Real Estate: High Interest Leads to Negative Performance Despite Solid Growth

The median real estate stock trades at a better discount than those of most other North American sectors.

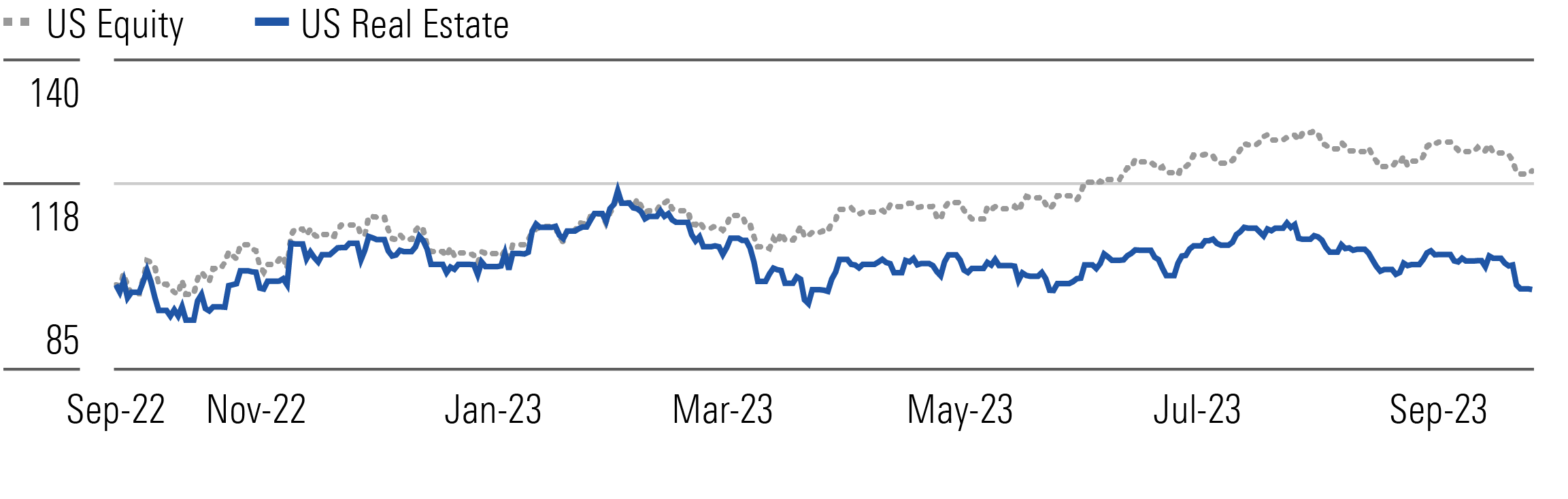

The Morningstar U.S. Real Estate Index is down 0.8% over the trailing 12 months, significantly worse than the 20.3% gain seen by the broader U.S. equity market over the same period. The sector was down 7.2% in the third quarter, while the broader market was down 2.3%. Real estate has underperformed the broader equity markets, despite companies in the sector reporting same-store net operating income growth above the historical average, as higher interest rates have reduced the impact of external growth for many companies.

Real Estate Has Underperformed U.S. Equities Over Past 12 Months

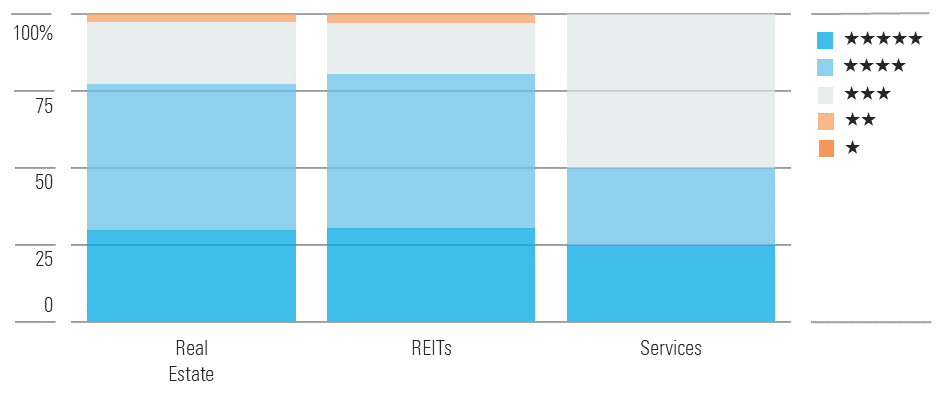

The median real estate stock currently trades at a 26% discount to its fair value estimate, which is better than most other North American sectors. Currently, 30% of the sector is trading in the 5-star range, 48% is in the 4-star range, 20% is in the 3-star range, and only 2% is in the 2-star range, while no company is currently in the 1-star range.

