Natural Gas and Renewables Slug It Out

Infrastructure investments supporting generation changes drive utility earnings and dividend growth.

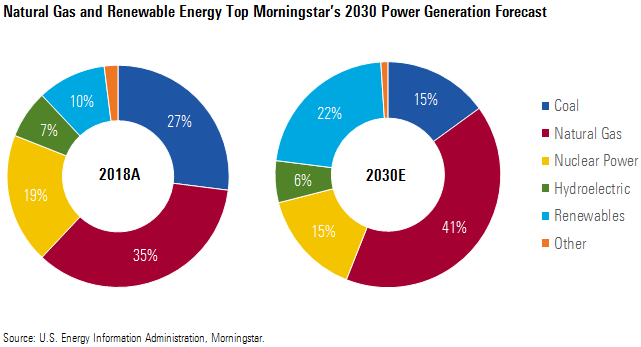

Coal and natural gas have been fighting for the top spot in the U.S. generation market for the past 20 years. Gas just threw the knockout punch. In 2016, U.S. gas generation topped coal for the first time since the U.S. government began keeping records. Gas is king with 35% market share and growing. Now the battlefield is shifting, and in the next decade, we expect natural gas and renewable energy to slug it out. Renewable energy has been growing at extraordinary rates but from a small base and still has just 10% market share. By 2030, we forecast renewable energy will pass coal, nuclear, and hydro as the second-largest source of power generation in the United States while gas extends its market share lead.

The U.S. Energy Information Administration believes renewable energy growth will level off as wind and solar tax credits ramp down, absent a spike in gas prices. We disagree and think renewables will continue to grow at a similar pace without tax credits and low gas prices. Our bullish outlook is built on the investments that utilities are making to meet state renewable portfolio standards and satisfy corporate demand. Gas generation will continue to grow because of its flexibility to support intermittent wind and solar. Nuclear power’s reliability and carbon-free generation will encourage continued legislative and regulatory support, but generation will fall about 10% during the next decade as plants retire and only two new reactors come on line. The future of coal remains ugly as its market share plummets.

We continue to believe that integrated utilities with supportive regulatory frameworks should benefit as they retire coal plants and replace these assets with natural gas, renewables, and transmission infrastructure. The largest U.S. utilities--Dominion Energy D, Duke DUK, NextEra Energy NEE, Southern SO, and Xcel Energy XEL--are investing billions in narrow- and wide-moat projects that should result in strong earnings and dividend growth over the next decade.

Natural Gas Keeps Growing, but Renewable Energy Closes Gap During the past 20 years, coal and natural gas were the main contestants for U.S. electricity generation market share. Natural gas won, with its share climbing to 35% in 2018 from 17% in 2001 while coal's share shrank to 27% from 51%. Renewable energy grew the fastest on a percentage basis but started from a low installed base.

In the next decade, we expect the main battle will be between natural gas and renewable energy, and we believe both will be winners. We forecast gas generation will grow 33% to 1,947 terawatt-hours between 2018 and 2030 while renewable energy will grow 142% to 1,094 TWh. Natural gas’ market share will climb to 41% from 35% while renewable energy’s market share will climb to 22% from 10% in our forecast.

The U.S. Energy Information Administration in its reference case believes renewable generation growth will level off early in the next decade as wind and solar tax credits ramp down. We think this is too bearish. The only scenario in which the EIA expects renewable energy growth to top our forecast is if gas prices jump. The EIA’s 2030 natural gas price bear case is $4.20 per mmBtu in nominal dollars, its reference case is $5.18 per mmBtu, and the natural gas price bull case is $7.59 per mmBtu. This wide range reflects the significant uncertainty of future natural gas prices.

Our forecast is partly based on our view gas prices will increase in line with inflation. Our midcycle gas price forecast starts at $3/mmbtu in 2023 and grows at 2.25% inflation through 2030. Our 2023 midcycle gas price is in line with the EIA bear price case, but we forecast smaller increases in the second half of the next decade. This results in our 2030 nominal gas price forecast that is 16% lower than the EIA bear case.

