Digital Ad Spending Poised for Exceptional Growth

With consumers flocking online during COVID-19, demand for digital ads should be strong in 2021 and beyond.

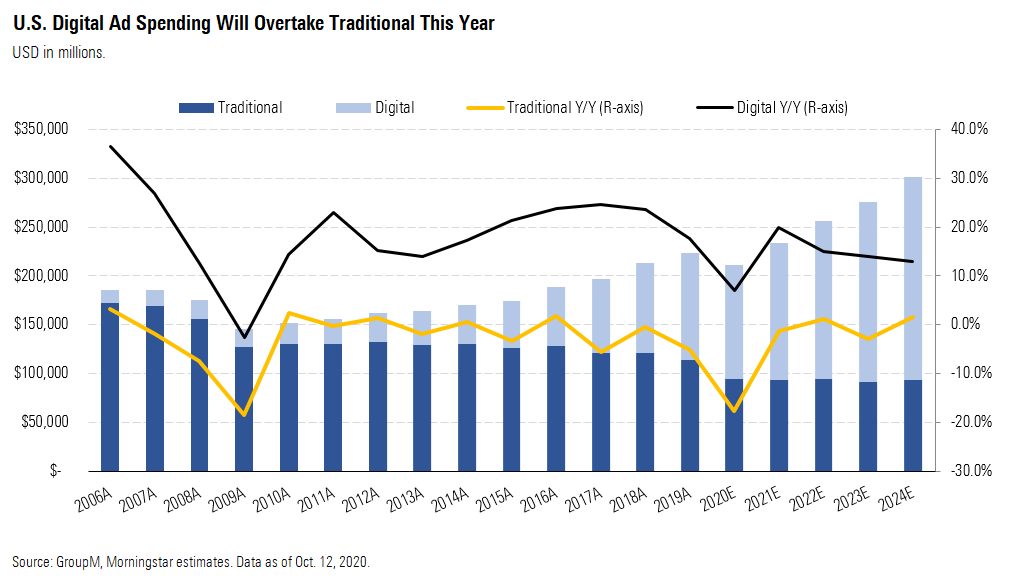

- We expect online ad spending to grow 20% next year and at a 14% average rate for 2022-24. By comparison, we expect total ad spending to increase 10.5% next year and at a 9% average rate for 2022-24.

While it has bounced back more quickly from the pandemic than we expected a few weeks ago, total ad spending is still likely to decline in 2020. We expect the market will return to solid growth next year, though, powered by the expansion of e-commerce and consumer time spent online that the pandemic has fueled, coupled with a return to economic growth. We believe higher digital ad spending on direct-response (or bottom-of-the-funnel) campaigns and the return of more upper-funnel brand marketing will drive advertising budgets higher through 2024, leaving traditional ad channels like television competing for a stagnant revenue pool.

In our view, however, rosy growth expectations for the digital advertising market are already priced into the stocks of the major players in the industry, including Snap SNAP, Pinterest PINS, Twitter TWTR, Spotify SPOT, and twin behemoths Facebook FB and Alphabet GOOGL. We view Snap as particularly overvalued. While the company has expanded its offerings and is attracting direct-response and brand advertisers, it serves a narrow segment of online users, which we think will limit ad dollars allocated to it in the long run.

Pinterest’s stock is also too richly priced, in our view. With users who often have an intent to purchase, we expect Pinterest to attract more direct-response and brand advertisers. We also applaud the company’s recent platform enhancements benefiting users and advertisers and strengthening its network effect. However, we have already captured the benefit of these efforts in our valuation. Spotify has also made smart moves recently, quickly gaining traction in the podcast market. We expect its ad revenue growth to outpace subscriber revenue and help create operating leverage, but again we believe those assumptions are already accounted for in the current stock price.

