After Earnings, Is Apple Stock a Buy, a Sell, or Fairly Valued?

With steady iPhone sales, here’s what we think of Apple stock.

Apple AAPL released its third-quarter earnings report on Nov. 2. Here’s Morningstar’s take on Apple’s earnings and the outlook for its stock.

Key Morningstar Metrics for Apple

- Fair Value Estimate: $150.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Apple’s Q3 Earnings

- Apple’s third-quarter earnings were about what was expected. Revenue guidance was a little light versus FactSet Consensus estimates, but not materially so. The iPhone 15 series won’t be an iPhone super cycle, but it also doesn’t look like it will be an especially weak cycle unless the global economy gets materially worse from here. Gross margins were the bright spot, with favorable pricing on the supply of memory chips, Apple seeing the benefits of its in-house processors for the Mac, and services rising as a percent of the total mix.

- For optimistic investors, the services revenue growth and gross margin expansion are the highlights. We don’t foresee massive topline growth for Apple in the years ahead, as the smartphone market has matured and the iPhone is such a large percentage of revenue. This is why we don’t rate Apple stock 4 or 5 stars. But Apple should fare better on the bottom line with some margin expansion, and the quarterly results and guidance support that thesis.

- Revenue in the September quarter was $89.5 billion, down 1% year over year but up 9% sequentially. iPhone revenue of $43.8 billion was in line with our expectations, and we view it as a good sign that demand for the iPhone 15 series will be resilient this year, albeit within a shaky macroeconomic environment. Services revenue of $22.3 billion was impressive, up 16% year over year, as the company continues to capture more paid subscribers and monetize the benefits of the iOS ecosystem by upselling more apps and services to its customers. Gross margin was also terrific at a record high of 45.2%, ahead of guidance, thanks to a favorable cost environment for components (likely memory chips). We also think Apple is reaping some cost benefits from deploying its in-house processors within iPhones, iPads, and more recently Macs.

- Apple’s revenue guidance for the December quarter had a couple of moving parts, but in total, it should be flattish year over year. iPad and wearables revenue should be down significantly due to the timing of new product launches versus the same period a year ago. iPhone revenue should be up modestly, Mac revenue should be up nicely (again due to product launch timing), and services should be a fast-growing segment. Gross margin guidance of 45%-46% is exciting, although we attribute it more to product mix and a lower proportion of sales of lower-margin iPads and Wearables. Overall, we remain impressed with Apple’s innovation, particularly with the upcoming Vision Pro.

