Three Lessons From the 60/40 Portfolio’s Stumble

Balanced funds are sometimes dangerous—but can their risks be avoided?

A Pretty Picture

This article was originally published on May 8, 2023. Its numbers are therefore slightly dated, but the arguments remain intact.

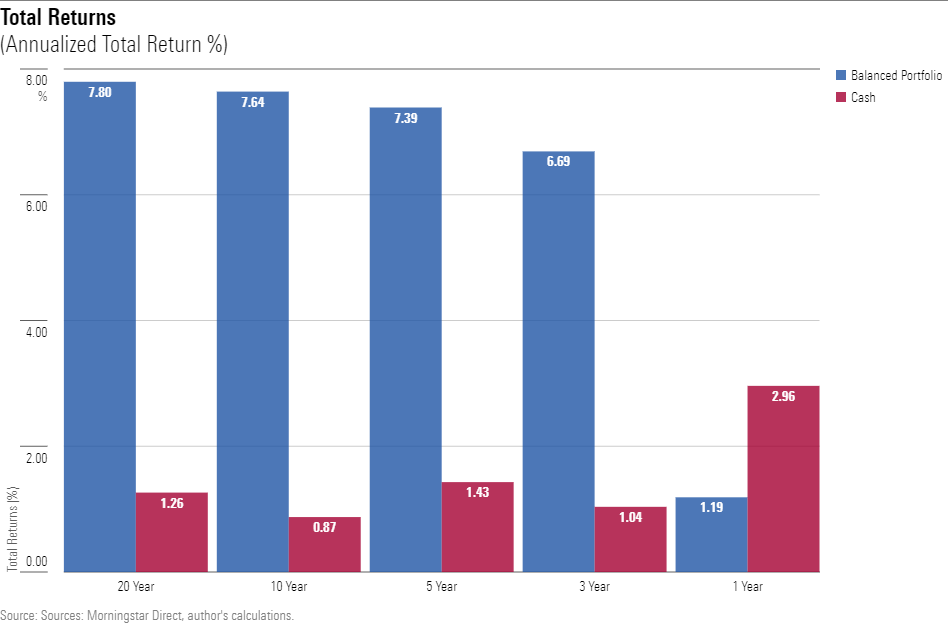

When evaluated over standard time periods, the total returns for a traditional balanced portfolio that places 60% of its assets in U.S. stocks and 40% in intermediate-term Treasuries look uniformly excellent. The only exception is over the past 12 months. Even then, the 60/40 portfolio has profited.

If shown the following chart, with the blue bars representing the balanced portfolio and the maroon bars representing cash, few investors would opt for the latter.

(Note: For this and all future calculations, the balanced portfolio consists of 60% Morningstar US Market Index and 40% Morningstar 5-10 Year Treasury Bond Index. Cash is represented by the Morningstar US 1-3 Month Treasury Bill Index.)