Although our view of natural gas prices is more bearish than the EIA’s, our estimate of electricity generation from gas is within the EIA’s range of forecasts. This is primarily due to our forecast for more nuclear and renewable energy than the EIA’s forecast. Since these sources have zero or low marginal operating costs, we expect more nuclear and renewable energy generation than the EIA even with our bearish outlook for natural gas prices.

Our forecast for more natural gas generation is also due to our more bullish outlook on electricity demand. Our 1.25% national electricity demand growth forecast through 2030--1.1% after incorporating distributed generation--is the highest among key third-party forecasts for U.S. electricity demand growth. However, the EIA increased its 2017-30 annual demand growth forecast to 0.8% from 0.6% in its 2017 Annual Energy Outlook and is now only 30 basis points lower than our forecast after accounting for distributed generation.

Renewable Growth Should Remain Strong Even Without Tax Credits We forecast U.S. renewable energy will increase 142% by 2030 versus last year, reaching 1,019 TWh, or 22% of electricity demand, excluding hydro. The ramp-down in solar and wind tax credits during the next few years won't slow growth as much as other forecasts assume. In our opinion, utilities that meet state renewable portfolio standards will fill most of the growth gap from the elimination of or reduction in tax credits. But we also think there will be growth in states that have already surpassed their RPS such as Texas and Iowa, and growth in states that don't have an RPS, notably Florida.

Corporations enhancing their ESG profiles by investing in renewable energy also supports our renewable energy growth outlook. Corporations generally have four ways to invest in renewable energy: distributed generation, power purchase agreements and virtual PPAs, renewable energy certificates, and green tariff programs.

Although distributed generation usually does not help a utility meet its RPS, PPAs, RECs, and green tariff programs can provide significant support. Initially it was high-tech companies or ones catering to millennials working to improve their ESG profile by buying renewable energy. Whole Foods was one of the first when in 2006 it announced it would purchase all of its power needs from wind farms using RECs. Today, we see all types of corporations and organizations using these methods to claim they have low or no carbon emissions.

Tax Credits Have Little Impact On Generation Mix The EIA assumes renewable energy is sensitive to natural gas prices following the expiration of and reduction in of tax credits. The U.S. IRS allows wind projects placed into service four years after the start of construction to claim tax credits. The credit has already dropped 60% from 2016 for projects that start in 2019 and are in service by 2023. Projects that start next year won't receive a tax credit. Solar is a similar story. The maximum solar investment tax credit is 30% for projects under construction by year-end 2019. The credit drops to 26% for projects starting in 2020, 22% for projects starting in 2021, and 10% for projects that start in 2022 and beyond. The EIA forecasts this ramp-down in tax credits will flatten renewable energy growth unless gas prices climb substantially in the next decade.

We disagree and believe wind and solar should continue to grow at a similar pace through the next decade due to state-level RPS, continued support from corporate demand, and technology improvements. Since our natural gas price assumption over the next decade is more in line with the EIA’s natural gas price bear case, our forecast for renewable energy growth is considerably more bullish than the EIA’s in the second half of the decade.

Coal Continues to Lose Share of Generation In 2005, coal-fired generation produced a record 2,000 TWh, or 50%, of U.S. electricity generation. It has been a downhill slide ever since. By 2018, coal generated only 1,150 TWh, or 27%, of utility-scale power generation. In just 13 years, coal's share of electricity generation shrank almost 50%, and we expect a similar loss of share during the next decade. What happened?

Coal has suffered from several demand killers, including cheap natural gas, tighter emission regulations, falling renewable energy costs, and sluggish power demand. The most lethal of these was cheap natural gas and the development of highly efficient combined-cycle gas turbine power plants. For the last decade, improved oil and gas drilling technology and widespread fracking practices liberated significant quantities of natural gas in the U.S. This ample supply drove down prices. In 2018, natural gas generated 35% of electricity in the U.S., almost doubling the 19% share in 2005 when coal hit its peak.

