Real Estate Stock Outlook: Sector Continues to Underperform Despite High Same-Store NOI Growth

Park Hotels & Resorts and Ventas are among our top picks.

This article is part of Morningstar’s Q2 market review and outlook.

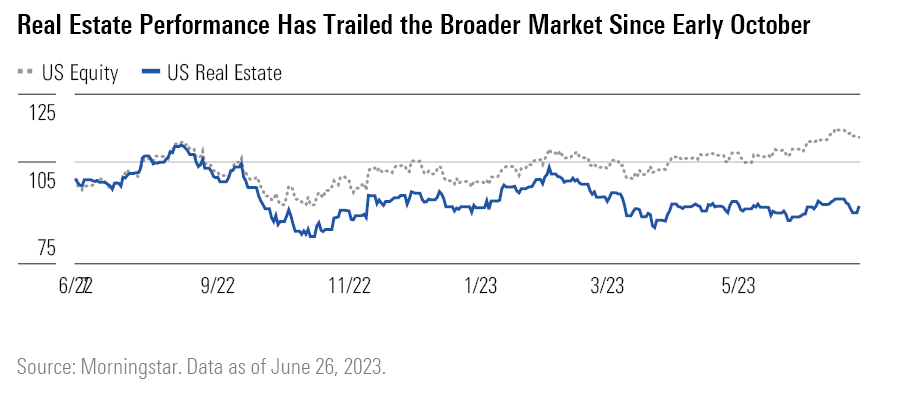

The Morningstar US Real Estate Index is down 8.0% over the trailing 12 months, which is much worse than the 12.3% gain seen by the broader U.S. equity market over the same period. The real estate sector was also down 0.6% in the second quarter of 2023 alone, underperforming the broader U.S. equities market, which was up 5.4% in the quarter. While the real estate sector has seen negative stock performance over the past 12 months, the companies continue to report same-store net operating income growth well above the historical average, with full-year guidance for 2023 suggesting that most companies will produce a very strong year of internal growth.

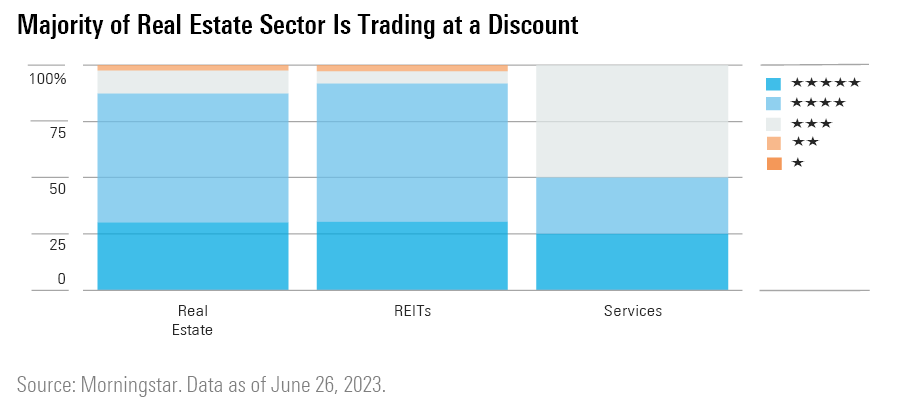

The real estate sector is trading significantly below our fair value estimates. Our real estate coverage currently trades at a 26% discount to our estimate of fair value, which is in line with or better than most other North American sectors. Currently, 32% of the real estate sector is trading in the 5-star range, 55% is trading in the 4-star range, 11% is trading in the 3-star range, and only 3% is trading in the 2-star range, while no company is currently trading in the 1-star range.

