Could Direct Indexing Lower Your Taxes?

8 factors to determine whether direct investing is right for you.

Tax Matters

Last spring, I wrote about the investment strategy of direct indexing, which involves buying an equity index directly rather than through a fund. (Technically, direct indexing usually samples a benchmark instead of holding everything, but never mind that.) There are several reasons why one might wish to direct index, such as implementing preferences (for example, by using environmental, social, and governance criteria), or adjusting the indexed portfolio to counterbalance a large outside position. All fair and good, but beside my point. What interests me for this column, and the two that will succeed it, is a more tangible potential benefit: tax reduction.

My first article traced direct indexing’s growth. Once marketed solely to the very wealthy, direct indexing has gone mass market. Schwab SCHW offers a service for a minimum investment of $100,000, while Fidelity’s entry requirement is a mere $5,000. For its part, Vanguard currently offers direct indexing only through financial advisors, but CEO Tim Buckley suggests that is just the first step, as the company is “investing heavily” in the capability.

My second article addressed the strategy’s general suitability. Just because the approach has become widely available does not mean it should be widely adopted. My conclusion: “Although direct indexing has merit, it is not for most. Direct indexing helps those who have substantial taxable assets, some of which generate ongoing capital gains. Relatively few investors meet that description.”

At that point I stopped, lacking the data to offer more detailed findings. That gap has since been filled, courtesy of 1) a white paper published late last year by Morningstar, “Sizing up the Potential Tax Benefits of Direct Indexing” (the paper may be ordered by financial advisors only) and 2) calculations on direct indexing’s efficacy supplied from Aperio, a unit of BlackRock BLK.

As each company provides direct-indexing services, investors should consume their research with caution. However, as we shall soon see, the size of the tax benefit conferred by direct indexing depends mostly on the investor’s personal circumstances. Trusting the research findings therefore comes down to ensuring that one’s own conditions match those of the study’s hypothetical shareholders.

The Big Picture

To begin at the top: Direct indexing provides very little tax benefit to those who own only tax-deferred accounts or to those hold tax-efficient investments in their taxable accounts. (Very little, but not none, as the IRS permits taxpayers to deduct $3,000 worth of capital losses against ordinary income.) The former makes no taxable distributions whatsoever. The latter does pay income—but so do stocks in a directly invested portfolio. Six of one, half a dozen of the other.

Direct indexing becomes useful, at least for tax management, only for those who hold significant amounts of tax-inefficient investments in taxable accounts. Likely candidates for such situations include 1) high-turnover stock accounts, 2) actively managed funds, and/or 3) infrequently traded securities that periodically realize long-term capital gains, such as profitable positions in company stock.

Direct indexing creates a separate account that is used to generate capital losses. With frequencies that range from monthly to as often as daily, the computer programs that oversee direct-investing portfolios “harvest” those stocks that sell below their cost bases while keeping the winners. The program reinvests the sales proceeds into the stocks of companies resembling the ones that were dropped. Rinse and repeat.

8 Factors

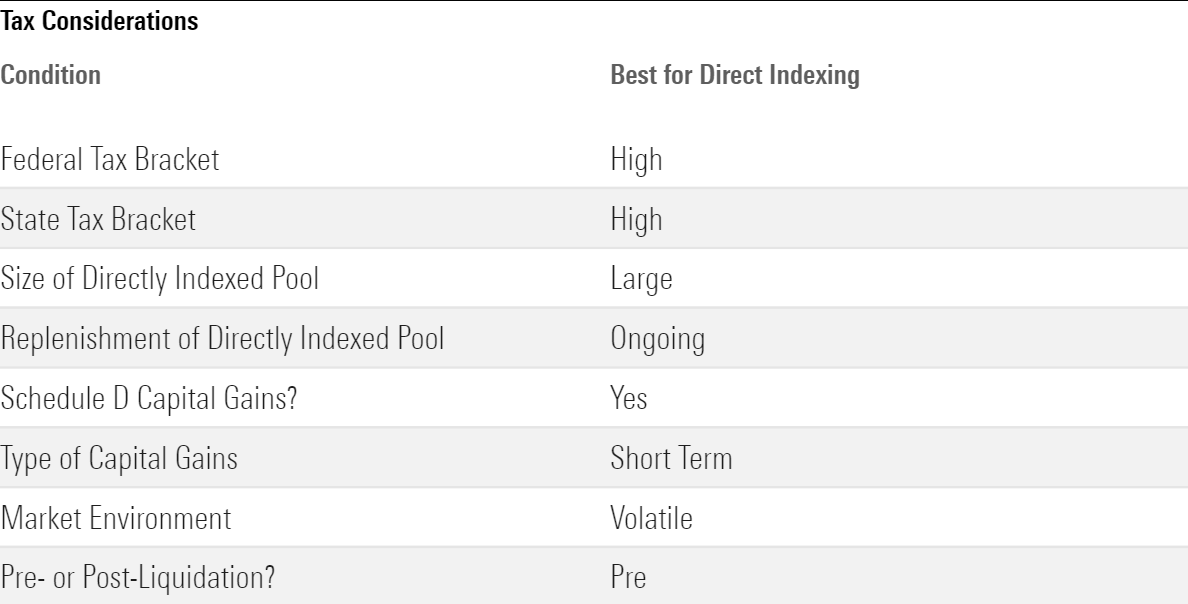

The effectiveness of direct indexing varies widely by personal circumstances. Aside from the overarching consideration, which is that the strategy only helps those who receive capital gains (aside, that is, from the $3,000 IRS deduction), eight (!) factors determine the potency of direct indexing. They appear below, followed by the condition that most favors the strategy’s use.

1) Federal Tax Bracket—High

The higher the federal tax bracket, the greater the potential benefit.

2) State Tax Bracket—High

This one is equally obvious. All things being equal, direct indexing helps Californians more than Floridians.

3) Size of Directly Indexed Pool—Large

The more money in the investment pool that is used for direct indexing, relative to the amount of the participant’s tax-inefficient investments, the more likely that pool can fully offset capital gains.

4) Replenishment of Directly Indexed Pool — Ongoing

The more frequently the directly indexed pool is replenished with new assets, the better it can offset capital gains, because (barring a prolonged bear market) the new assets will boast a relatively high cost basis.

5) Schedule D Capital Gains?—Yes

Short-term capital gains from some types of investments appear on Schedule D of the federal tax form, while those from other investment types do not. Regrettably, this distinction makes a meaningful difference for direct indexing’s tax benefits. I will discuss why in Friday’s column.

6) Type of Capital Gains—Short Term

Because short-term capital gains that appear on Schedule D are taxed at a higher rate than long-term gains, they benefit more from direct indexing. (Unfortunately, this statement does not apply to short-term gains that do not appear on Schedule D. This, too, will be covered on Friday.)

7) Market Environment—Volatile

Choppy markets, punctuated by the occasional crash, offer more potential capital losses than does an ongoing bull market.

8) Pre- or Post-Liquidation—Pre

As tax-reduction techniques are largely tax-postponement techniques, their effects are strongest for portfolios that are retained rather than liquidated. Direct indexing is thus particularly well-suited for assets that are to be either donated or passed along to heirs.

Wrapping Up (For Now)

To summarize the issues:

All these moving parts make for a complex analysis! Fortunately, although they create a huge number of combinations, their effects can readily be summarized. I will do just that in my two columns, accompanied by, yes, actual numbers.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)