Communication Services: Media and Telecoms Down, but We See Better Times Ahead

Pockets of strength have emerged amid technical hurdles and streaming losses.

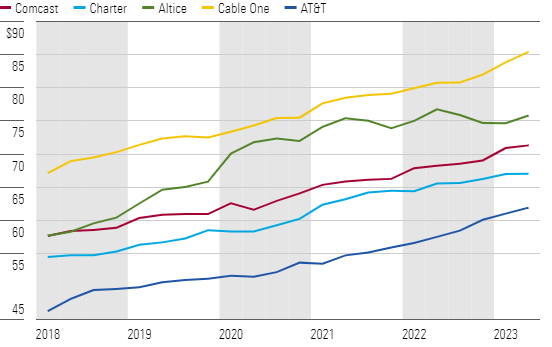

The surge in shares of Meta Platforms META and Alphabet GOOGL during 2023 remains the primary story within communication services, but other pockets of strength have emerged. Cable companies Charter Communications CHTR and Comcast NAS have rebounded despite their struggles to add broadband customers. Both have used heavy discounting to take shares in the wireless business via their wholesale agreement with Verizon Communications VZ, a strategy we don’t like. However, pricing in the core broadband market remains strong despite fixed-wireless competition from Verizon and T-Mobile US TMUS. We still think the market is overly pessimistic concerning Comcast and Charter’s long-term prospects, but in our view, their share prices are no longer unreasonably low.

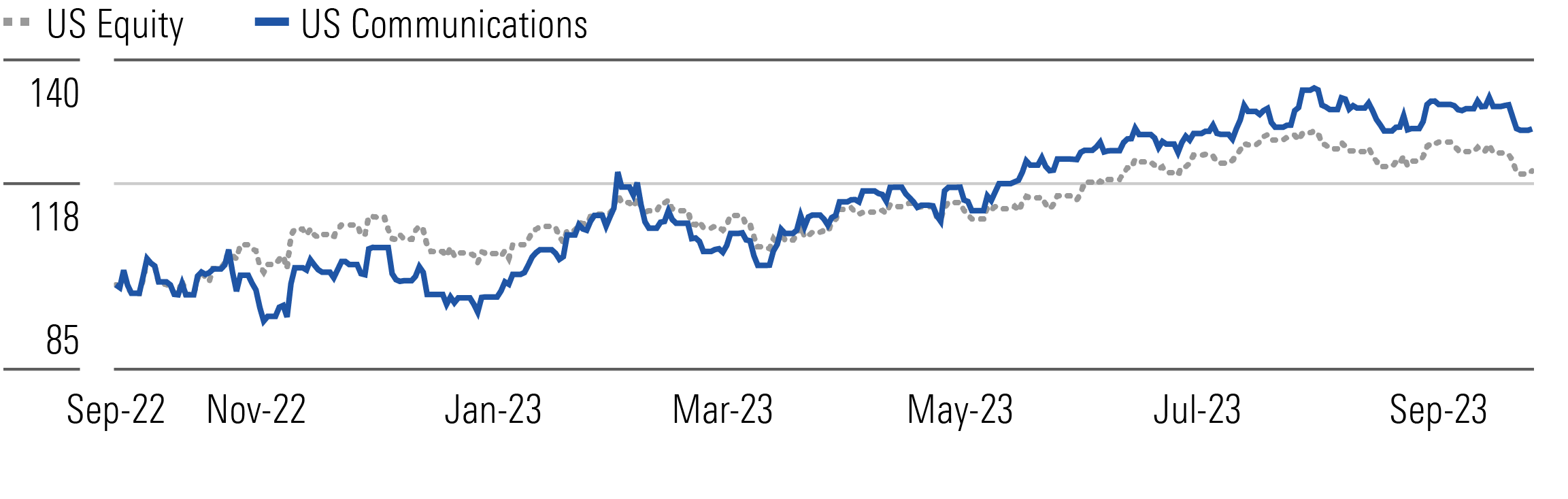

A Strong Rally in Meta and Alphabet Shares Has Defined Communication Services

Telecom carriers received another blow to sentiment when The Wall Street Journal published a series of articles on the potential environmental liabilities of lead-sheathed cables. We don’t believe this issue should be of significant concern for investors. We continue to see signs that competition in the U.S. wireless industry is growing increasingly rational. Each of the three major carriers has implemented price or fee increases or added high-end plans designed to increase revenue per customer. T-Mobile also initiated a dividend, adding to its share repurchase efforts, demonstrating its expectation that cash flow will remain solid. We expect that improving cash flow at AT&T T and Verizon will lift both firms’ shares in the coming quarters.

