10 Solid Value Stocks at Great Prices (and 10 to Pass Up)

We examined the nearly 500 holdings in the Morningstar US Value Index and found some solid stocks at great prices, and others that look too expensive.

At the Morningstar Investment Conference last week, Morningstar's Alex Bryan and AQR's Ronen Israel discussed some reasons the value premium exists, and why value investing is such an intuitive strategy.

The first theory is risk-based; essentially, value stocks' excess returns are compensation for bearing additional risks. Many value stocks are "cheap for a reason"; in other words, they are facing a tough economic environment, or a tough business outlook. Perhaps they are under some sort of regulatory or litigation risk, or there is uncertainty about the company's future. Maybe there are new managers in charge or the company is undergoing a restructuring, or both.

Take

But Valeant's problems are more than perceived: Investigations continue into its poorly disclosed ties to a mail-order pharmacy, and high debt levels put the company at risk of bankruptcy. Indeed, senior equity analyst Michael Waterhouse assigns the stock an "extreme" fair value uncertainty rating. Investors taking a gamble on Valeant's turnaround could potentially receive a big payoff. However, there's a lot of room for things to go wrong. Indeed, Valeant could be a "value trap"--a bargain-basement investment that ultimately ends up going nowhere.

Another theory as to why value investing has historically led to outsize returns has to do with investor behavior--the idea is that investors oftentimes overestimate information or become overconfident in the growth prospects of certain companies, which in turn causes those companies to be overpriced. The companies that are out of the limelight, meanwhile, get shunned or ignored and thus undervalued.

Remember the 2000-02 recession? The tech-dominant Nasdaq index increased from below 800 to more than 5,000 between 1995 and 2000 during the "dot-com bubble," and value stocks by contrast became very undervalued. During the stretch from March 2000 to October 2002 (after the bubble "burst"), the Morningstar US Value Index returned 1.7%. If that doesn't sound that great to you, keep in mind that the Morningstar US Growth Index lost 33.1% over the period.

Fast forward to today. Value stocks have underperformed their growth counterparts over the past 10 years, though not by nearly the same margin as they did during the tech bubble: Over the trailing 10 years ended April 30, the Morningstar US Growth Index has outpaced its Value counterpart by over 3 percentage points.

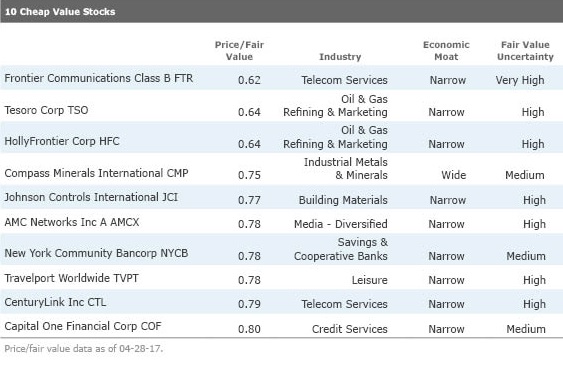

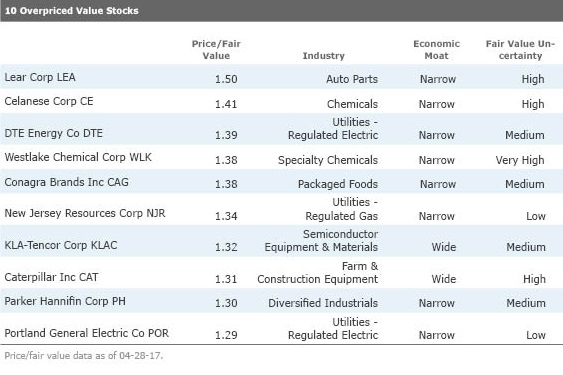

This invites the question, are there bargains to be found? We examined the nearly 500 constituents of the Morningstar US Value Index. First we removed companies that our analysts do not cover. Then we focused only on firms that have economic moats of wide or narrow, which means our analysts think the company has a durable competitive advantage that will allow it maintain its profitability over the long term. (This step helps avoid value traps.) Finally, we sorted the stocks that passed our screen by lowest and highest price/fair value to find the 10 cheapest value stocks, and the 10 most expensive. You can see the results listed in the table below, along with some highlights from our research reports on a few of the companies.

