5 Most Undervalued Defensive Stocks

Well-known names such as Moderna, CVS, and Kraft Heinz are trading at discounted prices.

After providing a cushion to investor portfolios during the bear market of 2022, defensive stocks have lagged the broader market as stocks rebounded this year. The good news for long-term investors looking for opportunities here is that many names are trading in undervalued territory. Among the most undervalued defensive stocks are Moderna MRNA and CVS Health CVS.

Defensive stocks are resistant to economic cycles because their products are necessary in both good times and bad. Consumer defensive companies are engaged in the manufacturing of food and beverages, household and personal products, packaging, and tobacco. Some companies provide education and training services. UnitedHealth Group UNH, Merck MRK, and PepsiCo PEP are among the largest companies in the Defensive Super Sector Index.

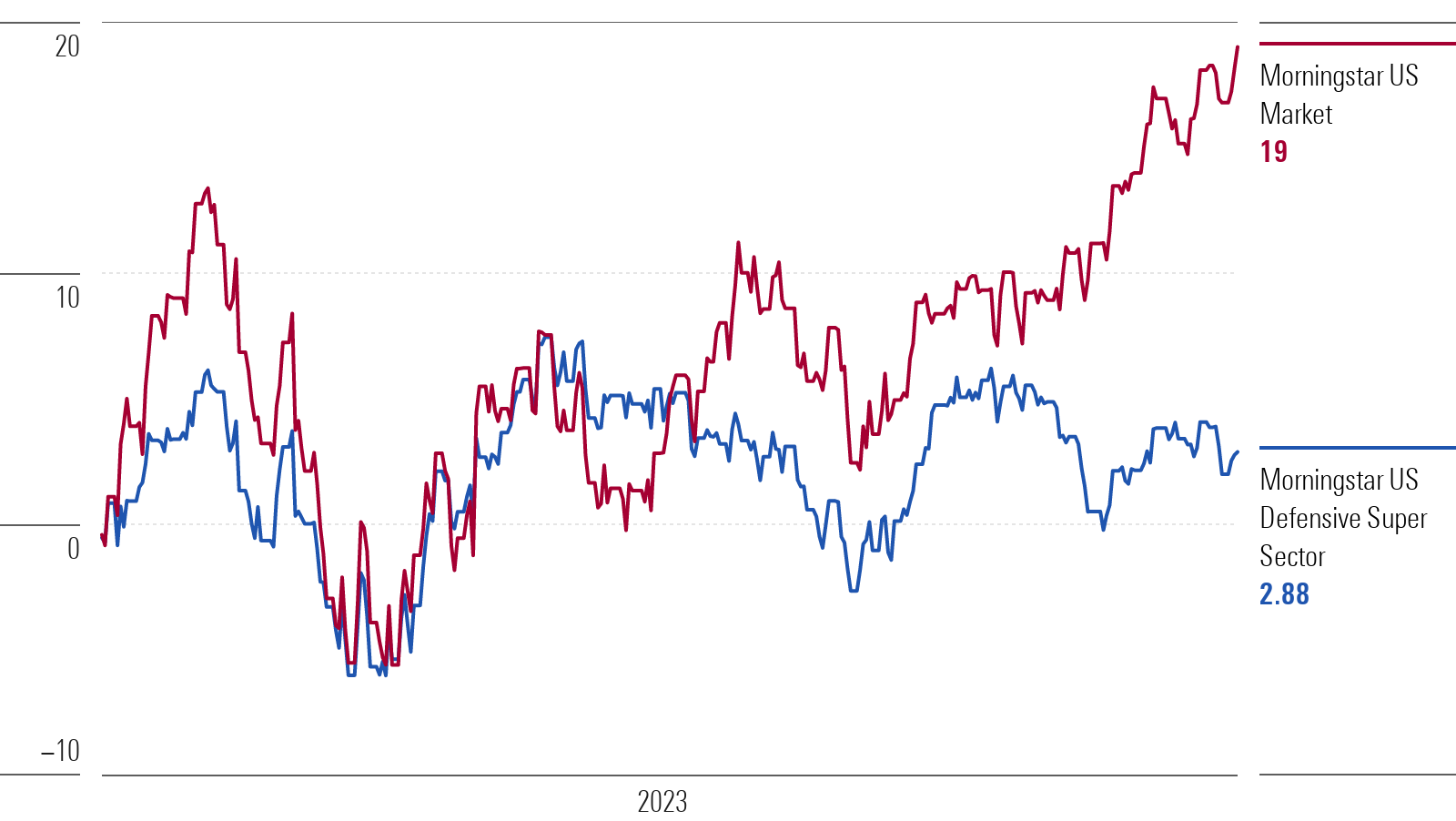

US Defensive Super Sector Index

Defensive Stocks to Buy Now

To look for undervalued defensive stocks, we turned to the Morningstar US Defensive Super Sector Index, which tracks stocks from traditionally defensive sectors like consumer defensive, food manufacturing, and healthcare. In 2022 the index lost 3.6%, compared to a 19.4% loss for the overall market as measured by the Morningstar US Market Index. So far in 2023, the defensive index is down by 1.8% while the market is up 17.4%.

Of the 309 stocks in the index, 151 are covered by Morningstar analysts. Of those, 91 were considered undervalued as of July 12, 2023.

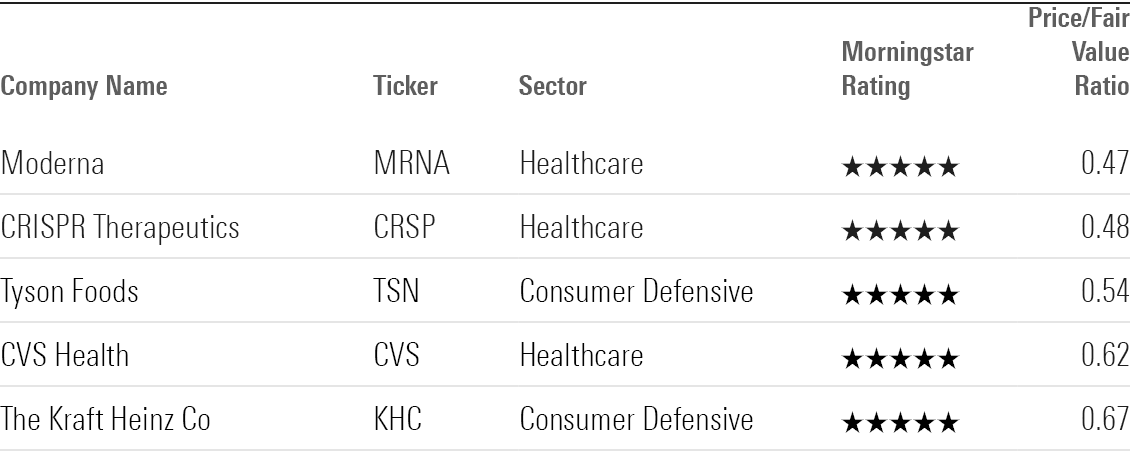

