Ultimate Stock-Pickers' Top 10 Buys and Sells

The most compelling story on the conviction holdings list of our top managers is narrow-moat rated Apple.

For the past 10 years, the primary goal of the Ultimate Stock-Pickers series has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers, 22 of which manage mutual funds that Morningstar's manager research group covers and four of which manage the investment portfolios of large insurance companies. As they become available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through some of the buying activity we saw from our Ultimate Stock-Pickers during fourth-quarter 2018 and the beginning of first-quarter 2019. The piece itself was an early read on the purchases--focused on high-conviction and new-money buys--that were made during the period, based on the holdings of many of our top managers. As all but one of our top managers have reported their holdings for the fourth quarter of 2018, we now have a more complete picture of what piqued their interest during the period. Following a recurring theme over previous periods, our Ultimate Stock-Pickers remained net sellers during the fourth quarter of 2018. We think that this long-standing selling trend is influenced by the prolonged shift in assets from actively managed products to passively managed products and is not necessarily indicative of an aggregate bearish stance on the market.

In terms of valuations, our view is that the January rebound in the overall market may have some more room to run. Currently, our market fair value estimate stands at .97, which suggests that stock valuations are slightly undervalued but are within the realm of reasonableness.

As for sector allocation, our top investment managers took more active sector weightings this quarter. The Ultimate Stock-Pickers remained meaningfully overweight in basic materials, industrials, and financial services relative to the weightings of the S&P 500 Index at the end of January, and they became meaningfully overweight technology this quarter. Our Ultimate Stock-Pickers also continue to hold meaningfully underweight positions in the utilities and energy sectors and became meaningfully underweight in consumer cyclical goods, healthcare, and real estate this quarter. The remaining sectors, consumer defensive and communication services, are both within 100 basis points of the passive benchmark.

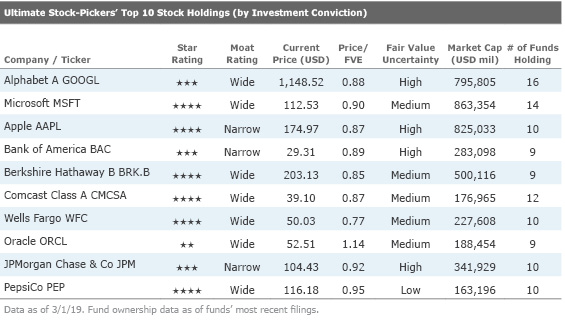

The overall makeup of the top 10 stock holdings by investment conviction changed slightly compared with the last period, as wide-moat rated PepsiCo PEP replaced wide-moat rated Johnson & Johnson JNJ. Wide-moat rated Comcast CMCSA and narrow-moat Bank of America BAC moved up the conviction holdings list, while wide-moat Oracle ORCL, Wells Fargo WFC, and Berkshire Hathaway BRK.B, as well as narrow-moat JPMorgan JPM, moved down. Six of the 10 conviction holdings, wide-moat rated PepsiCo, Wells Fargo, Comcast, Berkshire Hathaway, and Microsoft MSFT, as well as narrow-moat rated Apple AAPL, are undervalued. Eight of the top 10 conviction stock holdings came from either the technology sector or the financial services sector. No other sector had more than one stock present on the top 10 conviction holdings list.

Ultimate Stock-Pickers' Top 10 Stock Holdings (by Investment Conviction)

To us, the most compelling story on the conviction holdings list is narrow-moat rated Apple, Inc. Apple was formerly the largest company in the world and sustained a trillion-dollar market capitalization from August 2018 to October 2018, but the stock plummeted when the company's revenue guidance fell short of expectations at the end of October. Further, on Jan. 2, Apple released revised revenue guidance for its fiscal 2019 first quarter that implied a 5% year-over-year decline due to weakness in China. Morningstar Analyst Abhinav Davuluri thinks that the market has overreacted to these headwinds and that Apple's shares are now materially undervalued.

