Financial Services Stock Outlook: The Financial Sector Is Undervalued, but There Are Clouds On the Horizon

Expectations for interest rates have risen, and charge-offs could climb above pre-pandemic levels.

This article is part of Morningstar’s Q2 market review and outlook.

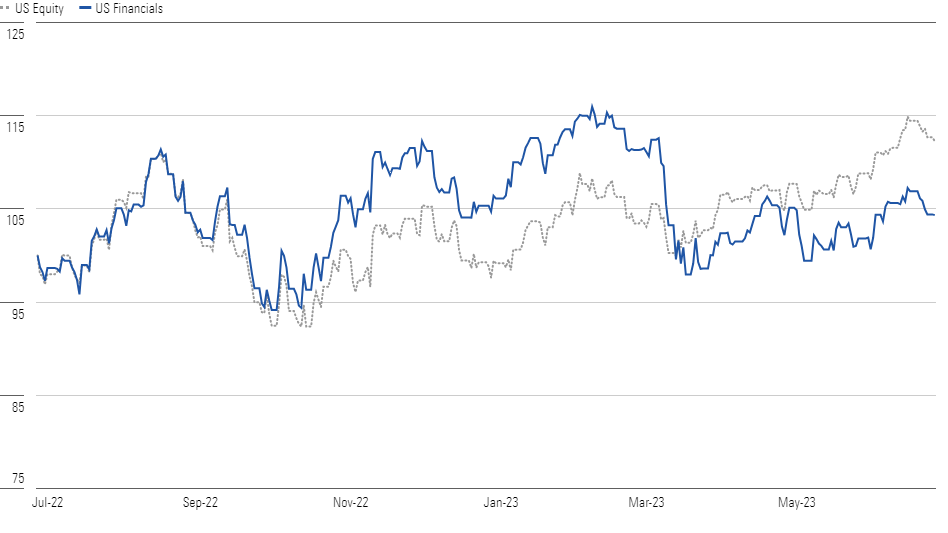

The Morningstar US Financial Services Index significantly underperformed the Morningstar U.S. Markets Index this past year, up only 4.3% compared with 12.3% for the benchmark. The sector moderately underperformed the previous quarter, up 1.9% compared with the market’s gain of 5.4%. The median North American financial sector stock trades at a 14% discount to its fair value estimate, compared with a 15% discount at the end of the first quarter of 2023 and a 21% discount at the end of the second quarter of 2022. We currently rate around 55% of the North American financial sector stocks that we cover as undervalued 5- or 4-star stocks, with about 5% rated as overvalued 2- or 1-star stocks.

Financial Sector Gains Haven’t Kept Pace With the Market

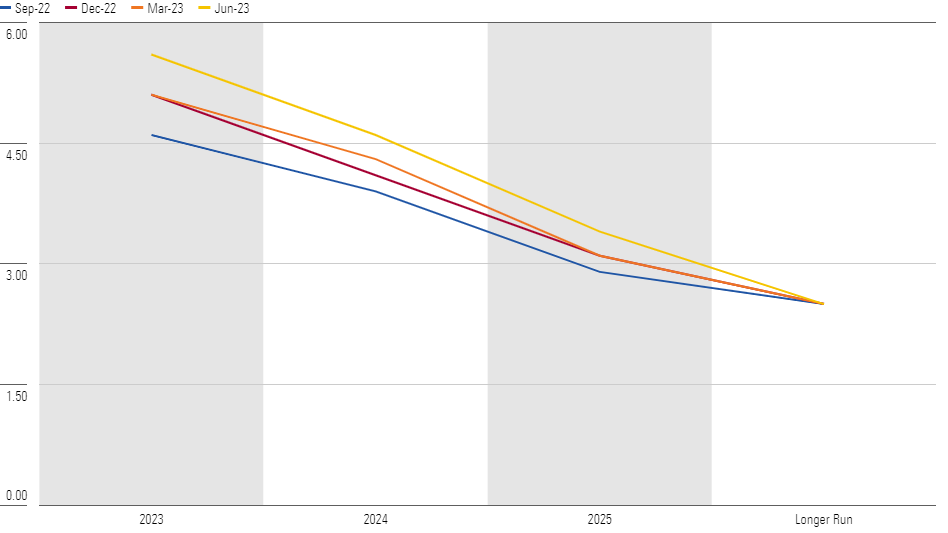

Members of the Federal Reserve Open Market Committee in June increased their assessment of how high the federal-funds rate should be—the median participant believed it will be 5.6% at the end of 2023 and 4.6% at the end of 2024. At the March meeting, the assessment was for 5.1% at the end of 2023 and 4.3% at the end of 2024. This increase and the respite from fears of regional bank collapses have helped financial sector stocks. But these factors haven’t been enough to lead to outperformance compared with the overall market, which benefitted from gains in the technology sector.

