Going Into Earnings, Is Netflix Stock a Buy, a Sell, or Fairly Valued?

With the continuing crackdown on password sharing and increased ad-supported subscriptions, here’s what we think of Netflix stock.

Netflix NFLX is set to release its fourth-quarter earnings report on Jan. 23, 2023, after the close of trading. Here’s Morningstar’s take on Netflix’s earnings and stock.

Key Morningstar Metrics for Netflix

- Fair Value Estimate: $410.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

What to Watch for In Netflix’s Q4 Earnings

- The biggest items of interest concern Netflix’s ad-supported subscriptions. Most notably, we’re looking to see whether net subscriber additions are again very high and driven by the ad-free tier.

- We’ll also be interested to hear where the firm is with generating revenue from advertisers on ad-supported subscriptions. Has ad revenue been material to the top line yet? How far away are we from ad-supported subscribers being as valuable as traditional subscribers?

- Finally, it will be interesting to hear where the firm thinks it is on its password-sharing crackdown. This should give insight into how much longer (if at all) the resultant boost in subscriber additions will last.

Netflix Stock Price

Fair Value Estimate for Netflix

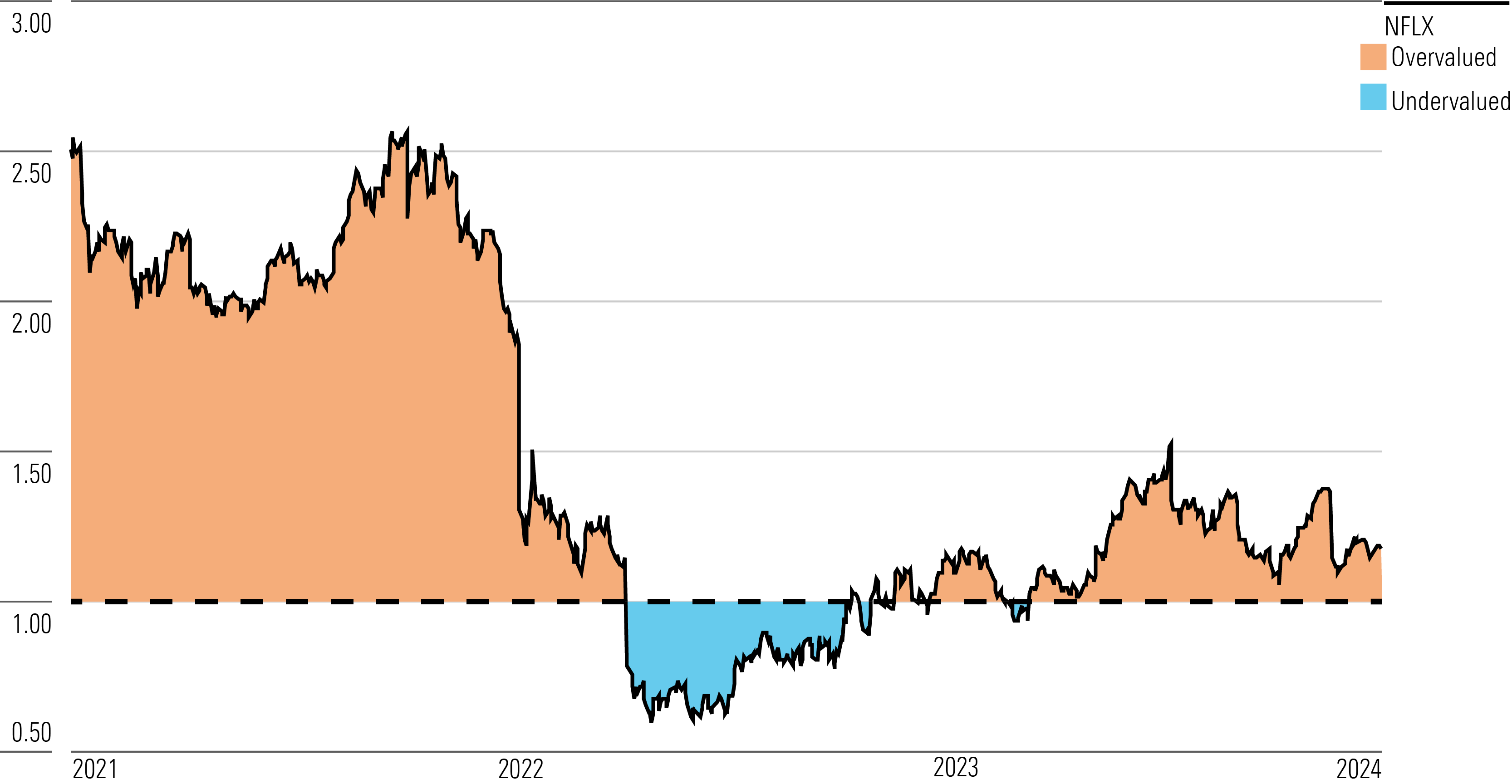

With its 2-star rating, we believe Netflix’s stock is overvalued compared with our long-term fair value estimate.