We view Twitter as overvalued. While it will benefit from the return of live events following the pandemic, which should attract brand advertisers, the company continues to struggle with its direct-response offering. As our no-moat, negative trend rating reflects, we believe Twitter is the worst positioned of the major online media companies, as it lacks the broad reach of a Facebook or the strong niche of a Pinterest.

For investors who want exposure to growing demand for digital ads, that leaves Facebook and Alphabet, both of which are reasonably valued and very well positioned, in our view. The companies have developed strong network effect platforms that not only have more users and viewers than competitors, but also continue to develop more ad offerings that further attract upper- and lower-funnel marketers. While Alphabet and Facebook will continue to face regulatory and antitrust risks, we believe the risks are manageable and won't detract from either company's value over the long term.

COVID-19 Forced Consumers to Remain Online, and Digital Advertisers Reacted Accordingly The decline in personal consumption immediately as the pandemic set in was drastic, but the data also indicates a sharp return in consumer spending, especially on durable goods. The CARES stimulus plan and unemployment benefits, plus the overall reopening up of the economy, initiated some recovery in consumption, but this rebound has continued even after the end of the unemployment benefits and without a second relief plan. Consumers may be dipping into their savings a bit more and/or shopping early for the holidays.

As consumption has begun to recover, ad dollars have followed even into some of the hardest-hit verticals. According to WardsAuto, after declining 38% and 46% year over year in March and April, respectively, auto sales improved gradually and were up 6% in September. Automotive ad spending, which represents around 17% of total ad spending in the United States, behaved similarly. After declining more than 60% year over year in April, it improved to a 40% decline in May, and during the last week of August, it was down only 10% from last year.

In the travel industry, online travel agencies such as Booking, Expedia, and TripAdvisor saw revenue decline 80%-90% year over year in the second quarter, after which there was improvement to a decline of 45%-65% in the third quarter. Marketing spending for those companies also improved a bit as the 70%-85% second-quarter decline improved to a 45%-60% decline in the third quarter. Based on data from Kantar, we estimate that travel advertising represents around 7%-10% of total ad spending in the U.S.

From this look at two major sources of ad revenue, we can conclude that the second quarter represented a bottom in terms of ad spending, and a gradual recovery even in the hardest-hit verticals is underway.

While consumer spending is inching higher, more of that consumption has been online. With traffic to physical stores down dramatically through the trough of the pandemic, e-commerce spending spiked up nearly 45% year over year during the second quarter, representing over 16% of total retail sales in the period compared with less than 12% in the first quarter and only around 11% a year ago. This shift has also driven an increase in ad budgets toward online and e-commerce marketing.

The pandemic has clearly driven more time spent online. According to Comscore, consumers spent around 10% more time online in March through July this year compared with 2019. This partially reflects the hours spent at home on smartphones and connected TV devices consuming online streaming content, partially at the expense of box-office revenue. Based on data provided by Comscore, we estimate that average daily video streaming hours per over-the-top streaming household (subscription and ad-supported) spiked 15% in mid-April from early March. EMarketer estimates that time spent per day consuming content on subscription OTT streaming platforms will increase 22% to over 60 minutes this year and further through 2022.

Online users have also increased engagement on social platforms such as Facebook, Instagram, Twitter, Snap, and TikTok. EMarketer estimates engagement--time spent on platforms per day--in the U.S. is likely to go up 9% year over year in 2020. While those minutes are expected to decline slightly in 2021 and 2022 after the sudden pandemic-driven growth acceleration this year, eMarketer believes they will remain above 2019 levels.

The increase in time spent online has increased ad inventory, while lower demand during the economic downturn has driven down prices. However, given that time spent online likely will not decline significantly during the return of economic expansion, which will increase demand, strong growth in ad spending in 2021 and beyond is expected.

Although the increase in working from home reduced commute times, the consumption of audio content likely hasn’t declined much. For example, according to a Nielsen survey, 40% of those who have worked from home during the pandemic listen to radio stations or audio streaming services. In addition, eMarketer estimates a daily podcast and radio listening decline of only 6.5% (to 34 minutes) and 3.6% (to 95 minutes), respectively, during 2020.

