After Earnings, Is General Electric Stock a Buy, a Sell, or Fairly Valued?

With strong aerospace demand and improving supply chain issues, here’s what we think of GE stock.

General Electric GE released its third-quarter earnings report on Oct. 24. Here’s Morningstar’s take on General Electric’s earnings and stock.

Key Morningstar Metrics for General Electric

- Fair Value Estimate: $123.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

What We Thought of General Electric’s Q3 Earnings

General Electric’s results materially beat our above-FactSet-consensus expectations thanks to commercial aerospace demand. Commercial aerospace shows no signs of material deceleration yet. GE’s total aerospace book/bill ratio remains at 1.2 times, which indicates continued strong demand for commercial engines and other aerospace-related products and services.

Supply chain issues have started to improve, as aerospace’s backlog burn rates have steadily moved higher on a sequential basis. The company is managing working capital, particularly inventory and receivables, better than expected.

Broadly, GE has begun delivering on CEO Larry Culp’s promise to drive greater “linearity” of free cash flow. We think investors should remain confident in Culp’s strategy and record of execution. Despite having room for additional operating improvements, results thus far demonstrate that GE is rapidly approaching what we’d classify as the midpoint of its lean transformation.

GE’s progress in onshore wind is another proof point. The firm won’t exit 2023 with full-year profitability for onshore wind, but that business should see a profitable second half. Not only has the grid business broken even this quarter (as it started to during last year’s fourth quarter), but it should also turn a profit for the full year. GE is on track to spin off GE Vernova (its power with renewables portfolio) at the beginning of the second quarter of 2024.

However, we don’t think the stock is attractive on an uncertainty-adjusted price-to-fair-value basis.

General Electric Stock Price

Fair Value Estimate for GE Stock

With its 3-star rating, we believe GE’s stock is fairly valued compared with our long-term fair value estimate.

We have lifted our fair value estimate to $123 per share from $118 following the firm’s excellent third quarter. Management increased its guidance for revenue, earnings, and free cash flow. Even so, we continue to model above both guidance and consensus on the strength of GE’s commercial aerospace business. We think GE Aerospace will trade for about $106 billion in equity value, while GE Vernova will trade for about $32 billion in equity value, based on our sum of the parts.

Commercial aerospace remains the most important driver of our valuation. Its fundamentals are still strong. Most of GE’s fleet of narrow-bodies have yet to see their first shop visits, and travel remains a continued priority in people’s budgets. Continued evidence of pent-up demand in strong backlog and order strength (1.2 book/bill ratio) gives us continued confidence that GE Aerospace’s revenue will grow at a mid-20s percentage in 2023 relative to 2022 results.

We believe Vernova will benefit from the energy transition at a top-line level, as well as from the Inflation Reduction Act. We expect its profitability will improve on better project selectivity, a focus on the North American market, and additional rightsizing. We expect that Power will maintain slightly over a 10% segment operating profit margin through the cycle, but that Renewables will only begin to profit in 2024, eventually reaching mid-single-digit operating margins. Eventually, we think Vernova is capable of delivering at the lower end of high-single-digit operating margins through the cycle.

Read more about General Electric’s fair value estimate.

