Which Value Stocks Are Leading the Way Over Growth?

It was more than just energy. These healthcare and consumer names have fueled the rally.

Surging oil prices have been making headlines, and in the process, fueling a rally in energy stocks that has been a big driver of the rebound in value investing strategies.

But it’s more than just the energy sector behind value’s revival versus growth stocks. Healthcare stocks such as AbbVie ABBV and consumer defensive stocks such as Costco COST also contributed to value’s outperformance. Despite the stronger performance of value stocks over the past year, most are not in overvalued territory, with the exception of oil and gas drilling stocks.

In nine of the past 10 calendar years, growth outperformed value. The tables started to turn in favor of value in 2021, and the first quarter of 2022 only solidified that trend.

The Morningstar U.S. Large Value Index rose 1.6% in the first three months of 2022, a small gain, but one that beat the Morningstar U.S. Growth Index by nearly 15 percentage points. That’s the widest gap between value and growth since the first quarter of 2009.

For the twelve months ending March 31, the Morningstar U.S. Value Index returned 12.8%, beating the Morningstar U.S. Growth Index by roughly 5 percentage points. During this period, value also outperformed the Morningstar U.S. Core Index, which is comprised of stocks that land between value and growth.

Much of the investor attention has been on the huge gains seen in stocks of companies that produce oil and gas. When oil prices were in a multi-year downtrend, these stocks, which mainly land in the value category, languished. But as oil has rebounded over the past year, and with names such as Exxon Mobil XOM rallying 36.4% in the first quarter and 56% for the trailing 12 months, value stocks as a group have gotten a broad lift.

The healthcare sector, led by AbbVie, contributed to one fourth of value’s strong performance over the past year. AbbVie rose 21% in the first quarter and 57% for the trailing 12 months. Consumer defensive stocks, which provide basic retail goods and tend to be less sensitive to changes in the economy, contributed 15% of the total return for value over the past year.

Value Stocks vs. Growth Stocks

Morningstar assigns each stock a “style score.” These stock scores are relative, with companies landing in value, core, and growth Morningstar categories. Stocks are also separately ranked by stock market value for small, mid-cap, and large capitalizations.

The style score is based on metrics such as growth rates for earnings, sales, book value, and cash flow. In addition, it factors in dividend yields and relative valuations such as the price/projected earnings ratio, price/book, price/sales, and price/cash flow.

Growth stocks have higher readings on earnings and sales ratios, for example, and low dividend yields. Companies that end up at the lower end of the spectrum on these metrics land in the value category, and those that land in the middle are considered “core.”

The question of where a stock lands in the style box is different than its valuation based on where Morningstar analysts set the stock’s fair value. ConocoPhillips COP, for example, lands in the large-value category but after its more than 90% rally over the past year to over $97, it is now seen as expensive compared to Morningstar’s fair value estimate of $80.

Which Sectors Led the Value Stock Rally?