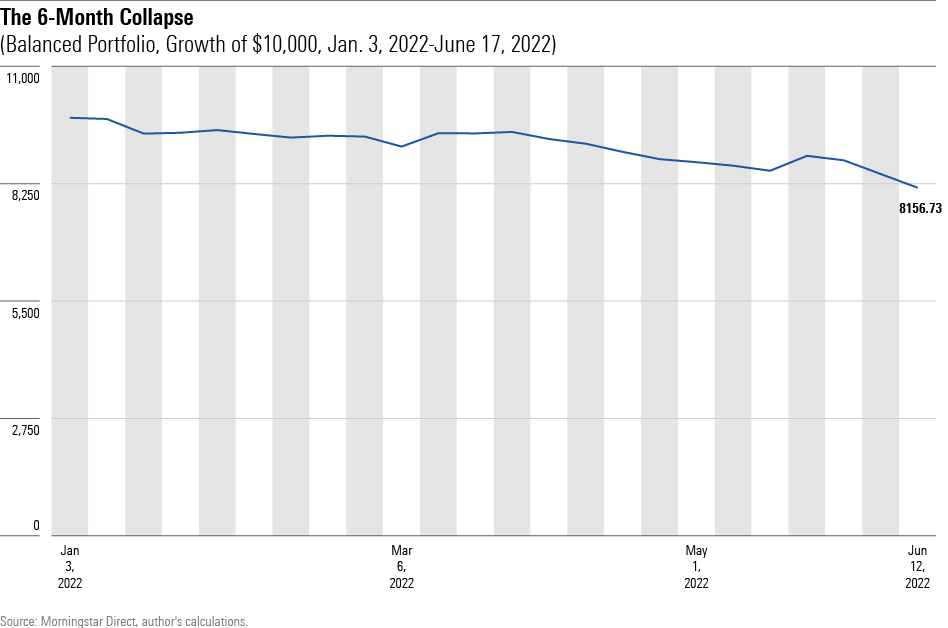

The Hidden Pitfall

The illustration is comforting but misleading. As the cliché goes, there are lies, damned lies, and statistics. Lurking beneath that soothing exterior is a true bear market. In 2022, the 60/40 portfolio lost 18.4% between Jan. 2 and June 17. That amount balloons to 23.3% after considering the effect of inflation—well above the 20% downturn that customarily defines a bear market.

Put simply, balanced portfolios were not. Investors in 60/40 portfolios cannot presume positive returns over every period, but they certainly have a right to expect a better outcome than that. After all, the 60/40 portfolio is billed as a moderately conservative investment. There is nothing moderately conservative about losing nearly 25% of one’s purchasing power in less than six months.

Consequently, last summer was a sobering time for those who had supported the 60/40 approach, as I had done in the wonderfully mistimed column of Feb. 3, 2022, “Why the 60/40 Portfolio Continues to Outlast Its Critics.” (I don’t often call market tops by accident, but when I do, I do so spectacularly.)

Stubborn and Untimely?

The 60/40 portfolio’s flop revived the longtime criticism that its strategy is inflexible. Holding a blend of stocks that benefit from economic booms and Treasuries that thrive during busts will usually create consistent performance, but not when inflation defies expectations. Rather than remain adamantly loyal to an out-of-favor strategy, investments should adapt to the prevailing conditions.