Apple Stock Price

Fair Value Estimate for Apple

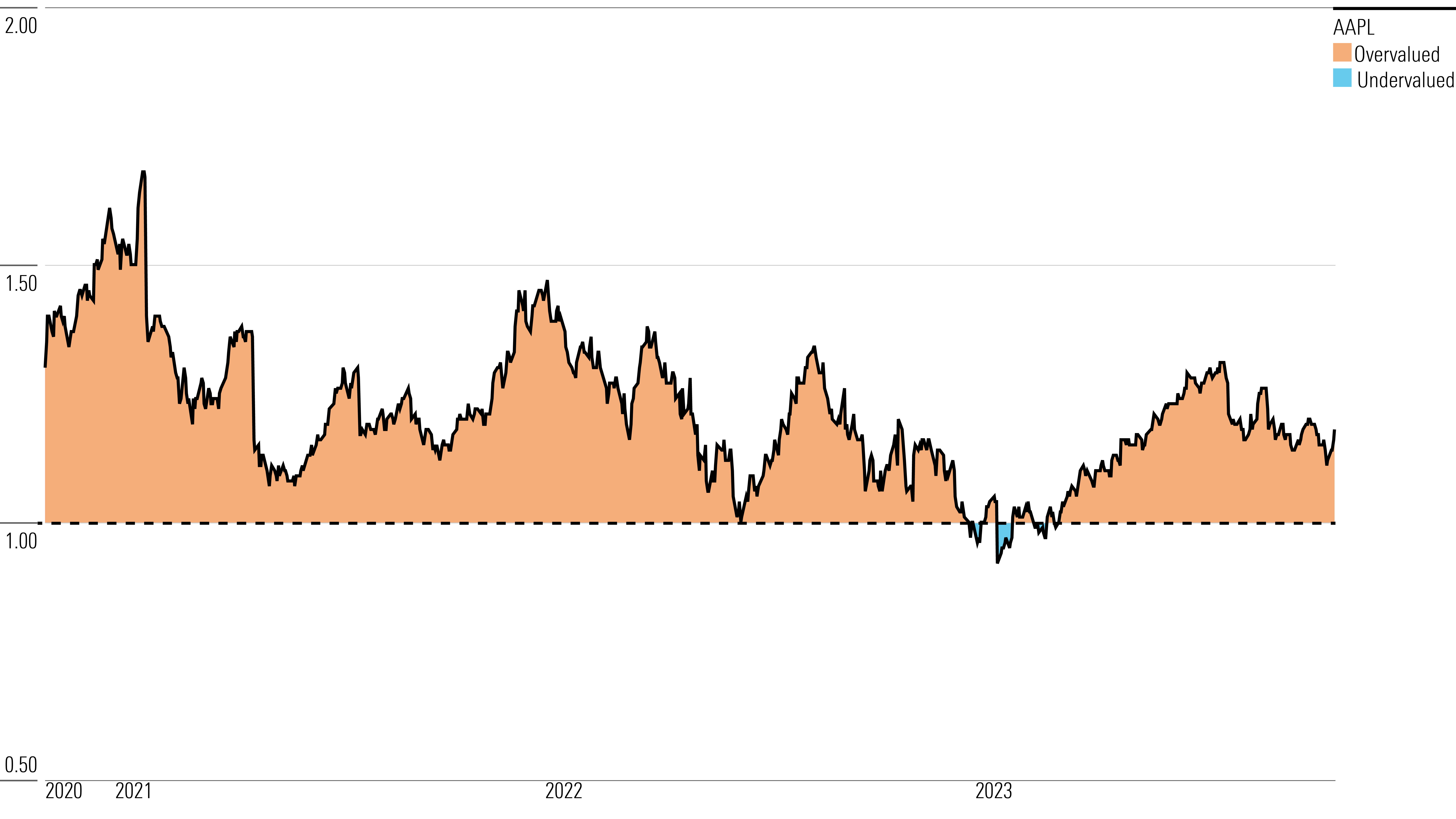

With its 2-star rating, we believe Apple’s stock is overvalued compared with our long-term fair value estimate.

Our fair value estimate for Apple stock is $150 per share. This estimate implies a fiscal 2023 (ended September 2023) GAAP price/earnings ratio of 25 times. In fiscal 2023, we expect total revenue to be down 2%, as services growth and flat wearable revenue will be offset by modest declines in iPhone and iPad revenue and a sharp drop in Mac revenue. We view the iPhone, iPad, and Mac revenue declines as reasonable following multiple strong years associated with work- and learning-from-home trends owing to COVID-19.

By product, we model iPhone revenue at a 3% compound annual growth rate over the next five years, with such growth coming off a strong fiscal 2022, again because of a spike in sales during COVID-19. We anticipate low-single-digit growth in both iPhone unit sales and iPhone average selling prices over our forecast period. We anticipate flat CAGRs for both iPad and Mac revenue, again off a strong base in fiscal 2022. We expect services to grow at a 6.5% CAGR over the next five years as iOS users buy more and more of the firm’s services like Apple TV+, Apple Music, and so on.

We model Apple’s wearables, home, and accessories segment to grow at a 17% CAGR over the next five years. We anticipate strong growth in Apple Watches and AirPods in the years ahead, while also anticipating the launch of an AR/VR headset over the next five years. Our fair value estimate assumes a launch with minimal revenue in fiscal 2024, but growing to an $11 billion business by fiscal 2027.

We expect gross margins to remain in the 42%-43% range, thanks to Apple’s exceptional premium pricing strategy and stable iPhone margins. We anticipate product gross margins tracking in the mid-30% range and services gross margins hovering a little over 70%. Although we think the higher-margin services segment will grow nicely, we foresee lower-margin other products, such as the Apple Watch, serving as an offset. We expect operating margins to remain around 30% over our five-year forecast period.