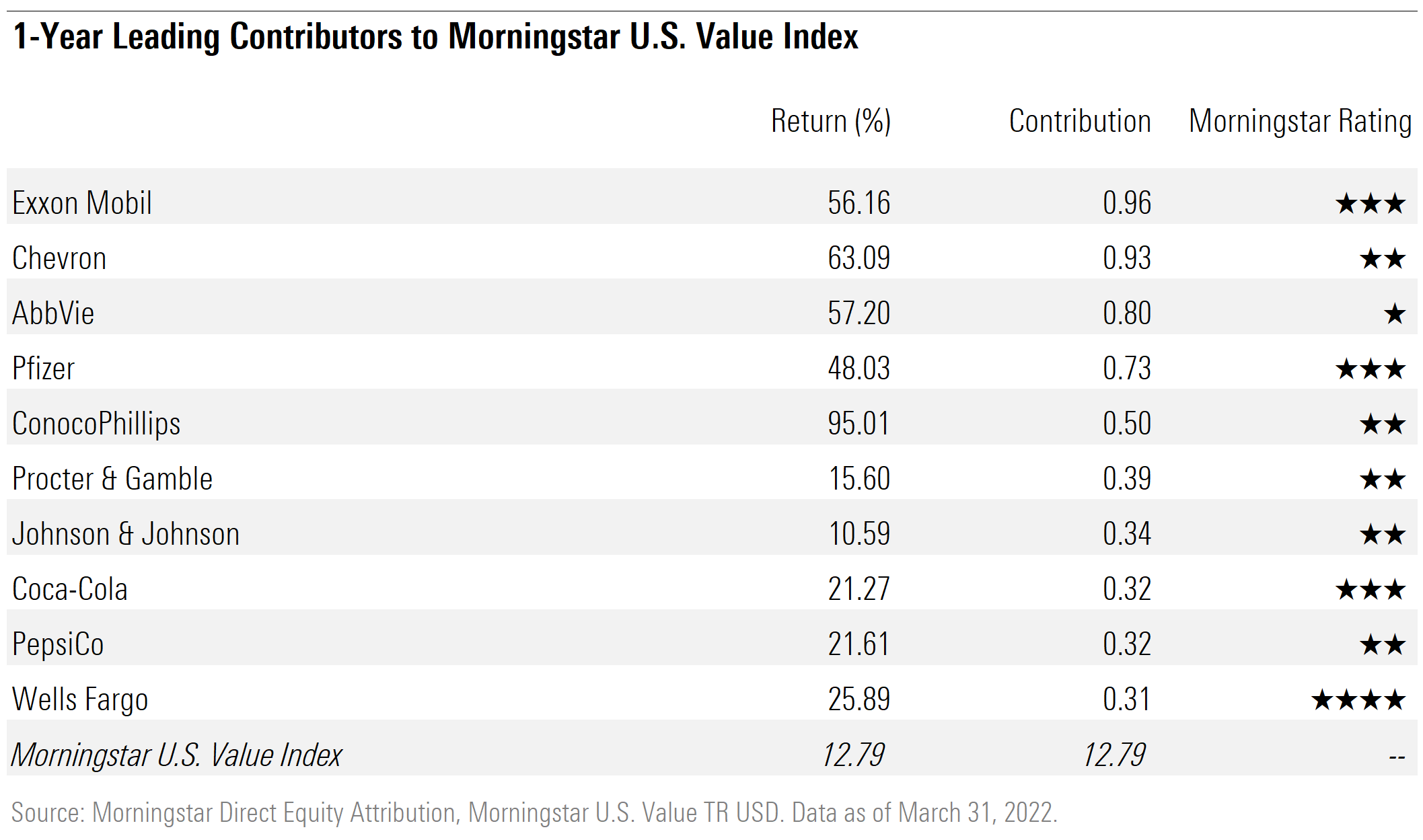

Of the Morningstar U.S. Value Index’s 12.8% rise, energy stocks were responsible for 4.3 percentage points. In addition to Exxon’s rally, Chevron CVX rose 63.1%, and ConocoPhillips gained 95.1%.

Healthcare companies, meanwhile, contributed a full 3 percentage points to value’s return. On an industry level, the biggest gains came from general drug manufacturers (up 23.7% as a group), and healthcare insurance plan providers (up 31.2%). That included a 48% gain for Pfizer PFE, and a 38.9% 12-month return for UnitedHealth Group UNH. The first quarter wasn’t as strong for these names. Pfizer lost 11.7% and UnitedHealth rose 1.9%.

Consumer defensive companies contributed 1.9 percentage points to value’s gains over the trailing twelve months, led primarily by Costco, up 64.5%, and consumer goods heavyweight Procter & Gamble PG, which gained 15.6%.

1-year leading contributors to Morningstar U.S. Value Index

Q1 Solidified the Value Trend

Even in a volatile market, value stocks stayed afloat as a group, hovering near zero for most of the quarter. While the U.S. growth index was at one point down 23.4% from the start of the year, at it’s worst level, the Morningstar U.S. Value Index was only down 2.7%.

In the first three months of this year, high-growth communication services stocks dragged down the large growth index. Netflix NFLX lost 37.8% and Disney DIS was down 11.5%. While technology stocks finished the quarter among the worst performers, many names recovered from the worst of their losses. Microsoft MSFT, for example, finished the quarter down 8.1%, after falling nearly 18% in early March.

Value Stocks Aren’t Overpriced Just Yet

Even as value outperformed the rest of the market, the group has managed to avoid moving into overvalued territory. The Morningstar U.S. Large Value Index showed an average price/fair value ratio of 1.00 by Morningstar analyst and quantitative calculations. At the end of last year the index was 3% overvalued.

Growth stock valuations have also cooled since the start of the year. The Morningstar Large Growth Index ended the quarter in fair value territory, with an average price/value ratio of 0.99. That’s a drop from its year-end valuation of 1.17, which was 17% above fair value.

Small growth stocks ended the quarter at a 10% discount to fair value on average, with Beyond Meat BYND and Boston Beer SAM both hovering at around a 50% discount to analyst-assessed fair value. And small caps ended the quarter at a discount across styles--small value real estate investment trust Macerich MAC finished at just 55% of its analyst-assessed fair value. Within the Morningstar small blend index, some of the steepest discounts include cable television provider Altice USA ATUS, trading at 44% of fair value at quarter end, and car dealership operator Asbury Automotive Group ABG, trading at 69% of fair value.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)