Are Meal-Kit Delivery Companies a Threat or an Opportunity?

We see new growth avenues for CPG companies and online retailers.

If you’ve opened your browser or mailbox in the past year, chances are you’ve seen an advertisement for a meal-kit service like Blue Apron, HelloFresh, Home Chef, and others. These services offer an attractive alternative that overlaps with consumers’ evolving views about fresh, healthy, and convenient dining options. When these services first hit the market, we viewed them as largely no-moat companies that represented only minimal threat to our consumer coverage. However, after digging deeper and speaking with several executives from leading meal-kit delivery services, we believe these platforms and other subscription-based companies may be thawing consumer perceptions of online grocery and restaurant delivery services while offering new growth avenues for consumer packaged goods, or CPG, companies and online retailers.

Instead of viewing these services only as immediate threats to our grocery store, CPG, online retail, and restaurant coverage, as many investors have assumed, we believe they’ve played a part in changing consumer behavior that investors can’t ignore. We expect these services to play a big part in accelerating online grocery and CPG direct-to-consumer sales in the years to come.

Meal-Kit Services at the Intersection of Several Consumer Trends Despite relatively low penetration rates among U.S. adults, we believe it would be a mistake for investors to dismiss meal-kit delivery services. While the category is on the verge of consolidation and many players will not survive, the economics behind leading meal-kit delivery services like Blue Apron, HelloFresh, and Home Chef indicate more disruptive longer-term potential as the industry consolidates.

While we believe meal-kit delivery services currently represent less than 1% of total food and beverage retail sales in the United States, their disruptive potential is magnified because their buyers are often some of the most lucrative and influential customers of traditional grocers, specialty grocers, and restaurants. There is already compelling evidence that these services are changing consumer behavior, with loyal subscribers spending as much as 13% of their food purchases on meal-kit services. We believe this could escalate as meal-kit services refine their business models and accommodate their target demographics, which has obvious implications for the brand intangible asset and cost advantage moat sources for many of the companies we cover.

However, instead of viewing these behavioral changes as a threat, we believe they represent a significant opportunity for most consumer companies to rethink their approach to convenience and experience, which we consider the two most critical factors to drive traffic and play defense in an Amazon-oriented shopping environment. We anticipate that many consumer companies will emulate or partner with meal-kit service business models in the years to come, which we expect will lead to new investment opportunities across several industries.

Grocery Stores Could Gain From Increased Acceptance of Meal-Kit Services The transformative potential of meal-kit delivery services for the grocery store channel should not be overlooked. While meal-kit delivery services are probably out of reach for most low- and middle-income consumers, they've developed a following among a very affluent and influential customer base. There is compelling evidence that how consumers approach specialty and traditional grocery stores is changing.

As consumers find meal-kit services that best satisfy their taste and lifestyle preferences, we expect a further ripple effect across grocers in the years to come. We’re already seeing the first phase of this transformation play out, with several grocers developing their own meal-kit solutions or partnering with established players to create substitute products.

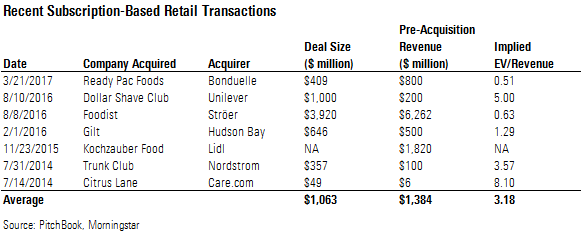

However, we believe later phases of this transformation will be more important from an investment standpoint, as slow starts to in-store offerings and public financing rounds force grocers to get more serious about meal-kit services. Assuming an initial public offering of a leading meal-kit delivery service later this year--Blue Apron is the most likely candidate--we expect grocers to target a number of other leading meal-kit services as acquisitions, not unlike the acquisitions of several apparel-oriented subscription services like Trunk Club and Gilt in the past several years. We believe

