Amid Coronavirus Outbreak, Chinese Internet Firms Could Benefit

We expect e-commerce, online entertainment, education, and business services to see faster adoption rates in the long term.

We think the main long-term beneficiaries of the coronavirus outbreak are Chinese Internet companies with online products and services that are not yet well penetrated, as they could see an increase in users. This includes companies offering online education, fresh food delivery, and office tools, which are likely to see faster adoption rates. Should the users of these services and products like the experience, their habits can be cultivated with relatively low acquisition costs, providing long-term benefits. E-commerce, which is not well penetrated in lower-tier cities and rural areas, should also see faster adoption rates in the long run. For services and products that are already well penetrated, such as online gaming, we expect shorter-term benefits from the surge in demand during the epidemic, without material long-term boosts. We expect the losers to be online advertising and online travel, which are adversely affected by reduced economic activity, with the latter severely hit by trip cancellations and drastically reduced travel demand, although we believe the pain is only short term.

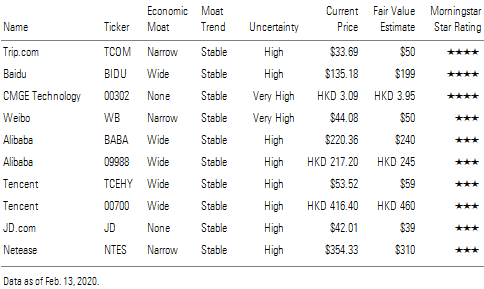

At this stage, we’re not changing our fair value estimates for the Chinese Internet companies we cover, as it’s too early to tell the long-term benefits, and the one-off short-term benefits or headwinds don’t materially change our cash flow estimates in the long term. We think CMGE Technology Group 00302 is an undervalued short-term beneficiary from the epidemic. Tencent TCEHY/00700 and Alibaba BABA/09988 could be net long-term beneficiaries from the outbreak, in our view.

We think the net impact on Tencent, Alibaba, Netease NTES, JD.com JD, and CMGE should be positive. Companies with major online gaming operations like Tencent, Netease, and CMGE stand to benefit in the near term. Drags on overall consumer confidence are short term and are likely to be offset by increased use of online services in the long term for Alibaba and JD.com. Gaming companies Tencent and Netease and e-commerce giant Alibaba should see benefits outside of their bread-and-butter businesses because of faster adoption of other businesses. Baidu BIDU and Weibo WB are likely to lose out because of their large advertising exposure, which is likely to be sensitive to overall economic weakness, with Trip.com TCOM the biggest loser. However, we note these are only short-term pains. In the near term, we expect the whole sector will incur some loss of productivity as the Lunar New Year holiday has been extended and production and services may be disrupted. We also expect to see additional expenses related to being good corporate citizens due to increased donations and volunteer services.

Long-Term Impact on E-Commerce Is Positive The impacts of the coronavirus outbreak on the e-commerce sector are more positive than negative in the long term, mainly due to faster penetration of online shopping into lower-tier cities and rural areas, and into groceries and fresh food, with Alibaba and JD.com the main beneficiaries.

Given the fear and discouragement of going out, this epidemic has led to more people in the lower-tier cities and rural areas trying online shopping, and people in all regions trying to shop for fast-moving consumer goods, groceries, and fresh food. In fact, in 2003, SARS helped give rise to e-commerce in China. We anticipate online supermarkets will see a jump in new users, which should bode well for both Alibaba and JD.com in the longer term. Netease’s YanXuan e-commerce business is likely to see less benefit, given the lack of fresh food choices and the narrow variety of groceries.

JD supermarket has been providing delivery services during Lunar New Year and saw food, instant food (such as instant noodles), edible oil, seasoning, vinegar, and so on registering growth from two- to twentyfold in some subverticals of these categories during the first three days of Lunar New Year. Because JD supermarket is one of the largest supermarkets in China, we think its self-owned operations with a strong supply chain and self-operated logistics services should be able to provide consumers with a more reliable service during the epidemic.