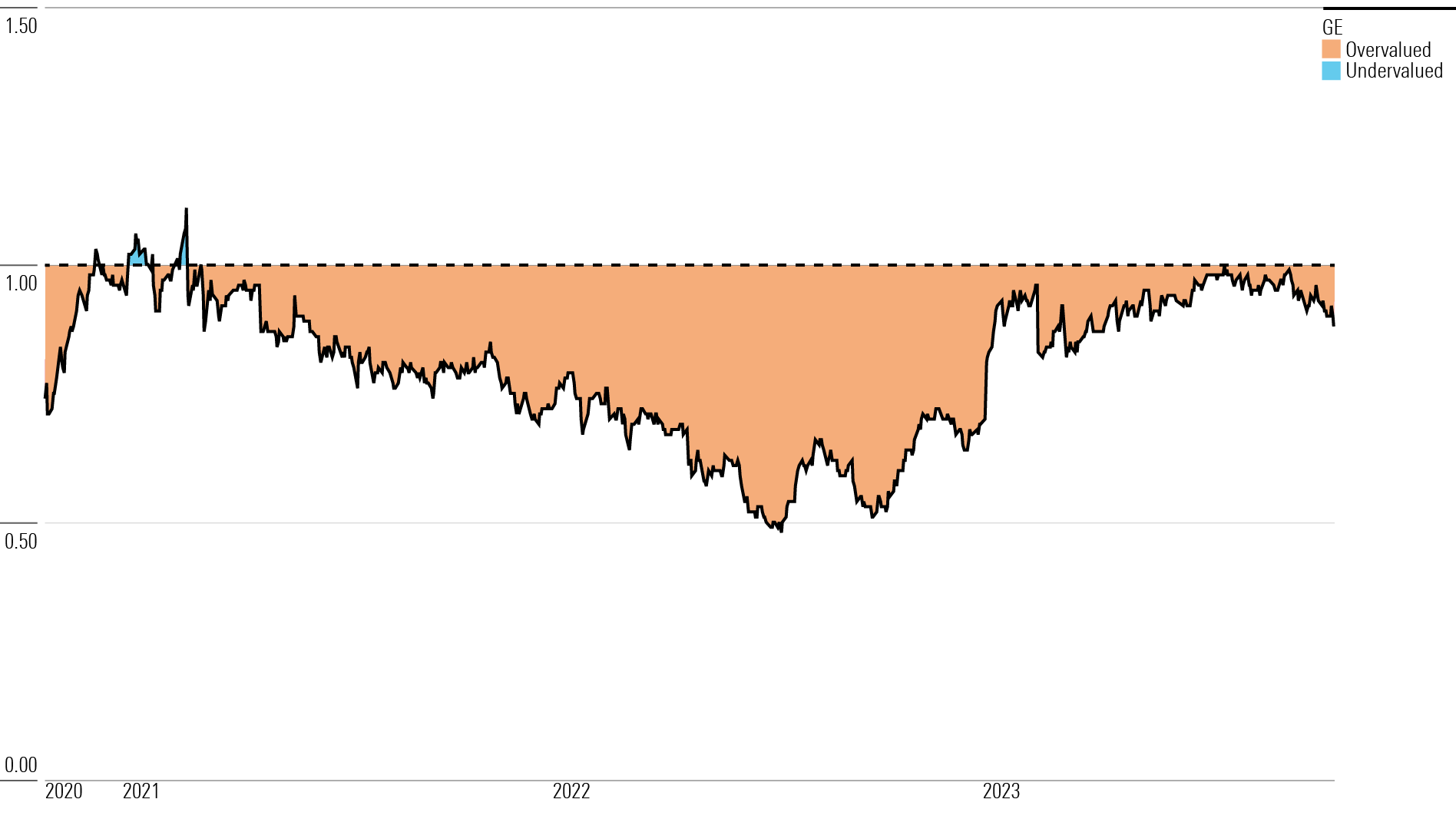

General Electric Historical Price/Fair Value Ratio

Economic Moat Rating

We assign GE a narrow moat based on its switching costs and intangible assets stemming from its massive installed base of industrial equipment and differentiated technology. We hold off on assigning a wide moat because of our lack of confidence in our 20-year hurdle rate for excess return on capital.

GE Aerospace meets our highest standard of a wide-moat business and is the company’s crown jewel. The segment benefits from intangible assets and switching costs, and we think it is the premier commercial engine manufacturer that can deliver at scale. GE competes in a virtual duopoly in both the wide-body (twin-aisle) and narrow-body (single-aisle) space against Rolls-Royce and Pratt & Whitney. Excluding its 50% interest in the CFM joint venture with Safran, we estimate that GE typically commands roughly half of the total commercial engine market, as measured by the installed base.

Outside Aerospace, GE’s competitive position fares far worse, with its other businesses facing secular pressure. GE Power faces pricing pressures and a shifting energy mix in its end markets toward renewables. Vernova has no moat. While Power operates in a three-way oligopolistic market with Siemens and Mitsubishi, GE Renewable Energy competes in a more fragmented industry (onshore wind revenue represents most of Renewable Energy’s portfolio).

Furthermore, GE was late to realize the transition from fossil fuels to renewables, which are predicted to compete subsidy-free from a levelized cost of electricity standpoint. GE Renewable Energy suffers from many of the same competitive dynamics that plague GE Power—including even greater price competition to gain market share and cheaper alternatives from other forms of energy, like solar—and depends heavily on production tax credits. As such, we don’t believe it has a durable competitive advantage.

Read more about General Electric’s moat rating.

Risk and Uncertainty

GE’s principal risk is related to the fallout of COVID-19 on its commercial aerospace business, including government interventions and acceleration of infections that ultimately affect both revenue passenger kilometers (demand) and load factors (utilization). Additional risks include GE’s significant cash burn amid pricing pressures in some of its operating businesses, including renewable energy, and its insurance liabilities (though they’ve been less of a concern in recent years, given rising interest rates).

From an environmental, social, and governance standpoint, we think GE faces a few risks that by now are well-known to investors, including government investigations into its accounting practices, shareholder lawsuits, potential embargoes from defense sales, and the impact of the global energy transition on GE’s gas and steam turbine business (though GE exited its new coal build business, and the energy transition mostly helps it with sales of renewables). However, we think the greatest ESG risk relates to fallout from the climate impact of aerospace engines, though we don’t think this is enough to be material, and we point out that GE is developing a next-generation sustainable engine within its CFM Rise program. The firm has also teamed up with NASA to develop hybrid electric engine technology to address climate issues. Given its technology leadership, we expect GE will remain ahead of its competitors, which should ameliorate investor concerns.

Read more about General Electric’s risk and uncertainty.

GE Bulls Say

- Bears vastly underestimate the incremental profits GE will make from operating leverage when commercial aerospace fully recovers, as well as the windfall from the Inflation Reduction Act.

- GE is led by, in our view, the premier U.S. multi-industry CEO. Culp has assembled a team of leaders who are steadily changing GE’s culture to one embracing lean principles.

- GE’s installed base boasts the youngest fleet, with nearly 50% of its CFM fleet yet to make its first shop visit. This bodes well for its high-margin aftermarket business.

GE Bears Say

- GE’s turnaround has a lot of unknowns, including when renewables will finally reach profitability and when the Inflation Reduction Act will move toward full implementation.

- While GE will generate orders from the energy transition, it has consistently made negative earnings from both Power and Renewables, and new equipment orders will only pressure and dilute margins further.

- Bulls vastly underestimate the amount of contingent liabilities GE will have to contend with.

This article was compiled by Adrian Teague

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)