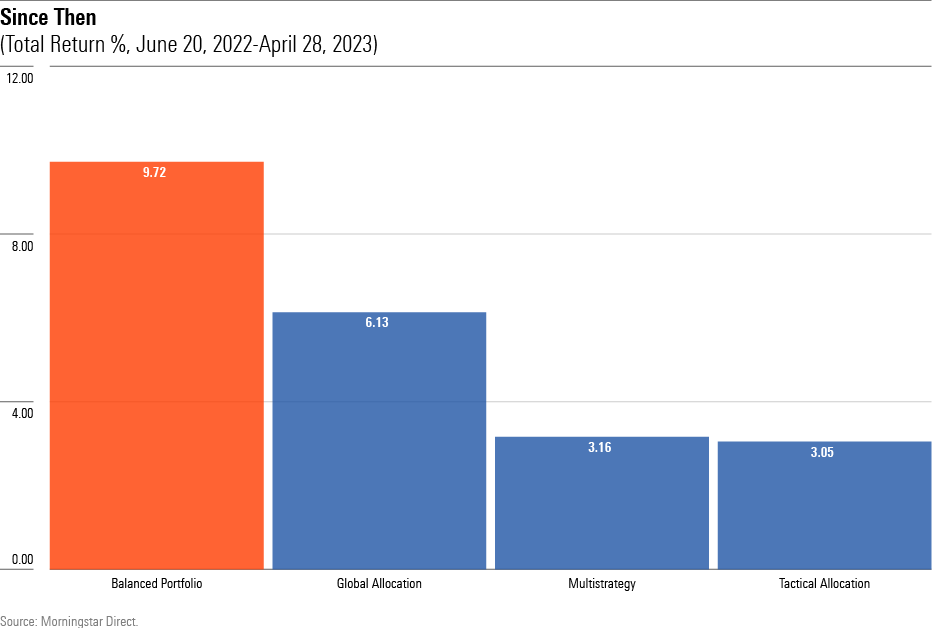

That logic, understandably, attracted listeners in the summer of 2022. In July and August, balanced funds endured their steepest redemptions since the global financial crisis of 2008. Meanwhile, two apparently timely Morningstar Categories—tactical-allocation funds, which modify their positions in response to changes in the financial markets, and multistrategy funds, which hold “alternative” investments—were receiving inflows. Out with the old, in with the new.

You can probably guess what happened next. Since then, the 60/40 portfolio has outgained its rivals. The exhibit below shows the subsequent performance of those investments, along with those of global-allocation funds, which are another potential substitute for balanced funds.

Three Lessons

1) A 60/40 portfolio can quickly lose a great deal of money.

Balanced portfolios flourish when interest rates fall and the economy is sound. They also perform acceptably during recessions. But they cannot withstand inflation shocks that lead to sharply rising rates. The 60/40 portfolio floundered in 2022, just as it periodically floundered during the 1970s and early 1980s.

As demonstrated by the chart that began this column, that drawback does not invalidate the 60/40 strategy, assuming that the Federal Reserve can keep inflation at least somewhat under control. Despite its steep early-2022 drop, a balanced portfolio has profited investors who stayed the course.

2) On the surface, tactical adjustments are prudent.

Entering last year, the potential danger for balanced portfolios was apparent. The spike in inflation coupled with the Fed’s intention to raise interest rates suggested that both legs of the 60/40 strategy might wobble. At the least, balanced portfolios could have shortened their fixed-income stakes.

This is not hindsight analysis. Not only were 60/40 detractors advancing that argument, but even some of the strategy’s supporters concurred. For example, my February 2022 article suggested “reducing the portfolio’s bond market risk by swapping into shorter notes or even raising cash.” That unusually low bond yields had reduced the appeal of the traditional 60/40 portfolio was no secret.

3) Unfortunately, such adjustments are more easily said than done.

Recognizing that bonds are precariously priced is not the same as the ability to act upon that suspicion. Never mind retail shareholders—even the professional investment managers who purported to divine the future flunked last year’s test. From January through June, when the 60/40 portfolio plummeted, the average return of tactical asset allocation funds was 4 basis points below that of traditional balanced funds. The cure was (very slightly) worse than the disease.

Conclusion

I regularly receive emails from investors (and sometimes financial advisors) who claim to have foreseen market events—in particular, the rise in inflation. Most, I suspect, possess selective memories. They had indeed ruminated along those lines but not with enough conviction to affect their investment decisions. What’s more, because we tend to remember our successes rather than our failures, they forget the many occasions when their other reflections did not transpire.

But I could be wrong. If so, those investors have good reason to implement their future views. So, as well, do those who strongly believe that the 60/40 portfolio’s recent gains are merely a mirage, the respite before resurgent inflation leads to a second downturn. Such investors should not only swap their bonds for cash, but should also diversify into energy, alternatives, and/or inflation-adjusted bonds.

Otherwise, though, it makes sense to heed the lesson of the past 18 months. Critics of the 60/40 portfolio had the perfect environment to prove their case. Not only did the static portfolio perform badly, but the reasons for its struggles were relatively predictable. Neither inflation’s increase nor the Fed’s policy were huge revelations. Yet, despite those advantages, these critics could not answer the call. It seems unlikely that they will be able to do so the next time, either.

End Note: Since this article was originally published in May 2023, multistrategy funds have earned their keep, outgaining a 60/40 portfolio by 2 percentage points during a choppy market. But the average global-allocation and tactical-allocation fund has continued to trail, once again demonstrating that while it’s easy to criticize balanced funds for not adjusting to prevailing market conditions, it’s much tougher to devise superior investments.

The views expressed here are the author’s.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)