After Earnings, Is Ford Stock a Buy, a Sell, or Fairly Valued?

Raising our fair value estimate slightly for the firm’s stock.

Ford Motor Co. F released its second-quarter earnings report on July 27. Here’s Morningstar’s take on Ford’s earnings and stock.

Key Morningstar Metrics for Ford

- Fair Value Estimate: $20.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: High

What We Thought of Ford’s Q2 Earnings

Battery electric vehicles (BEV): Good news was anticipated, given better volumes and the chance (if not expectation) of a guidance increase. That did happen, but the firm pushed back its 600,000 BEV production run rate to next year, and CEO Jim Farley sounds very flexible on the target of 2 million BEVs for 2026. This suggests the EV plans Ford talked about only a few months ago are now unlikely to manifest.

Ford did confirm its target of 8% for its Model e BEV segment in late 2026, which means the important midterm goal is still in place. However, the cadence and path of this plan have already changed unfavorably, hence the stock’s decline right after earnings. And the approximately $1.5 billion in Model e losses this year, to $4.5 billion, also does not help. But given pricing pressure for EVs and the lower volume than what was planned, more losses are understandable.

Ford Pro and in-vehicle services: Less-patient investors may give up, while patient ones will perhaps see the news as a large bump in the road but believe Ford is still on course. The second-generation BEVs coming once BlueOval City opens in a couple of years should bring the large extra volume and desirable pricing that the Model e needs. The dividend is still there for yield-focused investors, and the commercial vehicle segment (Ford Pro) had a phenomenal quarter, which suggests more good news for that business as the new Super Duty pickup gets more volume this year and Ford sells more in-vehicle services, which have a far higher gross margin than selling vehicles.

However, the day after earnings, Ford announced a large recall of the F-150. Ford’s same up-and-down story continues.

Ford’s potential: If Ford were to ever perform to its full potential, we think it could trade far above $20 when there are no large macroeconomic fears in the market, but we see the stock as requiring a lot of patience for now. We think Farley is the right person for the job, and we think that they are doing good things with BEVs, but visible results on all this investment will take a few more years to manifest.

