We're Optimistic About AutoNation's Road Ahead

The national brand opens doors in e-commerce, collision centers, parts, and used stores.

Mid-cap narrow-moat franchise dealer

We think the decline is due to a variety of factors such as fear about what peak auto sales means for the industry and disarray in Washington, meaning that tax reform could be in jeopardy. Also, the company’s selling, general, and administrative expense as a percentage of gross profit has elevated in 2017 above 73% as a result of excessive discounting hurting new-vehicle gross profitability, and the company’s investment in its brand through AutoNation USA stand-alone used-vehicle stores, AutoNation-branded parts, four additional auction sites, and opening or acquiring 18 more AutoNation-branded collision centers (up from 70 recently). The company’s SG&A/gross profit ratio, typically in the upper 60s, is normally one of the best in the industry.

As the leader of the largest dealer, chairman, CEO, and President Mike Jackson was smart, in our opinion, when in 2013 he rebranded volume-brand stores as AutoNation. The premium original-equipment manufacturers did not want this change. This single nationwide brand laid the foundation for the branding of other products now underway, as well as AutoNation Express, the company’s digital shopping experience that allows customers to get trade-in appraisals, apply for financing, schedule test drives, and reserve a vehicle at a guaranteed price. A single brand also makes sense to us for web searching. The firm’s One Price concept allows no-haggle pricing of the firm’s 20,000-plus used vehicles, creating a more satisfying buying experience, and will now also be at AutoNation USA used-vehicle stores.

The company intends to open its first five stand-alone used-vehicle AutoNation USA stores this year, with the first opening in Texas earlier this summer. We consider it too early to determine the eventual ramping-up rate of store openings, but management has talked about 5-10 for 2018, with that cadence going on for years. Management has already identified 25 store sites in existing AutoNation markets. We think these are the right moves to make AutoNation an even stronger leader in the dealer industry over the long run. However, the up-front spending with little to no corresponding revenue in some cases leads us to expect some minor margin compression and lower earnings growth. For example, we calculate that first-quarter operating income excluding gains from a legal settlement fell 5.1% from the prior-year period, but a poor second quarter in Houston and Florida, on issues we see as temporary, drove second-quarter operating income down 13.4%.

It is also important to note that management last October estimated that it will fund investments for its various brand extension moves via about $500 million in asset sales over the next several years. In February, management said about $215 million of sales have occurred since 2015, which comprise either land or acquired dealerships as part of a group acquisition that were not going to be good fits long term. This capital inflow shows the flexibility of owning real estate even though it means capital sunk into the ground. We’ve seen dealers avoid bankruptcy in part from owning real estate, and at about 75%, AutoNation has one of the higher ratios of owned real estate, along with Lithia LAD and Asbury ABG.

Like the other five public dealers, AutoNation sold off hard on June 16 when Amazon AMZN announced it was buying Whole Foods WFM. Last we checked, AutoNation is not a grocery store, and although Amazon recently moved into auto parts in the U.S., sells three Fiat models in Europe, and has hired former Oliver Wyman automotive consulting head Christoph Moeller to run its OEM business in Europe, we see a threat to U.S. automotive retail as further off in time and to a degree dependent on the automakers’ willingness to hurt their dealer partners. New vehicles can only be sold with the OEMs’ approval, so we think automakers will have to balance their desire for more volume with radically disrupting their distribution networks already in place. Parts and service business is where dealers really make their money, and the threat is more on how the parts are supplied rather than consumers substituting Amazon for going to a dealer for repair. We are not worried about Amazon destroying our dealer investment thesis anytime soon, if ever, but we think its actions in this space will be important to watch over the next decade. We think any future sell-offs in AutoNation caused by Amazon headlines would probably be a buying opportunity rather than a reason to panic.