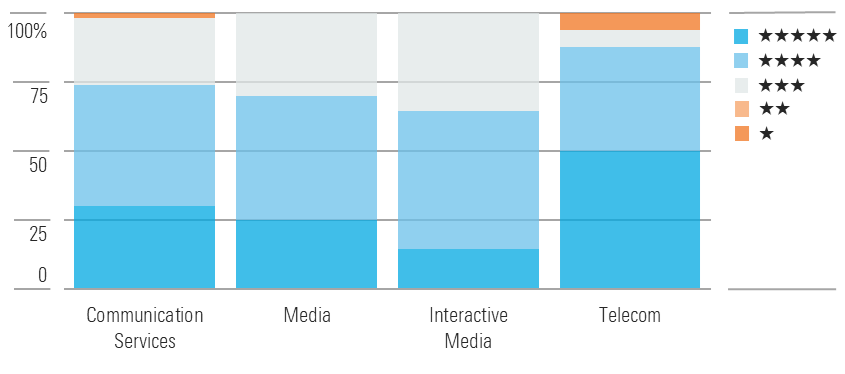

Traditional Telecom and Media Continue to Provide Opportunities

The fear surrounding the telecom industry and rising interest rates have dragged on wireless tower stocks over the past months, creating the first attractive opportunity to buy them in several years. Shares of Crown Castle CCI have been hit particularly hard since it operates only in the United States, where growth prospects have diminished as the carriers’ initial 5G investments wrap up. While Crown is trading at a larger discount to our fair value estimate, we still slightly prefer American Tower AMT, which offers exposure to multiple emerging markets, where network investment will likely remain elevated for several years to come.

Monthly Broadband Revenue per Customer: Competition Remains Rational

The traditional media business also remains mired in pessimism, as streaming losses mount and traditional television customers (a source of critical cash flow) continue to cut cords. We see signs of hope, though, as firms have started to increase pricing for streaming services while cutting back on content investment (albeit with help from the writers’ and actors’ strikes). In addition, we believe the renewed carriage agreement between Charter and the Walt Disney Company DIS could serve as a blueprint to increase the value of traditional television service and better integrate it with streaming services to stem further decline.

Top Communications Services Sector Picks

The Walt Disney Company

- Fair Value Estimate: $145.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

We believe Disney remains the best-situated traditional media firm to navigate the transition to streaming. The company’s deep content library, teeming with major franchises, provides both its famous family-friendly fare and content suited to older audiences. We expect fans will continue to flock to Disney’s parks and resorts, generating solid profitability while reinforcing its content popularity. Plans to invest aggressively in the parks over the next decade should enhance their unique experiences. We expect the emphasis on revenue and costs over the next year to continue, but the firm’s flagship streaming service Disney+ should continue to build momentum with audiences around the world while moving toward profitability.

Verizon Communications

- Fair Value Estimate: $54.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Verizon remains the cheapest of the three major U.S. wireless carriers relative to our fair value estimate. Investors have soured on these carriers as cable wins are increasing market share and competition appears stiff. Verizon specifically has struggled to improve wireless customer growth over the past year. We believe the firm will likely continue to gradually lose wireless market share, which we’ve factored into our fair value estimate. Pricing gains, coupled with a modest contribution from new services like edge computing and Fios expansion, should enable Verizon to slowly increase revenue. Continued cost-reduction efforts should allow margins to hold roughly steady over time as well, while a rational competitive environment will keep a lid on needed capital spending.

- Fair Value Estimate: $36.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

Pinterest’s PINS network effect is strengthening as more advertisers adopt its ad performance measurement tools, which we think will increase ad prices on the platform. The firm’s second-quarter results showed initial progress along these lines. At the same time, continuing user growth and improvements in engagement are providing more opportunities for advertisers to reach audiences. Finally, we think that with its Amazon.com AMZN partnership, Pinterest is now at the forefront of retail media options for advertisers.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_99626deb19c94bd4a5c406e19350f0ee_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U4OLR5WQ3JFYDHD76KVW6URKTU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOFK3IUSBRF5XHSFKBZHOG4J5A.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)