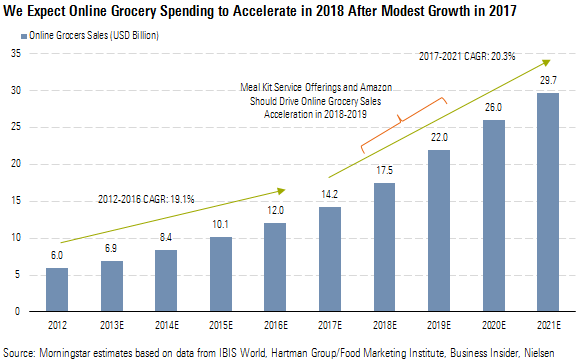

We expect grocers will take their time to find the appropriate meal-kit strategy that works for them. While most large grocery chains have the scale, personnel, and equipment to develop their own meal-kit strategy, acquiring or partnering with a third-party meal-kit or prepared-meal solution may make more economic sense, especially given the unique layout of meal-kit services’ fulfillment centers. As such, we expect U.S. online grocery sales to grow 18% to $14.2 billion in 2017, roughly on pace with 2016, as grocers refine their meal-kit plans and, by extension, take a closer look at their direct-to-consumer strategies. However, we anticipate that 2018 and 2019 will represent a key inflection point for online grocery sales in the U.S., where industry growth reaccelerates to 23% and 26%, respectively, driven by the halo effect of meal-kit services on online grocery sales.

Ancillary Insights Into E-Commerce Could Prove Powerful for CPG Firms While acceptance of purchasing grocery products online has failed to gain much traction until this point in the U.S., accounting for just a low-single-digit percentage of total sales, we foresee the barriers of broader consumer acceptance breaking down as retailers invest in their own online platforms and consumers become more comfortable buying food online. We think this could be facilitated by further penetration of meal-kit delivery services, particularly for fresh proteins and produce.

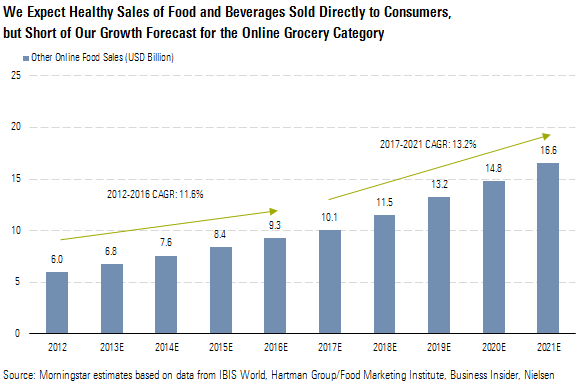

We view the meal-kit service category as another means through which packaged food firms can position their products to get in front of consumers, but we don’t see this as a major source of growth in the aggregate. For this reason, we expect online food and beverage sales sold directly to consumers (and not through an online grocery platform like Peapod or AmazonFresh) will grow at a low teens clip the next five years, which exceeds recent CPG category growth trends but comes in well short of the 20.3% average annual growth rate we forecast for online grocers the next five years. Overall, we believe the more sizable opportunity for packaged food firms is the potential to gain insights into the packaging, marketing, and supply chain logistics of the e-commerce realm.

While others in the packaged-food realm have tried to play in the space in the past, with varying degrees of success, we believe no-moat

Meal-Kit Services Spur Restaurant Digital Ordering, Delivery, Menu Innovation With meal-kit services and online grocery platforms offering consumers newfound convenience for food-at-home expenditures, it's critical for restaurant companies to have an appropriate defense strategy. While most restaurant chains don't have the ability to fully replicate the subscription-based nature of meal-kit delivery services, we believe an integrated digital order platform is one of the most effective tools that restaurants will have to defend against meal-kit delivery services and online grocery platforms and offer consumers greater convenience and stimulate repeat traffic.

Much like the retail industry adjusting to subscription-based retail models, increased consumer interest in on-demand delivery poses an interesting opportunity for many restaurant operators. However, in contrast with traditional retailers, which face major inventory coordination and logistics cost hurdles in trying to fulfill online orders directly from their stores, an order coming into a restaurant for delivery doesn’t necessitate major changes to the workflow process. A delivery order has to be prepared like any order placed in the restaurant, suggesting that there shouldn’t be material disruptions to the food-preparation process—assuming that staffing levels are adequate and there is optimally a secondary delivery hub or assembly line that doesn’t disrupt in-restaurant order preparation.

Most restaurant companies have taken measures to improve their mobile technology platforms and delivery capabilities in recent years. However, we think that in putting such a great emphasis on mobile technologies, many chains have underinvested in features that enhance the overall consumer experience, which is one of the issues weighing on restaurant traffic the past two years. Restaurants can’t replicate the hands-on cooking experience that meal-kit services offer, but we believe new approaches to restaurant layout and menu innovations may be required to drive new and repeat guest traffic in a time of declining retail traffic.