Utilities opt to dispatch from various generation sources in their portfolios depending in large part on each power plant’s variable costs, primarily fuel prices. Typically, nuclear will provide baseload generation because of its low variable cost and challenges cycling on and off. Coal is similar--a good baseload source with cheap fuel but challenges cycling on and off. Gas always had an advantage by being able to cycle on and off with relative ease, making it available to serve peak demand spikes and market volatility. But as gas prices fell during the last decade, gas generation was able to compete with coal as a baseload resource.

In another strike against coal, gas plants became more efficient, able to produce more electricity for a given volume of gas. That means coal had a harder time competing, even if the difference between natural gas and coal prices was relatively constant. The fleet of combined-cycle gas generators, which were some 30% more efficient than coal generators, continued to grow in the U.S. Efficiency improvements in gas turbine designs from suppliers such as General Electric and Siemens drove down average heat rates even further. The heat rate is the amount of energy used by a power plant to generate 1 kilowatt-hour of electricity.

As emissions restrictions became policy throughout the U.S., coal generators’ average heat rates began to rise--reduced efficiency--due in part to running emission-control equipment. This was partially offset by a fleet shift to larger, more efficient modern coal units as smaller, older, and less efficient coal plants retired.

Higher heat rates for coal plants to meet emissions restrictions and lower heat rates for gas plants benefiting from turbine technology improvements changed the dispatch economics for utilities. Natural gas generators dispatched more often and coal plants dispatched less often, resulting in gas generators stealing market share from coal generators.

Although President Donald Trump continues to support the coal industry, this can’t overcome cheap natural gas and growing renewables. We forecast coal generation will fall on average 5% annually through 2030, ending with a 15% share of the U.S. generation market, down from 27% in 2018. Our 2030 coal generation forecast of 704 TWh is below even the most bearish EIA scenario at 17% of total generation.

States Continue to Support Nuclear Power Nuclear generation has been relatively flat over the past decade, contributing about 800 TWh, representing 19%-20% of total utility-scale generation. However, recently several nuclear plants retired or owners announced future retirements. This is partially offset by two new nuclear reactors under construction at Southern's Vogtle plant in Georgia that will add 2.2 gigawatts of capacity for Georgia Power and its partners.

Most of the recent retirements or announced closures were plants in deregulated markets that faced operating issues or financial stress from low power prices due to cheap natural gas and renewable energy growth. Other closures were policy-related. The 2 GW Indian Point (New York) plant, one of the largest of these planned retirements, faced stiff public opposition over environmental issues and its proximity to New York City. PG&E’s 2.2 GW Diablo Canyon (California) faced opposition as it came up to a deadline to file for relicensing. State officials plan to replace the lost power with renewable energy, energy storage, and energy efficiency at a lower cost. An environmental settlement in New Jersey led to Exelon’s Oyster Creek plant retirement.

Although little has occurred at the federal level, several states have passed legislation to support existing nuclear plants, recognizing their zero-carbon emissions and reliability benefits for electricity grids. Local politics also favored nuclear plant subsidies to protect the plants’ high-paying jobs and large tax contributions in mostly rural areas.

Although state regulatory support has slowed the early retirement of existing plants, only Southern is adding new reactors. These two new units at Vogtle, each 1.1 GW, are over 80% complete and scheduled to begin commercial operation in 2021 and 2022. However, the new units are five years behind schedule and expected to cost more than $20 billion, more than double the initial cost estimate. Although other utilities have new reactors in the planning stage, most are unlikely to undertake the risk with the cost of renewables continuing to decline and cheap natural gas. Although nuclear power provides reliable baseload zero-carbon power, we think it is unlikely that additional reactors will be built during the next decade.

We expect nuclear generation to decline about 10% between 2018 and 2030. This would result in nuclear power representing 15% of total electricity generation in 2030 versus approximately 19% last year. Our estimate is slightly higher than the EIA’s natural gas bull-price scenario, although our natural gas price forecast is more in line with the EIA’s bear-price scenario.