Alibaba’s Hema supermarket has also increased sourcing to secure demand for fresh food, such as meat, eggs, and vegetables, and has recruited idle staff in the catering industry to help alleviate Hema’s current shortage of labor.

However, with a substantial reduction in GDP growth, we expect online sales of discretionary categories and the advertising budgets of merchants to see a hit, which should materially reduce earnings for Alibaba and JD in the first quarter of 2020. Alibaba announced measures to support merchants, including waiving service fees for the first half of 2020 for Tmall merchants and offering free services to eligible merchants registered in Hubei. We also expect to see offsets arising from warehouses being quarantined and merchants delaying or canceling orders. According to 36kr, delivery and logistics have been hampered by traffic restrictions, which we expect to also affect the e-commerce industry.

JD.com delivered medical supplies to Wuhan’s hospitals on the date of donation, Jan. 26, which speaks to the efficiency of its logistics and the benefits of owning its logistics arm. The Chinese government has also praised JD’s various efforts (rapid delivery of medical supplies, for example) amid this outbreak. Alibaba’s Cainiao organized the delivery of medical supplies to Wuhan’s XieHe hospital on Feb. 1 at around 10 a.m. in response to its request for help on Jan. 30. Overall, we see more positives than negatives for the e-commerce sector.

Online Gaming, Entertainment, and Education Benefit From People Staying Home We expect the games, music, and online video segments of Tencent; online games, music, and education arms of Netease; CMGE's gaming; Baidu's iQiyi video; and Alibaba's Youku video to benefit from the increase in time spent on online services and products as people avoid going out.

We think the Chinese online gamer base is mature, given the industry’s slow growth, so we don’t expect faster adoption and expect only a near-term boost in earnings in the gaming sector resulting from this epidemic. According to Sensor Tower, Tencent’s PUBG mobile grossed HKD 1.4 billion in January, up fourfold year over year, making it the highest-grossing game for the month. PUBG mobile includes the mainland version of Peacekeeper Elite, which accounted for 53% of total gross. Tencent’s Honor of Kings was the first runner-up, grossing CNY 1.2 billion, up 25% year over year. According to SINA news, Honor of Kings’ grossing on the even of Lunar New Year was estimated to be CNY 2 billion, a 54% year-over-year increase. There are reports by 36kr of a surge in traffic in leisure games as well. On the other hand, according to 36kr, gaming companies’ employees have expressed difficulty developing and adjusting games at home on schedule. Therefore, a prolonged outbreak is likely to still have some negative impact on new game launches.

Online video is a major form of online entertainment, making it a beneficiary when people spend more time at home. We predict that online memberships could increase as a result, some of which could be first-time subscribers. While some subscribers are expected to drop off after the epidemic is contained, we think some of them who never paid for online videos might stay if they enjoy the experience. Nevertheless, online video platforms’ significant reliance on online advertising, which is sensitive to economic conditions (accounting for 28% of revenue at iQiyi in the third quarter of 2019), may offset some of the benefits.

ByteDance's CNY 630 million purchase of Jiong Ma--a film that was originally scheduled to be shown in cinemas during Lunar New Year--for free online broadcasting on its Douyin, Today's Headlines, and Xigua platforms marks its ambition of entering the long-form video market where Tencent Video and iQiyi currently have leading roles. This is also the first time a movie scheduled for Lunar New Year release will have its free premiere online. Huanxi Media, which produced Jiong Ma, will collaborate with ByteDance for six months in the first phrase. This includes Huanxi Media's authorization of ByteDance to broadcast its new films and Internet dramas simultaneously as Huanxi.com in authorized regions, and ByteDance's support in promotion and marketing of Huanxi Media's films and TV projects. In addition, Huanxi Media will offer ByteDance film and TV content for advertising and the right of authorship as coproducers for films of which Huanxi is the lead producer. The second phrase will entail jointly establishing a cinema channel and building Huanxi.com's streaming platform and producing and purchasing new media copyrights of film and TV content.

