After Earnings, Is Home Depot Stock a Buy, a Sell, or Fairly Valued?

After strong performance in Q2, here’s what we think of Home Depot stock.

Home Depot HD released its second-quarter earnings report on Aug. 15, before the market open. Here’s Morningstar’s take on Home Depot’s earnings and stock.

Key Morningstar Metrics for Home Depot

- Fair Value Estimate: $263

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

What We Thought of Home Depot’s Q2 Earnings

Strong Q2 performance: Fiscal 2023 second-quarter results came in stronger than our expectations, primarily due to a less prominent comparable store sales decline (of 2%) than we anticipated (3.5%). Still, overall macro conditions were in line with our expectations, as consumers shifted toward less-discretionary and lower-priced items/project needs, represented by depressed big-ticket transactions (purchases over $1,000), which declined 5.5%. It was encouraging to hear that the pro backlog remains above the historical average, signaling that the demand for home improvement remains solid despite the uncertain economic backdrop and consequent consumer sentiment.

Competitive edge remains intact: We see no reason to alter our long-term view of Home Depot. As it’s the leader in the North American home improvement market, with a market share in the high teens, we believe Home Depot’s competitive edge remains intact. This edge is supported by its brand cachet (characterized by its loyalty program, omnichannel capabilities, robust product offerings, and more) and scale-based low-cost position. We think Home Depot is a high-quality stock, boasting a wide moat and an Exemplary capital allocation rating, but its current share prices don’t offer compelling investment opportunities.

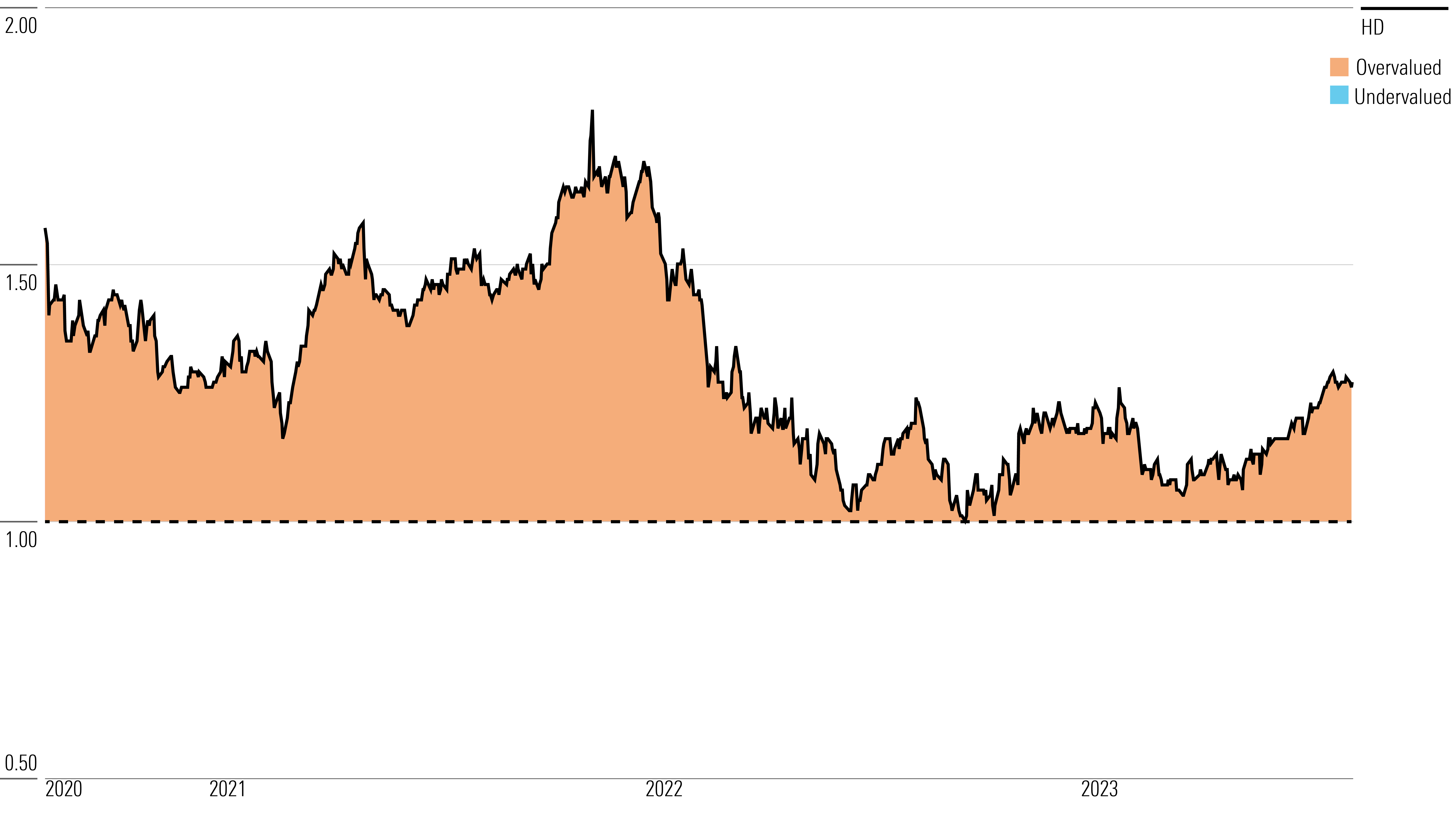

Wait to buy until shares are cheap: Home Depot stock rarely gets cheap; share prices remained north of our intrinsic valuation over the past five years. However, when it does, we’d highly suggest stocking up.

