4 Dividend-Payers From the Ultimate Stock-Pickers

These firms are both trading at a significant discount to their fair value estimates and offer a solid dividend yield.

The vast majority of our

have never been mistaken for dividend investors. That said, a handful of them--

As you may recall from our last dividend-themed article, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to home in on the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of more than 500 different dividend-paying stocks held by our Ultimate Stock-Pickers and then narrow it down by focusing on firms that we believe have competitive advantages, which should allow them to generate the excess returns they'll need to maintain their dividends longer term, as well as lower uncertainty regarding future cash flows. We accomplish this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, represent firms with wide or narrow economic moats, and have uncertainty ratings of either low or medium.

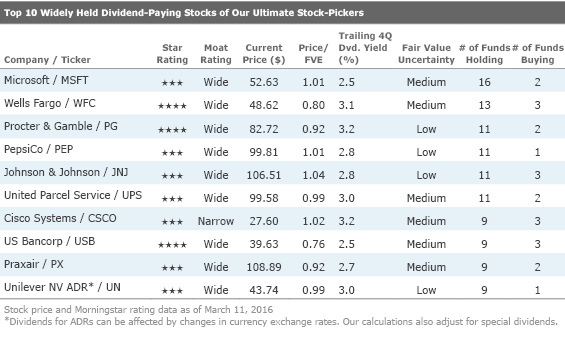

Once our filtering process is complete, we create two tables, one that reflects the top 10 dividend-yielding stocks of our Ultimate Stock-Pickers, and the other representing stocks that are paying dividends in excess of the S&P 500 that are widely held by our top managers. In our view, finding stocks that are yielding more than the benchmark index but that operate in more stable industries, where there is less uncertainty surrounding their future cash flows, should offer some downside protection for investors. Given the increased level of volatility we've seen since the start of 2016, we expect that this is at the forefront of most investors' minds. We should also note that our dividend yield calculations in each of these tables are based on regular dividends that have been declared over the past 12 months, and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Top 10 Dividend-Yielding Stocks of Our Ultimate Stock-Pickers

When looking at the changes that have taken place in the list of top 10 dividend-yielding stocks of our Ultimate Stock-Pickers since

we would note that wide-moat

While the sell-off in the global equity markets since the start of the year has been fairly broad, healthcare and energy stocks were hit harder than most sectors. Given the higher uncertainty ratings that are attached to many of the stocks in the energy sector, we saw relatively few names make either list of dividend-yielding stocks--with wide-moat

That said, there was not much conviction buying or selling of any of the names that made their way onto our list of top 10 dividend-yielding stocks, with wide-moat

in our last Ultimate Stock-Pickers' article. Both Procter & Gamble and wide-moat

Widely Held Dividend-Paying Stocks of Our Ultimate Stock-Pickers

Looking more closely at the top 10 widely held securities that met our criteria for dividend-paying stocks, which has traditionally had very little overlap with our list of the top 10 dividend-yielding stocks, we see more diversity in the names. Only one healthcare name made this list, with the remainder consisting of three consumer defensive stocks, two each from the financial-services and technology sectors, and one from both the industrials and basic materials sectors. Procter & Gamble and Cisco were the only names that appeared on both lists.

Consumer defensive stalwarts wide-moat Procter & Gamble,

Wide-moat Wells Fargo and

Wide-moat

We also saw a change among the technology stocks represented on the list, as Qualcomm had its uncertainty rating changed to high since the last time we looked at dividend-yielding stocks, which eliminated it from our screen. Two major developments led to the increase in the uncertainty rating for Qualcomm. First, the firm has had difficulty collecting royalties from Chinese original-equipment manufacturers, despite seemingly favorable legal rulings. On top of that, an unfavorable initial report issued last year by South Korea's Case Examiner, which stated that Qualcomm's royalties should not be based on the price of the phone but on a lesser base--perhaps either the price of a cellular baseband chip or the price of all cellular components, like baseband, radio frequency, and antennas, within a phone--could significantly reduce the royalties that Qualcomm collects in that market (and might have ripple effects in other markets). Given the regulatory and legal uncertainty surrounding both of these situations, future cash flows have become less definitive.

Wide-moat

The other new addition to the list was wide-moat

With valuation and safety being a top concern for investors, especially given the selloff in the global equity markets in January and February, we continue to believe that the best way for investors to protect their capital is to invest in quality businesses at attractive prices. As such, we have once again homed in on the names on both list that are trading at less than 80% of our analysts' fair value estimates, believing that there might be more value to be had in solid dividend payers offering investors a wider than average margin of safety. We've included a few of our observations below, starting with Sanofi, the cheapest holding on a price/fair value estimate basis:

Sanofi SNY

Current Yield: 4.1%

Price/Fair Value: 0.74

Wide-moat Sanofi has experienced some near-term pressures for its largest blockbuster drug, a long-acting insulin product called Lantus, which currently accounts for 16% of sales. Patents for the drug expired in 2015. This, along with other headwinds facing the pharmaceutical industry, has put pressure on the stock since the second half of last year. Morningstar analyst Damien Conover believes the recent negative trends for Lantus have masked the remaining businesses at Sanofi, which he feels are poised for steady growth with strong returns on invested capital. While patent cliffs are always difficult, Conover notes that Sanofi has a robust pipeline of new drugs. The recently launched cholesterol-lowering drug Praluent could generate peak sales over EUR 2 billion, and the news for Sanofi's insulin franchise isn't all bad as a new insulin drug called Toujeo is in the early stages of a successful launch, generating EUR 98 million in sales during the most recent quarter. Conover estimates that this drug could eventually generate peak sales of over EUR 2.5 billion. The complex biologic structure of insulin products also makes them harder and more expensive to replicate, which should reduce the threat of generic competition and limit price erosion. Conover believes the backing of a strong pipeline combined with stable already marketed drugs should offset losses on Lantus and lead to modest growth of 4% annually over the next five years. He expects annual free cash flow of at least EUR 6 billion during the same time frame, supporting future distributions to shareholders through dividends and share buybacks. Conover is currently modeling average dividend-per-share growth of roughly 3% during 2016-20.

Pfizer PFE

Current Yield: 3.8%

Price/Fair Value: 0.78

Pfizer also operates within the pharmaceutical industry and boasts a wide moat. Conover covers the firm and believes that investors are currently underappreciating the company's long-term potential, with the company capable of generating 9% annual earnings-per-share growth during the next five years. He expects this to be driven by the benefits provided by the

Novartis NVS

Current Yield: 3.8%

Price/Fair Value: 0.79

To round out our review of the healthcare-related names that drew our attention, we now turn to wide-moat Novartis. Conover believes that the firm's moat has been built on patents, economies of scale, and a powerful distribution network. He notes that Novartis derives its primary strengths from a diversified operating platform that includes branded pharmaceuticals, generics, eye-care products, and consumer products. Although the majority of its competitors focus solely on the high-margin branded pharmaceutical segment, Novartis runs several complementary operations, which reduces overall volatility and creates cross-segment synergies. Similar to Sanofi, Novartis has a blockbuster drug that accounts for a large percentage of overall sales and that recently came off of patent protection. In Novartis' case, it is the cardiovascular drug Diovan, which accounts for roughly 10% of the company's overall sales. Novartis also has another major product, the cancer drug Gleevec, coming off of patent protection in 2016. While patent losses over the next three years will affect more than 10% of the company's total sales, Conover believes that Novartis' strong pipeline combined with stable currently marketed drugs should lead to modest growth of 2% annually over the same time frame. He expects more than a billion dollars in peak annual sales from a new cardiovascular drug, Entresto, and a new psoriasis drug, Cosentyx. These should offset Novartis' patent losses, allowing the firm to continue to invest in research and development and set up a stable lineup of next-generation drugs. Conover notes that entrenched ophthalmology and generic drug franchises create an additional layer of competitive advantage and further insulate future cash flows. This highlights the benefit of having multiple and diversified operating segments that can provide more stability and consistency than a branded-only pharmaceutical firm. Conover believes that Novartis possesses ample financial resources and that the firm's ongoing free cash flow (of about $11 billion in the 12 months ended in September) contributes to a fairly flexible financial position. He feels that the firm should have no problem covering its current dividend, which is likely to increase 4% on average in each of the next five years.

US Bancorp USB

Current Yield: 2.5%

Price/Fair Value: 0.76

Wide-moat US Bancorp remains a top pick in the financial-services sector, trading at a nearly 25% discount to our $52 per share fair value estimate. While Morningstar analyst Dan Werner continues to believe that US Bancorp is one of the highest-quality banks we cover, the shares have been pressured much as the rest of the banking sector since the start of the year. Werner believes that several factors should continue to work in US Bancorp's favor. First is the discipline of the bank's loan underwriting. Werner notes that during the 2008-09 financial crisis US Bancorp did not incur the same level of losses from the severe credit charge-offs as other institutions. With its well-diversified mix of loans and sound underwriting practices, net charge-offs peaked at just over 2% of loans during the crisis. Second, the bank has built an imposing slate of fee-based businesses from credit cards to wealth management and payments processing, which now account for around half of the firm's total annual revenue. US Bancorp's payments processing business, which carries payments between consumers and merchants, is particularly lucrative, helping the bank produce an exceptionally low efficiency ratio--which is typically in the low 50% range, but has been pushed up some by the historically low interest-rate environment. US Bancorp also has a lower-cost deposit base compared with the aggregate of banks insured by the FDIC. And the firm has a balance sheet that is asset-sensitive, such that any rise in interest rates should lead to net interest margin expansion, lifting both earnings and returns. Werner notes that dividends have been limited in recent years by regulators to about 30%-35% of net income, and he expects that the regulators will continue to limit large U.S. banks' dividend payouts from net income following their annual reviews. That said, dividends should continue to increase as US Bancorp demonstrates its ability to generate excess capital. Werner notes that the company aims to return 60%-80% of net income back to shareholders in the form of dividends or share repurchases.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Eric Compton owns no shares of any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)