After Earnings, Is Alphabet Stock a Buy, Sell, or Fairly Valued?

Search revenue acceleration, YouTube ad revenue, and cloud service stability—here’s what we think of Alphabet stock.

Alphabet GOOGL released its second-quarter earnings report on July 24, after the close of trading. Here’s Morningstar’s take on what to think of Alphabet’s earnings and stock.

Key Morningstar Metrics for Alphabet

- Fair Value Estimate: $161

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Alphabet’s Q2 Earnings

- Search growth accelerated: This supports our assumption that Google won’t lose its dominant position in search.

- YouTube ad revenue returned to growth: YouTube Shorts is beginning to be monetized, and brands are coming back and advertising on the platform. It appears that ad spending is back, even on campaigns with long-term objectives. This could also be seen in the results of ad-holding firms like Omnicom OMC and Interpublic IPG. While their overall numbers were not that impressive, their media-buying businesses strengthened, indicating a possible increase in spending by larger brands.

- Cloud: This side of the business remained strong on the top and bottom lines, with another profitable quarter. While management remained cautious about future cloud growth, we look for revenue acceleration, driven mainly by increasing demand for artificial intelligence tools and features. It appears that our assumption of full-year profitability in 2024 for cloud has a higher chance of being correct.

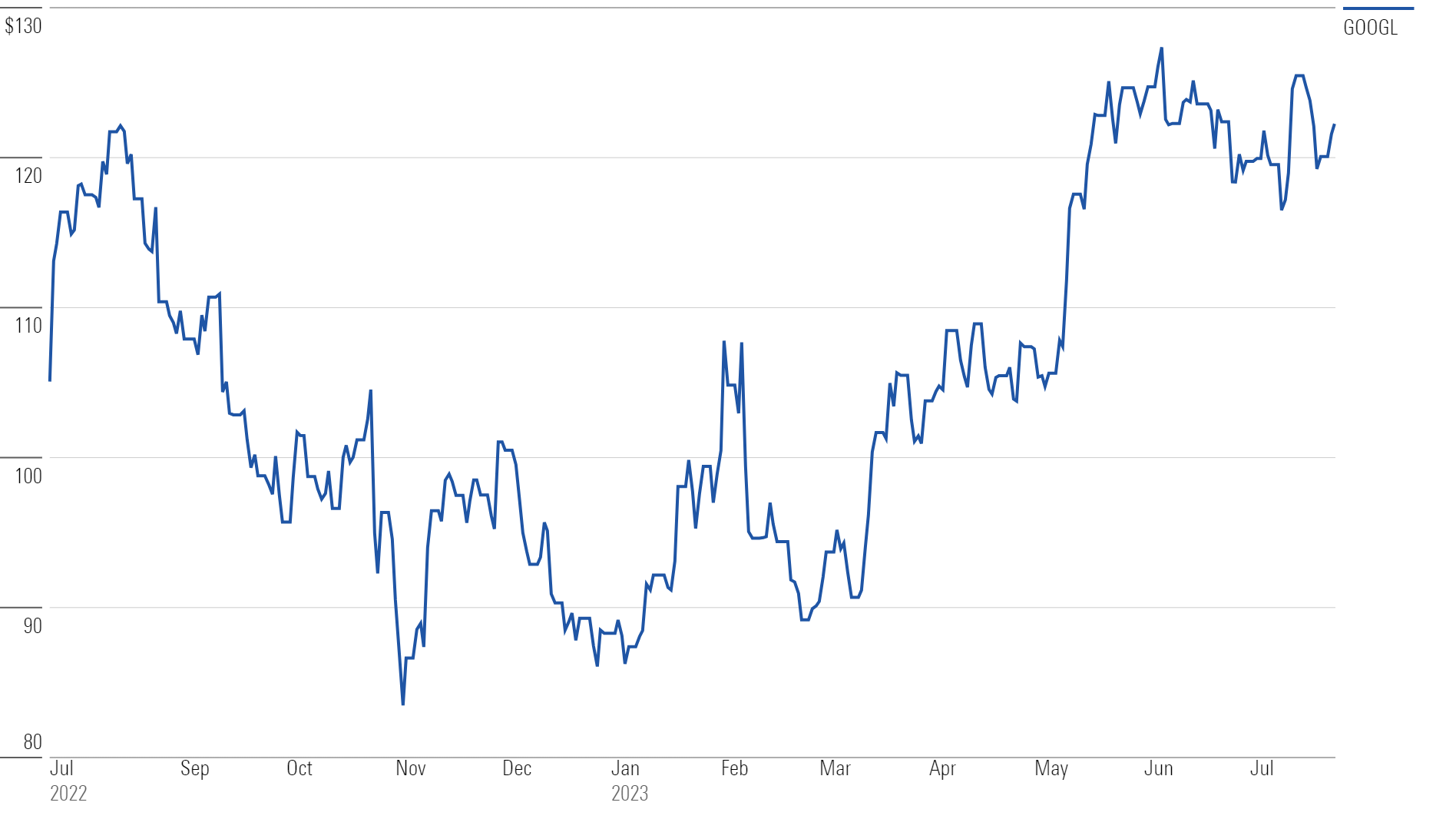

Alphabet Stock Price

Fair Value Estimate for Alphabet

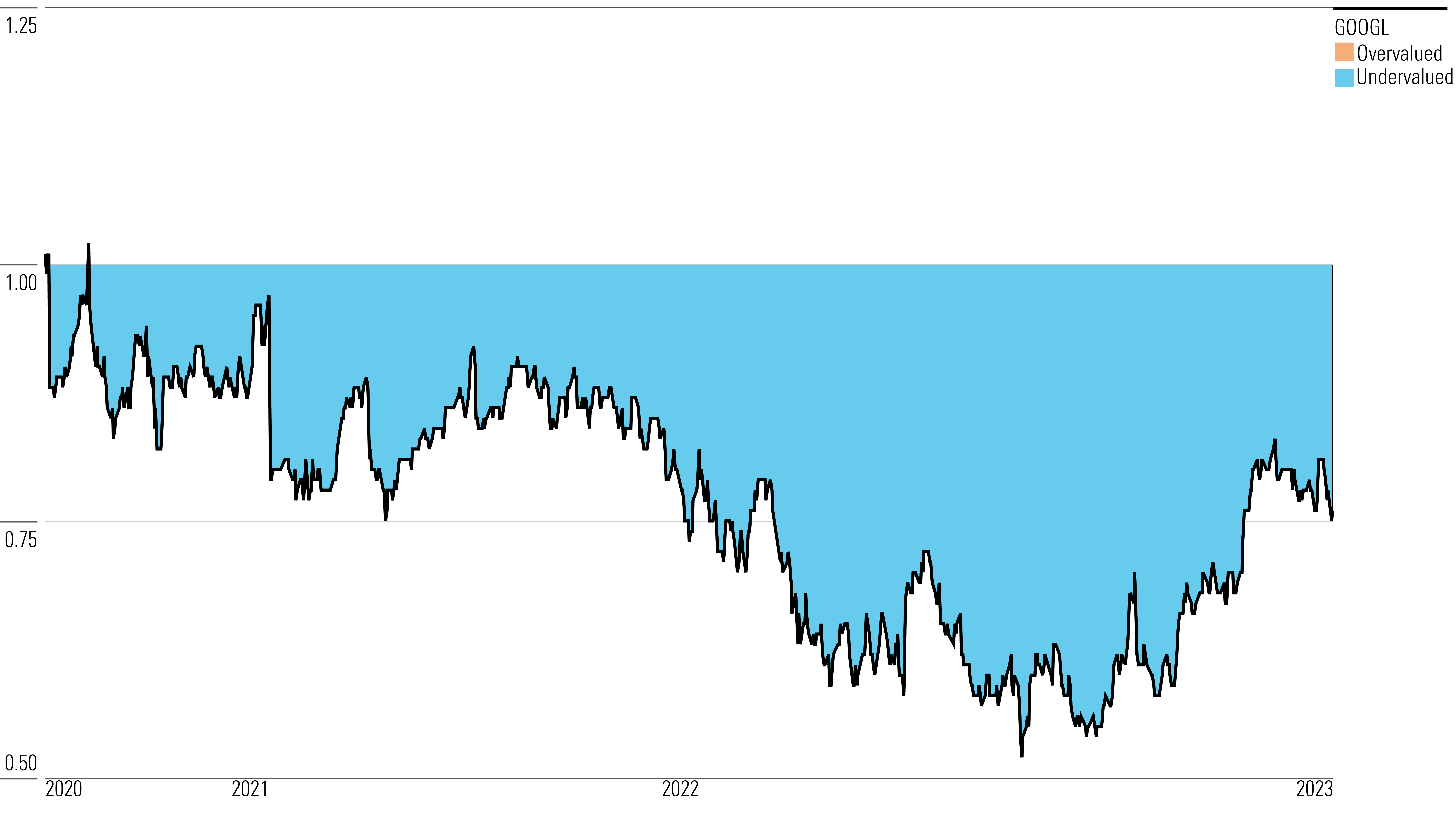

With its 4-star rating, we believe Alphabet’s stock is undervalued compared with our long-term fair value estimate.

