Hotel REITs Wait for Business Travelers to Check In

These companies have underperformed the industry, but we see years of solid growth ahead.

The coronavirus pandemic caused a historic downturn in the U.S. hotel industry that was larger than the ones caused by either the 2008-09 recession or the 9/11 attacks. While spending on hotels fell to historic lows at the outset of the pandemic, much of the industry has since recovered. In fact, the economy and midscale hotel chain segments have already returned to and surpassed their 2019 revenue levels, largely due to the quick return of leisure travel thanks to the rapid rollout of vaccinations in 2021.

However, the continued spread of the virus due to the delta variant has caused many businesses to delay plans to return employees to the office, which has kept business and group travel near historic lows. With the upscale, upper-upscale, and luxury hotels more exposed to business and group demand, revenue for these chain segments remains below prepandemic levels. Because the hotel real estate investment trusts are exclusively focused on these higher-end chain segments, they have reported same-store portfolio performance that has lagged the U.S. hotel average. With the delta variant likely to further delay the return of business and group travel, hotel REIT stocks have underperformed the broader U.S. REIT market. While the lingering effects of the pandemic may slow the pace of recovery for the upscale and luxury hotel segments, we believe that business and group travel will eventually return over the next few years.

The slow but steady return of this business should lead to several years of REITs outperforming the hotel industry on revenue growth. Additionally, hotel REITs typically find new ways to permanently cut costs during a downturn, so we believe operating margins will return to above the prior peak once revenue recovers, which should lead to net operating income well in excess of 2019 levels. Therefore, we believe that the short-term disruption caused by the delta variant and any other lingering effects of the pandemic has created an attractive discount for investors looking for a REIT sector that should produce years of growth above the historical average.

Hotel REITs Slowed by Exposure to Business and Group Travel

While the overall hotel industry has rapidly recovered, many investors are concerned about the hotel REITs reporting significantly lower performance through the pandemic. Just looking at U.S. hotel industry figures suggests that hotels should be almost back to prepandemic levels, with revenue per available room going from 44% of 2019 levels in February to in line with prepandemic revPAR in July 2021. However, from the end of February to the end of September, Host Hotels & Resorts’ HST stock price rose just 1%, Pebblebrook Hotel Trust’s PEB stock declined 1%, and Park Hotels & Resorts’ PK shares fell 14%, while the U.S. REIT average increased 15%.

Hotel REITs haven’t enjoyed the same ride up with the rest of the hotel industry or with real estate in general because of their concentration on demand from business and group travelers, who haven’t returned nearly as quickly as leisure travelers. The portfolios of all three hotel REITs we cover are highly concentrated in the upper-upscale segment, with nearly all other hotels falling in either the luxury or upscale segments. The upper-upscale segment contains the hotels most exposed to business and group demand, which we have estimated is still 60%-80% below prepandemic levels. Therefore, we should expect hotel REITs to still be reporting revPAR well below 2019 levels.

As the delta variant causes many businesses and groups to delay travel plans, we expect that the hotel REITs will continue to underperform the U.S. hotel industry on revPAR for several more quarters. The hotel REITs have underperformed the U.S. hotel industry, the upscale segment, and the luxury segment since the beginning of the pandemic through July 2021. Their portfolio performance has been more in line with the upper-upscale segment, which is the worst-performing segment because of its high exposure to business and group travel, though even compared with that segment the hotel REITs have all had periods of underperformance. In 2020, the hotel REITs underperformed the upper-upscale segment as the REITs took more rooms off line, either for renovations or to cut operating costs, than the overall industry segment, leading to worse performance in the short term. As some of those rooms came back on line in 2021, Host was able to close the gap with the upper-upscale segment.

However, Pebblebrook and Park haven’t closed the gap, even as rooms have come back on line in 2021. Both companies are heavily concentrated in San Francisco, which has seen an even more dramatic decline in business travel as the tech sector has been able to easily shift meetings from in-person to Zoom calls, and Park has a large concentration in Hawaii, which has imposed significant restrictions on leisure travel to the state throughout the pandemic. We believe these trends will reverse over the next few quarters to years, which should lead to both companies reporting revPAR growth above industry and segment averages as they close the gap.

