Is Natural Gas Heating Going the Way of Buggy Whips?

We think not, and the market's misperception results in an attractive share price for NiSource.

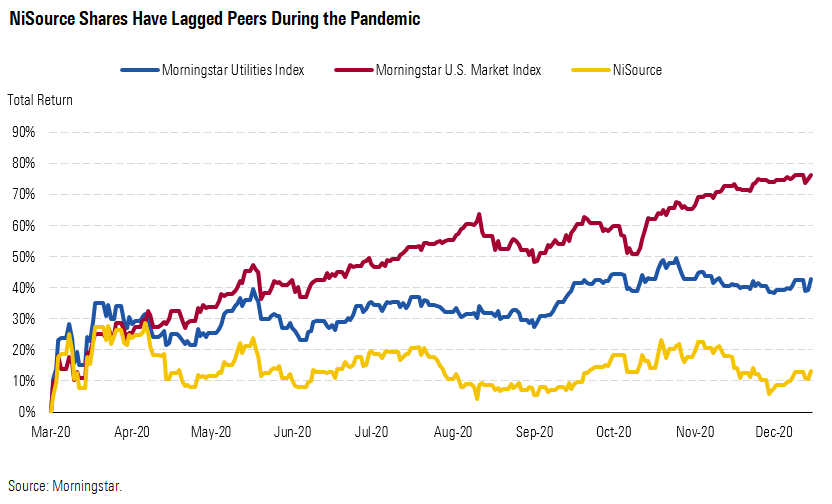

In 2019, Berkeley, California, became the first city in the country to pass a ban on natural gas in new buildings. One liberal college town does not make a trend, but other cities followed, and several utilities have gone wobbly on natural gas. Dominion Energy D, for example, sold its gas transmission business and abandoned the Atlantic Coast Pipeline with its partner Duke Energy DUK. At Consolidated Edison’s ED presentation on environmental, social, and governance issues, the CEO said the utility does not expect to make further gas transmission investments. DTE Energy DTE plans to spin off its midstream business, and CenterPoint Energy CNP and OGE Energy OGE are exploring the sale of theirs. And fracking has become a political issue. No wonder NiSource NI, with 60% of operating earnings from natural gas distribution, has lagged the Morningstar Utilities Index as the economy recovers from COVID-19.

We don’t believe natural gas heating is going the way of buggy whips. Electrification of building space and water heating has significant technical and economic obstacles, and the market’s misperception of the future of natural gas results in an attractive price for NiSource shares. NiSource has accelerated the pace of gas pipeline restoration investment following a tragic natural gas explosion in 2018, and this will reduce risk and cut methane emissions. NiSource’s electric utility will close its last coal-fired power plant in 2028 and replace the capacity with wind, solar, and energy storage. These actions should result in better than 7% earnings growth, strong dividend growth, an improved ESG profile, and reduced risk for investors.

Electrification of Building Heating Faces Economic and Technical Obstacles The electrification of building heating systems is typically based on the initial installation of an air-source heat pump or by replacing a natural gas, oil, or propane furnace or boiler with a heat pump. ASHP electric heating systems need to be supplemented with electric resistance heating for very cold days. The American Gas Association estimates that annual heating energy costs for the typical U.S. homeowner would increase roughly 50%. We agree with this estimate and believe NiSource customers, mostly in colder climates, would experience even larger cost increases. The impact on lower-income residents, who often live in older structures that are not as well insulated, would be even more pronounced.

An ASHP is the most common type of heat pump. In heating mode, an ASHP absorbs heat from the outside air and transfers it to the indoor space. An ASHP can also be used in cooling mode, transferring heat from inside air and ejecting it outside. While the combustion process can never produce more energy than consumed (more than 100% efficient), an ASHP transfers energy and can achieve efficiencies greater than 100%. In fact, 2023 U.S. Department of Energy standards will result in efficiencies typically greater than 300% when air temperatures are mild.

However, the efficiency and the amount of heat discharged by an ASHP decline as temperatures fall. Below about 30 degrees Fahrenheit, most systems require supplemental electric resistance heating to keep the building warm. Electric resistance heat is 100% efficient, but electric energy is 2-4 times more expensive than natural gas depending on the location. Therefore, electric resistance heating is significantly more expensive than a typical natural gas forced-air furnace or boiler typically operating at efficiencies above 80%. In colder climates, ASHP systems are not nearly as economical as a gas furnace or boiler combined with a separate air-conditioning system for summer cooling. In addition to the higher energy costs, homeowners switching from natural gas to electric would incur significant installation costs.

