How to Use International Stocks in Your Portfolio

What you need to know about the advantages and risks of international stocks.

Should you have international stocks in your portfolio? If you already have exposure to U.S. large-cap stocks, international stocks could be a logical addition thanks to their potential to improve portfolio diversification.

In this series on portfolio basics, I’ll explain some of the fundamentals of putting together sound portfolios. I’ll start with some of the most widely used types of investments and walk through what you need to know to use them effectively in a portfolio.

What Are International Stocks?

For investors who live in the United States, stocks of companies based in other countries are considered international stocks. International-stock funds can focus on developed markets (such as the United Kingdom, Germany, or Japan), emerging markets (such as China, India, or Brazil), or a combination of both.

As of July 2023, non-U.S. stocks made up about 40% of global market capitalization. Because international stocks make up a significant portion of the available equity market, it makes sense for most investors to have some exposure to international stocks.

Most international stocks are denominated in non-U.S. currencies and trade on exchanges in their local markets. For example, Taiwan Semiconductor’s stock is denominated in the new Taiwan dollar and trades on the Taiwan Stock Exchange, and Finland-based Nordea bank trades in the Danish krone on Nasdaq Copenhagen.

The exception: American depositary receipts, or ADRs, which are certificates issued by a U.S. bank that represent ownership in foreign companies. ADRs are denominated in U.S. dollars and trade on U.S. stock exchanges.

What Are the Advantages and Risks of Investing in International Stocks?

International stocks have two main advantages: diversification and the potential to perform better than U.S. stocks over certain periods.

In the past, non-U.S. stocks have had relatively low correlations with their U.S. stock counterparts, leading to better risk-adjusted returns for a globally diversified portfolio. As the economy has become increasingly global, though, U.S. and non-U.S. stocks have started moving more in tandem over the past couple of decades.

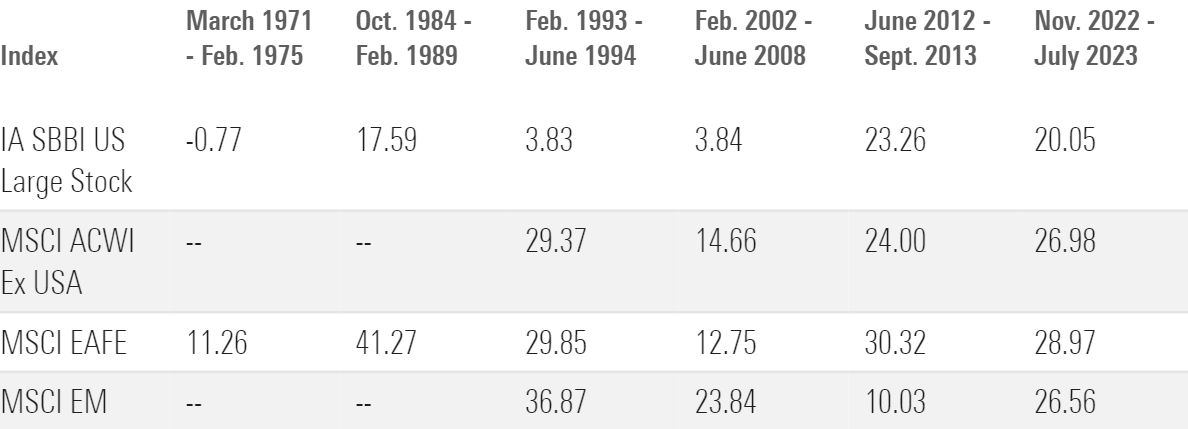

There have also been certain periods, such as the early 1970s, late 1980s, and 2002 through mid-2008, when international stocks have fared better than their U.S. counterparts. These periods often correspond to periods when the U.S. dollar was weak: Stronger non-U.S. currencies mean that investors in international stocks come out ahead when their returns are translated back to U.S. dollars. More recently, however, international stocks have fallen behind, partly because of how the U.S. dollar has strengthened over the past 10 years or so.