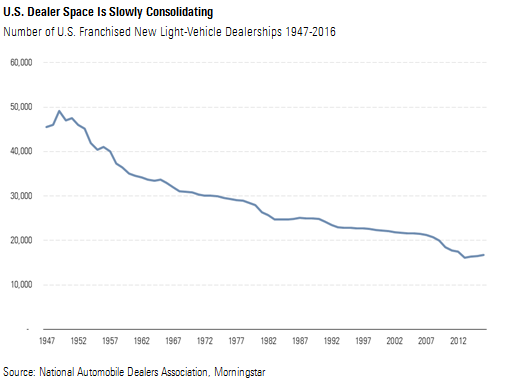

Cost Advantage in Scale Contributes to Narrow Moat AutoNation has the largest market capitalization of the dealers and only has about 101.6 million diluted shares outstanding due to its repurchasing (by our estimate) $8.2 billion of shares since 1999, reducing the diluted share count by 78%. The company repurchased the vast majority of these shares in the high teens--a smart move by management--and we like that it still bought back stock in the last recession, something some auto companies are afraid to do. Over the years, Eddie Lampert's ESL Investments has owned as much as 50%-plus of the company; it now holds about 16.6%. Bill Gates' Cascade Investment and the Bill & Melinda Gates Foundation own a combined 20.2% stake. It's noteworthy as well that Berkshire Hathaway BRK.B bought the largest private dealer group, Van Tuyl, in March 2015. We think these investors realize that the dealership space is not as undesirable as some may find the OEM space to be. It is a low-margin business, with a great dealer only generating about 4% operating margins, but it is a space that is very slowly consolidating in favor of the largest dealers.

The number of dealerships has steadily fallen since the late 1940s, from a peak of 49,200 in 1949 to 16,708 in 2016. NADA Data for 2016 puts the number of dealer groups owning just one store at 4,972, or 30% of dealerships, down from 7,514, or 36%, in 2008. The number of groups with 50 or more stores is now just 10 from 6 over the same time frame, which shows that the space is still highly fragmented. AutoNation, for example, is the largest new-vehicle dealer in the U.S., and we calculate that its 2016 new-vehicle retail sales of 337,622 equates to only 1.92% of U.S. new light-vehicle sales, up from 1.76% in 2009 when the industry bottomed out after the recession at about 10.4 million new unit sales. In 2016, the largest 150 dealer groups owned 19% of all U.S. dealerships and sold 21.6% of all new vehicles, up from 21.2% in 2015. We calculate that the six public franchise dealers had 5.8% U.S. new-vehicle share last year, up from 4.9% in 1999. The highly fragmented nature of the industry and dealers’ ability to only get so much margin per vehicle before they become uncompetitive with a rival store are why we do not see the dealers becoming wide-moat companies anytime soon.

The sector was long the domain of mom-and-pop family businesses, but that has been changing over the years, and we do not see the largest groups slowing their share gains. These groups have far better access to capital than a single dealer does, which enables more credit lines for inventory procurement and making acquisitions, and they also get far better scale on overhead expenses such as health insurance, uniforms, IT systems, and insurance. Trade journal Automotive News interviewed dealers in 2016 and estimated that a small dealer group pays $375-$900 a month per employee for health insurance while a larger group pays about $500 a month. Every dealer has a dealer management system, and a small dealer pays $3,500-$6,000 a month per store for the service from vendors such as ADP, while a large group pays $1,200-$5,100 a month.

Small dealers are also less likely to get favorable inventory allocations from the factory, are less likely to be awarded an open point (new store), and struggle to play the stairstep incentive game. These programs encourage dealers to hit volume targets via escalating discounting as a month unfolds. If the dealer succeeds in hitting a target, there are large cash payments by the factory to the dealer, but if a dealer misses the target, its earnings take a major hit.

AutoNation’s narrow moat comes from cost advantage in scale and an intangible asset with the parts and service segment’s warranty work locking in repair work over a garage for the first roughly five years of a vehicle’s life. A large dealer such as AutoNation can move inventory around to different stores within a market where it will be in most demand, something a small dealer with just one or two stores in that same market cannot do. The public dealers can centralize back-office operations and generate far more volume than a small dealer, which brings scale. Dealers have no burdensome retiree expenses, and the large public dealers are not dependent on the health of one brand. AutoNation’s first-half 2017 brand mix for new-vehicle units broke out as 34% Detroit Three, 46% import volume brands such as Toyota at 18.5%, and premium luxury at 20%, with Mercedes the largest at about 8%. The dealers enjoy mid- to high-single-digit gross margins on new vehicles and 100% gross margin on financing and insurance.