We Forecast Hotels’ Continued Recovery to Prepandemic Levels

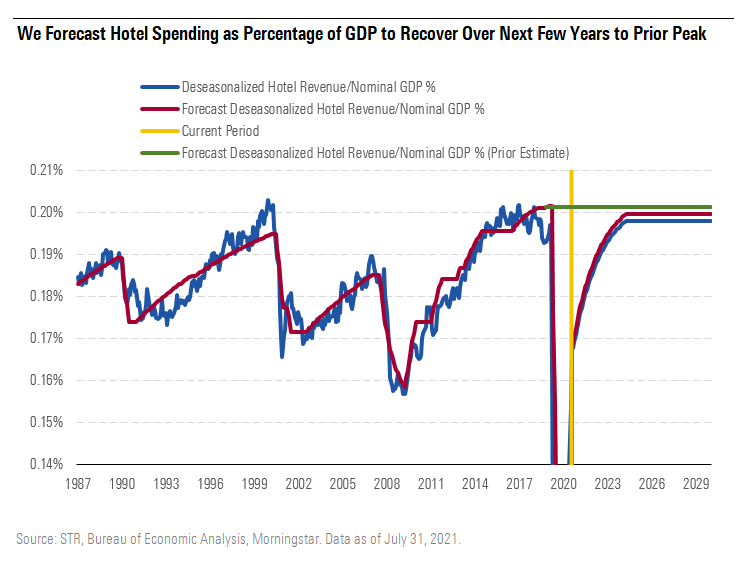

We think that the hotel industry has several more years of strong revenue growth ahead as travel, particularly business and group, returns to prepandemic levels, though the pace of the recovery will be slower than it has been over the past few months. Our hotel industry model uses nominal GDP growth to drive our hotel revenue growth forecast. The pandemic caused hotel spending as a percentage of nominal GDP to fall off the chart, declining from 0.192% of the economy in February 2020 to just 0.041% in April 2020. As points of comparison, hotel spending only fell to 0.157% of the economy in 2008 during the financial crisis and to 0.166% in the months after the 9/11 attacks, making the pandemic a truly historic negative event for the hotel industry.

However, from that low point, spending has bounced back faster than at any other time in history, reaching 0.168% of the economy in July 2021. While the recovery was driven by the quick return of leisure travel, we think the industry will see a slower return to prepandemic levels as businesses and groups add travel back in a more measured fashion. Using the methodology we devised, we believe that spending on the overall U.S. hotel industry will return to 0.198%, in line with before the pandemic, by the start of 2025. Therefore, we expect that U.S. hotel revenue growth should exceed U.S. nominal GDP growth over the next three and a half years as the industry recovers.

Running this analysis for the U.S. hotel industry and each hotel segment we model, we expect a double-digit revenue compound annual growth rate for hotels over the next decade. We estimate an 11.7% revenue CAGR for the U.S. hotel industry, with even higher revenue CAGRs of 13.7% and 17.2%, respectively, for the upscale and luxury segments from 2021 through 2030. Even backing up the analysis a year to include the decline caused by the pandemic, our 10-year revenue CAGR is 3.9% for the U.S. hotel industry, 5.0% for upscale, and 4.4% for luxury, all of which is within 0.5% of the 10-year CAGR forecast for revPAR for 2021-30 we made before the start of the pandemic. While the pandemic caused a massive disruption to short-term hotel operations, we don’t think it permanently impaired demand for the overall industry.

Similarly, we expect strong revPAR CAGRs for the industry over the next several years. Hotel owners and developers learned their lessons from the financial crisis and entered this hotel downturn better capitalized, leading to fewer hotels closing and fewer hotel development projects being abandoned than we would have anticipated. As a result, 2021 will see more hotel rooms added than were removed in 2020 due to the pandemic. This continued supply growth eats into the revenue recovery we expect over the next decade, though revPAR growth should remain above inflation through at least 2025.