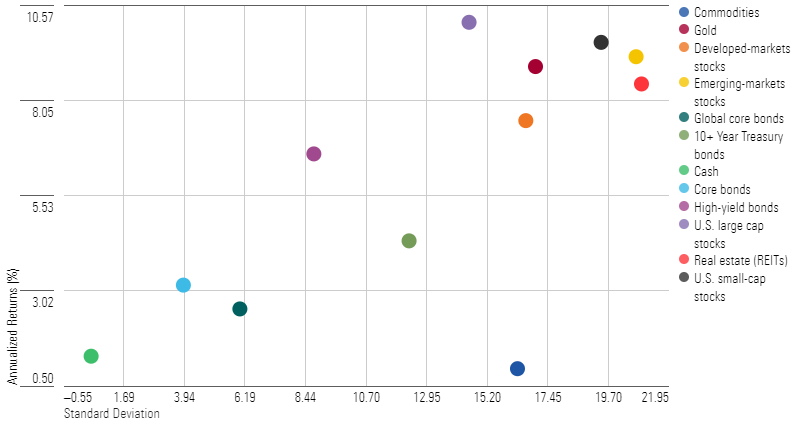

Along with their return potential, international stocks come with certain risks, including the impact of currency movements, political conflicts, and weaker accounting standards. This means that international stocks come with relatively high risks and returns. The table below shows annualized returns and standard deviations for international stocks in developed and emerging markets compared with other major asset classes over the past 20 years.

Trailing 20-Year Risk and Return: Cash and Other Assets

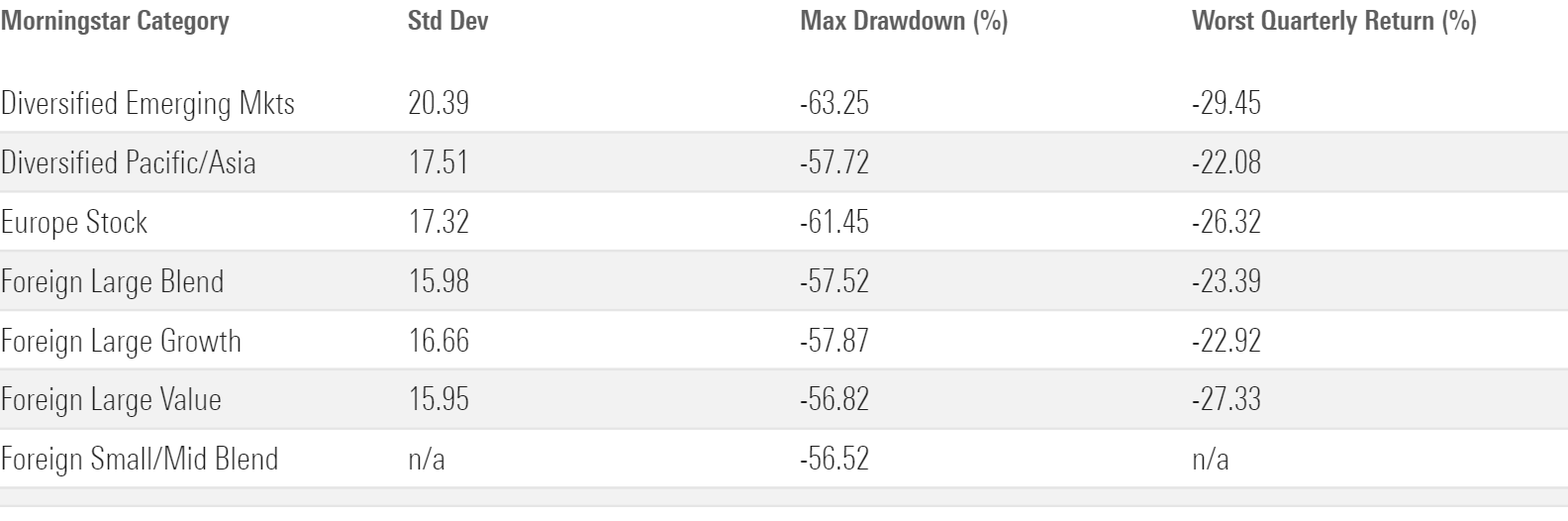

Historically, international stocks have lost as much as 50% or more during market drawdowns, such as the global financial crisis that started in late 2007 and the coronavirus-driven bear market in early 2020. On a quarterly basis, they’ve been subject to losses as large as 20% or more. Like other stocks, however, international stocks go up more often than they go down—helping them generate rewarding returns over time.

Other Risk and Drawdown Stats (Since 1990)

How to Invest in International Stocks

There are two main ways to invest in international stocks: by purchasing individual stocks or by purchasing a fund.

Buying international stocks on local exchanges would probably be impractical for most individual investors. As mentioned above, ADRs are another more accessible option for purchasing individual foreign stocks. There are about 430 ADRs currently traded on major exchanges in the U.S., plus about 2,000 more that trade over the counter.