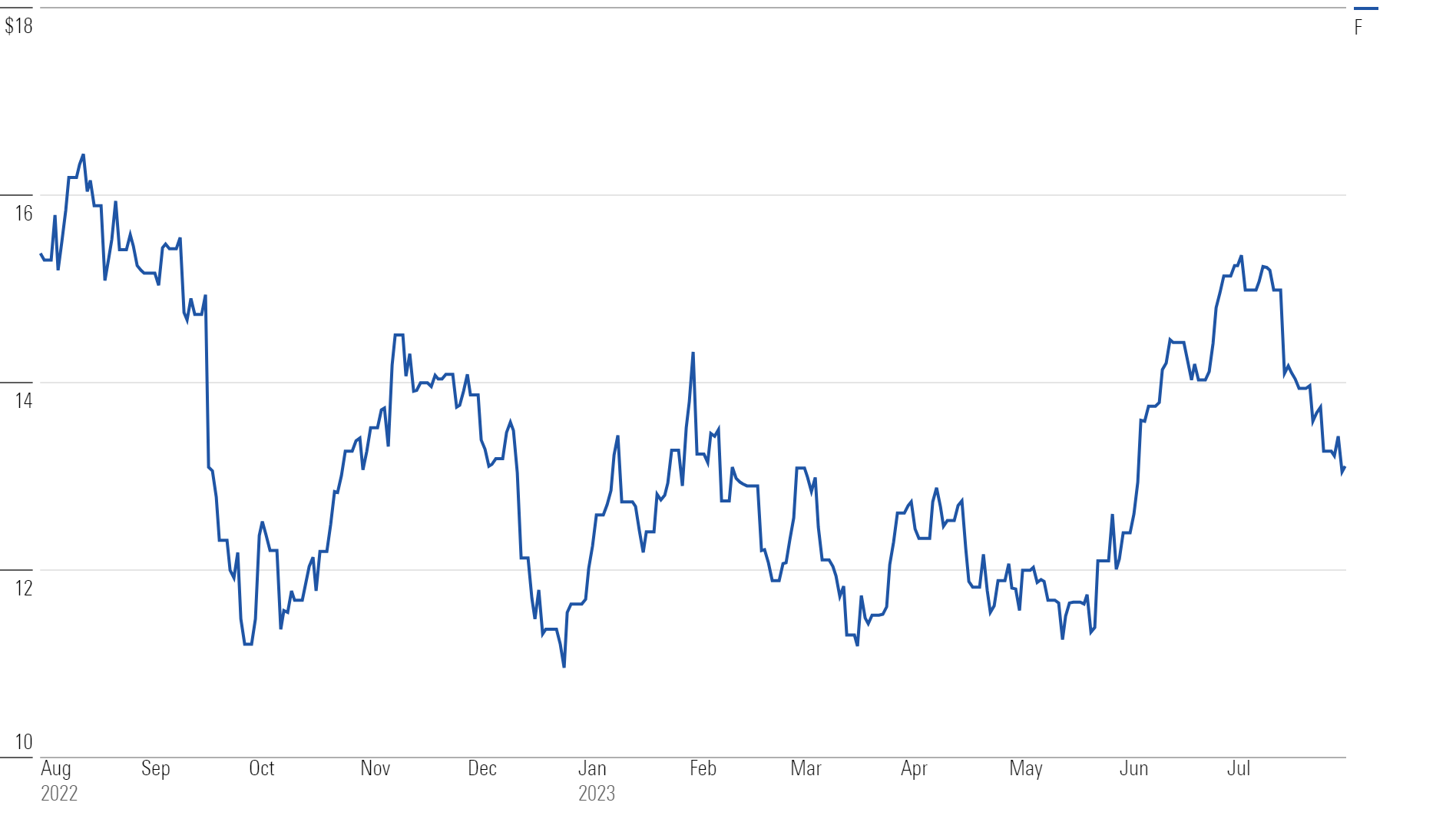

Ford Stock Price

Fair Value Estimate for Ford

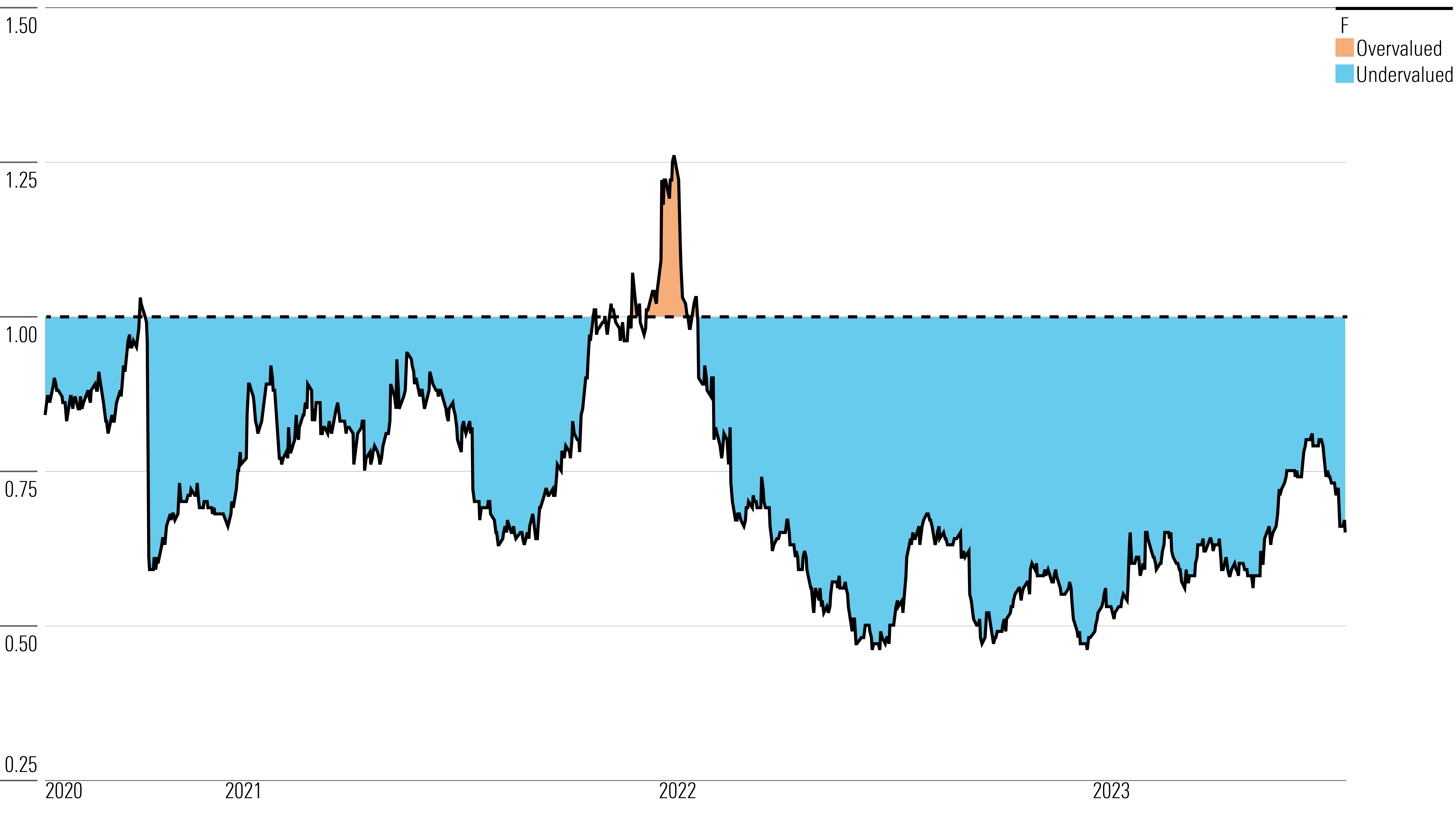

With its 4-star rating, we believe Ford’s stock is undervalued compared with our long-term fair value estimate.

We raised our fair value estimate to $20 per share from $19. The change is due to the time value of money and 2023 revenue progressing ahead of our prior model, so we now model about 11% more automotive revenue over our five-year explicit forecast period.

At Ford’s May 2023 analyst day, it announced a 2024 capital expenditure projection of $10 billion to $11 billion, up from as much as $9 billion in 2023. Before May, we were modeling $8 billion to $9 billion in capital expenditure annually for 2024-27, but since May we model $11 billion in 2024 and $10 billion in each of 2025-27. This 20.6% increase assumes capital expenditure after 2024 will remain close to 2024 levels to capture incremental spending needed in EVs and software as Ford transforms itself from a traditional automaker.

We think buying Ford’s stock may require investor patience for management to restructure the Ford Blue segment while scaling up the Ford Model e business. Most Model e segment scale may not occur until after the BlueOval City plant opens in Tennessee in 2025. Our midcycle total company EBIT margin number is nearly 7%. Ford introduced a 2026 target of 10% for the metric as part of separating the BEV business from the Ford Blue combustion business, but the company has said it is a target rate rather than an exit rate, so we keep our midcycle below 10%.

Read more about Ford’s fair value estimate.

Ford Historical Price/Fair Value Ratios

Economic Moat Rating

Ford does not have a moat, and we do not expect that to change. Vehicle manufacturing is a very capital-intensive business, but its barriers to entry are not as high as they were in the past. The industry is already full of strong competition, so it is nearly impossible for one firm to gain a durable advantage over another. Foreign automakers from China and India may soon enter developed markets such as the United States, and South Korea’s Hyundai and Kia have become formidable competitors, as has Tesla. Furthermore, the industry is so cyclical that in tough times even the best automakers cannot avoid large declines in return on invested capital and profit. Cost-cutting helps ease the pain, but it does not restore all lost profit.

Read more about Ford’s moat rating.

Risk and Uncertainty