Applying our revPAR estimates for the hotel industry leads to the hotel REITs we cover producing significant growth over the next several years. We expect revPAR for the hotel REITs to eventually go above 2019 levels, along with the rest of the hotel industry. We do think that the delta variant will lead to lower revPAR results for the rest of 2021 and the first half of 2022 compared with July’s high point as travel shifts slightly back to a higher mix of business and group travel.

We believe the hotel REITs will also be affected by the delta variant in the short term, though we foresee their revPAR plateauing at the July level, given that the delta variant will likely lead to a delay in business travel rather than a further decrease. Despite the delay, we think the hotel industry will return to prepandemic levels of revPAR by next summer and that the hotel REITs will slowly close the gap with the overall industry as business travel recovers, returning to prepandemic levels by the summer of 2023.

With revPAR expected to return to prepandemic levels for the REITs by the summer of 2023, we think that net operating income margins will follow shortly behind. The REITs all reported same-store NOI margins just under 30% in 2019. Despite NOI margins going negative in 2020 and the first quarter of 2021, the hotel portfolios are now producing enough revenue that they are able to produce positive NOI, which should lead to positive NOI margins for full-year 2021.

We think that the companies can return to their prepandemic level of just under 30% once business returns to normal in 2023. However, we have historically seen that operators and management teams for the hotel REITs learn new ways to cut costs during recessions, leading to permanent cost savings and slightly higher margins as they emerge from the downturn. We think that the owners learned many lessons about efficiently managing and operating hotels, particularly concerning labor costs. Therefore, we anticipate that the hotel REITs will all be able to achieve stabilized same-store NOI margins slightly above 30% over the next decade as revenue returns to prepandemic levels while costs are kept slightly below those of 2019. Given our views for revPAR and NOI margins returning to prepandemic levels by 2023, we think that the hotel REITs will be able to produce same-store NOI by the end of 2023 that matches what they produced in 2019.

While we think Host will achieve slightly higher NOI compared with its prepandemic level for the next few quarters, the gap that exists will quickly close as the small differences caused by different geographic concentrations disappear. Since all of the REITs own primarily upper-upscale hotels that draw a similar mix of leisure, business, and group travel, and because we think all three companies will achieve similar NOI margins just north of 30%, we estimate that NOI growth for all three REITs will be relatively similar over the next decade: about 35% higher in 2030 compared with 2019.

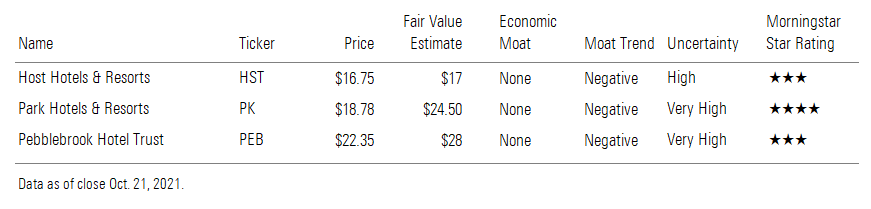

Our Favorite Hotel REIT

We currently believe that Pebblebrook Hotel Trust is the best investment opportunity among the hotel REITs we cover. All three companies have very similar long-term growth outlooks. Additionally, we like the management teams of all three companies and believe they are all strong stewards of capital. Therefore, the major distinguishing factor is the current discount each company is trading at compared with our long-term fair value estimate.

Investors looking for a hotel company to invest in during the pandemic have favored Host, as its low leverage makes it less risky in a business with a high level of uncertainty and variability in potential outcomes. Additionally, Host has recently reported slightly better results, as its diversified portfolio has protected it somewhat from underperforming markets. Pebblebrook and Park have seen worse stock performance as their higher leverage makes them riskier and concentration in San Francisco has hurt fundamentals.

However, we believe that the hotel REITs are through the worst of the pandemic, so the chance that either Pebblebrook or Park will run into a liquidity crunch is very low. We also think the differences among the portfolios will disappear over time, which will provide Pebblebrook and Park with higher growth over the next few quarters to years. We think both are attractive investments, but we have a slight preference for Pebblebrook.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)