After Earnings, Is Amazon Stock a Buy, a Sell, or Fairly Valued?

With good Q3 results and strong guidance, here’s what we think of Amazon’s stock.

Amazon.com AMZN reported earnings on Oct. 26. Here is Morningstar’s take on Amazon’s earnings and the outlook for its stock.

Key Morningstar Metrics for Amazon

- Fair Value Estimate: $155.00

- Star Rating: 4 Stars

- Economic Moat Rating: Wide

- Uncertainty Rating: High

What We Thought of Amazon’s Earnings

- Third-quarter results were good, with e-commerce-related revenues all coming in ahead of our estimates. The same was true for advertising, while Amazon Web Services, or AWS, was a little light.

- On e-commerce, Amazon saw consumers buying more household products and fewer discretionary items. It also saw consumers trading down and looking for lower-priced items. Finally, Amazon said inventory was in the best shape it’s seen in a long time.

- Advertising grew 26% year over year, which was strong and comparable to Meta Platform’s META growth of 23% and Alphabet’s GOOGL/GOOG 9%-10%. So momentum continues, and the firm’s mix shift helps margins.

- On AWS, which grew 12% (flat sequentially), management noted deal momentum has been very strong over the last couple of months, including post-quarter. A few of these deals were huge and effective starting in October. Further, many of these workloads are AI-related. Optimization efforts by clients have been easing and new workloads are being introduced, which management expects to continue in the near term. AWS and Azure both added about $900 million in new revenue sequentially, even if Azure grew at 29% and AWS grew at 12%. AWS is significantly larger, so it should be growing more slowly. We have modeled acceleration next year in AWS growth, from just over 13% this year to just under 17% next year.

- Profitability was the strong point of the quarter, with an operating margin of 7.8% versus 2.0% a year ago. This is well above guidance, our model, and the Street. The best margin performance in our model going back eight years is 8.2% in March 2021, during the height of the COVID-19 surge, so these results were impressive. Margin guidance was similarly good at 5.5%, which is also above both our call and the Street. We have tweaked our margin estimates up a little throughout our model, as management indicated they aren’t done yet with regional hubs, robotics, and other efficiency programs over the next several years.

- Amazon stock has run up hard this year, gaining 70% from Jan. 1 through mid-September. Given the firm’s wide moat and good secular position, we think this is another name that on the surface is pretty easy to buy, though worries about consumers may make other software names more attractive

Amazon Stock Price

Fair Value Estimate for Amazon Stock

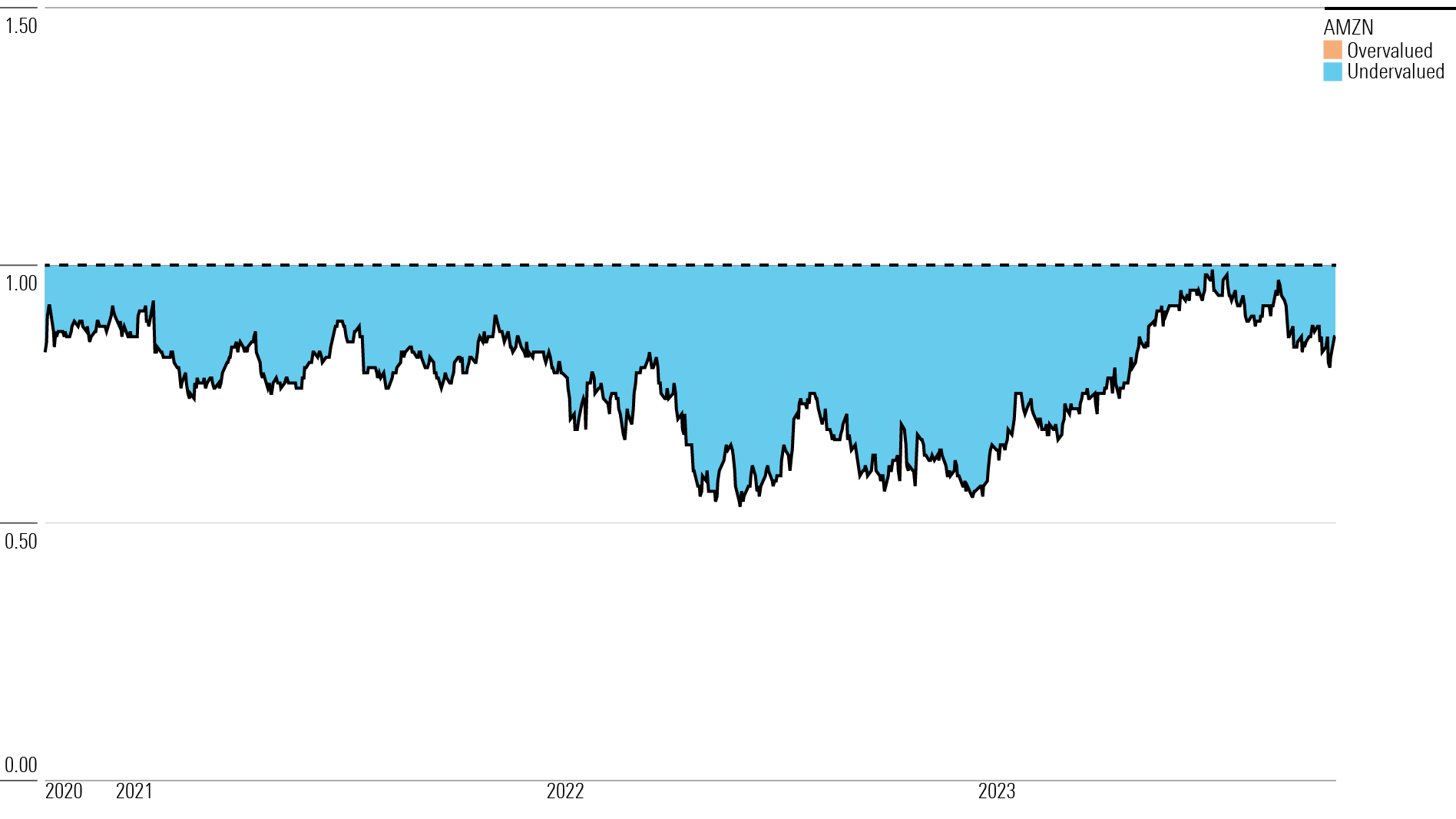

With its 4-star rating, we believe Amazon’s stock is undervalued compared with our long-term fair value estimate.