But buying individual stocks also comes with additional risks. If you own one stock (or even as many as 20 different stocks), you’ll be subject to stock-specific risk—meaning that the odds of things going poorly are much higher than they would be with a diversified portfolio. In 2021, for example, nearly one out of every three ADRs lost 10% or more, even though non-U.S. stocks as a whole gained about 8% for the year.

For most investors, broadly diversified index funds are the best way to invest in international stocks. Few active managers have been able to consistently outperform the overall market over time. Index funds, on the other hand, harness the market’s collective wisdom about the relative value of each stock included in a given benchmark. They’re also cheaper: Investors in actively managed international-stock funds pony up annual expenses of about 1%, on average, but the typical index fund costs less than half of that.

If you only own one international-stock fund, I’d focus on the foreign large-blend Morningstar Category rather than more specialized areas. The foreign large-blend category typically provides the broadest exposure to the overall market, and it isn’t as subject to market swings that can cause growth, value, or region-specific funds to go in and out of favor over multiyear periods. Global large-blend funds can also be a good option if you want to get exposure to U.S. and non-U.S. stocks in a single package.

When Do International Stocks Perform Best?

Like all stocks, international stocks typically perform best during periods of strong economic growth, rising corporate profits, declining interest rates, and low inflation.

As mentioned above, international stocks also usually fare best during periods of U.S. dollar weakness. The table below shows annualized returns for international stocks during some of their strongest periods.

Annualized Returns During the Best Times for International Stocks

How Long Should I Hold My Investments in Large-Cap Stocks?

Morningstar’s Role in Portfolio Framework recommends holding international-stock funds for at least 10 years. We came up with this guideline partly by looking at the historical frequency of losses over various rolling time periods ranging from one year to 10 years. We also considered the maximum time to recovery, or how long it usually takes to recover after a drawdown.

How Much of My Portfolio Should Be in International Stocks?

There’s no easy answer to this question.

Some people argue that you don’t need separate exposure to international stocks at all, given that many leading companies in the U.S. earn a significant portion of their revenue from overseas. Vanguard founder Jack Bogle was famously skeptical about the value of international investing, arguing that non-U.S. companies can’t keep pace with those in the U.S. based on innovation, productivity, technological advancement, and shareholder protection.

On the other hand, skipping out on international stocks would mean missing out on some of the world’s leading companies, such as Nestle SA, Samsung Electronics, and Novo Nordisk. Plus, international stocks can generate better returns at times when the U.S. might be struggling. And as mentioned above, international stocks currently make up about 40% of the market’s overall capitalization globally.

So, we maintain that most investors should probably have some type of exposure to non-U.S. stocks.

We consider foreign large-blend funds to be core holdings that could make up as much as 40% to 80% of a portfolio’s assets, although most investors will probably want to keep their exposure on the lower end of that range.

Foreign large-growth and foreign large-value funds fill more specialized roles; we consider them “building blocks” that could make up as much as 15% to 40% of a portfolio’s assets. Because of the higher risk inherent in emerging markets or region-specific funds, we recommend limiting them to 15% of assets or less.

What Are the Best International-Stock Funds?

