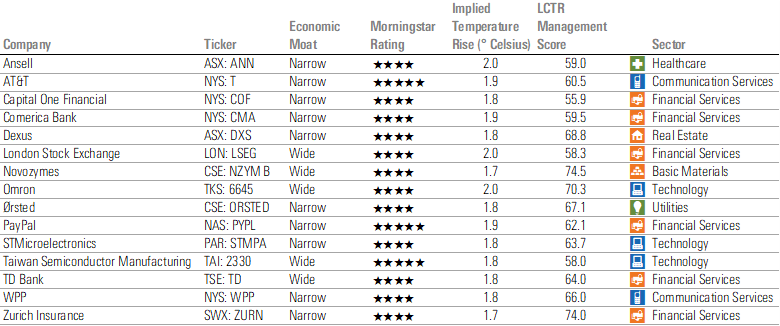

Equally, though, I don’t think investors must completely pass on highly misaligned companies. This rating is a good starting point for understanding how companies’ actions and commitments may affect their future carbon situations. If you scroll all the way to the bottom of this piece, you’ll even find a list of companies with wide or narrow Morningstar Economic Moat Ratings, whose managers seem in good shape to address climate challenges. (They include companies like PayPal PYPL and Toronto-Dominion Bank TD.)

But like all things in investing, context is important. The LCTR can be a useful measure of risk and an input into forecasting cash flows (akin to the ESG Risk Rating), but it shouldn’t be viewed as the sole determinant in an investment decision.

With that in mind, we can explore some additional context by examining the nearly 1,300 public companies that are covered both by the LCTR and Morningstar equity research analysts.

What the LCTR Tells Us—and Doesn’t Tell Us—About Economic Moats

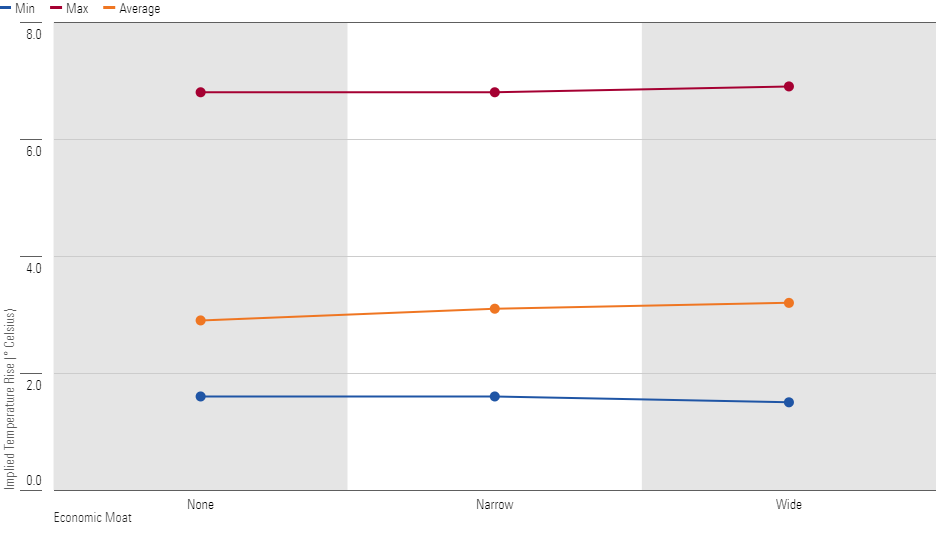

There is very little correlation between the LCTR and economic moat ratings. Plenty of companies that Morningstar equity analysts think have durable competitive advantages also have high ITRs, while a low ITR doesn’t necessarily guarantee a moat.

Implied Temperature Rise Across Moat Ratings is Strikingly Similar

I don’t think this is terribly surprising. While carbon emissions and policies can be important for a company, these need to be considered alongside all nonenvironmental concerns, investment opportunities, and competitive positioning when Morningstar equity analysts assign moat ratings. Sometimes issues of carbon policy are highly material—for energy stocks or utilities, for instance—but this isn’t universally true.

Management Counts!

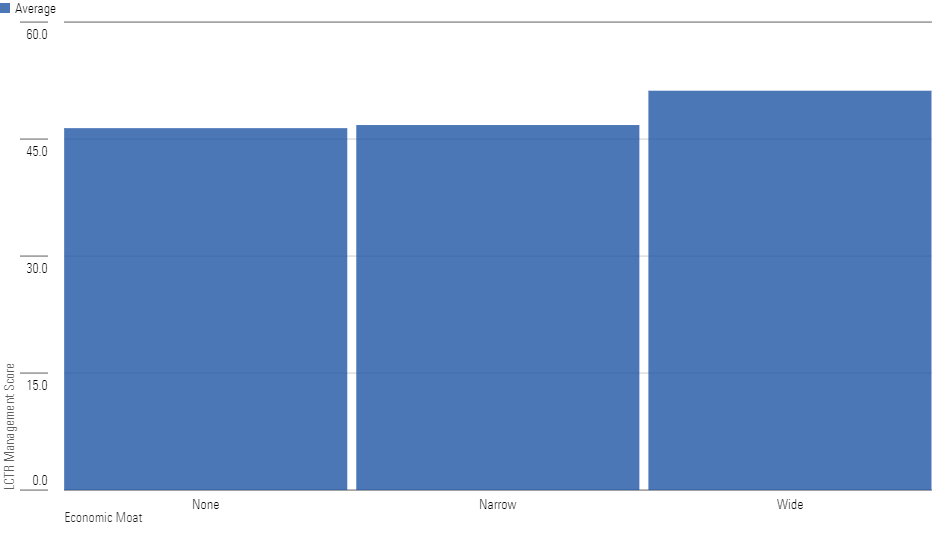

There is one area of overlap: The LCTR includes an assessment of management quality in measuring ITR, with a higher score being better. As shown below, wide-moat companies have slightly higher average management scores within the LCTR versus narrow- and no-moat stocks:

Wide-Moat Companies Boast Slightly Higher Average LCTR Management Scores

While this performance suggests better consideration of carbon issues by wide-moat companies, we need to avoid confusing correlation with causation. I suspect that companies with competitive advantages have greater financial wherewithal to better manage their carbon risks and provide appropriate disclosure, rather than better management necessarily leading to a moat.

This aligns with my prior points around sustainability: facing low environmental, social, and governance risk doesn’t automatically build a durable competitive advantage for a company. Better management of material risks—including those related to carbon—can’t overcome industry and competitive forces, and in some cases may come at the expense of high returns on invested capital.

As an example, Marathon Oil MRO is estimated to have Weak management within the Low Carbon Transition Rating, owing in part to a lack of internal carbon price integration and limited connection between emissions targets and non-CEO board and executive pay. Conversely, Shell PLC SHEL is assigned a Strong rating, given its better disclosures and arguably deeper commitment to decarbonizing.

But Morningstar equity analysts assign a no-moat rating to both companies. Despite Shell having an arguably clearer plan to transition away from traditional oil and gas, our equity analyst notes that “we don’t have the confidence that Shell’s plan to transition to a more renewable and low-carbon business will create competitive advantages.”

In the end, a company’s carbon transition plans can be an important input into assigning an economic moat, but rarely the only one.

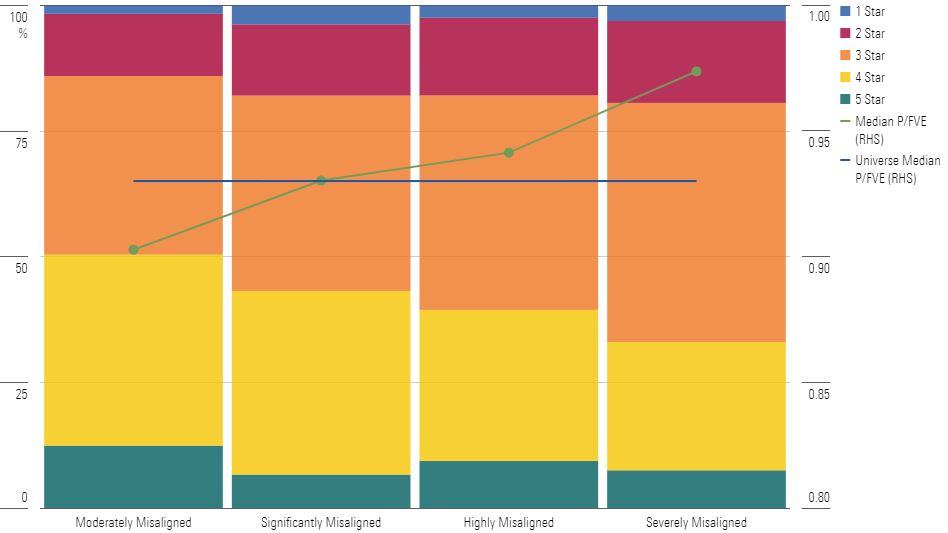

Stocks With Heightened Carbon Misalignment Are Slightly More Expensive

We get a bit more actionable information when turning to valuation. The median ratio of stocks’ prices to fair value estimates is slightly higher for Highly and Severely misaligned companies than the universe average, suggesting there are more opportunities in stocks with less misalignment. Still, the difference is relatively slim, and the median stock in all the misaligned categories screens as undervalued—0.97 for Severely Misaligned stocks versus 0.90 for Moderately Misaligned. (The sole Aligned company screens as about 4% overvalued.) These ratios are also close to the total covered universe ratio of 0.93.

Together, the data shows that while some valuation discrepancy exists at present, there are undervalued opportunities in each misaligned category.

Stocks With More Misalignment Screen as Slightly More Expensive

How Can Investors Use the LCTR?

The LCTR is another arrow in the quiver for investors to understand companies’ risks and express sustainability preferences. Combining this rating with other company-specific metrics can help to uncover stocks that are better managing their carbon transitions, have built durable competitive advantages, and are trading at substantial valuation discounts.

To that end, there are 15 companies globally that are only moderately misaligned and have relatively high management scores, per the LCTR, alongside wide or narrow moat ratings and 4- or 5-star ratings (as of July 31, 2023):

These 15 Undervalued Stocks Have Economic Moats Alongside Only Moderate LCTR Misalignment

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WYB37DY4NVDTVNZTSBDENH3GMI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JPJHXR5CGSNR4LKQF5ZKLCCVYQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)