In response, Tencent Video and iQiyi collaboratively broadcast Fei Long Guo Jiang--a film that was scheduled to be shown in cinemas on Valentine's Day--for CNY 6 per view (CNY 12 per view for nonmembers). Given that iQiyi is loss-making and not supported by strong cash flow-generating platforms unlike Tencent, we think iQiyi will face more challenges compared with Tencent with the entrance of ByteDance into the online long video market. We think iQiyi may need to review its decision to increase subscription prices as a new competitor comes in.

Tencent Music Entertainment should also benefit from increased participation in online karaoke and music-centric livestreaming services. These are under the social entertainment services segment that is the profit driver for Tencent Music Entertainment. Nevertheless, we see offsets coming from reduced advertising revenue.

Netease’s Youdao education provided free online winter holiday classes for primary and secondary school students in Wuhan. Free spring online classes were offered to all primary and secondary school students nationwide. Youdao accounted for only 2% and 1% of Netease’s revenue and gross profit, respectively, in the third quarter of 2019. We believe these categories should see net positive benefits from the outbreak.

B2B Boosted by Working From Home The outbreak has led to the largest trial of some business-to-business products, such as online office tools and cloud services. Remote work tools such as Alibaba's DingTalk and Tencent's WeChat Enterprise crashed temporarily from the spike in traffic amid the outbreak. DingTalk saw 200 million people working from home on Feb. 3. DingTalk offered free solutions for working from home, including video conference, calendar sharing, and collaboration for tasks and documents. WeChat Enterprise increased the number of participants in an online meeting to 300 people, a feature that can allow teachers to livestream online classes, and students can use WeChat to attend classes. Tencent documents increased the capacity of participants filling out forms (which can be used to fill out health status for compiling statistics) to 7,000 and offered free membership. Parents and employees can send these forms to the teachers via WeChat. Many office tools are available for free, as this is a good opportunity to develop usage habits, which we think will accelerate the adoption of these services that Tencent and Alibaba offer.

On the other hand, we expect the online payment businesses of Tencent and Alibaba to take a hit due to reduced discretionary consumption, partially offset by a surge in payment for online services and staple products.

Recovery in Online Advertising Market Likely to Be Delayed We expect the long-awaited advertising spending recovery to be delayed as a result of reduced business demand for ads amid a weak economy, which will affect Weibo, Baidu, Tencent, Alibaba, JD, and Netease. Big sporting events such as the World Cup and Olympics tend to help Weibo and Baidu in terms of traffic, and the coronavirus outbreak doesn't bode well for revenue at this time because of contracted advertising budgets, in our view. Eight-eight percent of Weibo's revenue and 73% of Baidu's revenue came from advertising in the third quarter of 2019, making these companies potentially the most sensitive to drops in ad sales among the peers we cover.

However, we also think Weibo should see increased viewership traffic, including in the lower-tier cities, as people want to stay on top of the news regarding the outbreak. Weibo has a vertical focusing on the coronavirus under the recommendation tab, and the top searches are dominated by news related to the Wuhan pneumonia. Baidu’s app also has a vertical dedicated to fighting the coronavirus and a hot search vertical with the top news related to the outbreak. Nevertheless, we believe reduced advertising budgets are likely to more than offset the benefits brought by higher traffic for Weibo and Baidu.

To partially offset the impact, we think Weibo and Baidu can try to expand into verticals that are less affected, such as online services. We anticipate a surge in searches related to the coronavirus and related illnesses at Baidu, which could lead to higher conversion for some medical ads. However, we estimate that medical ads accounted for less than 20% of Baidu’s core advertising revenue, so overall impact might still be negative instead of positive for Baidu. In the long term, we expect new ad formats and ad budget shifts to online will remain intact. Another offsetting factor is that online advertising should gain share at the expense of offline advertising due to higher online traffic during the outbreak.