Meal-Kit Services Could Be on the Cusp of Consolidation After beginning with hundreds of start-ups, the meal-kit delivery market is beginning to mature, with some players reaching scale. We estimate there are about 150 meal-kit preparation and/or delivery services companies in the U.S. with roughly another 50 in operation outside the U.S., based on information from Packaged Facts and our own analysis. Several executives we spoke to believe these figures are high, but this could be because the third-party data services we used to develop our estimates also included niche operators specializing in ancillary segments like smoothies, snacks, or desserts.

We think consolidation is likely to eventually take place, and business models will evolve and pivot. Using the economic moat framework that Morningstar applies to consumer companies, we believe there are three building blocks to a successful meal-kit delivery service: (1) identify and cater to a specific target audience to build a brand intangible asset and network effect; (2) find ways to raise prices, whether organically (service fee increases) or through add-on products/services; and (3) develop enough scale to drive down purchasing, customer acquisition, and fulfillment costs. Below, we provide an overview of some of the leading meal-kit delivery services that have demonstrated these qualities.

Blue Apron. While not the first company to the market, Blue Apron is now the U.S. market leader and is the closest to the point of sustained profitability on a stand-alone basis, in our view. According to several recent articles discussing the company's plans for a potential IPO in 2017, Blue Apron generated $750 million in revenue during 2016, up from approximately $100 million in 2015 and implying roughly a third of total category sales in the U.S. Founded in 2012 by CEO Matt Salzberg, COO Matt Wadiak, and CTO Ilia Papas, Blue Apron has been most successful targeting the foodie crowd, including cooking show enthusiasts and consumers looking to experiment with unique and hard-to-find ingredients, in our opinion. The company's private funding round in 2015, backed by Bessemer Venture Partners, Fidelity, and First Round Capital, valued the firm at about $2 billion (2-3 times forward sales).

HelloFresh. We view HelloFresh as the most established global player in the meal-kit delivery service category, with fiscal 2016 revenue that probably exceeded $600 million. The company has operations in Australia, Austria, Belgium, Germany, the Netherlands, the United Kingdom, and the U.S. As of September 2016, HelloFresh had 843,000 active subscribers and more than 7,500 recipes in its database and was on pace to deliver more than 90 million meal kits globally in 2016. The company announced plans for an IPO in October 2015 before withdrawing those plans about a month later. It raised EUR 85 million of Series G venture funding in a deal led by Baillie Gifford and Qatar Investment Authority in December 2016, putting its premoney valuation at EUR 2 billion.

Plated. Plated launched in 2012 around the same time as Blue Apron; it was founded by two of Blue Apron CEO Salzberg's former business school classmates, Josh Hix and Nick Taranto. Plated's sales have reportedly been lagging those of Blue Apron and HelloFresh in recent months. Plated delivers to the entire continental U.S. with the exception of a few cities in Texas. Plated places a special emphasis on sustainability in its food and packaging; it is working toward 100% carbon-neutral packaging. To fund its growth in 2013, Plated scored a deal with Mark Cuban on the Shark Tank TV show; while this tie-up ultimately fell apart, another of the show's investors, Kevin O'Leary, eventually opted to take a position in the business, although the terms of the investment were never disclosed publicly.

Home Chef. Chicago-based Home Chef was founded by Pat Vihtelic in 2013. Home Chef has targeted more mainstream consumers who appreciate home-cooked meals but with more familiar ingredients than those offered by some of its more exotic competitors. Home Chef offers a standard meal delivery subscription platform but also includes options to purchase breakfasts, fruit baskets, smoothies, and kitchenware. Unlike peers like Blue Apron, which won't repeat recipe options more than once a year, Home Chef will use the recipes best rated by customers in its meal kits as frequently as 90 days apart, though often tweaked based on customer feedback. Home Chef is currently delivering 3 million meals per month and can reach 98% of the U.S. with its deliveries.

PeachDish. PeachDish, founded in 2013 by Hadi Irvani, specializes in Southern food recipes. Its service does not require a subscription, allowing customers to order on a per-meal basis. The company ships more than 200,000 meals per year. It also sells individual items and ingredients on its website. PeachDish ships to the entire continental U.S.

