Is Netflix a Buy, a Sell, or Fairly Valued After Earnings?

We’ve raised our fair value estimate for Netflix stock to $330 to account for higher subscriber growth and faster margin improvement.

Netflix NFLX released its second-quarter earnings report on July 19, 2023. Here’s Morningstar’s take on what to think of Netflix earnings and stock.

Netflix’s Stock at a Glance

- Fair Value Estimate: $330

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

What We Thought of Netflix Q2 Earnings

Netflix posted a solid second quarter with net customer additions of 5.9 million, well ahead of our estimate. The firm benefited from the rollout of its crackdown on password sharing which encompassed over 100 countries, including the United States.

Despite the subscriber beat and additional shared account fees, revenue was in line with our estimate due in part to foreign exchange headwinds, as well as stagnant average revenue per user, or ARPU, in Netflix’s two largest regions.

Netflix introduced its ad-supported plan in November 2022, adding another revenue lever and slightly changing its growth outlook. However, management remains reluctant to share data on the number of users on the tier. While the company disclosed monthly active users of around 5 million globally in May, The Information reported that Netflix has only 1.5 million subscribers on its ad-supported tier in the U.S. as of June. We estimate that the company has around 68 million subscribers in the U.S. (90% of the UCAN region), implying that 2% of the base is on the ad-supported tier.

This relatively low penetration is probably one of the main reasons Netflix canceled its Basic with Ads plan in both the U.S. and the United Kingdom on July 19. As a result, the cheapest ad-free tier now costs $15.50 per month, making the ad-supported plan more attractive at $7 per month. Since management claims the ad revenue per user makes up for the gap between the two plans, Netflix is indifferent to consumer preference.

Netflix ended the quarter with 238.4 million global paid subscribers, up from 232.5 million last quarter and 220.7 million a year ago. Customer growth in the quarter was spread across all four regions, with Europe leading the way. Management expects further subscriber growth over the remainder of the year from paid sharing as the program rolls out to every country and borrowers in all markets continue to start new accounts.

Revenue improved 3% (6% excluding the currency impact) to $8.2 billion—the third straight quarter with growth below 4%. Revenue growth has not hit double digits since the fourth quarter of 2021, despite price hikes and revenue enhancement initiatives like paid sharing and ad-supported tiers.

Revenue in the U.S. and Canada was roughly flat despite a million more average subscribers, as ARPU was also flat at $16. The region did post its strongest net add since the fourth quarter of 2021 (1.2 million), but Netflix’s most profitable region has still gained just 360,000 subscribers over the last six quarters. After the benefits of paid sharing wear off, we think attracting new subscribers in UCAN will remain challenging due to the service’s high penetration rate and intensified competition.