Utilities' Plans Indicate Strong Growth for Renewables, Natural Gas Our analysis of U.S. regulated utilities' long-range plans confirms our view that utilities will continue to retire coal plants and replace these with renewables and natural gas-fired generation. Utilities work with regulators to develop integrated resource plans that anticipate what resources will provide electricity over the next 10-20 years. These plans have varying degrees of detail and are subject to change, but the IRPs for the most part provide anecdotal support for our forecast that renewable energy and natural gas generation will continue to replace coal plants at a faster pace than the EIA expects.

Several utilities are undergoing dramatic changes in their generation mix over the next decade that will allow them to benefit from retiring coal plants and replacing the capacity with natural gas generation and renewable energy. Utilities will also benefit from transmission and distribution investments that modernize the grid to make it safer, more reliable, and more flexible. Investments in gas generation, renewable energy, and grid modernization will replace utilities’ decadelong investments in environmental upgrades for existing coal plants. The significant new investment opportunities will result in growing rate base, earnings, and dividends for many utilities.

Dominion Energy Dominion Energy D is the only utility with a wide economic moat rating, and it has already benefited from its transition away from coal. In the past 10 years, wholly owned Virginia Electric Power, now Dominion Energy Virginia, has built four large very efficient gas-fired power plants, three of which receive a 100-basis-point premium over the utility's 9.2% base allowed return on equity in 2019. The fourth plant, Greensville County, was completed in late 2018 and will not receive a premium. Even without the premium, the allowed ROE is above our estimate of the 7.5% we believe shareholders require for investing in Dominion shares.

The changes in wholly owned DEV’s 2017 IRP illustrate the input regulators, politicians, and others have on utilities’ long-range planning. In 2018, Virginia passed legislation that provides rate rider mechanisms to support direct or indirect investments in clean energy and sustainability. We think these investments come with returns that are worthy of economic moats. The Grid Transformation and Security Act allows rate rider mechanisms for investments in solar energy, undergrounding of at-risk aboveground distribution systems, cybersecurity, and advanced metering infrastructure.

Based on the GTSA and feedback from regulators and others, DEV modified its 2017 IRP to increase its investments in renewable energy and reduce its investments in baseload fossil fuel generation. The revised IRP, approved in September, includes more simple-cycle gas generation capacity. These combustion turbines can be quickly ramped to full capacity when wind or solar energy is unavailable.

The share of coal generation in DEV’s portfolio declines rapidly by 2030 while generation from gas and renewable energy increases. DEV’s two nuclear plants remain part of the long-term plan but lose market share as electricity sales grow.

The revised IRP also includes alternative plans that include a larger share of renewable energy supplemented by simple-cycle natural gas turbines to support the intermittent generation sources. Dominion followed through with these alternatives when in September it proposed the largest offshore wind project in the U.S. The 2,600-megawatt project would include 220 wind turbines located on 112,800 leased acres about 27 miles off the coast of Virginia Beach. The proposed project, which is estimated to cost $8 billion, would come on line in 2025 and 2026 and drive renewable generation at DEV higher than the 12% we currently forecast.

Earlier this year, we increased our estimate of Dominion’s total capital expenditures (including maintenance capital) in 2019-23 to roughly $35 billion, $6 billion higher than our previous estimate. The increase was driven in large part by an acceleration of growth investments at DEV after the GTSA legislation passed earlier this year. We estimate the acceleration of growth investments should drive 7% annual operating earnings growth. However, earnings per share growth will be only about 5% due to equity issuances that we estimate will total about $4.6 billion during 2020-23.

Constructive regulatory treatment of Dominion’s proposed huge offshore wind project has the potential to drive earnings growth higher during the remainder of the decade. This would allow Dominion to accelerate annual dividend increases above the 2.5% we currently project over the next five years.

Duke Energy Coal-fired power plants provided roughly 60% of Duke Energy's DUK electricity generation in 2005, declining to 30% last year. Duke now plans to retire an additional 1 GW of coal capacity by 2024 and projects coal generation will shrink by 50%, to about 15%, by 2030. Duke will be able to reduce its reliance on coal by making significant investment in natural gas plants (increasing to 41% of generation from 32%) and renewable energy (increasing to 14% of generation from 5%) during the next decade. Nuclear output will remain fixed and represent about 30% of generation in 2030, declining 2% over the coming decade due to increasing generation output as Duke expands its power plant fleet to meet the needs of a growing retail customer base.