We think the best source of competitive advantage is the parts and service operations. Many customers bring their vehicle to the dealer for servicing, because either the vehicle is under warranty or the dealer is close to home and has the factory parts and expertise to service the vehicle. Once vehicle owners know a dealer, we think they are likely to keep going back to the dealer for service. The dealer knows the vehicle, and comparison shopping for repair work is very time-consuming, as the customer must bring the vehicle to each shop to get a quote. AutoNation does not disclose retention data because a large portion of the vehicles it services were not sold by it, but it did say in 2013 that about two thirds of the vehicles it services are zero to five years old. This percentage is now probably higher, given that new-vehicle sales have grown every year since 2013. These search logistics for the consumer create inelasticity of demand, which creates pricing power for the dealer and is a source of excellent profit in good times and bad. In fact, during a downturn in new-vehicle sales, dealers generally report higher gross margins due to a favorable mix shift to parts, but then report lower operating margins due to SG&A deleveraging. Excluding large impairment and restructuring charges, dealers can still report positive EBIT even in a severe recession.

AutoNation is not a lender, and all finance and insurance business is a 100% gross profit business due to the commission nature of selling products such as extended warranties, guaranteed asset protection insurance, and a dealer reserve markup on the lender’s interest rate, which for AutoNation averages about 90 basis points. CEO Jackson said on the first-quarter earnings call that subprime customers are about 6% of AutoNation’s combined new- and used-vehicle revenue. This is not terribly concerning to us.

Current Fair Value Estimate Hinges on Tax Reform Our $49 fair value estimate for AutoNation is based in part on our industry light-vehicle forecast. We model operating margin including floorplan interest (used to procure inventory, like a payable), averaging 3.2% during our explicit forecast period. We think recent levels of 4% and 3.6% in 2015 and 2016, respectively, are more indicative of peak margins for a cycle. We also project a 2.7% margin in 2019 so as to model a mild economic downturn at some point in our forecast. AutoNation's operating margin fell to 2.6% in 2008 from 3.3% in 2007 but rebounded to 3.5% in 2009 despite a 24% year-over-year decline in revenue. The parts and service business helps keep a dealership afloat in hard times, and gross margin in 2009 increased 110 basis points to 17.9%, as service revenue reached 20% of total sales in 2009 even though year-over-year service revenue declined 13%. Our midcycle operating margin is 3.5%. We model buybacks throughout our five-year forecast period totaling about $350 million. Return on invested capital did reach about 6% during the last recession, but we think that was an automotive depression rather than a typical downturn. We model ROIC in the low double digits for some of our forecast period, only slightly lower where it has been recently due to our expectation for margins to head lower from recent peak levels.

We do not think the next recession will suppress auto sales to anywhere near the 10.4 million new units sold in 2009, so we do not model any declines in overall company revenue in any single year of our five-year forecast period. We think the dealers all make more effort to retail used vehicles rather than dump them in auction as in the past, especially with AutoNation USA, so we do not expect AutoNation’s profit drop in the next recession to be as severe as in 2008-09.

One valuation caveat focuses on our long-term tax rate assumption of 28.5%. Morningstar made a departmentwide policy change this spring to incorporate our belief that tax reform under the Trump administration is more likely than not to occur, so we assume the corporate federal rate falls to 25% from 35% in January 2018. This change is material to AutoNation’s valuation because all its stores are in the U.S., and CEO Jackson has said in the past that he has no plans to expand overseas as some dealers such as Group 1 GPI and Penske Automotive Group PAG have, because he sees so much growth runway in the U.S. Should our tax rate assumption prove incorrect and reform never happens, then our fair value estimate would fall to $43 from $49.

No Major Concerns on Governance Governance is worth discussing for AutoNation even though we do not have any major concerns, because there are several points we think investors will find interesting. We previously mentioned the large share ownership by Eddie Lampert and Bill Gates. In 2009, automakers gave ESL permission to increase its stake above 50%, and ESL did so. We have heard from AutoNation management that redemptions at ESL were what forced it to pare its stake, rather than Lampert's losing conviction in AutoNation. We do not expect ESL to cash out of AutoNation's stock, nor do we expect Gates' stake to be sold.

