6 Undervalued Wide-Moat Industrials Stocks

High-quality names, including Equifax and TransUnion, are trading at attractive prices.

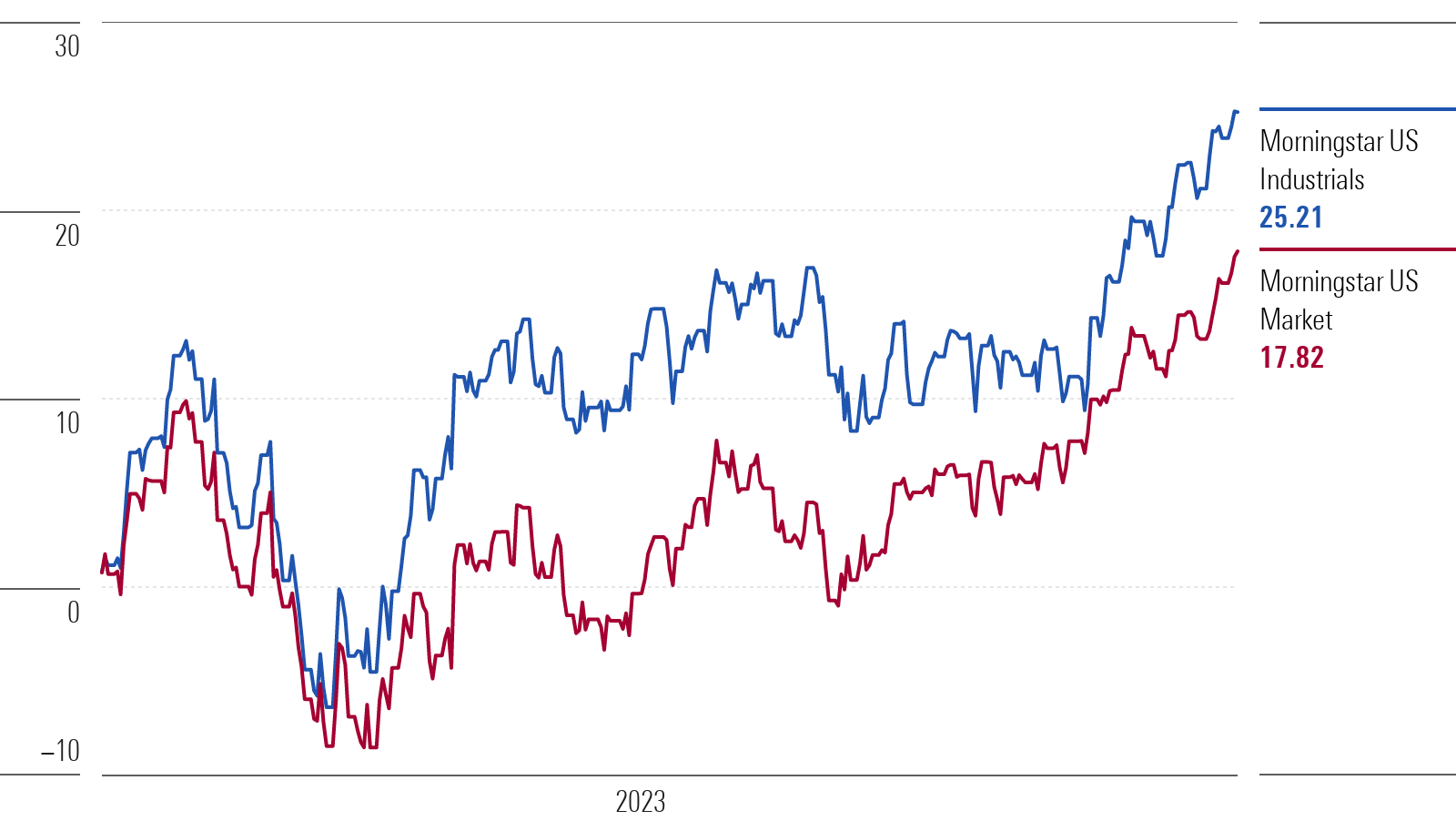

After holding in better than the overall market in 2022, industrial stocks have lagged the broader market’s rally this year. In 2022 the Morningstar US Industrials Index lost 8.1%, compared with a 19.4% loss for the overall market as measured by the Morningstar US Market Index. However, so far in 2023, the industrials index is down up 14.5% while the market is up 19.9%.

