Our 'Buy American' Moment Has Arrived for U.S. Multi-Industrials

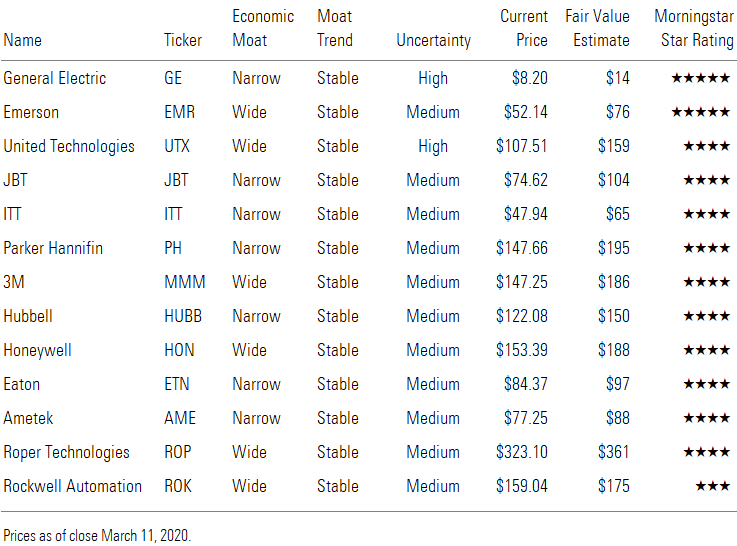

The discounts we see now are several and sometimes compelling.

Today, we remind investors of what Ben Graham wrote about Mr. Market in The Intelligent Investor 70 years ago: "Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or sell you an additional interest on that basis. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them. Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly." Just a few months ago, we believed greed was taking hold of Mr. Market, as our diversified coverage was split 57/43 in favor of 3-star and 2-star-rated stocks. We had no multi-industrial stock ideas.

Now, fear has spread to even tenured investors regarding the long-term implications of the coronavirus outbreak, which has had a larger impact than almost any expert predicted early on, and by all accounts is likely to remain with us for some time to come. But as was true when Warren Buffett wrote his "Buy American" New York Times op-ed in 2008, fears regarding the long-term prosperity of moaty companies make little sense when measured from our bottom-up, long-term assessment of the fundamentals of these stalwarts of American industry. That's not a blank endorsement of every U.S. multi-industrial we cover; there are names that we still don't believe merit a place in an investor's portfolio at today's prices. Nevertheless, while we could be early, and intrinsic value is hardly immutable, we think we find multiple decent and even some compelling discounts at today's prices. Keep in mind that for companies protected by a moat (the wider, the better), the lion's share of our assessed value lies in stages two and three of our valuation. Even assuming the coronavirus pandemic is a two-year disruption, buying the stocks of companies protected by a moat should provide downside protection for investors.

To that end, General Electric GE now trades below our 5-star price, and while it remains a highly uncertain name (as underpinned by our high fair value uncertainty rating), we believe the risk/reward could pay off for patient long-term investors. GE is the cheapest stock on our list of U.S. multi-industrials, and its fundamentals are improving, which we credit to a combination of market forces and Larry Culp’s leadership. This is even with the caveat that we are likely to see larger-than-average fair value changes to GE, given its aerospace exposure. GE’s military exposure, for instance, is more defensive, and at 15% of segment revenue, constitutes a smaller yet still meaningful offset to the commercial engine business. While we could be wrong, we will let the long-term weighing machine of the market determine Culp and his team’s ability to restore GE to a high-single-digit free cash flow yielder. Management has already explicitly built in about $400 million at the midpoint for coronavirus impact on GE’s business, and we’ve already modeled an additional cushion this year that will take us past next quarter. Even assuming the effects last longer, we suspect there is conservatism in management’s numbers as there was last year (we were expecting slightly negative free cash flow versus $2.3 billion of actual free cash flow).