Larger Advertisers Have Cut Spending, but Smaller Ones Have Stepped Up Their Digital Ads As consumer behavior has shifted faster toward digital, advertisers have followed. We think this shift will continue, resulting in faster growth in digital ad spending than in traditional areas like television, print, and radio, through at least 2024. Digital ad dollars initially overtook TV ad spending in 2017 and will likely surpass total traditional ad spending this year.

With more data regarding consumer behavior online, real-time performance measurement, flexibility in terms of real-time ad placement and message adjustments, and the ability to more effectively target potential customers, we expect more advertisers to shift their budget toward digital ads. While this secular trend was set in motion more than a decade and a half ago, the pandemic has accelerated it.

As advertisers reacted quickly to the pandemic and slashed ad budgets, digital spending initially took a hit, causing a significant deceleration in revenue growth at Google, Facebook, Snap, Pinterest, and Twitter during the second quarter. In the North American market, the large advertising agency holding companies also saw organic growth evaporate. Digital ads became less expensive as a result of lower demand and higher supply.

However, lower prices allowed some smaller and previously less aggressive advertisers to step in and purchase inventory. For example, in the second quarter, Facebook’s ad volume sold went up 40% while prices declined 21%. The first and second quarters of 2020 marked the first time the company posted double-digit declines in ad pricing. With slightly better demand among larger advertisers and continued strong demand among these smaller ad buyers, prices declined at a far slower rate during the third quarter, far below the increase in ad volume sold. And Facebook’s experience was not unique; we saw some recovery in revenue growth across the major players in the digital advertising during the third quarter.

The North American advertising agencies have seen the pace of revenue decline slow, though the path to growth will be longer as their clients tend to be larger advertisers rather than the smaller companies that have benefited the digital ad business overall.

Digital Direct-Response Ads Provide a Safe Haven The retail industry, which accounts for more than 20% of total digital marketing, provides insight into how the ad market has evolved. While retail ad spending declined significantly when the pandemic hit, it has begun to recover, which along with other verticals is likely to continue next year.

However, with uncertainty about the duration of the pandemic (which may have lengthened, given the recent rise in COVID-19 cases) and shifts in consumer behavior, companies have put brand marketing aside and focused more on direct-response, or bottom-of-the-funnel, ad campaigns.

Direct-response advertising tries to target consumers who are ready to make a purchase with calls to action such as clicks and/or transactions. These direct calls to action make the performance of direct-response advertising more easily measurable. Easily demonstrated returns on investment make direct-response advertising costs easy to digest during times of heightened uncertainty. While some forms of traditional advertising include a direct-response component, digital dominates this area, providing a cushion during periods of economic weakness that advertising-based businesses haven’t enjoyed in the past.

All is not lost for brand advertising, though. Brand building doesn’t necessarily have the objective of initiating a click or purchase right away but rather aims to communicate a brand’s benefits to the consumer, so that when the consumer is ready to buy, he or she will first consider that brand. While the pandemic has forced businesses to prioritize direct-response over brand marketing, the two are intertwined during normal economic times. Without brand marketing, the conversion of direct-response digital ads may become less likely. In addition, brand marketing improves customer retention and frequency, increasing the lifetime value of each customer. However, without effective direct-response marketing, those long-term ROIs on brand marketing decline. The two help cover the entire funnel--from top-of-the-funnel marketing, which creates awareness and helps attract potential consumers, to bottom-of-the-funnel marketing, which attempts to convert them into customers.

We Expect Gains for All Forms of Digital Ads While not all changes in consumer behavior will be permanent, increased overall time spent online and the accelerated growth of e-commerce should boost all forms of digital advertising. We estimate that with an economic turnaround, overall ad spending will return to growth in 2021, driven mainly by digital ad spending. With the measurable and flexible features that digital platforms provide, we believe marketers will more easily integrate brand and direct-response campaigns. The largest and best-known digital display and audio ad platform providers such as Google, Facebook, Pinterest, Snap, Twitter, and Spotify should benefit.