Three-Quarters of the Real Estate Sector Is Trading at a Discount

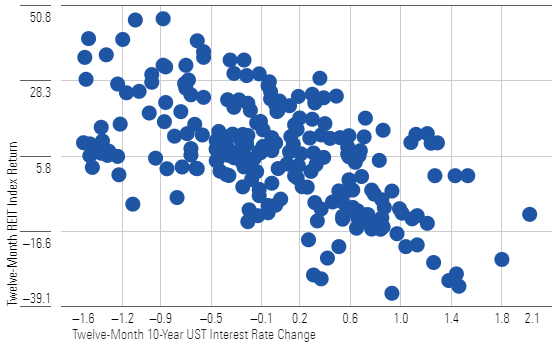

Since 2000, real estate investment trusts have demonstrated a significant negative relationship between relative stock performance and interest rate movements for the 10-year U.S. Treasury. While many income-oriented investors favor REIT investments for their dividend payments during periods of low rates, rising rates cause them to rotate money into lower-risk investments. Additionally, rising interest rates increase the debt costs many REITs rely upon to fund acquisitions and development projects, so external growth becomes less accretive to REIT cash flows as interest rates rise.

Relative Performance of REIT Sector Negatively Correlated with Interest Rate

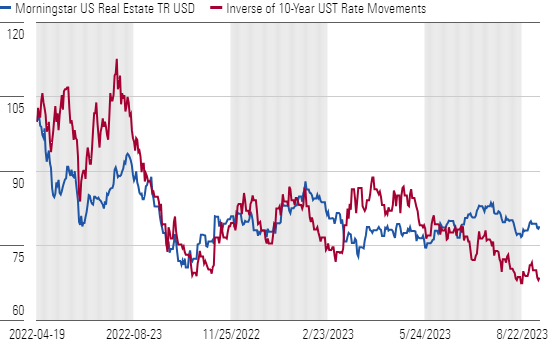

Due to the strong negative correlation, rising interest rates in 2022 directly led to the negative performance of the real estate sector that year. While interest rates have mostly flattened out since October 2022, the higher rates have kept REIT stock prices down. REITs have so far reported higher interest expenses and lower acquisition and development activity compared with prior years. However, most real estate subsectors have also produced rate, revenue, and net operating income growth above the historical average so far in 2023. Rising interest rates have a limited long-term impact on REIT cash flows, so we believe many companies are trading at a discount due to short-term disruption caused by higher interest rates.

REIT Index Mirrored Inverse of Interest Rate Movements Over Past 18 Months

Top Real Estate Sector Picks

Park Hotels & Resorts

- Fair Value Estimate: $26.50

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

While the COVID-19 pandemic significantly impacted Park’s PK operating results, with high-double-digit declines in revenue per available room and negative hotel EBITDA in 2020, the company’s portfolio has significantly improved operations over the past two years. Leisure travel rebounded to pre-pandemic levels in 2021, while group travel returned to pre-pandemic levels in 2022. The company has produced revPAR growth of almost 18% so far in 2023, and we anticipate that the continued recovery of business travel combined with above-average inflation will lead to a few more years of above-average growth.

Ventas

- Fair Value Estimate: $72.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Ventas VTR owns high-quality assets in the senior housing, medical office, and life science fields. While the company’s medical office and life science portfolios were unaffected by COVID-19, the senior housing portfolio saw a large drop in occupancy in the first year of the pandemic. However, occupancies have steadily recovered since the start of 2021, with the company reporting double-digit net operating income growth. In the long term, the industry should see strong demand growth from the coming demographic wave of Baby Boomers aging into senior housing facilities, which will produce high occupancy levels and rate growth.

Federal Realty Investment Trust

- Fair Value Estimate: $139.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Federal Realty FRT owns and operates high-quality shopping centers and mixed-use assets in eight of the largest metropolitan areas. The average population density and average median household income around its portfolio are higher than those of any other retail REIT. Occupancy in Federal Realty’s portfolio has stabilized at 94%, and the company reported double-digit re-leasing spreads on newly signed leases for the past three quarters. The company has a large development pipeline of mixed-use assets, which should provide significant growth when the projects deliver over the next few years.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)