Trip.com Is the Largest Loser Amid the Outbreak Trip.com's results will be severely hit by this outbreak. The only potential upside is whether the company will be able to provide great customer experience that will enhance its brand image, which is hard to quantify. Travel product supply and demand have plunged to new lows. Many countries have implemented travel restrictions on those having been in China or coming from China. Individual visit schemes to Hong Kong and Macau, which accounted for 37% of China outbound tourists in the third quarter of 2019 according to the China Outbound Tourism Research Institute, were halted. The government suggested that all domestic and outbound tour groups be halted. Airlines have started to cancel flights to and from China.

As a result of the virus outbreak, Trip.com has implemented special cancellation policies for users. All hotels worldwide booked before Jan. 28 with an accommodation period from Jan. 22 to Feb. 29 will be refunded without charges. All flights purchased using the Ctrip app before Jan. 28 with a flight date after Jan. 28 can be refunded without charges based on the latest policies of the airlines. All domestic tour groups, individual visits, hotel accommodations, destination tickets, and customized travel products will be fully refunded if the reservation was made before Jan. 24 and the departure date is between Jan. 27 and Feb. 29. All costs of outbound tour groups other than visa fees and fees that are covered by insurance will be borne by Trip.com if the reservation was made before Jan. 24 and the departure date is between Jan. 27 and Feb. 29. Trip.com is still processing these cancellations.

Trip.com will need to absorb some losses in certain cases where travel providers such as airlines and hotels are unwilling to take the loss. We think Trip.com is at risk of meeting its targeted non-GAAP operating margin of 20% this year. But if the outbreak is contained quickly and travel demand rebounds, we think Trip.com will be able to meet the margin guidance in 2021.

CMGE Is the Short-Term Winner That Is Undervalued Currently No-moat CMGE, which has a very high uncertainty rating, is undervalued, in our opinion, mainly due to its strong near-term earnings growth profile. Exclusive licensing agreements with Tencent and ByteDance highlight the quality of CMGE's games and provide some earnings certainty in 2020. The investment of $20 million by Shengqu Technology into CMGE has led to the licensing of the World of Legend popular game IP for three years until August 2020. We think a renewal of the IP licensing agreement is very likely. World of Legend's game genre is Chuan Qi, which has a stable player base in China. We think the acquisition of Wenmai Hudong, which only focuses on the development of Chuan Qi type games should provide some earnings certainty for CMGE. Nevertheless, compared with gaming giants such as Tencent and Netease, the gaming ecosystem of CMGE is materially weaker, which gives us less confidence that revenue can be maintained at 2020's high level in the longer term. This uncertainty has been captured in our discounted cash flow model.

Wide-moat Tencent has an unrivaled network, with over 1.2 billion users and a very strong ecosystem. The number of mini programs on WeChat was over 2.3 million as of June 2019, more than tenfold that of the next leader, Alipay, according to QuestMobile. Tencent has achieved success with its international game expansion with PUBG mobile. We think Tencent has a competitive advantage in developing games based on its world-class gaming investees’ IPs for international gamers. Its famous IP League of Legends will launch its mobile MOBA game called Wild Rift for international gamers, and the popular Dungeon & Fighter will also launch its mobile game. Both launches are expected to occur this year, serving as catalysts. Advertising business in 2020 will see delayed recovery as a result of the epidemic. Looking long term, WeChat Moments’ ad load still has substantial room to grow from its current level of three units per day to eight, in our view. This is derived from our understanding that WeChat Moments has 750 million viewers per day and over 10 views per day in 2019. We also expect Tencent to reverse the previous trend of margin decline, helped by greater contribution from higher-margin game development for its overseas games. We expect online advertising margin will gradually increase, because higher-margin social and other advertising is expected to grow faster than media advertising. The financial technology and business services segment will gradually see reduced marketing expenses in the payment market as the market is closer to saturation, reducing expenses associated with reduced withdrawal from WeChat pay, a higher mix from higher-margin wealth management, and more value-added cloud products and services.

