Which Funds Are the Biggest Holders of Meta Stock?

Fidelity, Davis, and a Capital Group ETF have large stakes as Meta stock surges.

Fueled by strong earnings and a surprise announcement of a new dividend, stock in Meta Platforms META has extended its big rally of the past year.

With a more than 20% gain on Friday, Meta stock is up roughly 34% in 2024. That comes on top of a 2023 rally which saw the stock’s price nearly triple. That’s a big turnaround from 2022, when it lost some 70% of its value.

For many fund investors, Meta’s soaring price is good news. It’s a top-10 holding in many mutual funds, including the most widely held index funds. For example, in the SPDR S&P 500 ETF Trust SPY, Meta was the fifth-largest holding as of Thursday’s close of trading, at 2.1% of the portfolio. For Vanguard Total Stock Market ETF VTI, Meta was the sixth-largest holding, at 1.7% of the portfolio.

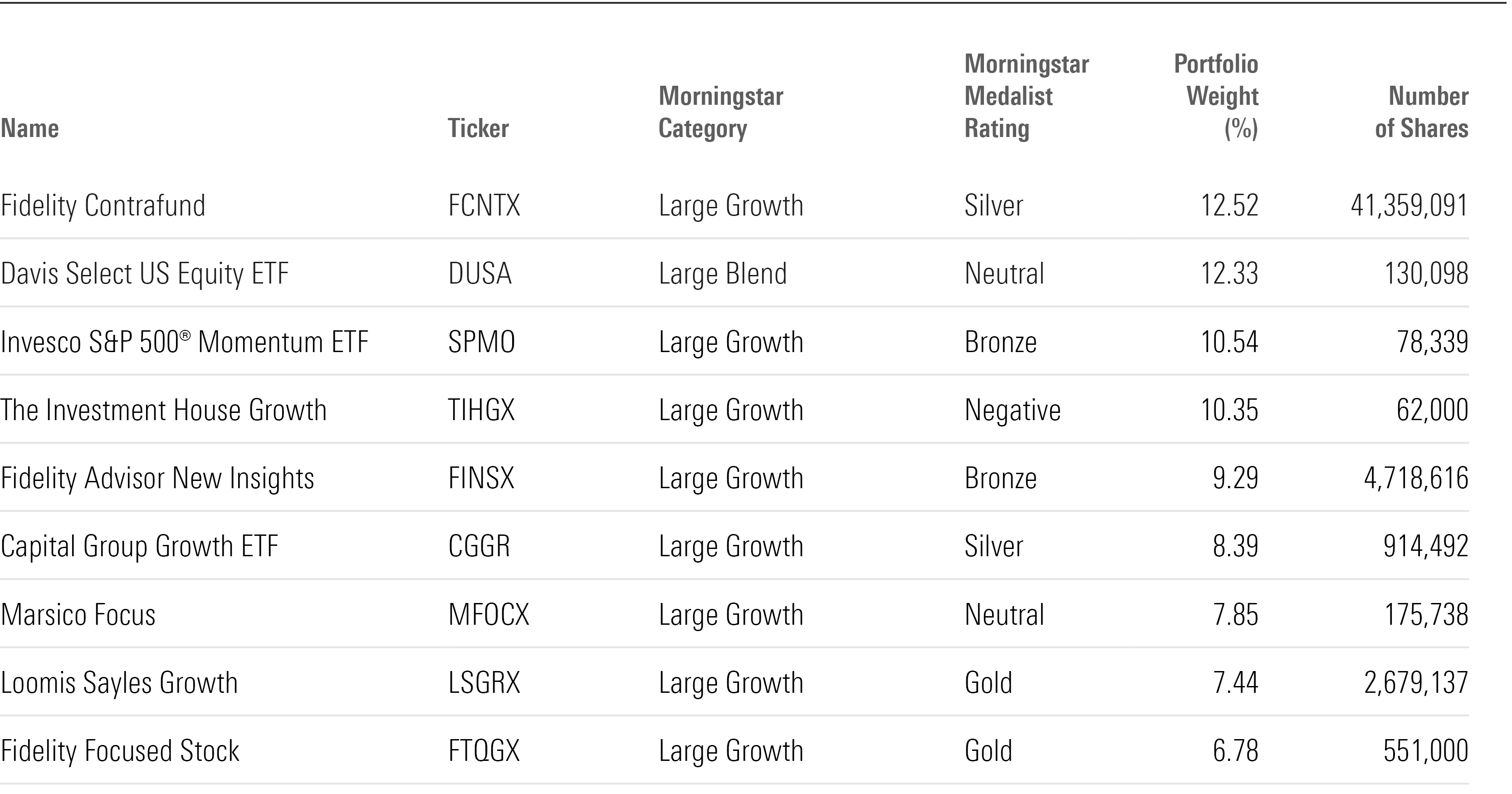

The earnings and dividend news - along with the big 2023 rally - have been especially good for funds that hold outsized positions in the stock. We screened diversified U.S. stock funds for those with the largest weightings of Meta. According to the screen, the 10 biggest owners of Meta stock are:

- Fidelity Contrafund FCNTX

- Davis Select US Equity ETF DUSA

- Invesco S&P 500 Momentum ETF SPMO

- Investment House Growth TIHGX

- Fidelity Advisor New Insights I FINSX

- Capital Group Growth ETF CGGR

- Marsico Focus MFOCX

- Loomis Sayles Growth Y LSGRX

- Fidelity Focused Stock FTQGX

More information on these funds and their performances can be found below.