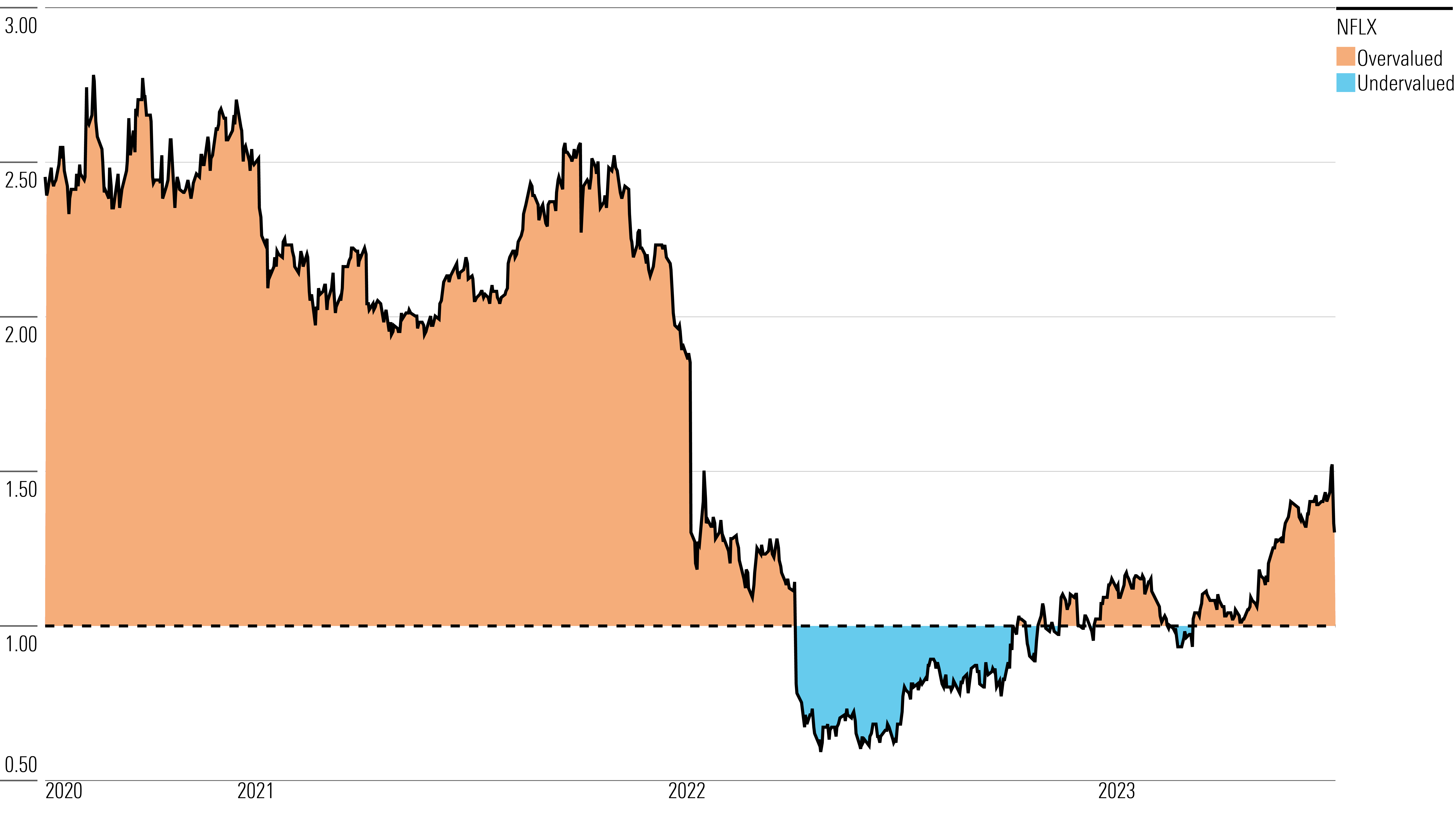

Netflix Stock Price

Fair Value Estimate for Netflix

With its 2-star rating, we believe Netflix stock is overvalued compared with our long-term fair value estimate of $330 per share.

Following earnings, we raised our fair value estimate for Netflix stock to $330 from $315 to account for slightly higher subscriber growth in 2023, as well as marginally faster margin improvement. However, we believe Netflix stock is now expensive, failing to reflect the maturity of the U.S. market and the long road ahead in emerging markets.

Our fair value estimate assumes the platform’s domestic paid streaming subscriber count expands only slightly to 78 million by 2027. Price elasticity plays a major role as well. In general, we are skeptical of the claim that pricing increases won’t harm customer counts globally. Due to the addition of lower-priced ad-supported plans and lower prices in markets like India, we expect the global streaming paid subscriber base to expand to 305 million by 2027 from 230 million in 2022.

Our domestic subscriber and pricing forecast generates a 6% average annual revenue growth between 2023 and 2027, as Netflix benefits from price increases every 18 months. However, customers will become more price sensitive as the standard plan gets closer to $20, and competitors like Disney+ are already undercutting Netflix’s prices. We believe these price differentials will cause lower subscriber growth and increase churn. We expect increased revenue from the crackdown on password sharing will be somewhat offset by increased churn, and that the lower-priced ad-supported tier in the United States will largely take subscribers from the traditional basic plan.

Read more about Netflix’s fair value estimate.

Netflix Historical Price/Fair Value Ratios

Economic Moat Rating

As the largest subscription video-on-demand provider in the U.S., Netflix has a narrow moat rating and is rapidly expanding globally.

With over 130 million subscribers worldwide, Netflix mines its vast data set to improve content selection and customer experience. The company tracks customer interactions, analyzes data traffic and performance, and leverages real-time data to iterate quickly. The platform’s substantial subscriber base and data advantage set it apart from competitors like Amazon Prime.

Netflix’s cloud database helps with content creation, acquisition, and running its content discovery engine. The company uses subscriber usage data to understand their preferences beyond simple ratings, enabling targeted content acquisition. Netflix’s ability to understand viewer habits and preferences gives it a competitive advantage in the streaming video market.

Despite increasing content costs, Netflix is well-positioned to invest in high-value content and partner with renowned production studios. Additionally, the company’s experience and large-scale infrastructure make it challenging for new entrants to efficiently compete.

Read more about Netflix’s moat rating.

Risk and Uncertainty

Netflix’s move to rely on original content has added costs and risks. The platform now depends heavily on its ability to find and create compelling new original programming with relatively tight schedules on an ongoing basis. If this pipeline falters, subscribers could bolt to competitors.

Netflix’s expansion outside the U.S. could continue to drag on margins because of different tastes and lower pricing. While Netflix has experienced some success in using its non-U.S. content in other markets, much of the local language content will likely not travel as well. Additionally, pricing in large emerging markets, such as India, remains considerably below that of the U.S. and Western Europe. With increased competition in this market, Netflix may need to lower pricing.

Increasing the subscription price in mature markets could limit growth and increase churn. While churn spikes have been temporary in the past, Netflix is now one of the most expensive services in markets like the U.S., and further price hikes could cause subscribers to cancel.

Read more about Netflix’s risk and uncertainty.

NFLX Bulls Say

- Netflix’s internal recommendation software and large subscriber base give the company an edge when deciding what content to acquire.

- Netflix has built a substantial content library that will benefit it over the long term.

- International expansion offers attractive markets for new subscribers.

NFLX Bears Say

- The firm continues to burn billions of dollars of cash to create original content, with no end in sight.

- The level of competition in the U.S. and internationally is increasing and will continue to do so over the near future. Disney+ launched its own branded SVOD service in the second half of 2019.

- The need for increased content and marketing spending outside the U.S. will limit the rate of margin expansion for the international segment.

This article was compiled by Monit Khandwala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fab4d3e1-7951-4575-a38d-fd2028ad4ae3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fab4d3e1-7951-4575-a38d-fd2028ad4ae3.jpg)