Our Morningstar Uncertainty Rating for Ford is High.

The semiconductor shortage brings more uncertainty around recovery timing. Ford is spending $50 billion across 2022-26, betting consumers will switch to EVs. So much capital will be wasted if that adoption is too slow or if regulations change because not enough consumers make the switch. Barriers to entry are declining as a growing global market reduces fixed costs as a percentage of sales for new entrants. The company operates in a very cyclical industry, and there is massive uncertainty as to the timing and magnitude of demand recovery following COVID-19.

Macroeconomic conditions, rising interest rates, commodity prices, and trade agreement changes in key markets such as the U.S., Europe, and China can quickly derail management’s own plans and guidance, while significant disruption is on the horizon as vehicles become more high-tech and autonomous. Work stoppages are an inherent risk in contract years, but Ford’s union relationships have historically been better than GM’s. Farley’s success or failure as a CEO will only be known with time, but we are not worried.

Read more about Ford’s risk and uncertainty.

F Bulls Say

- Ford’s turnaround will take lots of time due to many restructuring projects around the world, but so far the international business seems to be getting better.

- Ford is focusing its investments where it gets the best return, which is why mostly exiting North American car segments and production in South America is the right move, in our opinion.

- Ford has tried to remove some administrative layers, and we like Farley’s aggressive moves into EVs, which the company was slow to adopt in the past.

F Bears Say

- The auto industry is very cyclical, and until recently, Detroit automakers had been losing significant U.S. market share to foreign automakers for years.

- Long-term profitability could be hindered by unions, which traditionally have wanted their share of the pie. The nonunionized import automakers in the U.S. do not have this problem.

- Ford’s stock can sell off heavily on macroeconomic fears, even if the company itself is doing well. Furthermore, it takes significant investment to fund growth in the auto industry, which limits potential margin expansion.

This article was compiled by Monit Khandwala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BMLHJZFOLJB3LP2IRVCCSTLZ6U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BSRZNDBL4JAMFPI4JSGK4QGDF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)