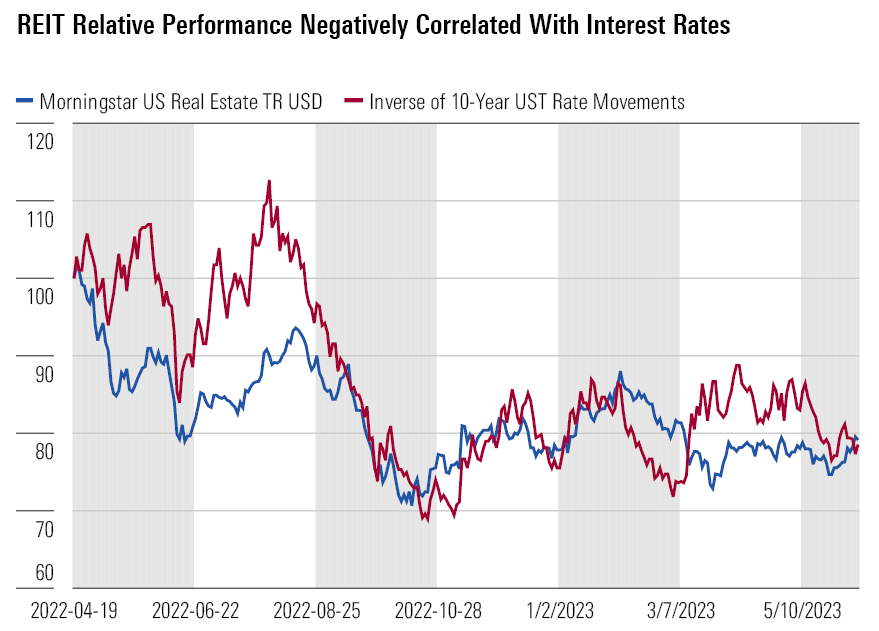

Since 2000, the relative performance of REITs compared with the broader equity market has shown a significant negative relationship to interest rate movements for the 10-year U.S. Treasury. While many income-oriented investors favor REIT investments for their dividend payments during periods of low interest rates, rising rates cause income-oriented incomes to rotate money out of the sector and into lower-risk investments. Additionally, rising interest rates increase the debt costs many REITs rely upon to fund acquisitions and development projects, so external growth becomes less accretive to REIT cash flows as interest rates rise.

Due to the strong negative correlation, rising interest rates in 2022 directly led to the negative performance of the real estate sector. While interest rates have flattened out since October 2022, the higher rates have kept REIT stock prices down.

Management team guidance for 2023 has been for significantly lower external growth and higher interest expense as they refinance debt. However, most real estate subsectors also guided to rate, revenue, and net operating income growth above the historical average. Rising interest rates have a limited long-term impact on REIT cash flows, so we believe many companies in the sector are trading at a discount due to short-term disruption caused by higher interest rates.

Top Real Estate Sector Picks

Park Hotels & Resorts PK

- Fair Value Estimate: $26.50

- Star Rating: 5 Stars

- Uncertainty Rating: High

- Economic Moat Rating: None

While COVID-19 significantly affected Park’s operating results with high-double-digit revPAR declines and negative hotel EBITDA in 2020, the company’s portfolio has significantly improved operations over the past two years. Leisure travel rebounded to prepandemic levels in 2021 with group travel returning to pre-pandemic levels in 2022. We anticipate that revPAR will see low double-digit growth in 2023 due to above-average inflation and that the company will report several more years of above-average growth as business travel slowly recovers.

Ventas VTR

- Fair Value Estimate: $68.00

- Star Rating: 5 Stars

- Uncertainty Rating: Medium

- Economic Moat Rating: None

Ventas owns high-quality assets in the senior housing, medical office, and life science fields. While the company’s medical office and life science portfolios were unaffected by either the pandemic or an economic recession, the senior housing portfolio saw a large drop in occupancy in the first year of the pandemic. However, occupancies slowly recovered in 2021 and 2022 with the recovery continuing in 2023. Long term, the industry should see strong demand growth from the coming demographic wave of baby boomers aging into senior housing facilities that will produce high occupancy levels and rate growth.

Federal Realty Investment Trust FRT

- Fair Value Estimate: $139.00

- Star Rating: 5 Stars

- Uncertainty Rating: Medium

- Economic Moat Rating: None

Federal Realty owns and operates high-quality shopping centers and mixed-use assets in eight of the largest metropolitan areas and the average population density and average median household income around its portfolio is higher than any other retail REIT. Occupancy in Federal’s portfolio has stabilized at 94%, and the company reported double-digit re-leasing spreads in the first quarter of 2023. The company has a large development pipeline of mixed-use assets that should provide significant growth when the projects deliver over the next few years.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZEMES5XIZBD2LHOJ4CE4VEBM6I.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_3bda971142bb429e90b0e551f31b1fbb_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/B26QQUGWL5BVLMVULGYK3QQASI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)