Healthcare Stock Outlook: Innovative Products and Defensive Nature Should Support Solid Results in Uncertain Times

We see plenty of opportunities in healthcare, especially in biopharma, healthcare providers, healthcare plans, and diagnostics and research.

This article is part of Morningstar’s Q2 market review and outlook.

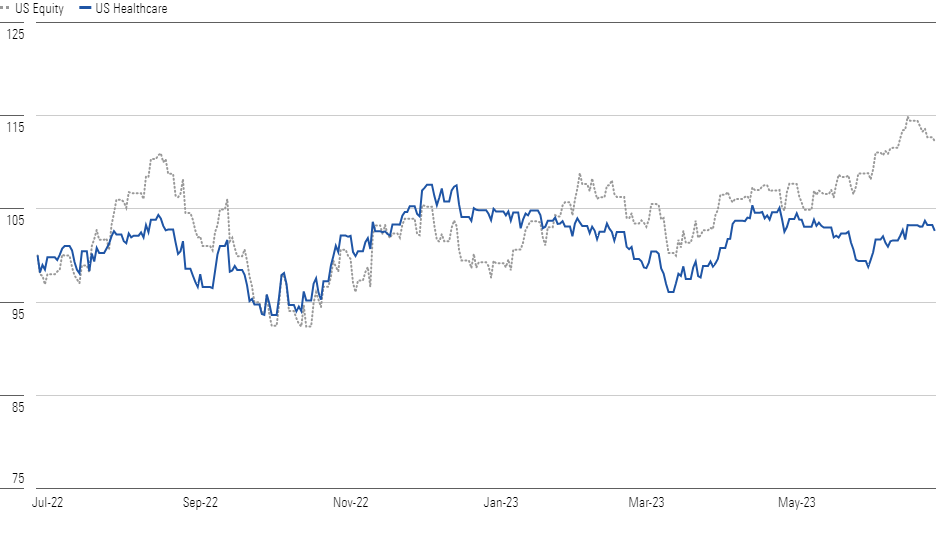

Over the past 12 months, overall equity performance has been above that of the Morningstar U.S. Healthcare Index. Nonetheless, the healthcare sector continues to remain relatively immune to several macro challenges, including banking system pressures and rising inflation and interest rates. Innovation within the sector and the defensive nature of healthcare products should support stable demand through economic cycles. While some healthcare companies may have a lag time before passing along inflation-related price increases, we expect most of the firms within our coverage (especially those with moats) to maintain strong pricing power due to patents and high switching costs.

Healthcare Underperforms the Market in Q2

We view the healthcare sector as undervalued, trading below our overall estimate of intrinsic value. We see plenty of opportunities in healthcare, especially in biopharma, healthcare providers, healthcare plans, and diagnostics and research. The drug manufacturers group holds the most 5-star stocks. Conversely, we see fewer undervalued stocks in the medical distribution industry.

We see attractive valuations within multiple healthcare industries, including biopharma, which is the largest healthcare industry by market capitalization. The drug group holds several undervalued companies and looks well-positioned for long-term growth driven by innovation in several therapeutic areas, including oncology, immunology, and rare diseases. Beyond the drug makers that will benefit from the 2.4% annual growth for the large-cap biopharma group over the next five years, we see several life science companies benefiting from this growth.

Life Sciences Companies are Well-Positioned to Support Biopharma Drug Development

