Basic Material Stocks: As Sector Underperforms, We See Strong Opportunities

Top picks in this sector are Albemarle, FMC, and Dow.

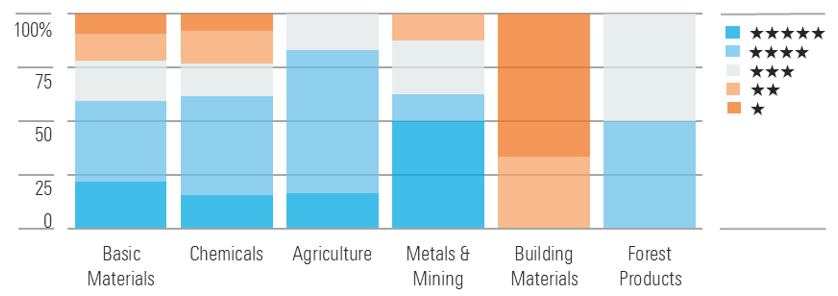

The Morningstar US Basic Materials Index underperformed the broader market during the fourth quarter of 2023 and has underperformed the market by 1,185 basis points on a trailing 12-month basis. In metals and mining, we attribute the decline to falling commodity prices. In chemicals and agriculture, the decline was due to inventory destocking unwinding excess inventory built up during the covid-19 pandemic. However, we see opportunities across the sector, with 60% of stocks trading in 5- or 4-star territory.

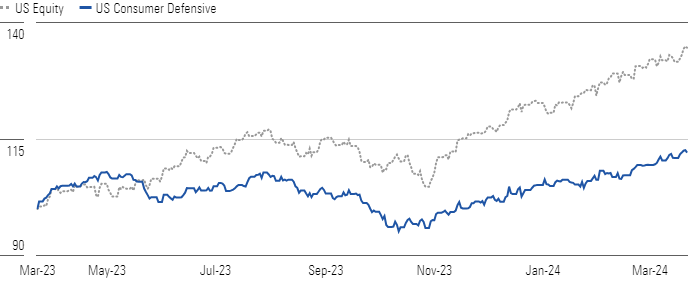

Consumer Defensive Stocks Are Lagging the Broader Market’s Outperformance

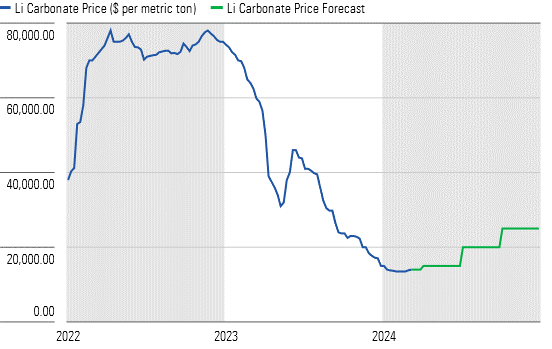

Lithium demand will grow 2.5 times by 2030 from 2023, largely due to increased electric vehicle adoption. EVs are projected to rise to 40% of global auto sales by 2030 from 12% in 2023. Over the long term, we view lithium as one of the best ways to invest in rising EV adoption, as all EV batteries require lithium. Since late 2022, prices have fallen over 80% due to inventory destocking among battery producers and supply growth. Prices are currently around $14,000 per metric ton. However, as destocking ends, lithium sales volumes will match solid end-market demand. We expect EV sales growth in 2024. Combined with supply cuts, we believe prices will rise in 2024. In the longer term, we forecast prices will average $25,000 per metric ton from 2024 to 2030.

60% of Our Basic Materials Names Trade In 5- or 4-Star Territory

Commodity chemicals demand fell in 2023 due to customer inventory destocking, leading to revenue declines for nearly all producers. This led to lower plant capacity utilization and negative operating leverage, creating outsized profit declines. As inventory destocking has largely run its course, we expect profits will rebound in 2024. We expect stronger profit recovery for US producers, which have a cost advantage due to low-cost natural-gas-based feedstock.

Lithium Prices Will Rise In 2024 as Demand Growth Outpaces Supply

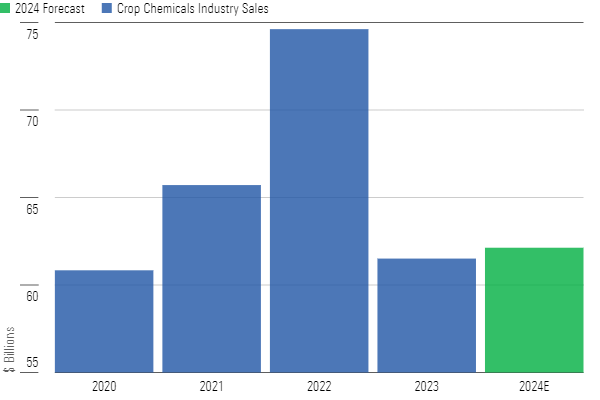

Crop chemicals sales fell 18% in 2023 due to inventory destocking. Fears of supply chain disruptions due to covid-19 led customers to buy and hold excess inventory in 2021 and 2022. However, destocking was largely completed by the end of the first quarter of 2024. We forecast industry growth in 2024. As demand returns, crop chemicals producers should generate profit growth.

We Forecast the Crop Chemicals Industry Will Grow In 2024

Top Basic Materials Sector Picks

Albemarle

- Fair Value Estimate: $275.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Albemarle ALB is our top pick to play strong lithium demand and rising prices from growing EV adoption. The stock trades at just under 60% of our $275 fair value estimate. Albemarle’s main business is lithium, which generated roughly 90% of its profits in 2023. The company produces lithium from three of the best resources globally, which creates the cost advantage that underpins our narrow moat rating. Among the lithium producers we cover, Albemarle also offers relatively lower company-specific risk. We point to rising lithium prices as a catalyst for shares in 2024.

FMC

- Fair Value Estimate: $110.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Our top pick to invest in demand recovery for crop chemicals is FMC FMC. The stock trades at a little less than 60% of our $110 fair value estimate. FMC is a crop protection pure-play company. The market is concerned with the risk around the expiration of FMC’s patent for its diamide products, which currently generate around 50% of its profits. However, as the industry recovers and the company develops new premium products from its strong research and development pipeline, we forecast FMC will see profit growth and margin recovery in 2024 and beyond.

Dow Chemical

- Fair Value Estimate: $68.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Dow Chemical DOW is our top pick to invest in recovering demand for commodity chemicals. The stock trades at nearly a 20% discount to our $68 fair value estimate. Dow is one of the largest chemical producers globally. It has a cost advantage, which underpins our narrow moat rating, as around 75% of Dow’s capacity comes from North America, which benefits from using low-cost US natural gas feedstock. Marginal cost players use Brent oil-based naphtha or higher-cost European natural gas feedstocks. As demand recovers, Dow’s capacity utilization should improve throughout the year, leading to a profit rebound in 2024.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)