U.S. Herd Immunity Could Be Coming by End of June

Limited vaccine supply in other countries could make global immunity tougher to achieve, though.

With 1.13 billion doses of coronavirus vaccines administered globally as of the end of April, the ramp-up in immunizations is well underway. In the United States, President Joe Biden targets July 4 for a return to near normal, which we think is feasible, given our assumption of potential herd immunity (through both infection and vaccination) by the end of June.

Outside the U.S., vaccinations have been delayed by manufacturing issues and rare side effects for adenoviral vector vaccines. The lower efficacy of non-mRNA vaccines and tougher distribution in developing markets make endemic virus more likely.

Despite herd immunity, if the virus does become endemic, annual shots could be necessary for vulnerable populations.

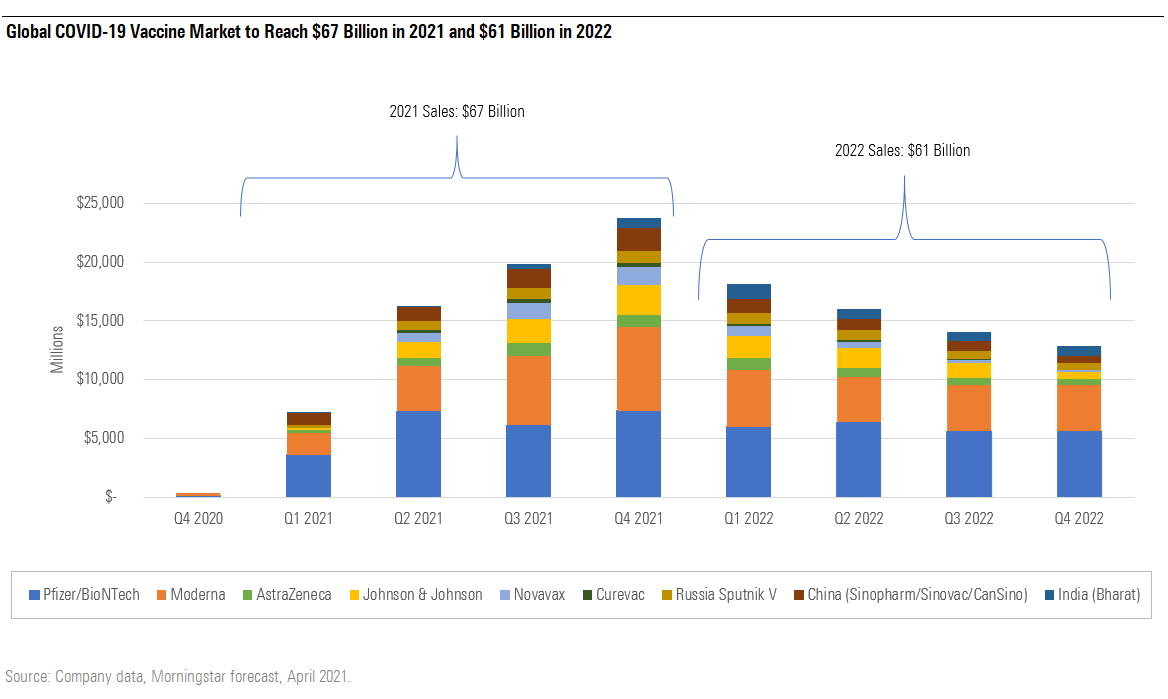

COVID-19 Vaccine Market to Expand to $67 Billion in 2021

As shown below, we forecast a COVID-19 vaccine market of $67 billion in 2021, $61 billion in 2022, and in our base case, $8 billion annually starting in 2023.

As mRNA vaccines dominate the U.S. vaccine market and negotiate a larger potential share of other developed markets because of manufacturing delays and rare side effects for adenoviral vector vaccines, we expect sales of these high-efficacy vaccines to also dominate the global market. Together, Pfizer/BioNTech PFE/BNTX and Moderna MRNA account for more than 60% of our total COVID-19 vaccine market sales estimate in 2021 and 2022.

We see their first-to-market status, manufacturing success, and leading efficacy and safety securing them dominant positions with relatively strong pricing power in the near term, although we’re watching for additional data from antigen-based vaccines and other mRNA vaccines that could alter the postpandemic market dynamics.