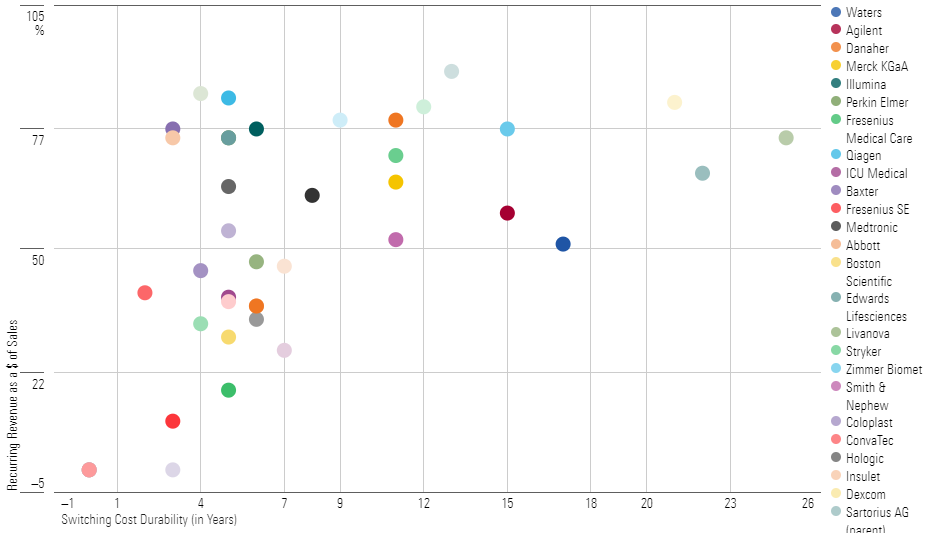

Medical Technology Switching Cost Durability Leaders

Investors often find life science toolmakers compelling for two major reasons. First, heavy regulation of the drug manufacturing process creates highly durable switching costs for end users and long potential revenue streams. Second, these firms often benefit from broad exposure to biopharmaceutical growth without taking on much product-specific risk. After the pandemic boom, life science operations started resetting, causing the companies’ shares to drop to reasonable (if not deeply discounted) levels. Wide-moat life sciences companies (appearing in yellow in the chart above) look well-positioned to benefit from supporting drug development over the next several years.

Top Healthcare Sector Picks

Illumina ILMN

- Fair Value Estimate: $269.00

- Star Rating: 3 stars

- Uncertainty Rating: High

- Economic Moat Rating: Narrow

Illumina is a reasonably priced opportunity for investors with long-term horizons. As the leading provider of genomic sequencing tools, the firm can capitalize on the expansion of these applications in research and clinical settings. While Illumina may face more competition in its legacy genomic sequencing technology, the factors that determine its economic moat (intangible assets and switching costs) should help it generate profits, especially considering its coming-to-market sequencing instruments. Illumina also owns the Grail liquid biopsy assets. Recent share prices only value the legacy business, meaning investors are getting a free option on the Grail assets, which could pay off in the long run even if Illumina unwinds Grail.

Moderna MRNA

- Fair Value Estimate: $266.00

- Star Rating: 5 stars

- Uncertainty Rating: Very High

- Economic Moat Rating: None

Moderna shares were on a roller coaster in 2021. Investors were overly enthusiastic about the potential for the firm’s technology, but subsequently too bearish on its post-COVID-19 growth. We have modest sales expectations for its COVID-19 vaccine following massive pandemic demand, but Moderna’s mRNA-based treatments are advancing rapidly. Despite sales dipping in 2023-24, we’re confident in the long-term sales trajectory of the firm’s diversified pipeline. Its phase 3 RSV, flu vaccine candidates, and approved COVID-19 vaccine could form the basis for a single vaccine. Additionally, the firm’s personalized cancer therapy has generated impressive data on melanoma.

Zimmer Biomet Holdings ZBH

- Fair Value Estimate: $175.00

- Star Rating: 5 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Wide

With the addition of its smaller competitor Biomet, Zimmer is the undisputed king of large joint reconstruction. We expect favorable demographics like aging baby boomers and rising obesity to fuel solid demand for large joint replacements, which should offset price declines. However, Zimmer stumbled into a series of pitfalls in 2016-17, including integration issues, supply challenges, and quality concerns. But new management has tackled these issues and the firm is poised to ramp up its growth.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DWP2KUBV6BHUNKMQTELEH3U7NI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)