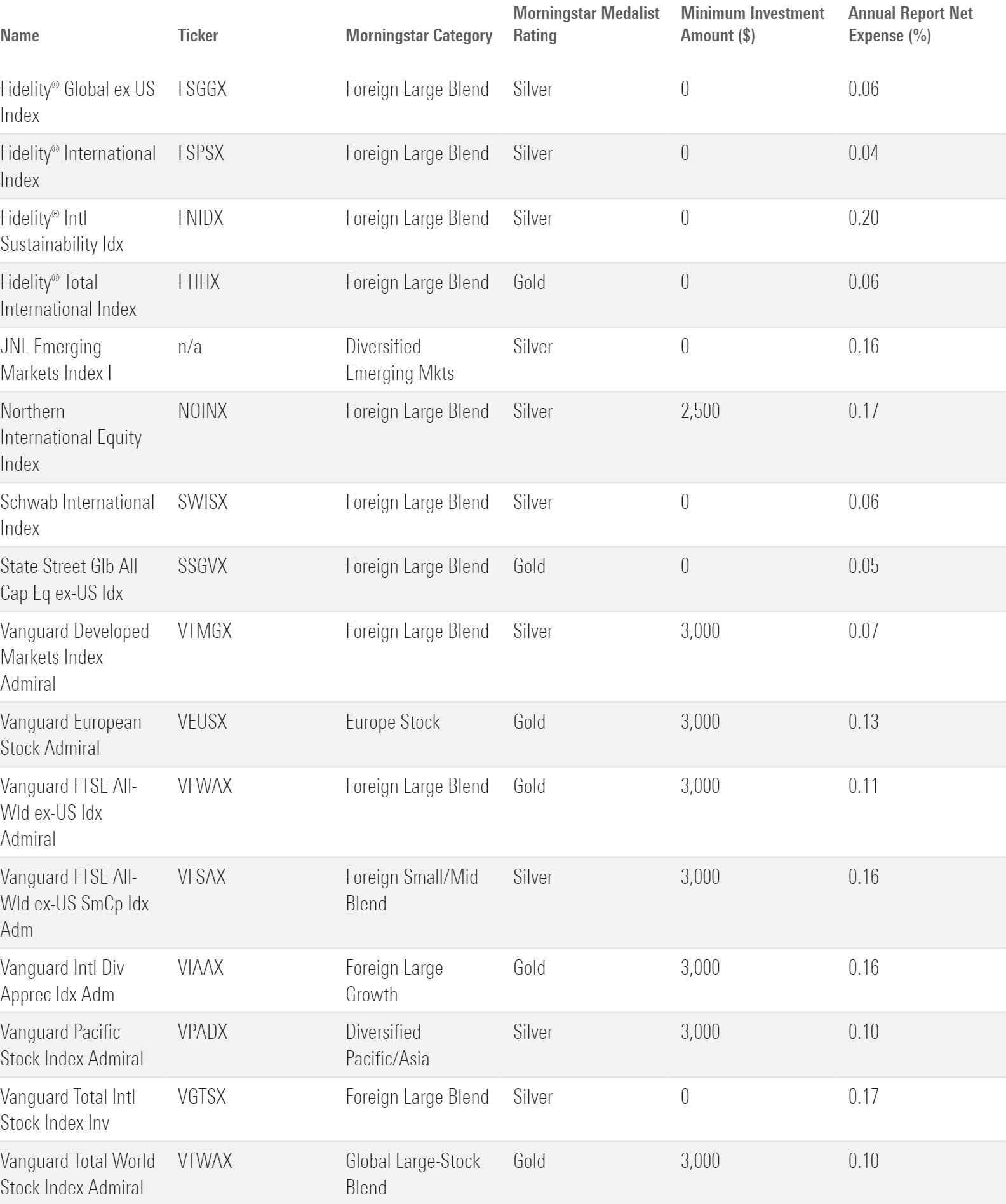

The table below shows a subset of highly rated index funds dedicated to international stocks. I’ve focused on international-stock funds that are broadly available through major brokerage platforms, with low investment minimums and ultralow expense ratios.

Highly Rated International-Stock Funds (Index Funds)

The list below includes some actively managed international-stock funds from Russ Kinnel’s “Thrilling 31″ list, which features funds with relatively low expense ratios, high Morningstar Medalist Ratings, portfolio managers who have invested at least $1 million in their own fund, and above-average returns during the manager’s tenure for at least five years.

Highly Rated International-Stock Funds (Actively Managed Funds)

What Funds Pair Well With International-Stock Funds?

If you’ve already added an international-stock fund to your portfolio, a bond fund or U.S. large-cap stock fund could be a logical addition.

- Bond funds typically help buffer against losses in years when the stock market is down (although rising interest rates and unexpectedly high inflation led to sharp losses for both stocks and bonds in 2022). Bond funds have also often had negative correlations with the equity market, which can help improve risk-adjusted returns for a portfolio that includes both stocks and bonds.

- U.S. large-cap stock funds are a key foundation for nearly every investor’s portfolio. They’ve produced outstanding total returns over time and are one of the best ways to generate wealth for long-term financial goals. As mentioned above, U.S. stocks currently make up about 60% of global market capitalization, so we consider them core holdings that could make up the majority of a portfolio’s equity exposure.

Should I Invest in International Stocks?

While they won’t outperform in every market, international stocks have produced solid returns over time. They can also provide diversification benefits (especially as a hedge against weakness in the U.S. dollar) and exposure to leading companies outside the United States.

Why Your Portfolio Needs International Stocks

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)