The fair value estimate for Alphabet is $161 per share, with a projected 2024 enterprise value/EBITDA ratio of 17. Margin pressure is expected in 2023 due to aggressive hiring, continued investments in growth initiatives, and the short-term impact of Microsoft Bing and generative AI. However, margin improvement is anticipated in 2024-27, driven by better generative AI search monetization and faster growth in the cloud through wider adoption of generative AI.

We expect advertising revenue to remain over 70% of Alphabet’s total revenue, with nearly 6% growth projected for ad revenue in 2023, due to economic uncertainty. Our estimates indicate total Google ad revenue to be $233 billion and $247 billion in 2023 and 2024, respectively, with YouTube contributing about 13% in 2023 and 14% in 2024.

We believe Google will gain traction in the cloud market, with 23% annual revenue growth through 2027. Google’s other revenue sources—including non-ad YouTube revenue, the Google Play Store, and hardware product sales—are projected to increase by 12% in 2023 and 20% in 2024.

Alphabet Price/Fair Value

Read more about Alphabet’s fair value estimate.

Economic Moat Rating

Alphabet is assigned a wide moat due to its durable competitive advantages, stemming from its intangible assets and network effect. The company holds significant expertise in search algorithms and artificial intelligence, as well as valuable data for advertisers. Google’s brand is perceived as the most advanced in the industry, and it can defend its dominance in search against competitors like Microsoft’s Bing with its own AI technology.

Alphabet’s network effects stem from its various products, such as Search, Android, Maps, Gmail, and YouTube, which create value for users, advertisers, and businesses. These network effects, along with the successful monetization of technology-based intangible assets through machine learning and generative AI, contribute to Alphabet’s wide moat.

While Alphabet has a strong moat, it does not possess a durable cost advantage compared with its peers. Customer switching costs associated with Alphabet’s offerings are negligible, as users can switch platforms without significant barriers. Additionally, Alphabet’s other bets segment, which includes ventures like Verily and Waymo, may not significantly contribute to its moat at present. However, the company’s continuous innovation through Google and its investments in technology may lead to further profit.

Read more about Alphabet’s moat rating.

Risk and Uncertainty

Morningstar gives Alphabet a High Uncertainty Rating, primarily due to its heavy reliance on continuing online advertising growth. A prolonged downturn in online ad spending could negatively impact the firm’s revenue and cash flow, leading to a lower fair value estimate. However, positive returns on its investments in cloud and moonshots could significantly increase its stock’s fair value estimate.

Google’s competitive advantages, such as its intangible assets and network effects, help the firm maintain its dominant position in the search market, but the risk of minimal switching costs for users to use a rival search engine remains manageable. Data privacy and security concerns related to the firm’s high dependence on user behavior data pose environmental, social, and governance risks. Additionally, Google faces antitrust pressure and claims regarding search bias and its market dominance, potentially leading to limitations on mergers and acquisitions, as well as lower user growth and monetization in certain regions.

Read more about Alphabet’s risk and uncertainty.

GOOGL Bulls Say

- As the number of online users and usage increase, so will digital ad spending, of which Google will remain one of the main beneficiaries.

- Android’s dominant global market share of smartphones leaves Google well-positioned to continue generating top-line growth as search traffic shifts from desktop to mobile.

- The significant cash generated from the Google search business allows Alphabet to remain focused on innovation and the long-term growth opportunities new areas present.

GOOGL Bears Say

- There is little revenue diversification within Alphabet, as it remains heavily dependent on Google and the state of the search ad space.

- Alphabet is allocating too much capital toward high-risk bets, which face a very low probability of generating returns.

- Google’s dominant position in online search is not maintainable, as more companies and regulatory agencies are contesting the methods through which the company has been extending its leadership.

This article was compiled by Saaketh Tirumala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EAAEIIRVVNE7HNVXBSGTD3WPSI.jpg)