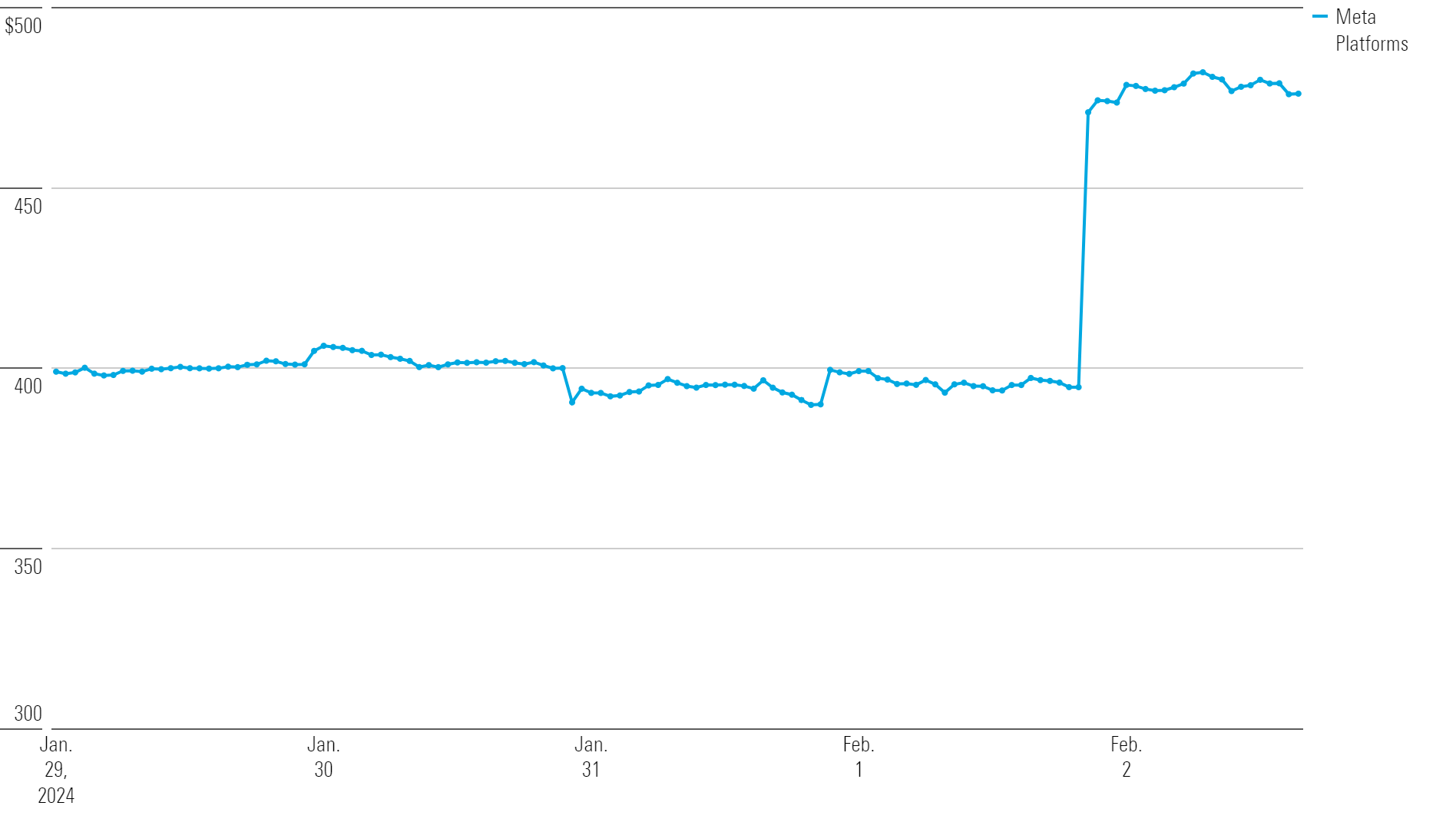

Meta Stock Surges After Earnings

The latest leg higher for Meta’s stock came on the heels of the company’s fourth-quarter earnings report. The firm reported its strongest quarterly sales growth in over two years, and to the surprise of many, it also announced it would be initiating a quarterly dividend.

Following the report, Morningstar senior equity analyst Ali Mogharabi significantly raised our fair value estimate of Meta’s stock to $400 from $322, based on increased optimism about its profit margin expansion.

“Meta’s fourth-quarter results showed strong network effects, which attracted more users and increased engagement while allowing it to sell more ads at higher prices with lower user and advertiser acquisition costs, impressively expanding margins,” he wrote. “We also commend Meta for instituting a dividend alongside share buybacks.”

Meta stock rallied 20.3% Friday, it’s biggest gain in a year. With the post-earnings rally, Meta stock is at a new record high.

Meta Stock Performance

Which Funds Have the Biggest Positions In Meta?

To find the biggest beneficiaries of Meta’s rally, we screened U.S. diversified stock funds in Morningstar Direct. This screen excluded funds that are less than a year old and have less than $100 million in assets. We also excluded funds whose most recent report on their holdings was dated before Nov. 30, 2023. Some funds that would have otherwise made the list—namely, other strategies run by Davis Advisors, such as Clipper CFIMX and Davis NY Venture A NYVTX—are not included because their last portfolio reporting date was Sept. 30, 2023.

Funds With the Biggest Weighting In Meta Stock