One technology that is more efficient in colder climates is geothermal heat pump systems. Ground temperature at fairly shallow depth may stay between 50 and 60 degrees F most of the year, providing a resource to draw heat in the winter or to discharge excess heat in the summer. However, the initial cost versus a conventional furnace and air-conditioning installation is roughly 50% higher, due in large part to the excavation required to bury pipes in the ground. Also, an existing building may require ductwork modifications. The Department of Energy estimates that installation paybacks can be 5-10 years for the extra costs, so this is not really that attractive for a homeowner versus other energy efficiency investments. Although there are federal renewable energy tax credits for geothermal heating and cooling systems that help lower the cost, the technology is more mature, and the dramatic cost reductions experienced by solar manufacturers are unlikely.

Environmental Benefit of Electrification Is Small and Expensive Mandates to convert existing natural gas heating to electric or require new buildings to be all-electric are driven by the assumption that the supply of electricity to the power grid will be from low- or zero-carbon-emitting sources. In 2019, Berkeley became the first city in the country to pass a ban on natural gas in new buildings. It was followed by other California cities, including Menlo Park, San Jose, and most recently San Francisco. Other municipalities, including Takoma Park, Maryland, and Ann Arbor, Michigan, are considering net-zero emissions targets that would likely require electrification mandates.

However, there has been pushback by states in the other direction. Earlier in 2020, Arizona passed legislation preventing local governments from banning the use of natural gas. Lawmakers in Minnesota, Mississippi, Missouri, Oklahoma, and Tennessee have proposed similar legislation.

We believe there are three flaws in policies eliminating natural gas for residential and commercial structures. These mandates will materially increase energy costs, require significant investment by building owners and electric utilities, and have only a small environmental benefit.

Flaw 1: 10 times more energy needed to heat buildings compared with air conditioning. The first flaw in electrification mandates is the significantly higher energy required for heating versus cooling in the space conditioning of homes. In the Midwest and Northeast, home to 86% of NiSource's gas customers, space heating accounts for over 50% of the energy consumption in a home. If water heating is included, the amount of total energy climbs to over 70% of total consumption. For a typical NiSource residential customer, the annual energy required to heat a home (natural gas) is over 10 times the energy required to cool a home. If hot water is included (also usually natural gas) the ratio is over 15 times. Thus, eliminating natural gas for space heating and hot water will require massive amounts of additional electric energy.

Flaw 2: Excess winter electric capacity is small or nonexistent. The second flaw in the argument of eliminating natural gas space and water heating is the false assumption that utilities always have extra winter electric generation capacity. NIPSCO Electric, NiSource's electric utility in Indiana, does have significant excess capacity, in large part because the electric service territory is extensively served by NIPSCO Gas.

On the other hand, a new building that uses electric heating or conversion of a gas heating customer currently served by NiSource’s Columbia Gas of Pennsylvania will require additional electric capacity. If this energy is to be supplied with low- or zero-emitting carbon sources, more renewable capacity or energy storage will be needed. In addition, solar output would be low or zero when heating demand is the greatest in the early morning hours.

Proponents of electrification argue that energy storage technology is likely to become more economical with time. However, current utility-scale lithium-ion battery technology is designed to provide capacity for hours, not days. Typically, summer nights are more pleasant than blistering summer days, providing a break in the peak electric usage and a chance for batteries to recharge. This is not necessarily the case during brutally cold winters, when temperatures can be near zero 24/7 for weeks. During these long cold stretches, there may never be a period of excess renewable energy, and battery storage would have little value.

Flaw 3: The environmental benefits are likely small. The third flaw in the argument to eliminate natural gas heating is that it would have a significant impact on reducing greenhouse gas emissions. The Environmental Protection Agency estimates that 12% of U.S. greenhouse gas emissions are from the residential and commercial sectors and primarily due to the direct emissions from fossil fuel combustion for heating and cooking, management of waste and wastewater, and refrigerant leaks.

The EPA also estimates that approximately 80% of these emissions, or less than 10% of total U.S. greenhouse gas emissions, are from natural gas. It would be difficult and very expensive to supply a large portion of this displaced natural gas energy with electricity from renewable energy. We believe a significant portion of the natural gas combustion eliminated at the building site would be replaced with natural gas generation at the utility. Thus, the reduction in greenhouse gas emissions would likely be small.