Despite management’s failure to appreciate the effects of the trade war on its end markets, we like wide-moat 3M’s MMM short-cycle exposure, and we like its price. At $141 per share, we believe investors could get 3M’s growth “for free” and still service its potential PFAS liabilities, which we believe are less than the market believes. We think 3M’s personal safety division, which sells personal protective equipment, should see double-digit growth with minimal disruptions to it supply chain in mask production. We believe this is a short-term catalyst in the stock that the market fails to appreciate. Like GE, 3M has significant healthcare exposure, which tends to be stable compared with its more cyclical industrial counterparts.

Honeywell HON is also a name we like. Despite its significant aerospace exposure, the company has 60% of its exposure in short-cycle businesses, including the personal protective equipment market. We could see Honeywell’s warehouse solutions business benefiting, particularly as consumers may increasingly make e-commerce purchases instead of visiting fixed store locations during a quarantine. On the flip side, Honeywell offers autonomous warehouse solutions, which are vital in the event there are disruptions to the labor force. We think Honeywell has a wide moat and exemplary stewardship. It’s our favorite of the traditional, large conglomerate names we cover, and we’d like it even more if it dipped to 5 stars.

Other wide-moat names we like in 4- and 5-star territory include United Technologies UTX and Emerson EMR. Each of these companies’ businesses have very different demand drivers. United Technologies’ Otis and Carrier, for instance, rely on long-term trends like urbanization and demand for energy efficiency. While these businesses won’t be immune from the impacts of the virus (very few businesses will be), infrastructure will still have to be built, and very few competitors can offer the breadth of service either of these two have for commercial accounts, which are sticky by nature. Emerson will see its business hurt because of its large China exposure, even as we’re modeling in an S&P consensus low for its top-line production in 2020 and 2021. That business was already making efforts to protect margins on already weak expectations for global demand, as its mix shifts to higher-margin aftermarket revenue. And while not quite in 4-star territory, Rockwell ROK shares have some upside for a well-managed, wide-moat enterprise that offers the additional advantage of significant short-cycle exposure at this point in the cycle. We would watch it for now and be a buyer at 4 stars.

Narrow-moat Ametek AME is a cash compounder, as is narrow-moat JBT JBT to a lesser extent. Both are trading in 4-star territory. Ametek’s moat is on the wider side of narrow, in our view. Ametek’s products are mission-critical, have a high cost of failure, and offer few substitutes. We have been at the very bottom of CapIQ consensus on this stock for a while, but we finally believe it’s an opportune time to buy, since cash compounders rarely get cheap and are difficult to value: The market implicitly awards value based on unannounced acquisitions, in our view. Nevertheless, this is one of the most innovative companies we cover and is one of the few that actually takes price greater than inflation (typically 20-30 basis points, but that range has widened recently). Its capital expenditure requirements are low and free cash flow conversion is high, which it uses to buy adjacent, differentiate niche businesses at attractive prices. Our favorite business under our diversified coverage is wide-moat Roper Technologies ROP, which currently trades at 4 stars. That business rarely trades at a discount to intrinsic value and requires negative working capital and minimal maintenance capital expenditures to operate.

Finally, Parker Hannifin PH, Eaton ETN, Hubbell HUBB, and ITT ITT all trade in 4-star territory. Eaton has several catalysts that we think should better highlight its value, including the astute sale of its underwhelming hydraulics business to Danfoss, which we think should better reveal its value over time. ITT is a business with a high amount of upside, in our view, on the back of CEO Luca Savi’s productivity initiatives, which should continue to drive meaningful improvements in operating margin and return on invested capital over time. The company reports that China is now back at nearly 100% production, from our understanding, and there were no delays during February. Additionally, we understand three facilities in Italy are still undergoing normal operations. While we concede it’s unlikely that every single one of these stocks will offer market-beating returns over the long run, we think at worst they offer some downside protection during these uncertain times.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)