After Earnings, Is Apple Stock a Buy, a Sell, or Fairly Valued?

As services grew amid macroeconomic pressures and an overall slight revenue decline, here’s what we think of Apple stock.

Apple AAPL released its third-quarter earnings report on Aug. 3, after the market close. Here’s Morningstar’s take on Apple’s earnings and stock.

Key Morningstar Metrics for Apple

- Fair Value Estimate: $150

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Apple’s Q3 Earnings

Apple’s results came in as expected. The business faced some currency headwinds and macroeconomic pressures, but it was still in better shape than many of its peers. Services growth was quite nice.

We think the earnings highlighted some of our valuation concerns with Apple. It trades at a relatively high price/earnings multiple, yet it isn’t in a high-growth phase. Though services grew nicely, the entire business saw a 1% revenue decline as reported, and would have seen only modest growth in constant-currency terms.

Apple Stock Price

Fair Value Estimate for Apple

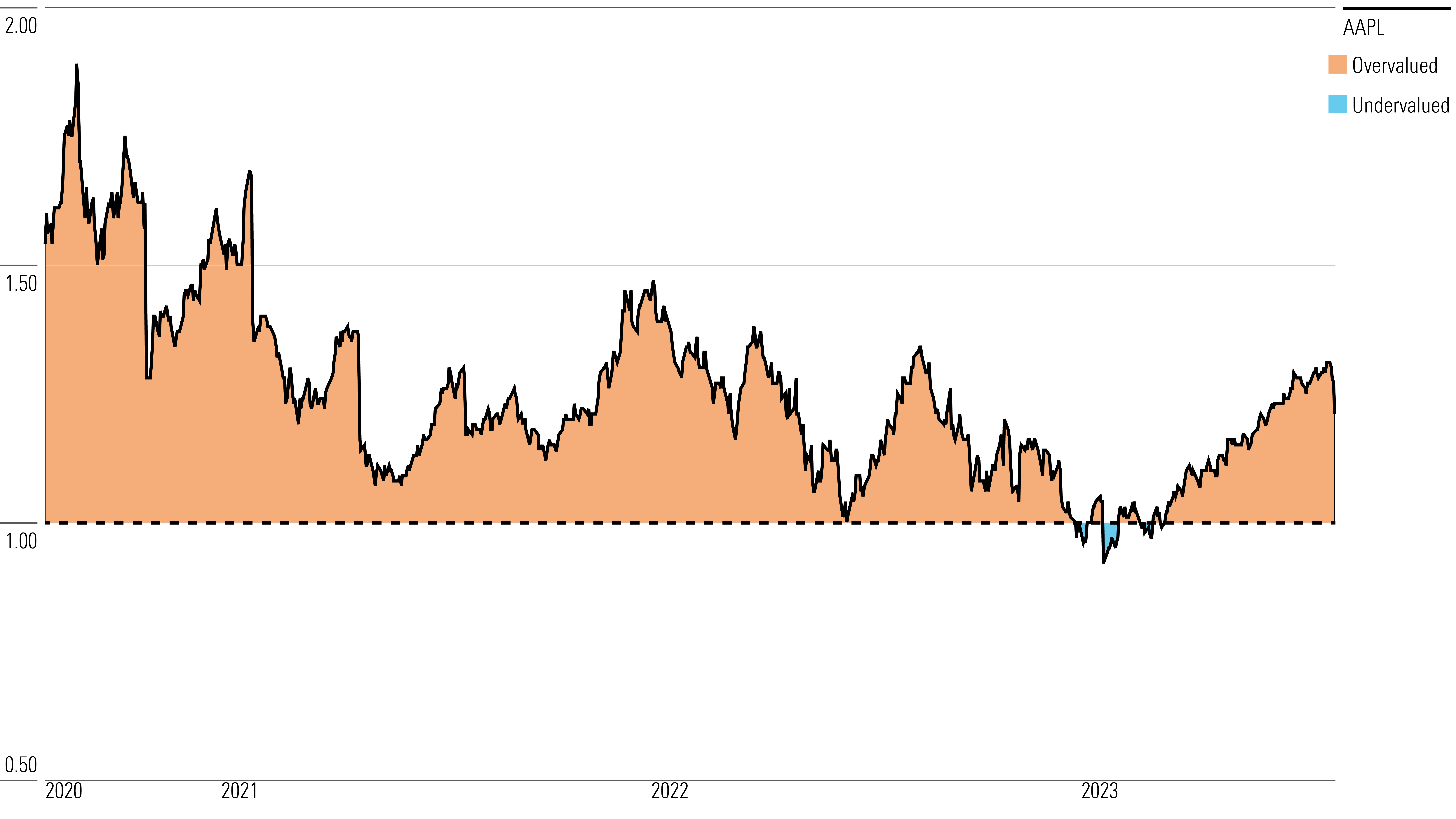

With its 2-star rating, we believe Apple’s stock is overvalued compared with our long-term fair value estimate.

Our fair value estimate is $150 per share. Our estimate implies a fiscal 2023 (ending September 2023) price/earnings ratio of 25 times. In fiscal 2023, we expect total revenue to be down 2%, as services growth and flattish wearable revenue will be offset by modest declines in iPhone and iPad revenue and a sharp drop in Mac revenue. We view these declines as reasonable, coming after multiple strong years due to trends in working and learning from home caused by the COVID-19 pandemic.

We model iPhone revenue growth at a 3% compound annual growth rate, or CAGR, over the next five years, coming off a strong fiscal 2022 (again because of a COVID-19-induced spike in sales). We anticipate low-single-digit growth in both iPhone unit sales and iPhone average selling prices over our forecast period. We anticipate flattish CAGRs in both iPad and Mac revenue, again off a strong base in fiscal 2022. We expect services to grow at a 6.5% CAGR over the next five years, as iOS users buy more of the firm’s services like Apple TV+, Apple Music, and so on. We model Apple’s wearables, home, and accessories segment to grow at a 17% CAGR over the next five years. We anticipate strong growth in watches and AirPods in the years ahead, as well as the launch of an augmented/virtual reality headset over the next five years. Our fair value estimate assumes the product launches with minimal revenue in fiscal 2024 but grows to an $11 billion business by fiscal 2027.