Our fair value estimate for Amazon stock is $155 per share, which implies a 2023 enterprise value to sales multiple of 3 times and a 3% free cash flow yield. We think multiples are a little less meaningful for Amazon, given the ongoing heavy investment and rapid scaling that depresses financial performance. However, we expect the company to significantly grow its free cash flow as it matures.

Over the long term, we expect e-commerce to continue to take share from brick-and-mortar retailers. We further expect Amazon to gain share online. We believe that over the medium term, COVID-19 pulled forward some demand by changing consumer behavior and better penetrating some retail categories—such as groceries, pharmacy, and luxury goods—that previously had not gained as much traction online. We think Prime subscriptions and the accompanying benefits, combined with selection, price, and convenience, continue to drive retail. We also see international as a longer-term opportunity within retail. We model total retail-related revenue growing at a 9% compound annual growth rate, or CAGR, over the next five years.

We believe the critical growth drivers over the medium term will be AWS and advertising. Since these segments earn materially higher margins than the rest of the business, we also expect them to drive margins higher over time. Over the next five years, we project AWS revenue growing at a 15% CAGR and advertising revenue growing at a 19% CAGR. In total, Amazon should grow at an 11% CAGR through 2027. We model GAAP operating margin expanding from 2% (actual) in 2022 to the low double digits in 2027 as the company grows into its expanded footprint and optimizes its substantial investment in transportation.

Amazon Historical Price/Fair Value Ratio

Read more about Amazon’s fair value estimate.

Economic Moat Rating

We assign Amazon a wide moat based on its network effects, cost advantages, intangible assets, and switching costs. Amazon has been disrupting the traditional retail industry for more than two decades while also emerging as the leading infrastructure-as-a-service provider via AWS. This disruption has been embraced by consumers and has driven change across the entire industry, as traditional retailers have invested heavily in technology to keep pace. COVID-19 has accelerated change, and given the company’s technological prowess, massive scale, and relationship with consumers, we think Amazon has widened its lead, which we believe will result in economic returns well in excess of its cost of capital for years to come.

We believe Amazon’s retail business has a wide moat stemming from network effects associated with its marketplace, whereby more buyers and sellers continually attract more buyers and sellers. It has a cost advantage tied to purchasing power, logistics, vertical integration (proprietary brands, owned delivery, and so on), and a negative cash conversion cycle. Finally, it has intangible assets associated with technology and branding.

We also think AWS is a wide-moat business, thanks to high customer switching costs, a cost advantage associated with economies of scale whereby few competitors can keep up with Amazon’s investment pace, intangible assets arising from semiconductor and facility development, and a network effect associated with a marketplace for software created to make AWS work better.

Additionally, we would assign Amazon’s burgeoning advertising business a narrow moat based on intangible assets from its proprietary data on hundreds of millions of users and a network effect again focusing on buyers and sellers meeting in the largest available venues.

In our view, the wide moat for Amazon’s entire business is greater than the sum of its parts. We prefer to analyze Amazon’s moat on the whole, as the company’s segments reinforce one another and returns result in an unrivaled consumer experience. Together, we believe Amazon’s retail business enjoys a wide moat supported by cost advantages, intangible assets, and network effects.

Read more about Amazon’s moat rating.

Risk and Uncertainty

Amazon has a High Uncertainty Rating. Despite being an e-commerce leader, the company faces a variety of risks.

Amazon must protect its leading online retailing position, which can be challenging as consumer preferences change (especially post-COVID-19, as they may revert to prior behaviors) and traditional retailers bolster their online presence. Maintaining an e-commerce edge has pushed the company to make investments in nontraditional areas, such as producing content for Prime Video and building out its transportation network. Similarly, the company must also maintain an attractive value proposition for its third-party sellers. Some of these investment areas have raised investor questions in the past, and we expect management to continue to invest according to its strategy, despite periodic margin pressure from increased spending.

The company must also continue to invest in new offerings. AWS, transportation, and physical stores (both Amazon-branded and Whole Foods) are three notable areas of investment. These decisions require capital allocation and management focus, and they may play out over a period of years rather than quarters.

Read more about Amazon’s risk and uncertainty.

AMZN Bulls Say

- Amazon is the clear leader in e-commerce and enjoys unrivaled scale to continue to invest in growth opportunities and drive the very best customer experience.

- High-margin advertising and AWS are growing faster than the corporate average, which should continue to boost profitability over the next several years.

- Amazon Prime memberships help attract and retain customers who spend more with Amazon. This reinforces a powerful network effect while bringing in recurring and high-margin revenue.

AMZN Bears Say

- Regulatory concerns are rising for large technology firms, including Amazon. Further, the firm may face increasing regulatory and compliance issues as it expands internationally.

- New investments, notably in fulfillment, delivery, and AWS, should dampen free cash flow growth. Also, Amazon’s penetration into some countries might be harder than in the United States due to inferior logistic networks.

- Amazon may not be as successful in penetrating new retail categories, such as luxury goods, due to consumer preferences and an improved e-commerce experience from larger retailers.

This article was compiled by Tom Lauricella.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)