Approximately 20%, or $7.4 billion, of Duke’s five-year $37 billion growth capital plan is designated for electric generation. The largest vertically integrated regulated utility in the U.S. has retired 49 coal plants since 2010, replacing these plants with natural gas and renewables. The company began construction on the $1.1 billion Western Carolinas modernization project in 2017. The project, which we expect to be completed by late 2019, includes retiring coal units at the existing Asheville Plant, building two new, very efficient natural gas-fired combined-cycle plants totaling 560 MW, and building a solar generation farm and battery storage. The $600 million W.S. Lee CCGT plant in North Carolina and the $1.5 billion Citrus County CCGT in Florida were completed in 2018.

In September, Duke announced a new goal of zero net emissions by 2050. This will probably require the retirement of additional coal plants beyond the five-year plan, which already includes approximately 1 GW of coal plant retirements. In addition, Duke is investing heavily in renewables. Its near-term plan includes adding about 700 MW of regulated solar plants in Florida, increasing its solar farms in North Carolina by roughly 500 MW, and procuring roughly 1,200 MW of solar and wind farms that will be owned by commercial customers utilizing the tax benefits. With the goal of tripling renewable generation by 2030, Duke’s renewable investments will continue at about the same pace and drive approximately 5% operating earnings growth through the next decade, by our estimates.

Xcel Energy With service territories in regions where wind and solar energy resources are plentiful, Xcel Energy XEL has a plan to get 60% of its electricity from renewable energy by 2030 while reducing its reliance on fossil fuel generation.

For decades, Xcel was one of the largest coal generators in the U.S., but that is changing rapidly. Coal provided roughly 56% of Xcel’s electricity generation in 2005 but fell to 33% last year. Xcel now plans to retire an additional 2 GW of coal capacity by 2030 and projects coal generation will fall by half again, to about 15% of its generation mix by 2030.

Renewable energy offers solid investment opportunities with regulatory support, driving our 6% annual earnings and dividend growth outlook for at least the next five years. That could climb to 7% or higher if Xcel gets regulatory approval for additional investments. Management is targeting 5%-7% earnings and dividend growth. The utility’s “steel for fuel” program includes plans to install 3 GW of new wind capacity by 2021 on top of the 1.5 GW it currently owns.

The new steel for fuel plan will require an additional $20 billion-$30 billion of investment over the next decade and add 12-18 GW of renewable energy. Xcel also expects to make significant investments in solar, especially in Colorado and West Texas. Renewable energy accounted for 22% of Xcel’s electricity supply in 2018, including third-party contracts, and the new plan is expected to drive this to 60% by 2030. Natural gas generation will to shrink to 15% by 2030 from 29% in 2018 if the company executes the plan. Xcel is able to reduce natural gas generation more than most utilities due in large part to some of the highest average annual wind speeds in the country combined with good solar resources.

Southern In 2000, Southern SO generated about 78% of its electricity from coal. By 2030, we estimate that will fall below 20%. Nuclear, natural gas, and renewable energy are all increasing to make up the difference. The transformation has had hiccups, but we think Southern's long-term plan to dramatically reduce the amount of coal used by one of the largest utilities in the country remains on track.

The two new units at the Vogtle nuclear plant are $10 billion over budget and five years behind schedule, but in December 2017, the Georgia Public Service Commission voted 5-0 to move forward with the project. The new units at Vogtle will put Southern on track to reduce electricity generation from coal to roughly 20% by the middle of the next decade.

Southern’s transformation also faced delays and cost overruns at the Kemper (Mississippi) project, an integrated gasification combined-cycle power plant that was to convert lignite coal to syngas and the first plant at commercial scale to use carbon capture. The $7 billion plant was completed in 2017, three years behind schedule and over double its initial cost estimate. Southern abandoned the lignite-to-gas conversion and the plant is running on natural gas.

Even with the significant issues Southern has faced as it changes its generation mix away from coal, we project over 7% annual adjusted net income growth. However, with almost $3 billion of forecast equity issuance, we estimate adjusted annual EPS growth of approximately 5%, the midpoint of management’s 4%-6% target.