For this screen, we looked for the most undervalued stocks in the index that currently carry a Morningstar Rating of 4 or 5 stars. We then looked for the stocks trading at the lowest prices compared with their fair value estimates set by Morningstar analysts.

Among those trading at extremely low price/fair value ratios, only CVS Health is deemed by Morningstar to have an economic moat, meaning it shows durable competitive advantages. The combination of an economic moat and an attractive valuation has historically led to strong stock performance.

These were the most undervalued 5-star stocks in the Morningstar Defensive Super Sector Index as of July 12:

The most undervalued defensive stock is Moderna, trading at a 53% discount to its fair value estimate.

5 Undervalued Defensive Stocks

Moderna

- Industry: Biotechnology

- Fair Value Estimate: $266.00

- Economic Moat: None

“In a record-breaking span of just 11 months, Moderna created, developed, manufactured, and got regulatory authorization for mRNA-1273, a two-dose COVID-19 vaccine that is one of the first two mRNA vaccines ever authorized. The pandemic accelerated Moderna’s evolution into a commercial-stage biotech company, and we expect the firm’s ramp-up in manufacturing and clinical know-how will pave the way for faster timelines for additional programs. Moderna’s mRNA platform, involving rapid design and similar manufacturing across programs, allows the company to pursue multiple programs in parallel.

“Moderna’s most advanced program outside COVID-19 is for cytomegalovirus, a leading cause of birth defects. Several other vaccines are advancing into late-stage trials, including respiratory virus vaccines for RSV and influenza. Moderna is also pursuing a broad spectrum of other therapeutic indications, from cancer to cardiology to rare diseases, with an expanding early-stage development pipeline.”