Here are Morningstar’s key metrics for the funds that have the biggest positions in Meta’s stock.

Fidelity Contrafund

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

- Morningstar Category: Large Growth

- Fund Size: $121.9 billion

- Index Fund: No

Davis Select US Equity ETF

- Morningstar Medalist Rating: Neutral

- Morningstar Rating: 2 stars

- Morningstar Category: Large Blend

- Fund Size: $423.9 million

- Index Fund: No

Invesco S&P 500 Momentum ETF

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4 stars

- Morningstar Category: Large Growth

- Fund Size: $312 million

- Index Fund: Yes

Investment House Growth

- Morningstar Medalist Rating: Negative

- Morningstar Rating: 3 stars

- Morningstar Category: Large Growth

- Fund Size: $209.8 million

- Index Fund: No

Fidelity Advisor New Insights I

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 3 stars

- Morningstar Category: Large Growth

- Fund Size: $18.6 billion

- Index Fund: No

Capital Group Growth ETF

- Morningstar Medalist Rating: Silver

- Morningstar Rating: None

- Morningstar Category: Large Growth

- Fund Size: $4.3 billion

- Index Fund: No

Marsico Focus

- Morningstar Medalist Rating: Neutral

- Morningstar Rating: 3 stars

- Morningstar Category: Large Growth

- Fund Size: $806.9 million

- Index Fund: No

Loomis Sayles Growth Y

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 4 stars

- Morningstar Category: Large Growth

- Fund Size: $12.8 billion

- Index Fund: No

Fidelity Focused Stock

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 3 stars

- Morningstar Category: Large Growth

- Fund Size: $3 billion

- Index Fund: No

Performance of the Funds With the Largest Meta Weightings

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)