Chef'd. Chef'd differentiates itself from its subscription-based peers with a more ad-hoc business model, allowing customers to order as many (or as few) meals as they'd like at any one time from hundreds of options. Chef'd, which was founded by Jesse Langley, Jason Triail, and Kyle Ransford in 2015, has exclusive partnerships with more than 90 chefs, companies, and brands to provide their recipes and products and to help facilitate delivery. According to various estimates, the company's annual revenue is close to $5 million. Chef'd delivers to the entire continental U.S. Among its meal-kit delivery service peers, we believe Chef'd has been most active in partnering with consumer product companies (including Quaker Oats PEP and Hershey HSY) to build out its recipe options.

Purple Carrot. Purple Carrot, cofounded in 2014 by Andrew Levitt, offers only vegan recipes. Through the company's partnership with New England Patriots quarterback Tom Brady, Purple Carrot offers a special Tom Brady line of weekly meals. As part of its partnership with Whole Foods WFM, Purple Carrot offers its meals at a select number of the grocer's test locations. According to crowdsourced third-party data provider Owler, Purple Carrot has roughly $3 million in annual revenue. Purple Carrot currently delivers to 36 states, primarily in the Northeast, Mid-Atlantic, and West Coast.

Sun Basket. Founded in 2014 by Adam Zbar, Justine Kelly, and Braxton Woodham, Sun Basket emphasizes its adherence to healthy and environmentally friendly meals and practices. It employs data scientists and nutritionists to assure that recipes meet Sun Basket's standards. The company is certified organic by the U.S. Department of Agriculture and offers a variety of meals each week that are gluten-free or vegetarian. It also specifically includes paleo options. Sun Basket ships to most of the continental U.S., except for Kansas, Minnesota, Montana, North Dakota, Nebraska, and South Dakota. The company reportedly hired investment bankers in March to explore the possibility of an IPO.

We expect at least one major IPO by a meal-kit services company in 2017, with Blue Apron the most likely candidate, given its size, scale, and brand image. We believe this could have a domino effect across the rest of the space, with grocers looking to acquire or establish partnerships with other leading players--similar to the run on apparel-oriented subscription services the past several years. Using other subscription-based retail transactions as a proxy, we believe acquisitions in this space could reach as high as 5 times revenue, similar to the enterprise value/revenue multiple that Unilever UL/UN reportedly paid for Dollar Shave Club. We think Wal-Mart, Kroger, and Amazon--each of which has had a relatively aggressive acquisition strategy in recent years--are the most likely acquirer candidates from the grocery store category. At this point, enterprise value/EBITDA and price/earnings transaction multiples are largely irrelevant, given the lack of profitability for most meal-kit delivery services.

Investment Ideas to Capitalize on Growth in Meal-Kit Services Until meal-kit services companies come public, there are limited ways for investors to directly participate in their growth. However, we still believe there are several opportunities for investors looking to capitalize on many of the changes in consumer behavior that we've seen across our grocery, CPG, restaurant, and online retail coverage. Below, we've highlighted (in alphabetical order) a handful of attractively valued names that offer investors a way to take advantage of the themes we've identified.

Amazon.com

AMZN

As with almost every retail industry, it’s hard to analyze the prospects of meal-kit delivery services or the broader online grocery category without considering Amazon’s plans. While Amazon’s online grocery push has been slower than it hoped, it’s hard to deny the disruptive power of Amazon’s Prime membership program--we estimate that there are approximately 80 million Amazon Prime members, with roughly 55 million members in the U.S. alone as of December--and logistics capabilities. We don’t think customers have any issues with Amazon’s ability to get fresh food to their homes in a timely fashion. Instead, easing customers’ reluctance will come down to two factors: (1) convincing CPG companies to make changes in their business models to better adapt to online commerce and (2) helping consumers overcome their current preferences to see proteins and produce before making purchases. We believe consumers associate Amazon with convenience, but we believe the company will need to tap into some of the culinary and experiential aspects that have made meal-kit services successful to drive sales in this category. The company is testing its own chef-designed meal kits at its Amazon Go store pilot in Seattle and other meal-kit partnerships, but we would not rule out Amazon also stepping forward as a potential acquirer of a leading meal-kit delivery service in the near future. If we assume that even a fraction of Amazon’s U.S. Prime members become regular users of Amazon’s meal-kit services, it could offer a meaningful boost to the company’s online grocery plans.

