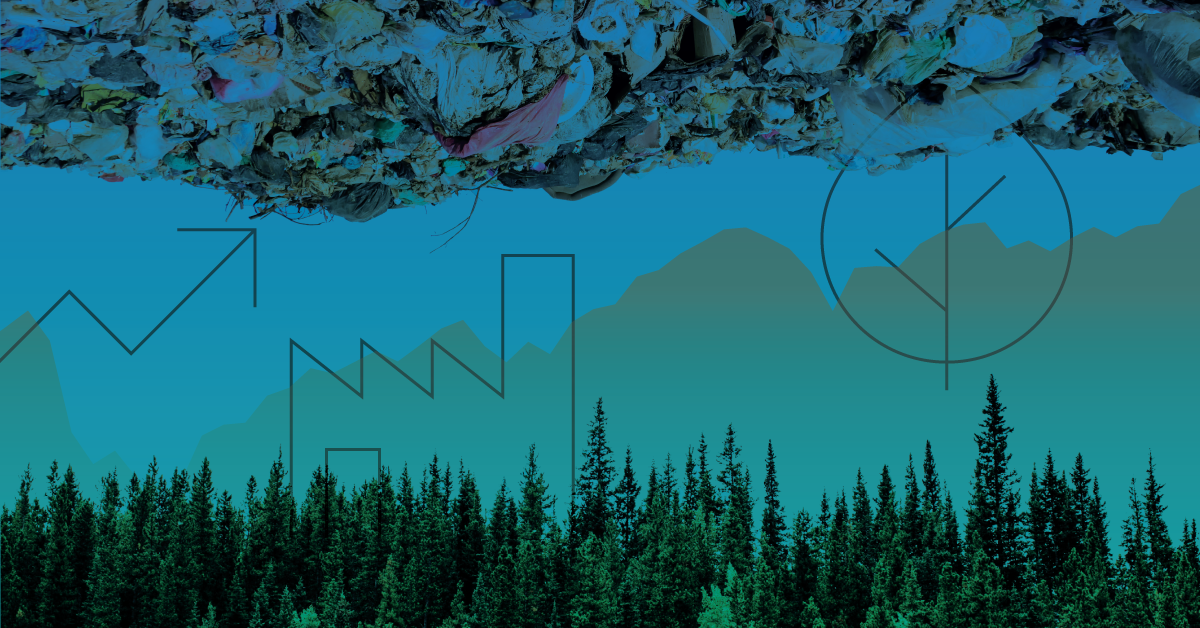

COP26 Deforestation Pledge Will Empower Companies, Investors to Attack Supply Chain Emissions

Plan to save forests aims to end deforestation by 2030, slowing global warming.

As global leaders at the COP-26 climate summit promised to end deforestation by 2030, investors are likely to grow emboldened to address emissions throughout a company's supply chain, analysts said. Under the plan to save forests, signed by the heads of 100-plus countries including the United States, Brazil, China, and Russia, deforestation will end by 2030. That would slow global warming: Forests store carbon and are critical to biodiversity, which helps support the ecosystem. In 2020, the World Wildlife Fund reported that the world lost 53% of forest wildlife between 1970 and 2018. In an opening letter to the summit in Glasgow, Scotland, COP president Alok Sharma wrote: "There is no viable pathway to net zero emissions that does not involve protecting and restoring nature on an unprecedented scale. If we are serious about holding temperature rises to 1.5 degrees and adapting to the impacts of climate change, we must change the way we look after our land and seas and how we grow our food. This is also important if we want to protect and restore the world's biodiversity, upon which all life depends." Expect more companies and investors to announce pledges to fight deforestation. "This [agreement] gives cover to people in the mainstream to take another look at deforestation," including asset managers and companies that are heavily reliant on forests and their products, says Michael Jantzi, founder of Sustainalytics. Index and other funds include the stocks of fast-food or chain restaurants and of paper products, food, and snack companies, many of which are responsible for deforestation. Last spring, Sustainalytics pointed out that deforestation produced long-term risks for companies, including decreased agricultural yields caused by depleted soils, regulatory risks, stranded assets, supply chain disruptions, and reputational fallout. "With the ongoing growth in ESG investing, it is expected that interest and awareness regarding issues of deforestation and biodiversity will continue to increase among investors," Sustainalytics wrote. Leslie Samuelrich, president of Green Century Capital Management, says the COP-26 statement "dramatically increases the number of investors who are now understanding that stopping deforestation is inextricably linked to curbing our climate crisis. And what I hope it means is that investors are more willing to engage their holdings up and down the supply chain to adopt zero-deforestation commitments." Much of global deforestation is commodity-driven, especially in South and Central America, Africa, and Southeast Asia. That poses problems for companies that use the commodities and for investors in those companies. The loss of tropical forests has accelerated as global demand for soy, palm oil, and beef has grown. Demand for paper products, such as toilet paper, is driving boreal forest destruction further north, as Morningstar's Jackie Cook wrote this past spring. For example, palm-oil plantations in Southeast Asia and Africa have decimated tropical forests. But once such products enter the global supply chain, they become commodities and are virtually untraceable. Such companies include commodity outfits like Archer Daniels Midland ADM and Bunge BG or the potential corporate consumers of these goods such as Domino's Pizza DPZ and Yum Brands YUM (KFC, Pizza Hut, Taco Bell), Cook wrote. Investors are already pushing for change, with some success. Last fall, a shareholder proposal by Green Century Capital Management urging Procter & Gamble PG to address deforestation and forest degradation risk received 67% of the vote at the company's annual meeting. Support came from the Big Three asset managers--Vanguard, BlackRock, and State Street--who, in the past, have not supported such resolutions. Indeed, BlackRock said this year that it is encouraging companies to disclose how their business practices are "consistent with the sustainable use and management of natural capital, including natural resources such as air, water, land, minerals and forests" and urging them to "publish 'no–deforestation' policies and strategies on biodiversity." Other deforestation proposals received 76.2% support at Bloomin' Brands and 98.9% at Bunge. Green Century is one of the most prominent shareholder activists around deforestation. Today, Samuelrich says the firm is asking companies for so-called cross-commodity commitments, "so it isn't just an agreement on just palm oil or beef or soy [but all]. I do expect other investors to put pressure on companies." In particular, Samuelrich expects European investors to pressure companies to lower their deforestation rates or divest. This year, the firm will work with companies to reduce so-called Scope 3 indirect emissions that occur along the company's value chain. Samuelrich won't say which companies the firm will engage with this year, but in August, Green Century announced that it signed on to Food Emissions 50, an initiative led by shareholder advocate Ceres to engage 50 of the highest-emitting public food companies in North America to improve emissions disclosures and accelerate progress toward net zero in the food and agriculture sector. "You can't reach net zero without addressing deforestation to curb climate risk," she says. "Scope 3 is the next frontier. We need to address it now, and Glasgow puts a real emphasis on this." Deforestation "is a huge driver of worsening climate outcomes," says Jon Hale, head of sustainability research for the Americas at Morningstar. "If you're a big multinational, then deforestation is something you have to deal with in your supply chain and you have some agency about it."

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)