Read more about Apple’s fair value estimate.

Apple Price/Fair Value

Economic Moat Rating

We assign Apple a wide economic moat rating because of its combination of switching costs, intangible assets, and network effects associated with its iOS ecosystem. Combined with the company’s asset-light business model, we think it is nearly certain that Apple will generate excess returns on capital over the next decade and more likely than not over the next 20 years.

We think Apple’s primary moat source stems from high customer switching costs, based on a variety of aspects of its hardware, software, and services. First, we think about the risk of customers moving away from today’s electronic devices, such as smartphones. Despite innovations in smart speakers, AR/VR headsets, and the Internet of Things, we don’t see the smartphone going away anytime soon. The smartphone has already replaced a host of standalone electronic devices (cameras, MP3 players, portable game consoles, etc.) while emerging as the primary portal with an intuitive interface for many other digital services (email, books, web browsing, shopping, social media, videos, and more) in a pocket-sized form factor. Apple’s iPhone fostered the industry and has maintained its position as the premier smartphone. We expect the firm to increasingly monetize its valuable installed base, with the iPhone as the catalyst.

Perhaps the stickiest aspect of the iPhone is the integration of iOS across multiple devices. Users of ancillary products—including the iPad, Mac, Watch, and AirPods—lose significant functionality when pairing those products with competitors’ smartphones. An iMessage will show up on one customer’s iPhone, iPad, Mac, and Watch. We do not believe these other hardware products are wide-moat businesses on their own, but together with the iPhone, they create a formidable customer lock-in. Wearables such as AirPods and the Apple Watch have also disrupted their respective predecessor industries and have created another expensive hook to keep customers tied to Apple’s ecosystem. Apple’s active installed base (iPhone, Mac, and iPad) reached 1.8 billion at the end of 2021—up 9% from a year prior—highlighting the growing adoption of multiple iOS products by individuals.