Read more about Apple’s fair value estimate.

Apple Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Apple a wide economic moat, stemming from its combination of switching costs, intangible assets, and the network effects associated with its iOS ecosystem. Combined with an asset-light business model, we think it is nearly certain that Apple will generate excess returns on capital over the next decade and more likely than not over the next 20 years.

We think Apple’s primary moat source is its high customer switching costs, based on a variety of aspects of its hardware, software, and services. First, we think about the risk of customers moving away from today’s electronic devices, such as smartphones. We view the smartphone as the most essential computing device for users, and despite innovations in other types of electronic devices like smart speakers, AR/VR headsets, and the Internet of Things, we don’t see the smartphone going away anytime soon. Apple’s iPhone fostered the industry and has maintained its position as the premier smartphone, and we expect the firm to increasingly monetize its valuable installed base with the iPhone as the catalyst.

Beyond the iPhone, Apple’s other key hardware products such as the iPad, Mac, Apple Watch, and AirPods each fill a computing niche that enhances the experience of the user. We do not foresee Apple’s primary electronic devices (smartphones, tablets, PCs, wearables, and “hearables”) becoming irrelevant. Perhaps the stickiest aspect of the iPhone is the integration of iOS across multiple devices. Ancillary products (including the iPad, Mac, Watch, and AirPods) lose significant functionality when paired with a smartphone other than the iPhone. Furthermore, if an iPhone user were to switch to an Android device, they would lose significant functionality with other iOS users.

Beyond switching costs, we believe Apple’s expertise in hardware, software, semiconductors, and services represents an intangible asset that even the strongest tech firms have struggled to replicate. While the Android cohort has replicated a similar feel of apps, app stores, and integrated experience, we have not seen third parties within the Android ecosystem work well enough together to deliver devices and services that are clearly superior to Apple’s. Apple’s intangible assets in hardware, software, services, and chip design give us confidence that the company is unlikely to be left too far behind if any revolutionary technology were to emerge.

Read more about Apple’s moat rating.

Risk and Uncertainty

We assign Apple a High Uncertainty Rating. As the largest firm in the world, it is prone to material competition. Consumer hardware is inherently vulnerable to cutthroat competition, since short product cycles and customers hungry for ever-superior features make it difficult to maintain market leadership. Although Apple has done well with its walled garden approach, the firm competes with Chinese original equipment manufacturers and Samsung across all tiers.

We also suspect that many customers are holding on to their phones longer than before, as premium devices are more than good enough for today’s needs (web browsing, streaming, and social media). Analogous to the decline of PCs, Apple faces the possibility of smartphone unit stagnation or even declines once emerging markets saturate or consumers gravitate to midtier devices. Should it be unable to innovate, Apple may lose its ability to charge premium prices for hardware that is no longer unique relative to devices from competitors.

Read more about Apple’s risk and uncertainty.

AAPL Bulls Say

- Between greater smartphone penetration in emerging markets and repeat sales to current customers, Apple has plenty of opportunity to reap the rewards of its iPhone business.

- The iPhone and the iOS operating system have consistently been rated at the head of the pack in terms of customer loyalty, engagement, and security, which bodes well for long-term customer retention.

- We think Apple is still innovating with its introductions of Apple Pay, Apple Watch, Apple TV, and AirPods. Each of these could drive incremental revenue, but more crucially help retain iPhone users over time.

AAPL Bears Say

- Apple’s decisions to maintain a premium pricing strategy may help fend off gross margin compression but could limit unit sales growth, as devices may be unaffordable for many customers.

- If Apple were to ever launch a buggy software update or subpar services, it could diminish the firm’s reputation for building products that “just work.”

- Apple is believed to be behind firms like Google and Amazon in artificial intelligence development (notably Siri voice recognition), which could be problematic as tech firms look to integrate AI to deliver premium services.

This article was compiled by Brendan Donahue.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)