We think there is still room for wide-moat Alibaba’s e-commerce business to penetrate the lower-tier cities and rural areas. Management said the percentage of new users coming from less developed areas was a bit lower than 70% in the September quarter, which is still very high. Alibaba has launched a CNY 10 billion subsidy program in Juhuasuan to compete with Pinduoduo and JD.com in attracting new users. Engagement numbers across Tmall and Taobao (as measured by revenue per active buyer) continue to grow in the high teens as merchants better attract consumers through Alibaba’s unique targeted marketing, omnichannel solutions, and product development capabilities. We also expect increased adoption of 88VIP (Taobao’s membership platform) and the introduction of games, livestreaming, and interactive entertainment products such as Taobao points and Taobao Life to drive greater marketplace engagement over time and strengthen Alibaba’s broader network effect. We like Alibaba’s strong B2B genes and believe the company is poised to be a leader in the industrial Internet era. While management remains in investment mode with AliCloud, we expect this business unit to maintain its leadership position with China’s public cloud industry (with roughly 43% share as of the first quarter of fiscal 2020) while offering several new services to improve the company’s margin profile. We don’t think AliCloud will see the margin expansion that Amazon Web Services did because of competitors like Tencent. We believe differentiated or specialized offerings like data analytics tools (including the Alibaba Business Operating System platform designed to enhance physical retailers’ operations, but that can also be adopted across financial services, logistics, and transportation/local services), artificial intelligence, autonomous vehicles, and blockchain, offer new monetization opportunities for China enterprise customers.

Baidu and Trip.com Are Net Losers Amid the Outbreak We think wide-moat Baidu is undervalued. The completion of moving the landing pages, a recovery in macroeconomics, reduced growth in advertising inventory in the market, and the need to cut sales and marketing expenses on low return on investment should drive Baidu's earnings. We have seen some of this materializing. Baidu now expects year-over-year fourth-quarter revenue growth of 4%-6%, materially better than its previous guidance of negative 1% to 6%. This assumes that Baidu core revenue will grow 4%-6% year over year, an improvement from the previous guidance of 0%-6%. Baidu expects net income to shareholders of CNY 6.2 billion-6.7 billion, and net income attributable to Baidu core is expected to rise 83%-90% year over year. The company also expects non-GAAP net income attributable to Baidu of CNY 8.9 billion-9.4 billion, which assumes that non-GAAP net income attributable to Baidu core will grow 50%-55% year over year. As early as the third quarter last year, operating income was up from CNY 233 million to CNY 2.4 billion due to a 11% sequential decline in selling, general, and marketing expenses, operating leverage resulting from the 7% sequential increase in the top line, and a 5% sequential reduction in traffic acquisition costs. Also, red packets to users--a means of marketing-- during this Lunar New Year amounted to CNY 500 million versus CNY 1 billion in 2019, giving us more confidence that Baidu is more cost-conscious. However, with the epidemic, we expect the recovery will be delayed.

We think narrow-moat Trip.com is undervalued as well. Trip.com has been facing headwinds such as public relation scandals, weak macroeconomics, weak sentiment amid the trade war, Hong Kong protests, and China’s ban on individual travel to Taiwan, and we believe the epidemic will further delay its recovery. But we urge investors not to lose sight of its long-term potential. Trip.com is very dominant in outbound travel and the higher-end travel segment. Online travel penetration in China is roughly 20% currently versus over 50% in the United States and Europe. Only 10% of the Chinese population travels outbound currently. We think the company’s faster-growing higher-margin international business will raise the overall margin. International products have higher margins as the price is on average 2 times higher than domestic business, and the take rate for international air tickets is also higher than domestic by 2 times. Operating leverage will arise as both the outbound and domestic businesses make use of the domestic infrastructure that is already well established. After the epidemic, we think Trip.com should be able to meet its non-GAAP operating margin guidance of 20% for the full year.

/s3.amazonaws.com/arc-authors/morningstar/d90882b5-8d5f-450c-b98a-e427c19012df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d90882b5-8d5f-450c-b98a-e427c19012df.jpg)