Going Into Earnings, is Netflix Stock a Buy, a Sell, or Fairly Valued?

Here’s what we think of Netflix’s earnings and stock.

Netflix NFLX is scheduled to release its second-quarter earnings report on July 19, after the close of trading. Here’s Morningstar’s take on what to watch for in Netflix’s earnings and stock.

Netflix Stock at a Glance

- Fair Value Estimate: $315

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

What to Watch for in Netflix’s Quarterly Earnings

- Update on paid sharing: Look for data on churn (the number of customers who stopped subscribing), net new adds (new accounts minus accounts that were canceled), and the number of users who added shared accounts. Overall, we’re watching for a bump in average revenue per user.

- More data on the ad-supported tier: We are still awaiting information about the size and number of ad-supported subscriptions.

- Spending trends: We’ll be looking for any discussion of content spending and how it will trend in 2023 and beyond. Another key area of focus will be any discussion on margins in 2023, and whether 2024 will see a rebound.

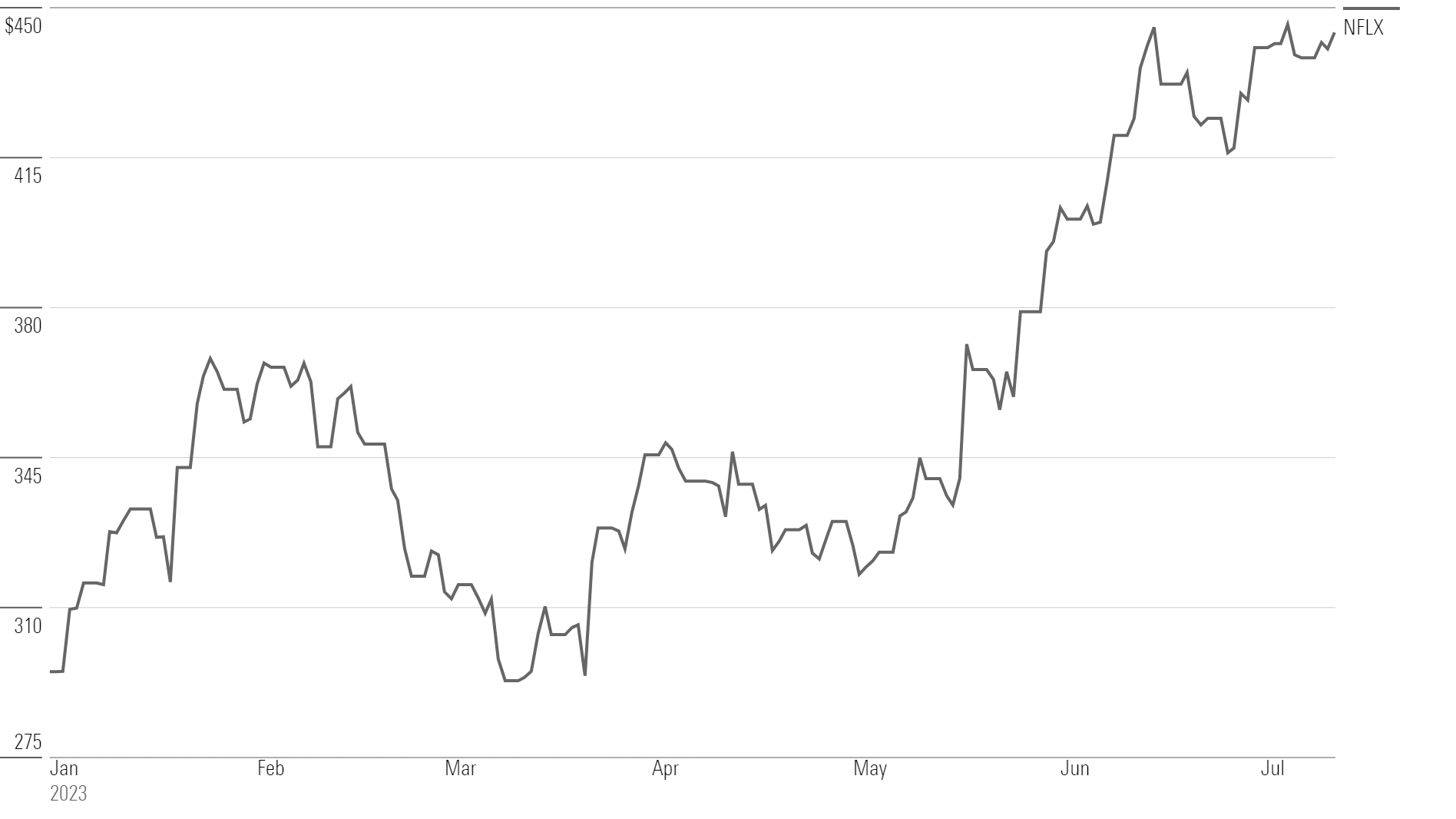

Netflix Stock Price

Fair Value Estimate for Netflix

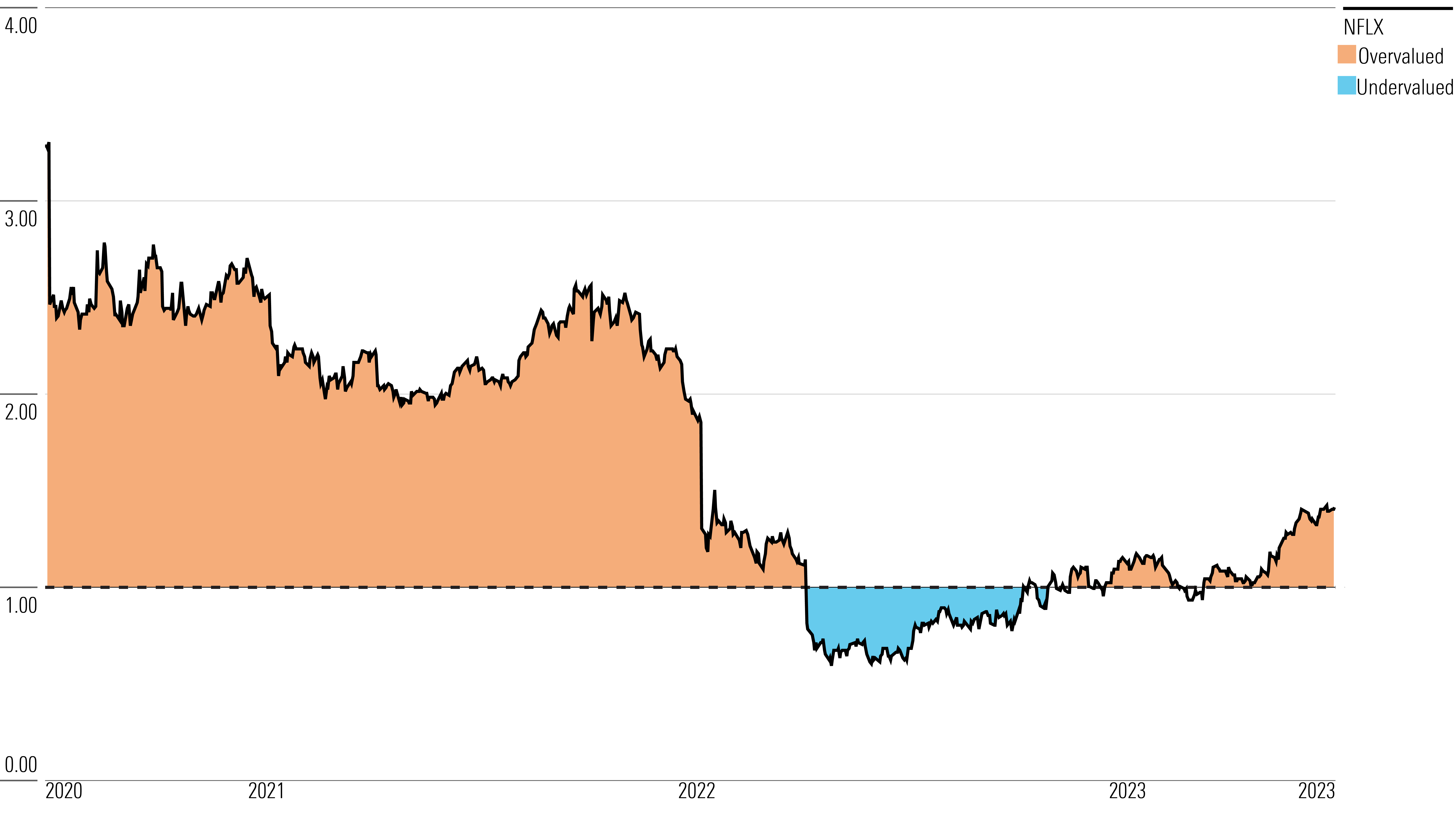

With its 2-star rating, we believe Netflix’s stock is overvalued compared with our long-term fair value estimate.

Based on our analysis, we have revised our fair value estimate for Netflix to $315 per share from $290. We anticipate a slight expansion of domestic paid streaming subscribers to 76 million by 2027, considering price elasticity as a key factor. While we don’t doubt that global pricing increases will impact customer counts, the introduction of lower-priced ad-supported plans and reduced prices in markets like India is expected to boost the global streaming paid subscriber base from 230 million in 2022 to 307 million by 2027.