But that’s good news for investors looking for opportunities with high-quality, undervalued companies. Among the names trading discount prices are Equifax EFX and General Dynamics GD.

Morningstar US Industrials Index

What Are Industrials Stocks?

Industrials stocks represent companies that manufacture machinery, hand-held tools, and industrial products. This sector also includes aerospace and defense firms, as well as companies engaged in transportation and logistic services and some business consulting services. Among the largest companies in the US Industrials Index are RTX RTX and Honeywell International HON.

Industrials Stocks to Buy Now

Of the 217 stocks in the Morningstar US Industrials Index, 92 are covered by Morningstar analysts. Of those, 35 were considered undervalued as of July 20, 2023.

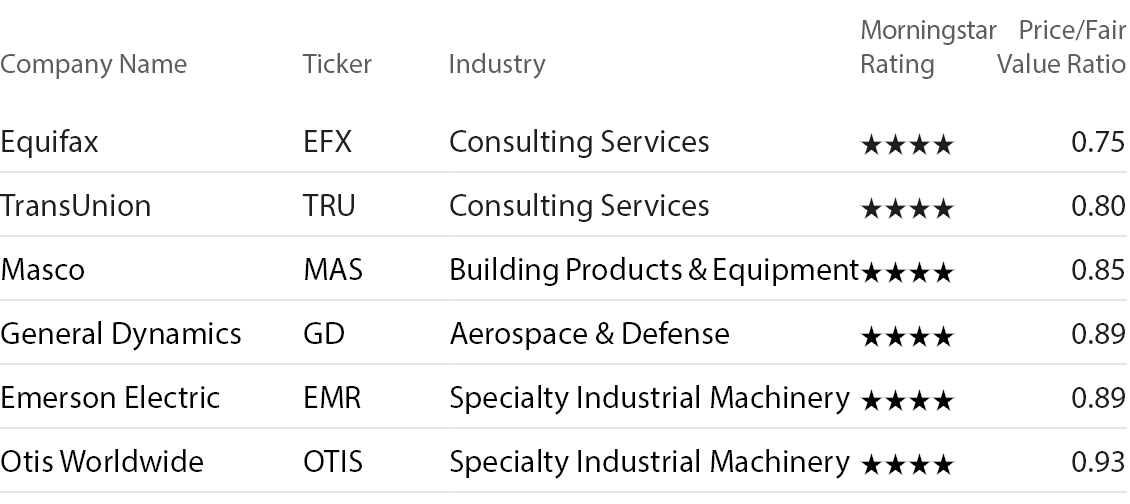

For this screen, we looked for the most undervalued stocks in the index that currently carry a Morningstar Rating of 4 or 5 stars. We then looked for the stocks trading at the lowest prices compared with their fair value estimates set by Morningstar analysts.

Among those trading at extremely low price/fair value ratios, we narrowed the search further to names with an economic moat rating of wide, meaning they show durable competitive advantages. The combination of an economic moat and an attractive valuation has historically led to strong stock performance.

These were the six undervalued, wide-moat, 4-star stocks in the Morningstar Industrials Index as of July 20:

The most undervalued stock in this group is Equifax, trading at a 25% discount to its fair value estimate. The least undervalued stock is Otis Worldwide, trading at a 7% discount.

Undervalued Industrials Stocks

Equifax

- Fair Value Estimate: $315.00

“Equifax is one of the leading credit bureaus in the United States. The firm’s reports provide the credit histories of millions of consumers, and its services are critical to lenders’ decisions. In addition, about a third of its revenue comes from workforce solutions, which provide income verification and employer human resources services. Equifax generates over 20% of its revenue from outside the United States.

“We expect Equifax’s competitive position to persist, as the large number of existing records and the difficulty of convincing employers to share employee information would be too tough for new entrants to overcome. In the years ahead, we expect Equifax to focus on expanding use cases of income verification beyond mortgage to auto, card, government services, and employment screening.”

—Rajiv Bhatia, equity analyst

TransUnion

- Fair Value Estimate: $101.00

“TransUnion is one of the leading credit bureaus in the United States. The company also provides fraud detection, marketing, and analytical services. TransUnion operates in over 30 countries, and about one-fourth of its revenue comes from international markets.

