After Earnings, Is AMD Stock a Buy, a Sell, or Fairly Valued?

With a solid Q3 and plans to increase presence in the AI accelerator market, here’s what we think of AMD stock.

Advanced Micro Devices AMD released its third-quarter earnings report on Oct. 31. Here’s Morningstar’s take on AMD’s earnings and the outlook for its stock.

Key Morningstar Metrics for AMD

- Fair Value Estimate: $125.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

What We Thought of AMD’s Q3 Earnings

- AMD’s third-quarter results were solid, but its fourth-quarter outlook was a bit light. However, this was mostly due to the firm’s embedded business. While profitable and important, that isn’t in the limelight in comparison to AMD’s AI chip prospects. We’re encouraged that AMD provided investors with a target of AI accelerator revenue “in excess of $2 billion” for 2024.

- We think investors own AMD because of the high potential that it will emerge as a second source of AI accelerator chips, such as those used in data center GPUs. AMD’s target of more than $2 billion of revenue next year puts the firm on track to be the #2 merchant supplier. Intel INTC has aspirations to get there too, while Amazon AMZN, Alphabet GOOGL, and others will also use in-house chips, but we think the quarterly results have AMD off to the right start in AI.

- Given the massive size of the AI accelerator market (which AMD expects to be $150 billion in 2027 versus virtually nothing a few years ago), AMD doesn’t need to carve out a huge portion of the market to justify upside to the stock. Just 10% of this market would be very significant to AMD’s valuation.

Advanced Micro Devices Stock Price

Fair Value Estimate for AMD

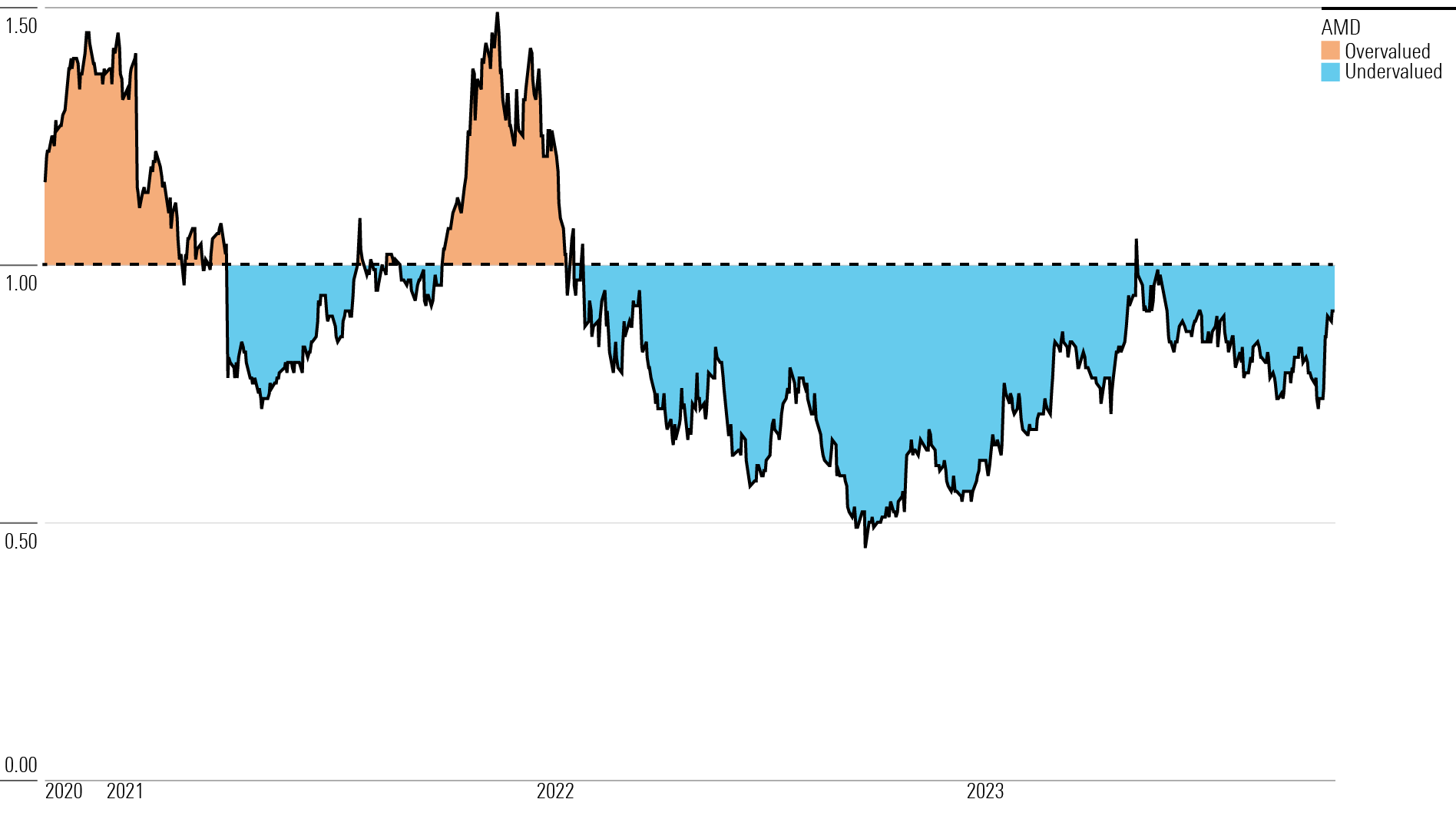

With its 3-star rating, we believe AMD’s stock is fairly valued compared with our long-term fair value estimate. Our fair value estimate for AMD is $125 per share, which implies a 2023 and 2024 adjusted price/earnings ratio of 48 times and 32 times, respectively, and a 0.6% free cash flow yield.