Over 2023-2027, Netflix is projected to achieve an average annual revenue growth of 6% through periodic price increases. However, as prices approach $20 and competitors like Disney+ offer lower prices, customer sensitivity to pricing will increase, potentially leading to lower subscriber growth and increased churn. Although revenue from addressing password sharing is expected to rise, the impact of churn is likely to partially offset it, and the lower-priced ad-supported tier in the United States is expected to attract subscribers from the traditional basic plan.

Read more about Netflix’s fair value estimate.

Netflix Historical Price/Fair Value Ratios

Economic Moat Rating

As the largest subscription video-on-demand provider in the U.S., Netflix has a narrow moat rating and is rapidly expanding globally.

With over 130 million subscribers worldwide, Netflix mines its vast data set to improve content selection and customer experience. The company tracks customer interactions, analyzes data traffic and performance, and leverages real-time data to iterate quickly. The platform’s substantial subscriber base and data advantage set it apart from competitors like Amazon Prime.

Netflix’s cloud database helps with content creation, acquisition, and running its content discovery engine. The company uses subscriber usage data to understand their preferences beyond simple ratings, enabling targeted content acquisition. Netflix’s ability to understand viewer habits and preferences gives it a competitive advantage in the streaming video market.

Despite increasing content costs, Netflix is well-positioned to invest in high-value content and partner with renowned production studios. Additionally, the company’s experience and large-scale infrastructure make it challenging for new entrants to efficiently compete.