Frontier Communications

FTR

Now that its latest Verizon transaction is closed, Frontier is turning its attention to integration and demonstrating that it can operate the acquired business efficiently. While the near term might be bumpy, equity analyst Alex Zhao believes Frontier now holds relatively high-quality assets overall, which should enable it to produce stable revenue and consistent cash flow over time. This narrow-moat company's advantage comes from the fact that it is still the dominant phone company in most of the small areas and rural markets it serves, providing scale and capabilities that are difficult for rival carriers to match, Zhao says.

AMC Networks

AMCX

AMC Networks has transformed its flagship AMC channel from a minor cable channel showing classic movies into a premier prestige platform for original scripted content. The transformation provides the smaller AMC with strong growth potential compared with larger rivals, says equity analyst Neil Macker. He notes, however, that this growth remains contingent on AMC's ability to source and cultivate strong original content as well as monetize the programs internationally. The company's narrow moat owes to the significant barriers to entry in the industry: Creating a new basic cable network with carriage, high-quality content, and attractive affiliate fees requires not only a large up-front monetary investment but also deep industry relationships.

Capital One Financial

COF

Equity analyst Colin Plunkett believes Capital One is one of the best-run banks and does not receive the respect it deserves. While much of its success can be attributed to an unrelenting focus on operations and organic growth, Plunkett points out that the firm has periodically created significant value by acquiring businesses opportunistically and at attractive prices. Capital One's narrow moat stems from cost advantages through years of steady internal investment in information technology, rewards programs, advertising platforms, and well-timed acquisitions, resulting in a captive cardholder base, Plunkett says. He also thinks Capital One benefits from switching costs, as cardholders do display mild loyalty after being issued a card. This results in a loan portfolio that is highly balanced and would take years to replicate, in Plunkett's view.

Lear Corp

LEA

Equity analyst Richard Hilgert believes narrow-moat Lear's revenue will grow faster than the rate of increase in annual worldwide vehicle production. The company is well-positioned to capitalize on several trends in the global automotive industry, including automakers' focus on quality interiors, premium-vehicle segment growth, and the proliferation of automotive electronics. Unfortunately, Hilgert says, the investment community is very well aware of Lear's growth potential plus its recent margin expansion. Consequently, the market has bid the shares up to an eye-popping 50% premium over our $95 fair value estimate. Hilgert thinks the stock is overvalued relative to our expectations for economic profits and future cash flows.

Celanese Corp

CE

As the world's largest producer of acetic acid, Celanese derives profit from producing the chemical for use internally in its specialized end products and for external sale, to the automotive, cigarette, coatings, durable goods, and medical end markets. It produces acetic acid from carbon monoxide and methanol, a natural gas derivative. Equity analyst David Wang explains that Celanese's below-market-price methanol supply contract ended in the second quarter of 2015 and its own methanol production facility is higher in cost than this prior contract. Wang thinks Celanese has a narrow economic moat due to its cost advantage in acetic acid production and intangible assets in acetate tow production. However, he is concerned that the company's margins have expanded to unsustainable levels, as selling prices have not followed raw material costs lower, and this trend is beginning to revert. At current market prices, shares appear overvalued, Wang says.

Conagra Brands

CAG

Following the 2016 split from its commercial foods business (Lamb Weston), ConAgra Brands' operations are now centered on consumer foods. But despite management's contention that this will allow for more focused execution, Lash isn't convinced this strategy will bolster its intangible assets--the source of ConAgra's narrow moat. For one, she says, ConAgra Brands still operates with a portfolio of second- and third-tier brands that have failed to amass much pricing power. And although ConAgra Brands is attempting to enhance its brand equity by bringing new products to market and reducing promotions (which also stands to prop up profits), this may prove a bigger mountain to climb. Lash remains skeptical that management's efforts will meaningfully prop up ConAgra's weaker competitive positioning and thinks the stock is overvalued.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UBLNP5GU6FGPFN3AAPXRHIRQ5U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G7LHSQ2WCVH73BP6DDQQS5H6FA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3a6abec7-a233-42a7-bcb0-b2efd54d751d.jpg)