We are most bullish on AMD’s data center segment, for which the firm foresees a $150 billion total available market for AI accelerators by 2027. We think AMD can carve out a decent portion of this market over time. Over the next five years, we model the firm’s data center revenue growing at a 30% CAGR, even ahead of its target from June 2022 of 20% (albeit before the launch of ChatGPT and the exponential boom in AI GPU spending). In turn, we model data center revenue rising from $1.7 billion in 2020 and $6.0 billion in 2022 to just over $10.0 billion in 2024 and exceeding $22.0 billion in 2027.

In Client revenue (that is, PC CPUs), we model a 0% CAGR over the next five years, as the sharp decline in 2023 will be offset by 7% average growth over the subsequent four years. AMD prospered from the remote working trend during COVID-19, with Client revenue peaking at $6.9 billion in 2021, followed by $6.2 billion in 2022. We anticipate that client revenue will fall 24% in 2023 to $4.7 billion, consistent with the sharp pause in PC demand after the pandemic. However, we foresee a rebound to $6.1 billion in 2027, thanks to a rebound in PC demand and some modest share gains over Intel.

Read more about AMD’s fair value estimate.

AMD Historical Price/Fair Value Ratio

Economic Moat Rating

We assign AMD a narrow economic moat based on intangible assets around a variety of chip designs (including those from Xilinx, which we rated as having a narrow moat prior to AMD acquiring it in 2022). We think it is more likely than not that the firm will generate excess returns on capital over the next 10 years, and perhaps even longer.

AMD is perhaps best known for its CPUs for PC desktops and notebooks within its client business segment. We think that AMD has a moat not only because of chip design expertise honed over decades but also because it’s one of two prominent firms to hold an x86 instruction set architecture license. For many years, effectively all PC software (including Microsoft’s MSFT Windows, Apple’s AAPL Mac operating systems, and any desktop software applications running on both operating systems) was designed for the x86 architecture. Today, however, Apple has already done the heavy lifting of converting its Mac software to ARM and has now built excellent in-house processors for its Mac lineup.

Further, an increasing portion of software is hosted in the cloud and can run on multiple operating systems, and isn’t tied only to x86 devices. Microsoft has dabbled in ARM-based versions of Windows and may increase these investments over time. Thus, we don’t think the x86 architecture is as moaty as it once was, although we still foresee x86-based processors from Intel and AMD as making up a significant portion of the PC market for the next several years.

In server CPUs within AMD’s Data Center segment, we see similar dynamics wherein most of the software is based on x86, and we think AMD has a moat in this segment too.

Looking ahead, we think AMD’s GPU expertise is becoming increasingly valuable in AI applications. GPUs perform parallel processing, in contrast to the serial processing performed by CPUs to run the software and applications on PCs, and so on in the past decade, the parallel processing of GPUs was found to more efficiently run the matrix multiplication algorithms needed to power artificial intelligence models. AMD is working diligently to deliver AI-centric GPUs to market.

Read more about AMD’s moat rating.

Risk and Uncertainty

We assign AMD a Morningstar Uncertainty Rating of High. The company sees a massive opportunity to gain share in GPUs targeting AI applications, but we view Nvidia NVDA as a clear leader here, with a wide economic moat not only in hardware design but also in software tools. Even if AMD’s GPU designs are up to par (or better), we view the associated software tools as a hurdle, with AMD needing to catch up to Nvidia. Further, we expect leading hyperscale cloud computing customers to continue to invest in AI processors. Google’s TPUs and Amazon’s Trainium and Inferentia chips were designed with AI workloads in mind, while Microsoft and Meta Platforms META have announced semiconductor design plans.

In PCs, AMD continues to square off against Intel—which, formerly the dominant market leader, has lost its manufacturing edge in recent years. If Intel can regain its manufacturing lead (it hopes to do so by 2025), AMD will face a more formidable x86 foe.

AMD’s gaming business often faces boom-or-bust cycles along with PC demand and, more recently, the sharp rise and fall of cryptocurrency mining. AMD also has customer concentration in its semi-custom business. It supplies processors into both Sony’s PlayStation and Microsoft’s Xbox, and it would be a blow to the firm if it were to miss out on either of these sockets in the next console cycle.

Read more about AMD’s risk and uncertainty.

AMD Bulls Say

- AMD has gained market share in the PC CPU market as Intel’s manufacturing prowess has hit road bumps in recent years.

- AMD’s partnership with chip manufacturing leader Taiwan Semiconductor TSM and its adoption of a chiplet manufacturing strategy has allowed it to come to market with more formidable products and greater flexibility to bring new products to market quickly.

- AI offers a massive opportunity to GPU makers, and while AMD lags industry leader Nvidia, we see plenty of room in the market for GPU alternatives like AMD’s products.

AMD Bears Say

- Despite AMD’s recent share gains, Intel remains the industry leader in PC CPUs, and the firm might recapture the vast majority of the market if it can once again deliver industry-leading manufacturing capabilities.

- AMD will need to improve its software capabilities to make a dent in Nvidia’s AI dominance, as Nvidia is strong not only in GPUs but also in associated AI software tools.

- AMD’s semi-custom gaming chip business is beholden to the design cycles and launches of new consoles, and it will be years before the next-generation consoles arrive.

This article was compiled by Adrian Teague

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)