We have believed AutoNation should buy its stock only when it is trading well below our fair value estimate, as at present, but we think buybacks must be considered in context with other capital needs. We’d rather see management reinvest in the business, which it’s always willing to do, to keep a leading edge in IT, make acquisitions, and fund AutoNation USA than buy back stock, so we do not mind that management bought back no shares in the first quarter, and we expect repurchases this year to be well below last year’s $499 million. Current authorization outstanding is $264 million at the end of June after $34.9 million of buybacks in the second quarter. We think buybacks will continue to be based primarily on reinvesting needs and sellers’ asking prices for acquisitions. Management rightfully says it prefers acquisitions to buying back stock. Lately, though, management reports asking prices have not been realistic, which could indicate looming buybacks.

Although AutoNation is not a family-owned company like some other public dealers such as Lithia, Penske, and Sonic SAH, we still consider it to have high key man risk--though certainly not as much as with Tesla TSLA and Elon Musk. Jackson, 68, joined the company as CEO in 1999 and became chairman in 2003. He spent much of his career at Mercedes-Benz USA, working his way up from a technician at a dealership to eventually president and CEO of Mercedes-Benz USA, something we have always respected and liked because Jackson has experience with dealers from a variety of angles. Jackson has become the public face of automotive retailing, with frequent business television appearances and keynote speeches at automotive events. He also is deputy chairman of the Federal Reserve Bank of Atlanta.

We are fans of Jackson because we like his blunt speaking style, and he is not afraid to share his opinion on a variety of issues. We find that his forecasts on auto demand tend to be accurate, so we pay attention to what he says. Jackson says he has no plans to retire, and although his contract runs through 2019, we do not expect him to retire then and suspect he can remain CEO for as long as he wants. However, we think AutoNation's stock would sell off rapidly should Jackson abruptly leave--something we do not expect to happen. Key man risk always raises the question of succession, and we are a little troubled by recent senior management turnover. The company has lost 20 high-level executives since 2014, according to Automotive News. Some have retired, some were connected to longtime president and COO Mike Maroone and left shortly after he did, and some left for more senior positions at other companies.

The most concerning departure came May 15 when president and COO Bill Berman abruptly resigned. The company has given no explanation for the departure. This surprised us because Berman had just become president Feb. 1, 2017, and COO in February 2015, succeeding Maroone, who retired after grooming Berman for the COO role. Maroone, 63, has since re-entered the dealership world in November by buying four stores in Colorado. Berman, 50, joined AutoNation in 1999 and led the firm's Western region before becoming COO. The February press release announcing his promotion to president also cited him as the "engineer" of all of AutoNation's brand extension strategies. We took his promotion to mean he was Jackson's eventual successor, but with his departure and Jackson adding the president's title on May 31, we assume that Jackson is not going anywhere for a long time. It is unclear who is next in line to lead AutoNation, but the firm did promote Lance Iserman to executive vice president of sales and COO on June 1 to replace Berman. Iserman joined AutoNation over 15 years ago and had been president of the Western region.

We do not think there is a leadership crisis at AutoNation, however. Jackson has pointed out his top 10 executives have on average 16 years of tenure with the firm, so we are not worried about a thin bench. We like one way the firm identifies and tries to retain rising talent via AutoNation University. This program, in place since 2006, is a five-week session that runs throughout a year taught by senior, even C-level, management. General managers and prospective GMs go through the program, and Berman told us in 2015 that 90% of the firm’s market presidents and regional presidents participated in this program.

Although we do not anticipate a major governance problem at AutoNation, we think a CEO with high expectations (a 2015 Barron's interview claimed Jackson has an urn in his office labeled "The Ashes of Idiots"), who is probably not going anywhere soon, leads to some ambitious junior executives leaving either involuntarily or for offers elsewhere, and we may see more turnover over time. Still, we think the company is one of the best dealers we cover and an interesting midcap name to look at in a broader market that we think is mostly devoid of bargains. We believe the stock is being sold off too harshly for investing to remain the top dealer in the U.S. in the future.

/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)