“TransUnion is one of the Big Three consumer credit bureaus. Given the fixed costs inherent in a data-intensive business, the firm has been able to generate meaningful margin expansion over the past several years. TransUnion’s core business is selling credit reports to U.S. lenders, but as this business is the most mature, the company has sought other avenues of growth. One avenue has been expanding beyond financial institutions into verticals such as insurance, rental screening, collections, and other sectors.”

—Rajiv Bhatia

Masco

- Fair Value Estimate: $71.00

“Masco manufactures a variety of home improvement and building products. The company’s plumbing segment, led by the Delta and Hansgrohe brands, sells faucets, showerheads, and related plumbing fixtures and components. The decorative architectural segment primarily sells paints and other coatings under the Behr and Kilz brands, but it also sells builder hardware and lighting products.

“We think Masco’s financial performance over the past decade has been as much of a self-help story as it has been about improving end markets. Masco almost entirely refreshed its senior executive management team in 2014. Since then, it has taken significant measures to build a stronger and more consistent business model. The firm divested its most cyclical and least profitable businesses; it spun off its installation business (now named TopBuild) to shareholders in 2015, and sold its windows and cabinetry businesses in 2019 and 2020, respectively. Management also executed significant cost-reduction initiatives and shored up the firm’s balance sheet.”

—Brian Bernard, senior director

General Dynamics

- Fair Value Estimate: $240.00

“General Dynamics is a defense contractor and business jet manufacturer. The firm’s segments include aerospace, marine, combat systems, and technologies. Its aerospace segment creates Gulfstream business jets and operates a global aircraft servicing operation. Combat systems produces land-based combat vehicles, such as the M1 Abrams tank and Stryker armored personnel carrier, as well as munitions. The marine segment creates and services nuclear-powered submarines, destroyers, and other ships. The technologies segment contains two main units: an IT business that primarily serves the government market and a mission systems business that focuses on products that provide command, control, computing, intelligence, surveillance, and reconnaissance capabilities to the military.

“Regulated margins, mature markets, customer-paid research and development, and long-term revenue visibility allow defense contractors to deliver a lot of cash to shareholders, which we view positively because we don’t see substantial growth in this industry. Indeed, defense budgets usually ebb and flow with a nation’s wealth and its perception of danger, both of which have been rising in the United States. Among many allies, notably Germany and Japan, geopolitics is leading to larger military budgets than what we’ve seen in decades.”

—Nicolas Owens, equity analyst

Emerson Electric

- Fair Value Estimate: $103.00

“Emerson Electric sells automation equipment and services under two segments: intelligent devices and software control. It also holds a majority interest in AspenTech, an industrial software business. Emerson’s tool business is also contained within intelligent devices, boasting several household brands like Ridgid. Emerson’s automation business is most known for its process manufacturing solutions, which consist of measurement and analytical instrumentation, control valves and actuators, and other products and services. Nearly half of the firm’s geographic sales come from the Americas.

“In our view, Emerson Electric is the undisputed powerhouse in process manufacturing on the west side of the Atlantic. Despite near-term headwinds in fiscal 2020 due to low levels of gross fixed investment amid geopolitical uncertainty and COVID-19-related disruptions, we believe Emerson is poised for several years of positive organic growth after a slow recovery in early 2021. Even as Emerson holds either first or second share in a variety of product categories, share from established firms remains somewhat fragmented (depending on the category, Emerson holds roughly mid-teens market share), suggesting a large runway for growth.

—Joshua Aguilar, senior equity analyst

Otis Worldwide

- Fair Value Estimate: $95.00

“Otis is the largest global elevator and escalator supplier by revenue, with around 18% of the global market share. In 1854, company founder and namesake Elisha Graves Otis invented a safety mechanism that prevented an elevator from falling if the hoisting cable failed. The company’s product and service lifecycle begins with the installation of elevator units in new buildings, continues with selling maintenance services on the units, and eventually ends with the replacement of the units after their average 15-to-20-year useful lifetime.

“Otis operates under an installed-base business model, wherein it monetizes its industry-leading reputation through the growth of the global base of elevators installed over many decades. Profit margins on new elevator sales are modest, with Otis sacrificing profits on new installations for subsequent elevator servicing contracts on the elevators it installs. Elevator service contracts are the industry’s main prize and command significantly higher profit margins than those of new equipment. Otis boasts the industry’s largest elevator service portfolio, with 2.2 million units under maintenance in 2022—about 11% of the total elevator units installed globally.”

—Grant Slade, senior equity analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)