NiSource Although NiSource NI owns a relatively small electric utility, we think the responses it received from its recent new generation request for proposals shows where the industry is headed during the next decade. In 2018, subsidiary Northern Indiana Public Service Co. issued an RFP as part of its long-term IRP and received 90 proposals for new generation projects. More than half of the proposals were for wind and solar generation. The wind and solar proposals were so cheap that NIPSCO has decided to accelerate its coal plant retirements. The utility found that by retiring all coal plants by 2028, it could save customers roughly $4 billion over 30 years.

In 2018, NIPSCO purchased approximately 30% of its power requirements from third parties, and in many cases, it is impossible to determine the source of this electricity. NIPSCO owns and operates two coal-fired power plants that represent 63% of its electric capacity. It plans to retire the 1.6 GW Schahfer plant by 2023 and its 469 MW Michigan City coal plant by 2028. It plans to retain approximately 2.8 GW of natural gas-fired capacity, about 22% of 2028 projected capacity.

In its 2018 IRP, NIPSCO said it plans for solar, wind, and battery storage to account for 65% of its generation capacity by 2028. In February 2019, NIPSCO announced agreements to add approximately 800 MW of wind projects. The IRP indicated that NIPSCO also will add about 1.5 GW of solar and storage capacity to replace the coal plants. Energy-efficiency programs, demand-side management, and market purchases would also provide reliability once the coal plants retire.

Over 50% of NiSource’s planned capital investments over the next decade are for modernization programs replacing steel and cast-iron pipe with plastic at its natural gas distribution utilities. These investments, combined with NIPSCO’s renewable energy growth, should drive 8% annual operating earnings growth during the next decade. However, significant equity issuances to finance these investments will reduce EPS and dividend growth to about 6% annually.

NextEra Energy NextEra Energy NEE is the largest utility in the U.S. by electricity sales and market capitalization. NextEra owns FPL and Gulf Power, regulated Florida utilities. However, its growth in renewable energy has been spectacular, and the company is now the largest domestic owner and operator of wind farms. Including the assets of 64.4%-owned NextEra Energy Partners and operated by wholly owned Energy Resources, NextEra has 15 GW of wind and 3 GW of solar generation capacity across the U.S. It currently has about 12 GW of signed renewable energy contracts in its backlog.

IN 2001, FPL generated one fourth of its electricity from coal. It will soon retire the 330 MW Indiantown cogeneration plant, its last remaining coal-fired power plant. In 2018, 95% of FPL electricity supply was from natural gas-fired or nuclear power plants.

In January, FPL announced a plan to install 30 million solar panels by 2030, about 10 GW of capacity. This will be the largest installation of solar panels by a regulated utility in the world and is expected to cost about $10 billion. Combined with energy storage, FPL expects about 20% of its electricity will come from solar by 2030 and the remainder primarily from nuclear and natural gas.

Nuclear power and natural gas will remain an important contributor to FPL’s generation fleet. None of FPL’s four nuclear reactors are expected to retire before 2030, and earlier this year the 1.7 GW Okeechobee CCGT began operating. Although solar will reduce the share of gas generation, FPL is continuing to modernize and add to its gas-fired fleet as its customer base grows. The recently approved 1.2 GW Dania Beach CCGT is expected to come on line in 2022. We expect the smaller Gulf Power utility, acquired earlier this year, to also retire its remaining coal plants in the future; it has already started investing in solar capacity with three projects totaling 225 MW in development.

Energy Resources is also not slowing down and expects to add wind and solar projects in line with its 2018 market share, 26% of the 9.6 GW of wind PPAs and 19% of the 9.1 GW of solar PPAs in the U.S. As renewable tax incentives disappear and more projects are won on economics, we believe Energy Resources, probably the lowest-cost renewable energy operator in the U.S., will be able to accomplish this goal. Thus, we believe NextEra could capture roughly 20% of new U.S. renewables as the market expands, by our estimate, to 22% of total electricity generation in 2030 from 10% last year.

/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)