Davuluri notes that the reason why Apple's first-quarter revenue fell is that iPhone sales fell 15%, but this was partially offset by non-iPhone sales growing by 19%. Davuluri notes that this trend toward non-iPhone sales will likely continue and anticipates that the growing services and wearables revenue will offset weak iPhone sales. Davuluri has significantly cut his iPhone unit forecasts for China going forward because he anticipates a more competitive environment along with the current tepid macroeconomic backdrop in the region and U.S.-China trade tensions. Davuluri foresees Apple's ongoing business benefiting more from existing customers than from new smartphone adopters.

Since hardware is becoming increasingly commoditized and replacement cycles are potentially elongating in the long term, Davuluri expects Apple to focus on newer software and services to augment the user experience and retain customers. Davuluri thinks that the firm’s additional products and services such as Apple Watch, iCloud, HomePod, AirPods, and Apple Pay act as both supplemental revenue opportunities and, more importantly, critical enhancements to the iOS ecosystem that support the iPhone. He notes that the firm’s active installed base for iPhones surpassed 900 million devices (up nearly 75 million in the past 12 months), which supports his thesis of a rich and loyal customer base from which Apple can extract services and wearables revenue. This was demonstrated this quarter, as services revenue grew 19% and wearables and home accessories rose 33% year over year.

Apple is notably the largest holding of Berkshire Hathaway's equity portfolio. Warren Buffett famously avoided technology stocks before purchasing Apple's shares, noting that he likes the stickiness of Apple's products. When asked about Apple's recent decline in market capitalization in an interview with CNBC's Betty Quick on Feb. 25, Buffet remarked:

Yeah, the stock market is there not to instruct me. It's there to serve me. So if there's bad news and the stock goes down, the question is in my--I have is--is the long-term valuation changed? And--you know, there was--well, there was certainly bad news at GEICO when we bought it, for example. But there was bad news in American Express when I originally bought it back in the '60s. It was the investment partnership I ever made. So what you like is bad news about a fundamentally good business. And then you going to make sure that it's still a fundamentally good business. But, no, bad news on a good business. We're better off because Apple stock is down significantly from where it was four or five months ago than if it stayed there. Apple will probably--they may not, but they have said they're going to down to cash neutral. They could do it either by acquisitions, or dividends, or repurchases. And my guess is it'll be mostly repurchases. They are about $130 billion away from cash neutral now. If the stock were at $200, it would buy 650 million shares. If it's at, you know $150, you buy close to 900 million shares. We're way better off, you know, if it's at a lower price when they're repurchasing shares. Our partners are selling out to us, and they're selling out cheaper than otherwise. The worst thing that can happen from our standpoint with Apple is that it sells at $230 or something like that because we don't like buying as well at that sort of price.

Turning to the Ultimate Stock-Pickers' top 10 stock purchases, we found that the Stock-Pickers once again focused their attention on high-quality companies that fit well within Morningstar's moat framework. Eight out of the top 10 high-conviction purchases and 10 of the top 20 names have been given a wide or narrow moat by Morningstar equity analysts. From a sector perspective, the Ultimate Stock-Pickers seem to be focusing their buying activity in financial services, which contributed four stocks to the list, while technology and industrials each contributed two stocks to the list.

Ultimate Stock-Pickers' Top 10 Stock Purchases (by Investment Conviction)

We have extensively covered many of the undervalued names on this list. One company that received several conviction purchases is narrow-moat rated General Electric GE. The battered industrial giant has made headlines as it grapples with the full extent of the liabilities that it generated from its legacy businesses in GE Capital. Oakmark Fund OAKMX made the largest conviction purchase into the stock during the fourth quarter. Although the fund did not make any direct commentary on the purchase in its most recent commentary, the fund did note in its third-quarter commentary that:

GE is different because it now has a new management team, new board members, and the divisions that account for most of our valuation case today—Aviation and Healthcare—have performed as expected. Our thesis does not require either a turnaround of GE's underperforming Power division or that the managers who spent years driving the bus into the ditch now drive it out.