Interest Rate Expectations Have Moved Higher

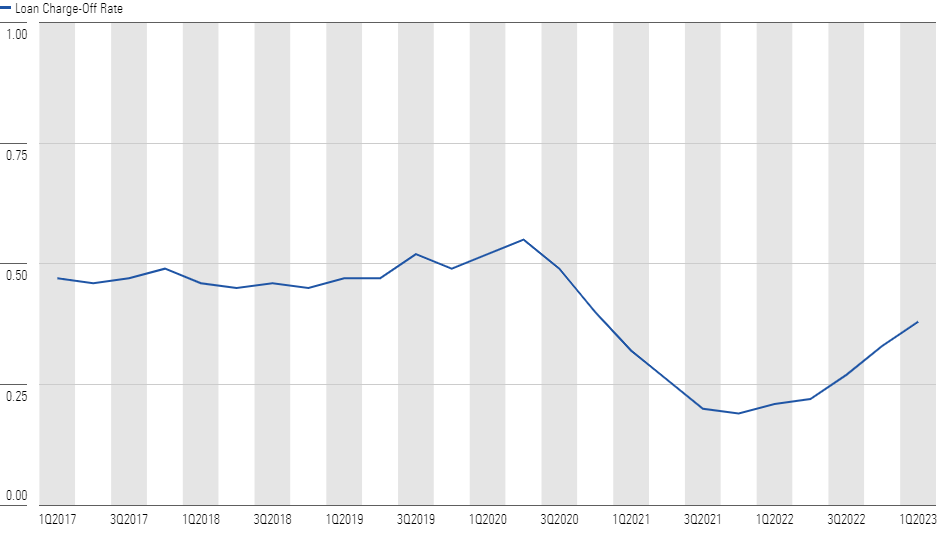

While we believe the North American financial sector is undervalued based on our long-term earnings projections, there are some clouds in the near and medium terms. Loan charge-offs at banks have materially bounced up from their mid-2021 to mid-2022 lows but are still below normal pre-pandemic levels, so they should continue to increase.

Charge-offs could climb above pre-pandemic levels because of any combination of the further decline of excess savings accumulated during the COVID-19 lockdown, the resumption of student loan payments, or a higher unemployment rate. Despite higher interest rates, net interest income growth could be stunted by higher deposit funding costs, difficulty with growing deposit balances, and lower demand for loans given the uncertain economic outlook.

Charge-Offs Are Rising

Top Financial Services Sector Picks

Berkshire Hathaway Class A BRK.A

- Fair Value Estimate: $555,000.00

- Star Rating: 4 stars

- Uncertainty Rating: Low

- Economic Moat Rating: Wide

We continue to view Berkshire’s decentralized business model, broad business diversification, high cash-generation capabilities, and unmatched balance sheet strength as true differentiators. Owing to its diversification and overall lower risk profile, we believe the wide-moat firm offers one of the better risk-adjusted return profiles in the financial services sector. We view the market losses recorded on its investment portfolio this year as near-term mark-to-market adjustments representing unrealized losses for a firm that has a rock-solid balance sheet and tends to be a buy-and-hold investor.

Blackstone BX

- Fair Value Estimate: $105.00

- Star Rating: 3 stars

- Uncertainty Rating: High

- Economic Moat Rating: Narrow

We believe Blackstone has built a solid position in the alternative-asset management industry, utilizing its reputation, broad product portfolio, investment performance track record, and cadre of dedicated professionals to not only raise massive amounts of capital but also maintain the reputation it has built for itself as the go-to firm for institutional and high-net-worth investors looking for exposure to alternative assets. With demand for alternatives increasing and investors limiting the number of providers they use, large-scale players like Blackstone are well-positioned to gather and retain assets for its funds.

Citigroup C

- Fair Value Estimate: $73.00

- Star Rating: 5 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: None

Citigroup is one of the most undervalued U.S. banks under our coverage and is trading below tangible book value. The bank is shedding nonperforming segments, refocusing its operations, and dealing with consent orders from regulators. The bank should be in a better position than the average regional bank in the current environment, as Citi’s size and status as a globally systemically important bank should encourage deposit inflows. Further, the bank’s unique idiosyncratic drivers can help break the correlation with the overall sector. The bank also has a lower percentage of unrealized losses to regulatory capital, another important metric in today’s uncertain times.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZEMES5XIZBD2LHOJ4CE4VEBM6I.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_3bda971142bb429e90b0e551f31b1fbb_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/B26QQUGWL5BVLMVULGYK3QQASI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)