Morningstar expects U.S. real GDP growth of 4.7% in 2021, following a 3.4% decline this year, and average growth of 2.3% through 2024. Building off this forecast, we expect economic growth will drive ad spending 10.5% higher next year, with 9% annual growth thereafter through 2024. During economic downturns (such as the 2007-09 Great Recession), advertising spending tends to decline much more than GDP, but it also recovers quickly as the economy begins to expand again.

Total ad spending has remained between 1% and 1.5% of nominal GDP during the last 20 years, but we believe it may be more toward the top of or slightly above that range during the next few years. Digital advertising, which will account for more than half of total advertising (compared with only 9%-13% during the Great Recession), has not only limited ad spending downside during the pandemic but also shown signs of sharp recovery, as indicated by digital ad platforms’ third-quarter results.

There is also seasonality in ad spending. Due to large sporting events such as the Olympics and the World Cup, which take place during even-numbered years, ad spending growth accelerates, then decelerates quickly in odd-numbered years.

Political ad spending is also a growth driver, mainly during even-numbered years. According to data from GroupM, political ad spending grew over 40% during the 2014 and 2016 election cycles. As a percentage of total ad spending, political marketing nearly doubled to 4% in 2016 and 2018, compared with an average of only 2% in 2000-14. For these reasons, overall advertising growth in those years spiked. We estimate that around $12 billion will be spent on political ads this year, which would represent close to 6% of our estimated total ad spending, partially offsetting the impact of the pandemic.

Digital Ad Spending Will Practically Carry the Rest of the Ad Market Given changes in consumer behavior, we expect growth in digital ad spending to easily outpace traditional. Traditional TV ad spending has benefited from the return of live sports and should continue to do so as schedules gradually return to normal and the postponed 2020 Summer Olympics take place in 2021. But aside from this benefit and the impact of higher political ad spending in even years, we do not anticipate much growth in traditional ad spending (including TV) through 2024.

As time spent on digital media by consumers continues to increase at the expense of traditional media, we expect advertisers will follow this trend and allocate more ad dollars toward digital channels. In total, we expect digital ad spending will grow at nearly a 16% average rate from 2021 to 2024.

We expect video ads (which are around 26% of total digital ad spending) to be the main growth driver because they are more effective at grabbing consumer attention than other digital forms. At the same time, online video advertising provides the ability to make real-time adjustments of ad content to minimize the chance of ruining the user experience. Plus, additional features (such as tagging products) have been added to digital video ads, which also makes purchasing easier for consumers. Lastly, we expect most digital brand campaigns, which we believe will be growing in 2021-24, will further gravitate toward the video format, as they have in the past in the traditional advertising world.

While ad spending in travel and hospitality may increase year over year in 2021, we believe spending in this category may take a couple of years to return to 2019 levels. In our view, the continuing growth of e-commerce will keep pushing retail ad spending (which represents the biggest chunk of digital ad dollars in the U.S.) higher. As e-commerce increases, marketers will look for more ways to more quickly convert online users to customers. While consumers may jump outside and storm into stores as the pandemic subsides, we believe that after pent-up demand is satisfied, the new normal will include a continuing increase of e-commerce as a percentage of overall retail sales. While less foot traffic to stores could reduce impulse shopping and buying, many online platforms have added features such as tagging products on pictures and videos and creating shoppable stories for advertisers, which should stimulate impulse ordering.

We think social media platforms Facebook, Pinterest, Snap, and Twitter will benefit the most during the economic turnaround that drives ad spending higher, given their large user bases and their focus on making e-commerce easier for their users and businesses. We expect Google’s search ad revenue to return to solid growth in 2021-24, although it will face increasing competition from Amazon. In addition, Spotify is well positioned to benefit from growth in podcast and overall digital radio advertising.

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)