The stock has rebounded substantially from the historic lows in December 2018, and Morningstar Analyst Joshua Aguilar thinks that the company still has room to run. GE has been selling some of its most valuable assets, notably the GE Healthcare division through a potential public offering, to pay down debt. These debt payments would deleverage GE's troubled balance sheet. A major portion of Aguilar's bullish take in December rested on his assertion that the net asset value of these segments, particularly GE Aviation and Healthcare, was greater than GE's market cap, even after deducting all of its liabilities. Recently, the company announced it has agreed to sell its BioPharma business to Danaher DHR for approximately $21.4 billion. While Aguilar recognizes that GE is losing one of its high-growth divisions, he thinks CEO Larry Culp is making the right strategic decision for a few reasons.

First, Aguilar understands that this deal may make a potential GE Healthcare initial public offering slightly less attractive, but he thinks that life science valuations are currently high, so this deal offers Culp and his team the opportunity to quickly monetize assets at a reasonable price. Second, Aguilar believes GE Life Sciences has little strategic value to GE’s future as an industrial infrastructure business, so there would be little value in keeping the rapidly growing division. Finally, the asset price discovery for GE’s valuable assets has been relatively in line with Aguilar's expectations, which supports his thesis that the net asset value of GE's segments is greater than current the market capitalization. The asset price discovery contrasts with GE bears’ assertions that the company will be forced into a fire sale of its most valuable assets to dig itself out of its self-imposed debt hole.

Ultimate Stock-Pickers' Top 10 Stock Sales (by Investment Conviction)

Turning to the Ultimate Stock-Pickers conviction sales list, we think that many of the Stock-Pickers are trimming stakes that continue to remain widely held. We would note that five of the top 10 conviction stock sales were present on the top 10 conviction holdings list. Additionally, five of the stocks on the conviction sales list were trading above our analysts' fair value estimates, but four of the companies remained materially undervalued. Four of the conviction sales came from the consumer defensive sector, and two stocks came from both the technology and financial services sector.

One conviction sale that our research disagrees with is BBH Core Select Fund's BBTEX conviction sale of wide-moat rated Unilever UN. The consumer goods giant is fighting strong organic growth headwinds from fragmentation in consumer profiles and retail and marketing channels as well as lower barriers to entry for startups. That said, Morningstar analyst Philip Gorham thinks that Unilever's management team is taking the right steps to reignite growth in some highly competitive categories. Gorham thinks that Unilever still offers a modest upside to its current market price but recognizes currencies and inflation in several commodities, including packaging materials, remain short-term challenges.

Gorham admits that the law of large numbers is unfavorable for the large-cap consumer companies and that moving the needle on Unilever's EUR 53 billion top line in a low-growth environment is challenging. To counter the niche, local, and artisanal brands that have been driving growth, Unilever has adopted the 70-20-10 rule, in which global brands make up 70% of the company's innovation, with local needs being served by the remaining 30%.

Further, the country category business team structure empowers local managers to deliver products to market at speed, bypassing the lengthy global approval process. Since Unilever has adopted management strategies that attack the heart of the challenges facing the industry, Gorham believes Unilever has a better chance than most of its peer group of reigniting growth in the medium term, which is demonstrated by his bullish forecast of a 4% growth rate.

Gorham also thinks that Unilever's strategies to streamline its cost structure will help it achieve cost savings. Gorham notes several programs that Unilever has instated such as 5S, which is focused on supply-chain and gross margin efficiencies, as well as zero-based budgeting, which has replaced budgets and spending targets with operational KPIs and primarily focuses on marketing spending and overheads, and finally Connected 4 Growth, which has delivered a 15% reduction in middle and senior management.

Recent evidence suggests that these strategies are working. Unilever's full-year consolidated underlying margin of 18.4% was almost a full percentage point above that of the year before, indicating fairly strong execution on costs. This approaches Gorham's normalized margin estimate of 19.3%.

Disclosure: Burkett Huey has an ownership interest in Berkshire Hathaway. Eric Compton does not have any ownership interests in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)