U.S. COVID-19 Vaccinations Already at Assumed Peak Pace

Approximately 2.5 million vaccine doses are administered each day in the U.S., a vast increase from the initial pace in January. Roughly two thirds of American vaccine recipients are obtaining their doses through state-run public health programs (state-run sites, hospitals, and doctors' offices) and the remainder through federal programs (pharmacies and, to a much lesser extent, mass vaccination sites).

We expect U.S. vaccine supply and the ability to administer available vaccines to remain at higher levels throughout the second quarter, particularly with the emergence of vaccine access to children ages 12 and up (Pfizer/BioNTech already reported data for children ages 12 and up, and Moderna should report data shortly). The U.S. has secured 800 million doses of authorized vaccines, with more vaccines available through remaining options with Pfizer/BioNTech, Moderna, and Johnson & Johnson JNJ and contracts with Novavax NVAX and AstraZeneca AZN (which could receive authorization in the second quarter).

With these assumptions around dose availability and access for children in mind, we think:

- The U.S. will be able to vaccinate 69% of the population by the end of the third quarter.

- AstraZeneca will still not become available in the U.S. vaccine market, due to safety issues, weaker efficacy, and a history of execution blunders.

- Johnson & Johnson's recent safety issues could prevent the vaccine from gaining significant share.

- Although we expect Novavax to generate solid data imminently from a U.S./Mexico phase 3 trial, second-quarter approval will come too late for it to significantly serve the U.S. population, at least during the initial series of shots.

State of the Vaccine Market Is Promising for U.S. Herd Immunity

The CDC estimates 83 million Americans were infected with COVID-19 in 2020, creating a baseline of at least 25% of the population that is essentially protected against further severe disease, at least in the near term. We estimate this number grew to 38% of the population by the end of the first quarter, and the U.S. should be able to vaccinate 58% of the population by the end of the second quarter.

We continue to expect that the U.S. will reach a level of protection (from both infection and vaccination) sufficient to allow for herd immunity by the end of June 2021. This expectation factors in our assumptions for COVID-19's R0 (reproduction number, or rate of transmission of the virus), average vaccine efficacy, and the number of Americans who have been infected with COVID-19 over the past year.

In practice, this could mean some pockets of the U.S. are protected while cases continue to spread in others, based on the rates of variation by state. That said, our base case assumes dramatically lower rates of infection by the end of the second quarter. While more contagious variants are spreading in the U.S., vaccine hesitancy is down: The Wall Street Journal has cited Census Bureau surveys showing only 17% of adults definitely or probably would not get vaccinated, versus 22% in January.

