After Earnings, Is Roblox Stock a Buy, a Sell, or Fairly Valued?

With another quarter of mixed results, here’s what we think of Roblox stock.

Roblox RBLX released its second-quarter earnings report on Wednesday, Aug. 9, 2023, before the market open. Here’s Morningstar’s take on what to think of Roblox’s earnings and stock.

Key Morningstar Metrics for Roblox

- Fair Value Estimate: $60.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

What We Thought of Roblox’s Q2 Earnings

Roblox again reported mixed results. The second quarter (like the first) saw strong revenue growth but also expanding operating losses due to elevated spending.

Despite strong underlying metrics, the stock fell over 20% in midday trading on Aug. 9, as we suspect investors expected larger cost cuts.

- Underlying metrics improved across the board. Global daily active users, or DAUs, reached 65.5 million, up from 52.2 million a year ago. Roblox’s reach with older gamers continues to grow, as 56.1% of users were over the age of 13 versus 53.0% a year ago and 55.8% last quarter. Engagement also expanded by 24% to just under 14 billion hours of use, with hours among those over 13 years old up 32%

- Those metrics demonstrate Roblox’s potential growth story, and how the company is not just holding onto its pandemic-expanded base but growing it.

- However, margin expansion remains weaker than expected, so investors should continue to monitor cost-cutting vs. investment over both the near and medium terms.