Accelerating Gas Distribution Capital Expenditures Doesn't Derail Our Thesis In addition to environmental pressures to reduce greenhouse gas emissions, gas distribution businesses have risk due to the potential for an ESG incident. Gas utilities have had several deadly explosions during the past 10 years, including a tragic incident north of Boston for Columbia Gas of Massachusetts, which NiSource sold in October 2020. These events have resulted in gas utilities, with the support of regulators, replacing thousands of miles of old substandard pipe and updating safety-related systems, requiring billions of dollars of investments.

NiSource’s gas utility capital expenditures totaled $5.8 billion during 2015-19, and we estimate the gas utilities will spend $7.3 billion over the next five years. Based on comments by NiSource management and disclosures by other gas utilities, we estimate that over 80% of these expenditures are related to pipe replacement and other safety-related expenditures.

These investments have received constructive regulatory treatment and allowed operating earnings of NiSource’s gas utilities to grow at a compound annual rate of 4.1% over the past five years. Operating earnings growth would likely have been higher if not for the extra operating costs associated with the Boston explosion. Based on the elevated level of investment, we estimate annual operating earnings growth at NiSource’s gas utilities to be 7.5% during 2019-24.

Our thesis--that electrification of heating will face significant economic and technical hurdles--is not derailed by NiSource’s increasing level of investment for pipeline replacement and other safety-related spending. The threat of a gas explosion is increased if these investments are delayed, and pipe replacement and safety-related spending have strong public and regulatory support.

NiSource has identified $40 billion of infrastructure investment over the next 20 years, and although management doesn’t differentiate between electric and gas, we suspect roughly 50% is for pipeline replacement. This level of investment will exceed depreciation, resulting in strong rate-base growth that will drive earnings and dividend growth over this period.

NiSource, like all utilities, monitors investments such that targeted rate increases are less than general inflation. Information provided in 2018 illustrates that the average NiSource customer bill declined between 2008 and 2017, and we believe it remained at about that level in 2018-20 due to the low cost of natural gas. In August, management indicated that the current investment plan would result in rate increases in the low to mid-single digits. This will likely pass with regulators, since current rates are low and the investment is mostly for safety.

Although there was much rhetoric regarding the energy industry in the last election, we think natural gas will remain plentiful and competitively priced for NiSource customers. Much of the natural gas in the NiSource service territory comes from the Marcellus and Utica shale gas plays. In fact, most of NiSource’s customers sit on top of or very near these shale gas areas.

We do expect greater hurdles on obtaining new pipeline approvals, particularly at the federal level where the Federal Energy Regulatory Commission has oversight. However, NiSource management has indicated to us that its distribution systems have access to plenty of gas transmission capacity to bring this shale gas to customers for the foreseeable future.

NIPSCO Electric Prioritizing Renewable Investment We estimate that NiSource's renewable energy investment and other capital expenditures in electric and natural gas distribution will result in five-year capital expenditures of almost $12 billion, in line with guidance. We estimate that this level of investment will drive annual EPS growth exceeding 7% for 2021-24, within management's 7%-9% target range given in September.

We believe the current annual dividend of $0.84 per share is secure because of an improving ESG profile, solid balance sheet, industry average payout ratio, and diverse earnings from several regulatory jurisdictions with constructive frameworks. The dividend currently provides a yield of 3.8%, which we estimate will grow at an average annual rate of 6% during 2020-24.

On Oct. 21, wholly owned NIPSCO announced an agreement with NextEra Energy Resources for the construction of three renewable energy projects totaling 900 megawatts of solar and 135 MW of battery storage. The new projects will require a NIPSCO investment totaling $850 million. Combined with the $400 million of wind energy projects under construction, the utility will be more than 50% of the way to meeting its $1.8 billion-$2 billion renewable energy investment target initiated in August. On Dec. 16, NIPSCO announced it would purchase 280 MW of solar energy from two projects developed by the clean energy infrastructure business of Capital Dynamics, a private asset-management firm. The planned investment in renewables and power purchase agreement will allow NIPSCO to retire its last coal-fired power plant in 2028 and reduce greenhouse gas emissions 90% by 2030.

We estimate that NIPSCO will invest $1.9 billion in renewable energy, which we expect will be included in rate base before the next electric general rate case filing planned for 2023. Indiana regulation has been constructive in the past, and the commission has expressed support for renewable energy with NIPSCO and other Indiana utilities in recent integrated resource plans. Thus, we are confident that regulators will approve the investment and provide constructive regulatory treatment.

/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)