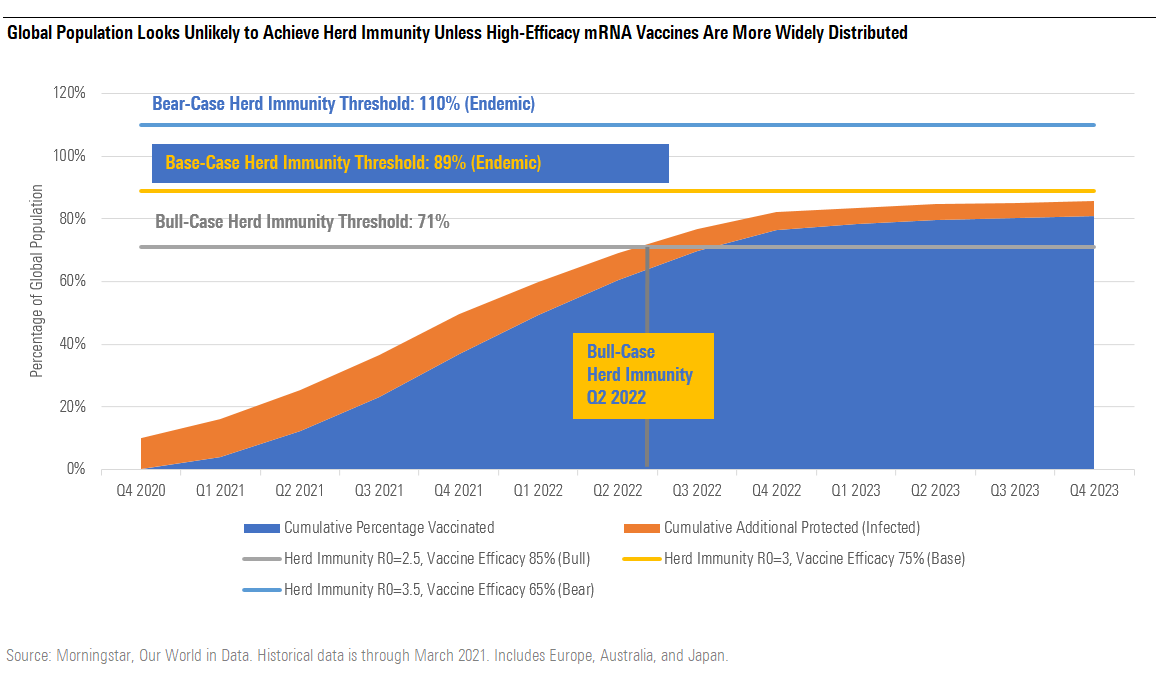

Global Herd Immunity Faces Headwinds From Lower Infection Rates, Lower Vaccine Efficacy

Outside of individual success stories in Israel and the United Kingdom, vaccination rates in the U.S. generally outpace those in other developed countries and far outpace those in developing markets.

Uncertainty around the rollout of the Johnson & Johnson vaccine in Europe has pushed the Continent to seek additional doses from Pfizer/BioNTech, which has been able to accelerate deliveries under a 600 million-dose contract for 2021 and has secured a large 1.8 billion-dose deal with Europe for 2022 and 2023, as first-series vaccinations that flow into potential third doses. We expect other developed markets outside the U.S. (including Europe) to broadly catch up to U.S. vaccination rates by the end of the fourth quarter. In developing markets, we think vaccinations will begin to grow more rapidly in the third quarter and then continue on a steady pace through 2022.

We still see herd immunity as tougher to achieve globally, due to lower average efficacy for vaccines covering much of the population (such as AstraZeneca and Johnson & Johnson's vector vaccines and several Chinese inactivated virus vaccines), logistical and financial difficulties with wide vaccination in many developing markets, the continuing spread of variants that lead to lower vaccine efficacy against mild/moderate disease (as seen in recent South Africa data from Johnson & Johnson and Novavax vaccines), and the fact that some East Asia countries have had a much lower incidence of disease, requiring even higher rates of vaccination to reach herd immunity. In addition, more contagious variants have raised the percentage of individuals who need to be protected in order to achieve herd immunity, in all geographies.

What Low Vaccine Supply in Europe and Developing Markets Means for Vaccination Timing

In Europe, part of the EMA plan is to vaccinate 70% of adults by the end of September 2021, although this is tougher to achieve given severely reduced estimates of vaccine availability from AstraZeneca due to low yields in some manufacturing plants, as well as restrictions now in place in certain countries suspending vaccination with Astra's vaccine for younger individuals due to very rare but serious blood-clotting side effects seen since approval in Europe in January. Europe has fully exercised existing Pfizer/BioNTech options (600 million doses in total in 2021) and recently negotiated more doses of its mRNA vaccine for 2022-23.

Large developing markets are unlikely to see enough vaccine supply in 2021 to approach herd immunity, even putting these concerns aside. As of early April, Covax aims to distribute 2 billion doses of vaccines this year, covering 30% of the population in low- and middle-income countries. We highlight that the vaccination goals of China, India, and Russia seem particularly aggressive.

The Future of Vaccine Supply and Distribution

The likely failure to reach herd immunity doesn't mean the pandemic will continue to rage. All three authorized vaccines in the U.S. are extremely effective at preventing severe disease, and recent data show this is likely true even against the toughest South Africa variant.

With high vaccination rates (and high rates of infection/immunity in many countries due to the pandemic), we expect levels of infection--and, most important, hospitalization and death rates--to fall to very low levels by this summer in the U.S., in the second half of the year in many other developed markets, and in 2022 in developing markets.

Regardless of whether the virus evolves to evade current vaccines or sees slowing rates of mutation, we expect the global population to benefit from the fact that high-efficacy mRNA vaccines--which can be quickly adapted to future mutations--should become more available to all geographies by 2022.

Although mRNA vaccines have required ultracold transport and freezer storage, additional studies since initial authorizations have led to eased requirements, and Pfizer/BioNTech is also working on a freeze-dried (lyophilized) version of its vaccine in a trial beginning in April that could lead to a refrigerated version in early 2022. In addition, the refrigerated antigen vaccine in development at Novavax has had positive data so far and has potential for large-scale manufacturing that could help fill any hole created by reduced demand or restricted use of the adenoviral vector vaccines.

In our next article, we’ll cover our expectations for the leading vaccine manufacturers’ valuations and profitability.

/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)