Read more about Netflix’s moat rating.

Risk and Uncertainty

Netflix’s reliance on original content brings added costs and risks, as the company needs to continually produce compelling programming to retain and attract subscribers. Expanding internationally poses challenges due to varying tastes and lower pricing in different markets, particularly in large emerging markets like India. Increasing subscription prices could limit growth and lead to customer churn, while introducing ads and cracking down on password sharing may impact brand equity and subscriber retention. Additionally, Netflix faces environmental, social, and governance risks in dealing with regulatory regimes across 190 countries, potentially including content restrictions, production regulations, and taxation issues.

Read more about Netflix’s risk and uncertainty.

NFLX Bulls Say

- Netflix’s internal recommendation software and large subscriber base give the company an edge when deciding what content to produce and acquire.

- Netflix has built a substantial content library that will benefit the firm over the long term.

- International expansion offers attractive markets for adding subscribers.

NFLX Bears Say

- The firm continues to burn billions of dollars of cash to create original content, with no end in sight.

- The level of competition in the U.S. and internationally is increasing and will continue to do so over the near future. Disney launched its own branded SVOD service, Disney+, in the second half of 2019.

- The need for increased content and advertising outside the U.S. will limit the rate of margin expansion for the international segment.

This article was compiled by Saaketh Tirumala.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fab4d3e1-7951-4575-a38d-fd2028ad4ae3.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fab4d3e1-7951-4575-a38d-fd2028ad4ae3.jpg)