—Karen Anderson, sector strategist

CRISPR Therapeutics

- Industry: Biotechnology

- Fair Value Estimate: $119.00

- Economic Moat: None

“CRISPR Therapeutics is a clinical-stage gene editing company focused on the development of CRISPR/Cas9-based therapeutics. We think the company’s proprietary technology has the potential to build blockbusters in rare diseases, such as exa-cel for the treatment of sickle cell disease and transfusion-dependent beta-thalassemia. We think CRISPR Therapeutics’ proprietary technology has the potential to build blockbusters in rare diseases with limited treatment options available

“While CRISPR Therapeutics’ products are still unproven, we recognize that if successful, multiple targeted treatment areas are potentially moat-worthy businesses. For example, TDT and SCD are two areas of high and critical need, and the company’s genetic therapies could have high efficacy, commanding strong pricing power.”

—Rachel Elfman, equity analyst

Tyson Foods

- Industry: Farm Products

- Fair Value Estimate: $85.00

- Economic Moat: None

“Tyson primarily sells raw beef, pork, and chicken, although it has increased its exposure to prepared foods. Despite the scale it has amassed, meat is a commodity and carries little to no brand or pricing power, exposing sellers to volatility in both costs and revenue. Tyson’s strategy to sell three types of meat is intended to offer diversification, but diversification has its costs, and the headwinds of any one meat have weighed on companywide results at times. Additionally, we think there’s limited revenue or cost synergies across different proteins.

“International sales include every protein sold outside the United States in roughly 140 countries. Historically, rising per-capita incomes in emerging markets portend higher protein consumption, and Tyson’s exposure to international markets should unlock faster growth than it would see in its home country. We forecast 7% annual segment sales growth, partly higher due to the small base.”

—Kristoffer Inton, strategist

CVS Health

- Industry: Healthcare Plans

- Fair Value Estimate: $113.00

- Economic Moat: Narrow

“CVS aims to be the most customer-centric health company in the U.S. It has spent over a decade positioning itself as a leader in healthcare services, with its acquisitions of pharmacy benefit manager Caremark in 2007, insurance provider Aetna in 2018, and provider Oak Street pending in 2023 defining its strategy. CVS’ top-tier retail pharmacy, health insurer, and PBM franchises create the potential to improve health outcomes and even bend the healthcare cost curve for its clients, especially if it can align incentives by owning healthcare service providers as well.

“With its integrated strategy, management aims to accelerate bottom-line growth to the low double digits on a maintainable basis in the long run, though it has pushed back the target date for this goal multiple times. Currently, it is aiming for double-digit growth starting in 2025. We would not be surprised to see that target postponed yet again, and we only incorporate high-single-digit earnings growth into our model for the long run.”

—Julie Utterback, senior equity analyst

The Kraft Heinz Co

- Industry: Packaged Foods

- Fair Value Estimate: $53.00

- Economic Moat: None

“Kraft Heinz benefited from consumers’ penchant for eating at home during the pandemic, with 85% of its sales driven through the retail channel. But we attribute recent performance to the prudence of its revamped road map (based on household penetration and repeat purchase metrics), rather than merely a byproduct of the macro environment. In this context, CEO Miguel Patricio has charged the firm to pursue efficiencies that prove to last, elevate brand spending (marketing and product innovation), enhance capabilities (category management and e-commerce), and leverage its scale to more nimbly respond to changing market conditions, which we perceive as judicious.

“Within this context, we think Kraft Heinz has abandoned its prior mantra of inflating profits at any cost in favor of consistently driving profitable growth. And even as stepped-up angst from broad-based inflationary headwinds (commodities, labor, packaging, and logistics, with a high-single-digit hit expected in fiscal 2023 on top of double-digit constraints each of the past two years) is beleaguering its consumer product peers, the company appears to be taking these pressures in stride.

“Beyond looking to surgically extract inefficiencies, it is also selectively raising prices (and will likely continue to do so). But it isn’t relenting on its focus to more effectively fuel marketing spending, targeting a 30% increase in marketing between fiscal 2020 and 2024, which we think stands to support its brand mix and its retail relationships.”

—Erin Lash, senior director

Correction: July 21, 2023: A previous version of this article incorrectly referred to a bull market in 2022 instead of a bear market.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)