Roblox Stock Price

Fair Value Estimate for Roblox

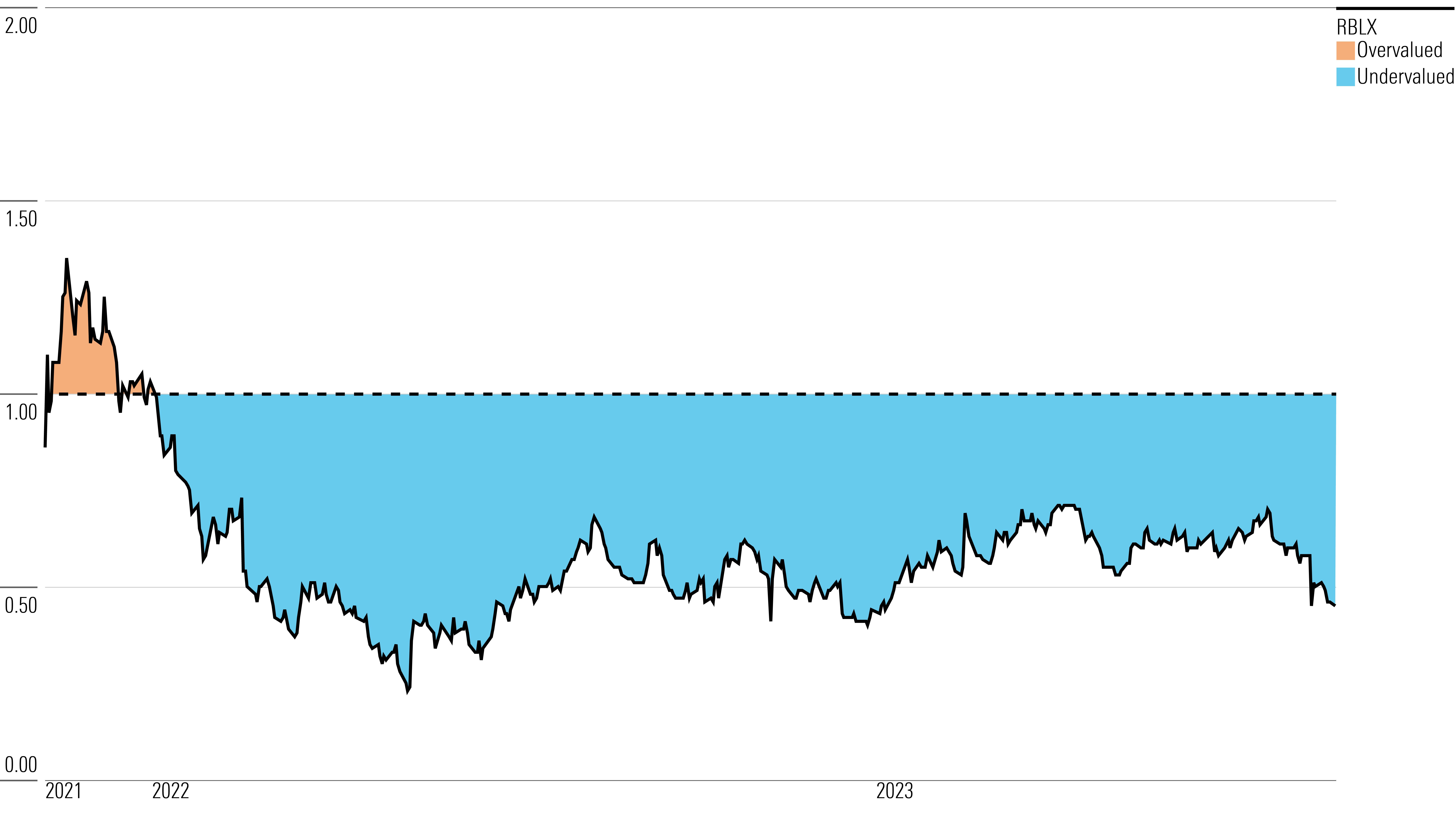

With its 5-star rating, we believe Roblox’s stock is undervalued compared with our long-term fair value estimate. Our $60 fair value estimate is generated using non-GAAP revenue (bookings). Roblox is largely self-funded thanks to deferred revenue, as customers provide cost-free capital to invest back into the business.

Despite not posting positive net income, the firm reported roughly slightly positive free cash flow in 2018 and 2019 and generated very strong free cash conversion in 2020, 2021, and 2022. We thus believe bookings provide a better projection of its business model and ability to generate cash flow.

We project that bookings will grow 14% annually over our 10-year explicit forecast, driven by continued expansion of the user base, with 14% annual growth increasing DAUs to 151 million in 2032. This growth will be propelled by the firm’s network effect, as the current user base continues to attract developers, who in turn create new games that attract more users. The social aspects of playing with friends will also help expand the base.

We also expect continued growth in monetization, albeit in a lumpy manner. We project that average bookings per DAU will drop over the next three years as the new user mix shifts toward emerging markets. Afterward, we expect growth to be driven by a slight increase in the age profile of users, as well as more diverse and complex games. We expect growth in the latter half of our forecast to also come from advertising/branding, as the growing user base will attract sponsors targeting young adults.

Read more about Roblox’s fair value estimate.

Roblox Historical Price/Fair Value Ratios

Economic Moat Rating

We assign Roblox a narrow moat rating, derived from its network effect.

The Roblox platform consists of three separate pieces that work together. The first is the Roblox Client, which players use on PCs, Android, iOS, and Xbox One to play games, connect and chat with friends, and make purchases. Roblox Studio is the development environment with which users create, publish, and operate their games. The final piece is Roblox Cloud, the infrastructure for both online games and development.

Roblox doesn’t generate revenue from the sale of the client, games, or server space, but via in-game transactions, avatar cosmetics, private servers, subscriptions, premium development plugins, and advertising for developers. All these transactions are done in Robux, the in-game currency that can be purchased at multiple price points with an effective exchange rate in the United States ranging from $0.0125 per Robux (400 Robux for $5) to $0.01 per Robux (10,000 Robux for $100). Users can subscribe to monthly premium plans to lower the exchange rate to $0.0091 per Robux.

Roughly 90% of Robux are spent within three days of being purchased, but the revenue for durable virtual goods is recognized over the life of the player (assumed to be 23 months under GAAP accounting). This difference accounts for the divergence between GAAP revenue and bookings (the actual amount of Robux purchased in a quarter or year), which can be particularly glaring during high-growth periods like 2020, when bookings were over 100% above GAAP revenue.

Read more about Roblox’s moat rating.

Risk and Uncertainty

Roblox operates in a highly competitive marketplace against firms with more financial and developmental resources. While its platform is a unique offering, the firm still competes with video game publishers both to attract new users and to hold onto their current players as they grow older. A key driver for the firm’s long-term growth will be keeping younger users as they age into and out of their teen years, as over two-thirds of users are under the age of 17 and around 40% are under 13 years old.

The young user base could also bring increasing regulatory inquiries, as parents and authorities have historically been concerned and vocal about games with very young users, particularly ones that allow chat, user-created content, and randomized in-game purchases. This additional scrutiny could force the firm to invest further in both algorithmic and human moderation, limiting the margin expansion.

Read more about Roblox’s risk and uncertainty.

RBLX Bulls Say

- Roblox is uniquely positioned to take advantage of the trend toward increased screen time among younger consumers.

- Roblox’s business model allows it to self-finance while it focuses on expanding its subscriber base and monetization.

- Roblox will benefit as its user base grows older and has more disposable income.

RBLX Bears Say

- Roblox’s tremendous subscriber growth was highly stimulated by the pandemic. A return to less-restrictive lockdown guidelines will cause a major decline in user growth and monetization.

- Roblox’s model will invite regulatory scrutiny and force the firm to spend more money on moderation, limiting margin expansion.

- Roblox’s competitors have more development resources and offer games with better graphics and deeper gameplay. As Roblox users grow up, they will leave the Roblox metaverse for other gaming experiences.

This article was compiled by Monit Khandwala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fab4d3e1-7951-4575-a38d-fd2028ad4ae3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fab4d3e1-7951-4575-a38d-fd2028ad4ae3.jpg)