Network effects represent another source of Apple’s wide moat. As iOS users gravitate to the App Store, Apple’s increasing installed base attracts further developers to build new apps for iOS. Apple’s integration of hardware and software also supports its developer networks, as Apple knows iOS will be loaded onto only a handful of screen sizes or iPhone models, versus the hundreds of devices and manufacturers that support Android. This leads to a more fragmented Android ecosystem, which we believe is relatively harder for developers to support. Apple consistently touts that the majority of its user base is on its latest operating system, which in turn allows developers to build for the latest version of iOS and know their apps are optimized for most of the company’s users.

We don’t foresee Apple’s user base scaling its walled garden anytime soon. We believe switching costs from iOS are as strong as ever thanks to more auxiliary products and services and greater inertia for users, making switching away from iOS more difficult over time. Regarding intangible assets, Apple’s differentiated user experience via iOS, along with its expertise in hardware, software, and now semiconductor design, together allow the firm to build vertically integrated products more seamlessly. We also see network effects around iOS and its 1 billion-plus installed base, with new app development favoring iOS. Going forward, we expect Apple to better monetize its captive user base via supplemental products and services that will evolve into a more robust recurring revenue stream. We see no other technology titan with comparable expertise across consumer hardware, software, services, and chip design.

Read more about insert Apple’s moat rating.

Risk and Uncertainty

We assign Apple a High Morningstar Uncertainty Rating. As the largest firm in the world, Apple is prone to material competition. Consumer hardware is inherently inclined toward cutthroat competition, as short product cycles and customers hungry for ever-superior features make it difficult to maintain market leadership. Although Apple has done well with its walled garden approach, the firm competes with Chinese original equipment manufacturers and Samsung across all tiers.

We also suspect that many customers are holding on to their phones for longer than before, as premium devices are more than good enough for today’s needs (web browsing, streaming, social media). Analogous to the decline of PCs, Apple faces the possibility of smartphone unit stagnation or even declines once emerging markets saturate or consumers gravitate to mid-tier devices. Should it be unable to innovate, Apple may lose its ability to charge premium prices for hardware that is no longer unique relative to competitor devices.

Some peers are willing to essentially sell hardware at cost to drive market share and stickiness in other business segments. A notable example is Amazon, which uses its Echo smart speaker, Fire TV, Prime Music, and Prime Video to attract and retain Prime customers. Should these devices/services supersede their iOS counterparts, Apple’s products may be at risk. A recent focus on AI assistants, such as Google Assistant and Amazon Alexa, has also put pressure on Apple’s Siri, which has fallen behind its peers in efficacy.

Read more about Apple’s risk and uncertainty.

AAPL Bulls Say

- Between greater smartphone penetration in emerging markets and repeat sales to current customers, Apple has plenty of opportunity to reap the rewards of its iPhone business.

- The iPhone and iOS have consistently been rated at the head of the pack in terms of customer loyalty, engagement, and security, which bodes well for long-term customer retention.

- We think Apple is still innovating with its introductions of Apple Pay, Apple Watch, Apple TV, and AirPods. Each of these could drive incremental revenue, but more crucially, they could help retain iPhone users over time.

AAPL Bears Say

- Apple’s decision to maintain a premium pricing strategy may help fend off gross margin compression, but it could also limit unit sales growth, as devices may be unaffordable for many customers.

- If Apple were to ever launch a buggy software update or subpar services, it could diminish the firm’s reputation for building products that “just work.”

- Apple is believed to be behind firms like Google and Amazon when it comes to artificial intelligence development (notably Siri voice recognition). This could be problematic as tech firms look to integrate AI when delivering premium services.

This article was compiled by Saaketh Tirumala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)