Home Depot Stock Price

Fair Value Estimate for Home Depot

With its 2-star rating, we believe Home Depot’s stock is overvalued compared with our long-term fair value estimate.

We have increased our fair value estimate for Home Depot to $263 per share from $259 to account for its better-than-expected second-quarter results. The firm’s $42.9 billion in revenue and $4.65 in diluted earnings per share outstripped our preprint estimates of $42.1 billion and $4.45, respectively. For fiscal 2023, we now expect $153 billion in sales, a 14.3% operating margin, and $15.32 EPS.

Given the maturity of the domestic home improvement industry, we expect demand to largely depend on changes in the real estate market, driven by prices, interest rates, turnover, and lending standards. We project 2.4% average sales growth over the next five years, supported by 2.0% average same-store sales increases, offerings like buying online with in-store pickup, and better merchandising.

In the longer term, we forecast gross margins to expand modestly over the next decade (by 10 basis points from 2022 levels to 33.6%) while the selling, general, and administrative expense ratio remains flattish (around 17%) as the firm capitalizes on its scale and supply chain improvement initiatives while investing to protect its market leadership. This leads to a terminal operating margin of 15.5%, higher than the 15.3% peak achieved in 2022.

Read more about Home Depot’s fair value estimate.

Home Depot Price/Fair Value

Economic Moat Rating

We assign Home Depot a wide economic moat. As the largest global home improvement retailer, we believe it possesses a competitive edge owing to its brand intangible asset and cost advantage.

Over the past 10 years, Home Depot’s sales growth has outpaced the 6.2% growth of the building materials and garden equipment and supplies dealer industry by 160 basis points annually. We surmise its strong brand equity and extensive scale should enable incremental market share gains in the highly fragmented $950 billion North American home improvement market, on top of the high-teens market share it has amassed thus far (given roughly $157 billion in sales in 2022).

Dissecting the components of its competitive prowess, we think Home Depot’s impressive same-store sales growth, which has averaged 7% over the past 10 years, suggests it has a brand intangible asset.

For one, we think the firm’s extensive product offerings and services have fostered brand loyalty. Home Depot moves 30,000-40,000 stock-keeping units in stores and 1 million units online, allowing consumers to save time and effort by visiting one shop for all of a project’s needs.

To continue to engage consumers and keep up with changing customer demand (for localization and personalization, for instance), Home Depot leverages consumer data, collaborates with suppliers, and conducts periodic merchandising resets to better refine its assortments. Apart from its trusted national brands, Home Depot holds eight private-label brands that primarily cater to its DIY customers, who tend to be brand agnostic. We think those brands not only allow broader product selection and brand positioning, but also provide margin benefits. (While not disclosed, we estimate private-label gross margins to be a few hundred basis points above those of national brands.) Additionally, Home Depot’s value-added services (including tools and trucks rental, installation, and remodeling) allow its wide range of consumers to smoothly embark on their projects.

In our opinion, it would be difficult for another retailer to enter the market and threaten Home Depot’s position, as smaller retailers would have a hard time building vendor relationships strong enough to undermine the company’s pricing prowess. While the threat of manufacturers creating their own retail network could jeopardize the availability of products in Home Depot’s retail channel, we doubt such an endeavor would be successful in the long term.

Read more about Home Depot’s moat rating.

Risk and Uncertainty

We give Home Depot a Medium Uncertainty Rating owing to its strong brand recognition, which has helped stabilize sales through the cycle. Its sales are largely driven by greater consumer willingness to spend on category goods, with stable existing-home price growth and decent turnover. In uncertain economic times, consumers remain in their homes and embark on improvement projects, which boosts do-it-yourself revenue. Alternatively, when home prices rise, the wealth effect generates a psychological boost to consumers, reinvigorating professional sales thanks to a higher willingness to spend on big projects. A diverse consumer base helps normalize revenue even in uneven times.

In our opinion, Home Depot has minimal environmental, social, and governance risk. Product sourcing, potential data theft, and consumer preference shift to sustainable products are relevant, but the firm should be able to adapt, and we do not see any material financial impact from these factors.

We believe the biggest risk is a slowdown in the real estate market, signaled by increased home inventories for sale, slower price growth, or higher mortgage rates (up about 170 basis points in the last 12 months).

Read more about Home Depot’s risk and uncertainty.

HD Bulls Say

- Home Depot’s continued investments in supply chain and merchandising should improve productivity and support its leading position in the home improvement market.

- The company has returned $70 billion to its shareholders through dividends and share buybacks over the past five years, above 20% of its market cap. In our outlook, we forecast Home Depot returning nearly $80 billion to shareholders over the next five years.

- The addressable maintenance, repairs, and operations market is around $100 billion, and Interline and HD Supply make up a low-double-digit share, leaving meaningful upside up for grabs.

HD Bears Say

- Weak consumer spending, higher interest rates, or an economic downturn could hinder sales for home improvement projects and affect Home Depot’s growth.

- IT and supply chain improvement gains could prove more challenging to achieve, as simpler efforts have already borne fruit. Further productivity efforts could face some implementation risks, creating inconsistent profitability.

- As home improvement demand normalizes, consumers could continue to shift discretionary spending into other discretionary categories, like leisure and restaurants.

This article was compiled by Saaketh Tirumala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)