Pilgrims Pride

PPC

We think Pilgrim’s Pride could ultimately take the plunge to bolster its presence in the meal-kit delivery business, similar to meat-processing peer Tyson. We believe this no-moat chicken producer should capitalize on rising fresh food and meat demand in North America, and current trading prices afford a sufficient margin of safety for investors considering a position. Low corn and soybean prices have coincided with strong demand for chicken, conditions that we believe will benefit Pilgrim’s balanced portfolio while providing investors with a steadier near- to mid-term outlook than large bird-focused producers if commodity tailwinds abate. Furthermore, we do not believe that recent media and regulatory scrutiny of industry pricing indexes is a material threat to Pilgrim’s top line. We have a favorable view of the firm’s recently acquired Mexican operations, which we anticipate will provide a meaningful source of long-term growth as the market develops and demand for meat rises with incomes, bolstered by limited domestically produced supply. The Mexican industry is structurally different from its U.S. counterpart, particularly in the popularity of live birds (about one third of chicken sales in the country), which are viewed as fresher and higher quality than packaged alternatives. As customers become more familiar with Pilgrim’s quality packaged products that offer a higher standard of food safety than traditional locally produced alternatives, we expect the segment will stabilize at higher margins than its northern counterpart.

Starbucks

SBUX

Perhaps more than any other restaurant operator, Starbucks has adjusted its business model to address evolving consumer expectations for convenience and experience, which have been crucial to the growth of meal-kit delivery services. With 7% of total orders at U.S. company-owned stores coming from a mobile device and 27% of transactions being paid for with one as of its most recent quarter, Starbucks’ mobile payment platform is one of the most widely adopted in the consumer sector today. There have been growing pains, as increased mobile orders and payments have led to greater congestion and throughput bottlenecks at stores. Nevertheless, we’d much rather have a situation where demand outpaces capacity, as it lends credence to the brand intangible asset behind our wide moat rating and tends to be more easily corrected than other issues. We’re confident that management has the expertise to develop solutions in the interim (adding more baristas at ticket stations and handoff points) and longer term (designing new restaurants with stand-alone mobile order and payment stations). We’re intrigued by Starbucks’ evolving portfolio of retail concepts, including large-format Roastery locations that offer a unique retail destination in major urban markets, upscale Starbucks Reserve stores that combine many of the experiential aspects of the Roastery stores (save for the roasting process) in a more flexible setting for upscale urban and suburban settings, the incorporation of Princi bakery counters at Roastery and Reserve locations (while offering the option of a stand-alone concept over a longer horizon), and aspirations to incorporate a Reserve Bar in 20% of its traditional stores longer term. In our view, the upscale experiential aspects of these locations have been underappreciated by the market and represent a key driver of future guest counts and average transaction size growth.

Wal-Mart

WMT

In a move to transform its business model further toward online retail, Wal-Mart acquired Jet.com in the third quarter of 2016, better positioning the company to compete with Amazon. We are encouraged by such initiatives, as well as the partnership with JD.com JD, and believe Wal-Mart remains one of the best ideas in our retail defensive coverage. Wal-Mart is using its physical footprint as a key differentiator to better win customer sales, leveraging its 11,500 stores and distribution centers to bring merchandise closer to customers with lower shipping and handling costs. We believe Wal-Mart’s online sales can grow 30% a year for the next three to four years and approximate 10% of sales, up from 3% today. Wal-Mart is also spending on technology to bolster its online grocery segment. Customers can order groceries online, then pick them up curbside, offering an elevated sense of convenience. Wal-Mart has rolled this out to 600 stores, with plans to double that in fiscal 2018. A huge advantage that Wal-Mart possesses over other retailers is its national store base, which enables it to be one of the best-positioned retailers to win at online grocery/curbside pickup. Looking out further, we think Wal-Mart is one of a few retailers able to deliver groceries economically (largely fresh foods), as its proximity to customers cuts down on last-mile delivery costs (70%-80% of total shipping costs). We expect a natural blending of the company’s e-commerce initiative and its online grocery business over time, and although this is in the initial stages, we remain encouraged.

/s3.amazonaws.com/arc-authors/morningstar/d989732f-19b3-4049-b5fe-f59c1fcfa828.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d989732f-19b3-4049-b5fe-f59c1fcfa828.jpg)