We’ve raised our fair value estimate of Netflix to $410 from $350, implying a multiple of 26 times on our 2024 earnings per share forecast. We project high-single-digit average annual revenue growth over our five-year forecast and believe there’s room for margin expansion as international markets mature and benefit from greater scale.

We expect subscriber growth to come mostly from international markets. After a jump in household penetration in 2023, which we attribute to the company’s crackdown on password sharing, we expect new member growth in the United States and Canada, or UCAN, to slow significantly in 2024. Over our forecast, we project UCAN member growth to track the rate of growth in household formation, about 1%-2% annually. This will imply a household penetration rate in the low-to-mid-50% range throughout our forecast.

We believe rising competition and higher prices will keep Netflix from reaching a greater percentage of households. We expect UCAN average revenue per user to rise at a low-to-mid-single-digit rate each year. The firm should continue raising prices at least every two years, but we also expect a bump in advertising revenue. Netflix began selling ad-supported subscriptions in 2022, but we think it has not yet reached its potential, leaving room for upside.

Netflix Historical Price/Fair Value Ratio

Read more about Netflix’s fair value estimate.

Economic Moat Rating

We assign Netflix a narrow moat based on intangible assets and a network effect. Netflix has two advantages that set it apart from streaming video peers. First, it has no legacy assets that are losing value as society transitions to new ways of consuming entertainment at home, allowing it to put its full effort behind its core streaming offering. Second, it was the pioneer in its industry, providing it a big head start in accumulating subscribers and moving past the huge initial cash burn necessary to build a successful streaming service. This subscriber base was critical in creating a virtuous cycle for Netflix that we doubt can be breached by more than a few competitors, which is what we think would be necessary to dampen its ability to earn excess economic returns for the foreseeable future.

Ultimately, having a successful streaming service is all about continually offering a depth of appealing content at a price point that consumers deem reasonable. The industry is not necessarily a zero-sum game, as customers can always add incremental subscriptions. But budgets are finite, so practically speaking, we expect only a handful of streaming services to consistently hold very large customer bases, which we think will be necessary to continue funding content investment.

Read more about Netflix’s economic moat rating.

Risk and Uncertainty

Our Uncertainty Rating for Netflix is High, based largely on the evolving streaming media landscape and the additional competition Netflix faces.

In our view, Netflix’s tremendous success is due to it being a first mover in the streaming industry, as well as how it successfully adapted its business model to where the industry was going while its media peers were largely still focusing on their legacy businesses.

The landscape has now changed, as nearly every major media company is promoting a standalone streaming service. Also, Netflix is more focused on profitability and cash generation than it was in its infancy, meaning its prices have risen substantially over the past several years. Customers now have other choices for streaming subscriptions and the price they pay for Netflix is no longer an afterthought, creating uncertainty around the firm’s ability to attract and retain customers.

As competing streaming businesses mature, their parent companies may bundle their services together (with or without Netflix), or they may offer these services as add-ons for pay-TV subscribers who receive their linear channels—a foothold Netflix doesn’t currently have. These factors make it possible that Netflix will have a tougher time growing its subscriber base or generating as much revenue per subscriber.

Read more about Netflix’s risk and uncertainty.

NFLX Bulls Say

- Netflix has already created many hit shows that are exclusively available on its platform and have attracted a massive customer base. The firm’s advantage in cash generation over its competitors makes it more likely that this virtuous cycle can continue, with Netflix creating more content that attracts and holds subscribers.

- Advertising-supported subscriptions will open Netflix to a new base of subscribers and a potentially substantial new source of revenue.

- Netflix has significant room to grow in international markets, where it has already shown promise with local content.

NFLX Bears Say

- Netflix is beginning to face competition that it has not had to deal with in the past. As consumers have more options for quality streaming services, it’s more likely that Netflix could get cut out of some consumer budgets.

- Netflix’s U.S. business is mature, with a high penetration of total households. This means price increases need to be its main source of growth, and consumers may not accept higher prices.

- Creating attractive content is always a gamble, so the allure of Netflix’s service will always be tenuous and dependent on the firm continually producing hits.

This article was compiled by Freeman Brou.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)